With the receding of the epidemic dividend and the amplification of the negative impact of severe inflation, the outlook of market demand in the global monitor industry has become extremely uncertain. On the panel supply side, monitor brand customers have been lowering their orders demand, panel prices also continue to decline, panel makers profitability is under pressure; on the demand side, the overseas consumer market recovery is not strong, and consumer brands face serious internal friction. As for Chinese market, affected by the epidemic in the first half of the year, China’s domestic consumer demand was weak. Combined with the limitations of domestic logistics capacity, Chinese monitor market shipments are poor in 22Q2, especially from April to May.

As a result, the performance of Chinese 6.18 market in 2022 has attracted particular attention, directly affecting the confidence and trend judgment of the Chinese market and the demand of Chinese brand customers. By looking at the performance of the Chinese market, Sigmaintell believes that the following hypotheses need to be tested.

First, under the downward trend of cost, can the end consumer demand be boosted by the aggressive price strategy?

Second, is the competition pattern of monitor tech consistent with the performance of demand?

Third, is the brand game in the Chinese market changing significantly?

Fourth, does the Chinese market still have development potential in the downward period?

Around the above questions, the answers given by the market will help the industry understand the characteristics of the changing demand in the downward and find suitable development opportunities.

In order to test the above hypothesis, Sigmaintell has conducted a detailed analysis of this year's "6.18" Chinese monitor market and has launched a specific analysis of seven important questions related to it.

First question: Why is the market "increasing in volume but decreasing in value"?

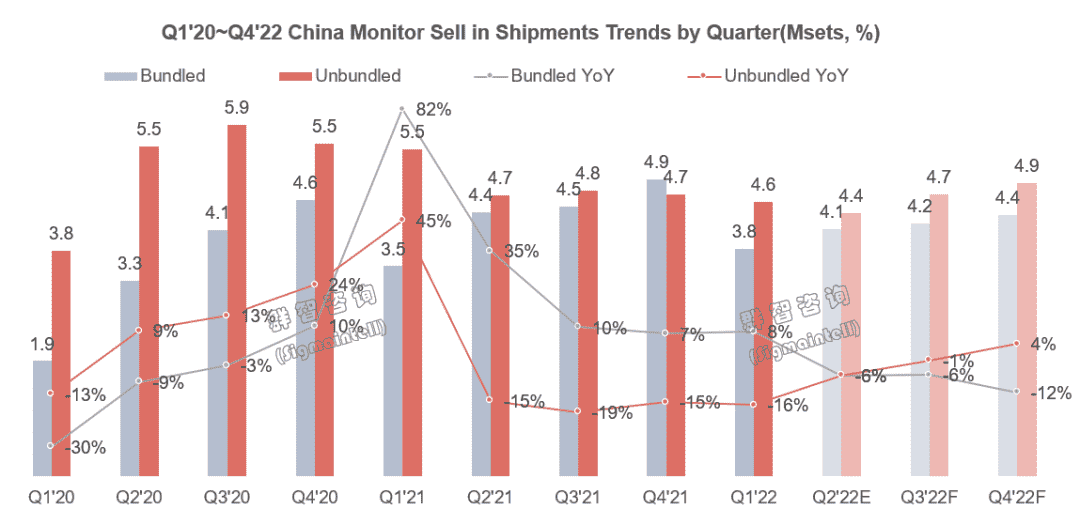

Sigmaintell’s data shows that during the "6.18" in 2022, China's online unbundled monitor market was characterized by "volume increase but value decrease": total sales of about 885,000 units (JD + Tmall), a positive YOY growth of 15%. The total sales was about 1.22 billion CNY, down 2% YOY.

Further combined with the trend of average price changes, the average price of the unbundled monitor market in 2022 is about 1,376 yuan, down about 15% YOY, the average price returned to the level equivalent to the market in 2020. At the same time, the market structure upgrade significantly, especially in the unbundled gaming monitor market. It can be seen that the decline in sales is not due to the reverse shift of market structure to the low-end market but is driven by the price cuts due to lower overall costs, and the positive impact is the growth of sales volume. Therefore, the strategy of stimulating demand with the price is effective in the current Chinese monitor market.

It should be noted that the impact of price strategies on boosting demand is based on a certain market background, mainly pointing to the "compensatory consumption" effect brought about by the decline in E-commerce logistics affected by the epidemic from April to May this year. Therefore, the reference of this strategy for the global market is limited.

Second question: Why is the brand competition pattern fluctuating significantly?

Since the price stimulation strategy has a certain degree of effectiveness, why do brands perform differently in the current market game? Sigmaintell believes that it is difficult to balance the profit and scale of a brand. Because aggressive or defensive strategies are no longer the expression of a single brand's will, but also test the strategic vision and supply chain capabilities at the level of the major set maker groups.

