发布时间: 2022/04/08 关注度: 1032

With the increasingly serious social-environmental pollution and the global oil crisis, global governments are paying more and more attention to the development of the new energy industry. In recent years, various policy subsidies have promoted the development of the new energy vehicle industry to a certain extent. In 2021, the global new energy vehicle market has ushered in a golden period of rapid development, and sales continued to grow. Due to the repeated global epidemics, indirect shutdowns of chip foundries in some regions, and the surge in demand for consumer electronics chips, chip resources are tilted, which further exacerbates the supply shortage of automotive-grade chips with a long stocking cycle. Since the level of intelligence is higher than that of traditional vehicles, new energy vehicles will be more affected by the shortage of chips.

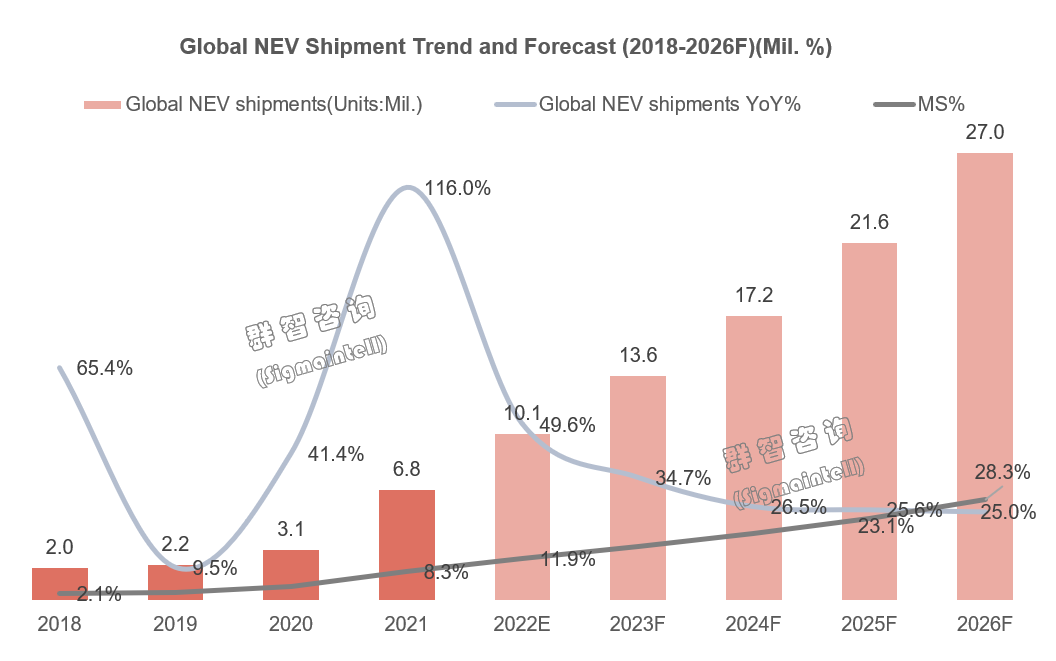

Market Insights: It is estimated that the global new energy vehicle market will exceed 10 million in 2022, a YoY increase of about 50%.

According to data from Sigmaintell, the global new energy vehicle market reached nearly 6.8 million in 2021. Benefiting from the lower base in the same period of the previous year and the recovery of various industries after the epidemic, the YoY increase was about 116%, reaching the highest growth rate in recent years. As the market size base expands year by year and subsidies for new energy vehicles in various regions of the world gradually decline, the growth rate will begin to slow down after 2022. Global sales of new energy vehicles will continue to grow by about 50% in 2022, surpassing 10 million for the first time. In the long run, the market size will reach about 27 million vehicles in 2026, a comprehensive increase of 300% compared to 2021.

New energy vehicles and traditional vehicles are undergoing iteration. It is expected that the market share of new energy vehicles will exceed 10% for the first time in 2022, and the proportion of new energy vehicles will reach 28% by 2026. The main driving force is the rapid growth of pure electric vehicles (BEVs). According to data from Sigmaintell, the global shipment of pure electric vehicles in 2021 was 4.8 million units, an increase of about 1.2 times YoY, accounting for more than 70% of global new energy vehicle shipments. After 2022, this figure will continue to climb, eventually realizing the vision of completely carbon-free travel.

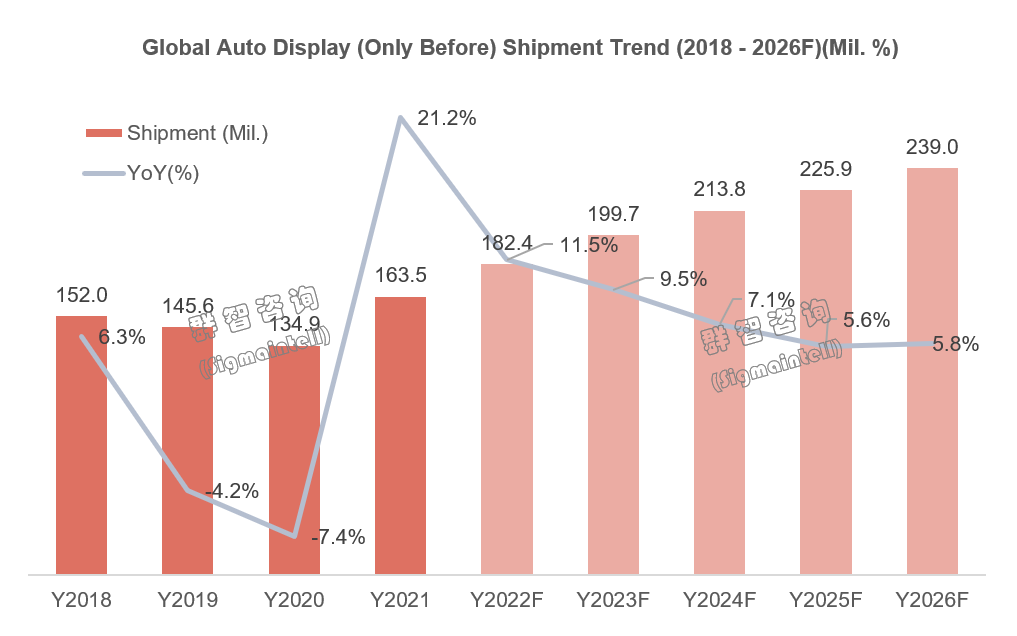

Vehicle display: In 2021, the global demand for auto display panels (before market) was about 160 million pieces, a YoY increase of about 21.2%.

With the explosive growth of new energy vehicles and smart vehicles in 2021, the auto display has also ushered in rapid development. The first is the pursuit of multi-screen, high resolution, and large size by end-users and OEMs. Secondly, according to their advantages, major panel makers have adopted active diversification strategies, actively adjusted their layouts, increased the exploration of cockpit displays, and promoted market development. According to statistics from Sigmaintell, the global demand for auto display panels (before market) in 2021 was about 160 million pieces, a YoY increase of about 21.2%. Among them, the shipment of LTPS LCD panels is also increasing rapidly, and its penetration rate reached 12.0% in 2021.

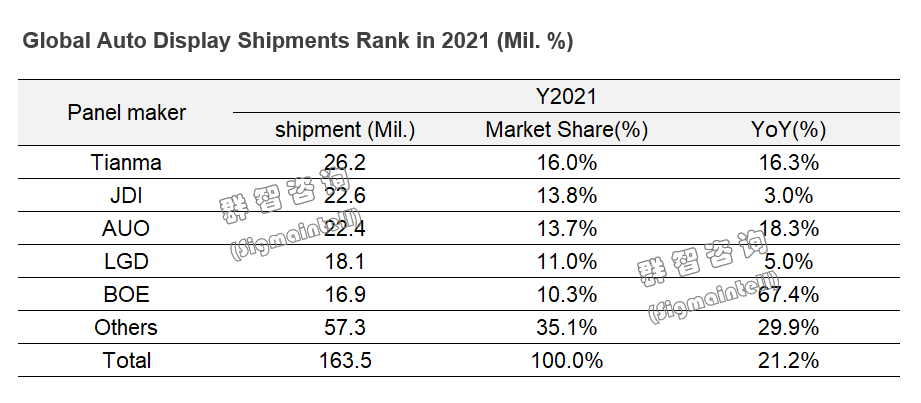

The automotive market has continued to be affected by the shortage of chips since 21H2, and the Russian-Ukrainian war in 2022 casts a new shadow on the original short supply situation, which will slow down the growth of automotive displays. However, due to the accelerated penetration of automobile intelligence, especially new energy vehicles as the best carrier of automobile intelligence, and vehicle display as an important hardware facility for human-computer interaction, the trend of large-screen and multi-screen is accelerated. The average number of vehicles has also increased rapidly, and the industry is still on an upward trend for a long time. According to data from Sigmaintell, it is estimated that in 2022, the global auto display panel shipments will be approximately 180 million units ((before market only), a YoY increase of about 11.5%. The specific performance of the panel makers' competition pattern is as follows:

Tianma

According to Sigmaintell data, Tianma continued to lead the auto display market with a shipment of 26.2 million units in 2021, a YoY increase of about 16.3%. At the same time, Tianma continues to deepen the industrial layout, enrich the product structure, expand the shipment of LTPS LCD vehicle products, actively deploy the development of cutting-edge technologies such as Mini-LED and Micro LED, and increase investment in high-value-added products such as complex modules.

Japan Display (JDI)

With the gradual relief of upstream supply components such as driver ICs, the shipment scale and revenue of JDI's auto display have improved significantly in the second half of the year. According to the survey data of Sigmaintell, the shipment volume of auto displays in 2021 is about 22.6 million units, a YoY increase of 3.0%, ranking second in the auto displays(before market) with 13.8%.

AUO

In 2021, AUO continued to make efforts in smart cockpits, develop large-size fully-fitted products, and promote the progress of auto display products such as Mini-led. Its auto display panel shipments are approximately 22.4 million pieces, a YoY increase of 18.3%. AUO ranked third with 13.7% of the global automotive (before market) share, and its LTPS LCD automotive product shipment share achieved a significant breakthrough, and its shipment share in the fourth quarter exceeded 20.0%.

LG Display (LGD)

Driven by the strategy of pursuing high profitability, LGD has gradually reduced its shipment proportion of low-end products such as small size and a-Si. As a leader in the field of flexible AMOLED automotive products, LGD has contributed many forward-looking products to the automotive display industry. According to Sigmaintell data, in 2021, LGD auto display panel shipments were approximately 18.1 million units, a YoY increase of 5.0%, and the proportion of large-size and LTPS product shipments increased steadily.

BOE

Benefiting from the strong demand of China's auto market in 2021 and BOE's continuous development in the auto display, especially in the NEV market, BOE has maintained rapid growth in the shipment of auto display panels, and its business has continued to expand. Its auto displays have also been mass-produced. According to Sigmaintell data, in 2021, its auto display (before market) panel shipments were 16.9 million, a substantial increase of about 67.4% YoY, ranking fifth in the front-mounted market shipments. In addition, BOE sold about 6.8 million pieces in the aftermarket, making it the fastest-growing panel supplier in the auto display market.

Image Radar: In 2021, the global vehicle camera market size reached about 130 million, a YoY increase of about 23%.

Image Radar: In 2021, the global vehicle camera market size reached about 130 million, a YoY increase of about 23%.

With the accelerated penetration of new energy vehicles and the improvement of the level of intelligence, vehicle intelligent hardware equipment is about to usher in a harvest period. Hardware such as auto cameras and lidars are gradually becoming irreplaceable in the evolution of new energy and smart cars from L1 to L5. Lidar has just started and has not yet ushered in a large-scale node, and auto cameras have now become fixed accessories. From reversing cameras, and driving recorders, to the current L2 level automatic parking, forward collision warning, driver monitoring, and other functions, the market size of auto cameras will achieve rapid growth in synchronization with the outbreak of new energy vehicles.

According to Sigmaintell data, the global auto camera market size reached about 130 million in 2021, a YoY increase of about 23%. There are more than 3 bicycles on new energy vehicles, of which nearly 50% are surround-view cameras that realize the 360° panoramic parking function. In the future, with the popularization of autonomous driving functions, the proportion of cameras equipped with perception cameras will gradually increase. It is estimated that by 2025, the average number of cameras on new energy vehicles will be more than 8. Among them, the penetration rate of cameras that realize ADAS functions such as front view and side view will also reach about 14%. The proportion of standard hardware such as surround view and rearview in the vehicle will show a downward trend year by year. With the increase in ADAS penetration rate and the upgrade iteration of pixels, the value of a single camera will gradually increase, and the market prospect is considerable.

According to Sigmaintell data, the global auto camera market size reached about 130 million in 2021, a YoY increase of about 23%. There are more than 3 bicycles on new energy vehicles, of which nearly 50% are surround-view cameras that realize the 360° panoramic parking function. In the future, with the popularization of autonomous driving functions, the proportion of cameras equipped with perception cameras will gradually increase. It is estimated that by 2025, the average number of cameras on new energy vehicles will be more than 8. Among them, the penetration rate of cameras that realize ADAS functions such as front view and side view will also reach about 14%. The proportion of standard hardware such as surround view and rearview in the vehicle will show a downward trend year by year. With the increase in ADAS penetration rate and the upgrade iteration of pixels, the value of a single camera will gradually increase, and the market prospect is considerable.

Summary and Outlook: The general trend in the environment, NEVs promote industrial upgrading.

The impact of the epidemic on recession, whether it will completely defeat the virus or coexist with it, will gradually weaken. Negative factors such as chip shortages and factory shutdowns will be alleviated. At the same time, the environmental protection industry and the new energy industry are destined to return to the right track and become the trend of the next decade. As a favorable measure to achieve the carbon neutrality goal, developing new energy vehicles as the second-largest smart device after the era of the mobile phone industry has considerable advantages in the long run. This will also re-integrate the original automotive industry supply chain, from upstream raw material factories, midstream software, and hardware, to downstream Tier 1, new power auto companies, etc., emerging companies that adapt to the development of the times will usher in unprecedented opportunities. At the same time, traditional car companies also need to be prepared for danger, quickly carry out industrial transformation and iterative upgrades, and adapt to the automotive industry in the new era with a new look.

中文

随着社会环境污染愈加严重以及全球面临着石油危机,各国政府越来越重视对新能源产业的推进,近年推出的各种政策补贴等驱动力一定程度上促进了新能源汽车行业的发展。过去的2021年全球新能源汽车市场迎来了高速发展的黄金时期,销量持续增长,而随着全球疫情反复及部分受影响地区芯片代工厂间接性停工,加上消费类芯片需求激增导致芯片资源有所倾斜,造成了原本备货周期就较长的车规级芯片供应紧张状况进一步加剧。由于智能化水平相对传统汽车更高,新能源汽车受到芯片短缺的影响将会更大。

市场洞察篇:预计2022年全球新能源汽车市场规模超1000万辆,同比增长约50%

根据群智咨询(Sigmaintell)数据显示,2021年全球新能源汽车市场规模达到近680万辆,受益于前年同期较低的基数以及疫情后各产业的复苏,同比增长约116%,达到近年增速最高点。随着市场规模基数逐年扩大,以及全球各地区对新能源汽车补贴陆续开始退坡,2022年后增速将开始放缓,2022年全球新能源汽车销量继续增长约50%,首次超过1000万辆,从长期来看2026年市场规模将达到约2700万辆,相比2021年综合增长300%。

新能源汽车与传统汽车正在进行着迭代替换,预计2022年新能源汽车的市场份额将首次超过10%,而到2026年新能源汽车占比将达到28%,其中主要动力来源于纯电动车型(BEV)的快速增长。群智咨询(Sigmaintell)数据显示,2021年全球纯电动汽车出货量为480万辆,同比增长约1.2倍,占全球新能源汽车出货量的70%以上,2022年之后这一数据将不断攀升,以至于最终实现完全无碳化出行的愿景。

车载显示篇:2021年全球前装车载显示面板的需求规模约为1.6亿片,同比增长约21.2%

随着新能源汽车及汽车智能化在2021年爆发式的增长,车载显示也迎来了发展的快速时期。首先,终端用户及整车厂对多屏化、高分辨率、大尺寸化等的追求,其次,各大面板厂根据自身优势,采取积极的多元化策略,主动调整自身布局,加大在座舱内显示的探索,推动市场发展。根据群智咨询(Sigmaintell)的统计数据显示,2021年全球前装车载显示面板的需求规模约为1.6亿片,同比增长约21.2%。其中LTPS LCD面板的出货量也在快速提升,2021年其渗透率达到12.0%。

虽然从2021下半年开始汽车市场持续受到芯片短缺影响,进入2022年又叠加俄乌战争的影响,使原本紧缺的供应局面又蒙上新的阴影,使得车载显示屏增长局势的节奏有所放缓,但受到汽车智能化加速渗透,特别是新能源汽车作为汽车智能化最好的载体,车载显示作为人机交互的重要硬件设施,主其大屏化、多屏化的趋势加速推进,其单车平均搭载数量也跟着快速增加,行业景气长期仍处于向上趋势。根据群智咨询(Sigmaintell)的数据显示,预计2022年全年全球车载显示面板出货量约为1.8亿片(仅前装),同比增长约11.5%。面板厂竞争格局来看,具体表现如下。

天马(Tianma)

根据群智咨询(Sigmaintell)数据显示,2021年深天马以2620万片的出货量继续引领车载显示市场,同比增长约16.3%。同时继续深耕产业布局,丰富产品结构,扩大LTPS LCD车载产品的出货,并且积极布局Mini-LED,Micro LED等前沿技术的开发,加大复杂模组等高附加值产品方面的投入。

日本显示(JDI)

随着驱动IC等上游供应器件逐步得到缓解的情况下,JDI下半年车载显示的出货规模及营收有了明显的复苏好转,根据群智咨询(Sigmaintell)调查数据显示,2021年全年车载显示出货规模约为2260万片,同比增长3.0%,以13.8%位居车载显示前装市场销量第二位。

友达(AUO)

2021年,友达(AUO)在智能座舱领域的继续发力,继续开发大尺寸全贴合的产品,推动Mini led等车载显示产品的进程,其车载显示面板出货规模约为2240万片,同比增长约为18.3 %。以13.7%的全球车载前装市场份额位居第三位,并且其LTPS LCD车载产品出货份额取得明显突破,其四季度的出货份额更是超20.0%。

LG显示(LGD)

LG显示(LGD)在追求高盈利的策略驱使下,逐渐减少其小尺寸和a-Si等低端产品出货比重,并且作为柔性AMOLED车载产品领域的领导者,为车载显示行业贡献了很多具有前瞻性的产品。根据群智咨询(Sigmaintell)数据显示,2021年车载显示面板出货量约为1810万片,同比增长约5.0%,其大尺寸及LTPS产品出货量占比稳定提升。

京东方(BOE)

得益于2021年中国汽车市场的旺盛需求及公司在车载显示领域持续开拓,特别是新能源汽车市场的发力,京东方(BOE)在车载显示面板出货量保持高速增长,其业务不断扩大,并且在AMOLED车载显示屏也已实现了量产。据群智咨询(Sigmaintell)数据显示,2021年其车载显示前装市场面板出货1690万片,同比大幅增长约67.4%,位居前装市场出货量第五位,另外其在后装市场销售约680万片,成为车载显示屏市场增长速度最快的面板供应商。

影像雷达篇:2021年全球车载摄像头市场规模达到约1.3亿颗,同比增长约23%

随着新能源汽车加速渗透以及智能化水平的提升,车载智能硬件设备即将迎来收获期,车载摄像头、激光雷达等硬件逐渐在新能源以及智能汽车从L1向L5进化过程中表现得不可替代,激光雷达目前刚刚起步,还未迎来大规模上量的节点,而车载摄像头目前已成为汽车固定配件。从倒车影像、行车记录仪,再到目前可实现L2级别自动泊车以及前方碰撞预警、驾驶员监测等功能,车载摄像头的市场规模将随着新能源汽车的爆发实现同步的快速增长。

根据群智咨询(Sigmaintell)统计数据显示,2021年全球车载摄像头市场规模达到约1.3亿颗,同比增长约23%。在新能源新车上单车搭载数量超过3颗,其中实现360°全景泊车功能的环视摄像头占比近一半。未来伴随着自动驾驶功能的普及,汽车搭载感知类的摄像头比例将逐渐提高,初步预估到2025年新能源汽车平均搭载摄像头为8颗以上;其中前视、侧视等实现ADAS功能的摄像头渗透率也将达到14%左右,而环视、后视等标配硬件,在整车中的比例将呈现逐年下降的态势。随着ADAS渗透率的提升以及像素的升级迭代,单颗摄像头的价值量也将逐步提升,市场前景可观。

总结展望篇:环境大势所趋,新能源汽车促进产业升级

疫情影响衰退,无论是彻底克服还是与之共存,随其带来的影响也将逐渐减弱,芯片短缺、工厂停工等消极因素将有所缓解,同时环保产业、新能源行业注定将回到正轨,成为下一个十年的风向。作为实现碳中和目标的一大有利举措,发展新能源汽车,将其作为手机产业时代后的第二大智能终端,从长期趋势来看优势十分可观,这也会重新整合原有的汽车产业供应链,从上游原材厂、中游软硬件,到下游Tier1、新势力车企等,顺应时代发展的新兴企业将迎来前所未有的机遇。与此同时,传统车企也需居安思危,快速进行产业转型、迭代升级,以全新的面貌来适应新时代下的汽车行业。

提交右侧信息,了解更多会员服务方案;

或直接联系我们:

+86 151-0168-2530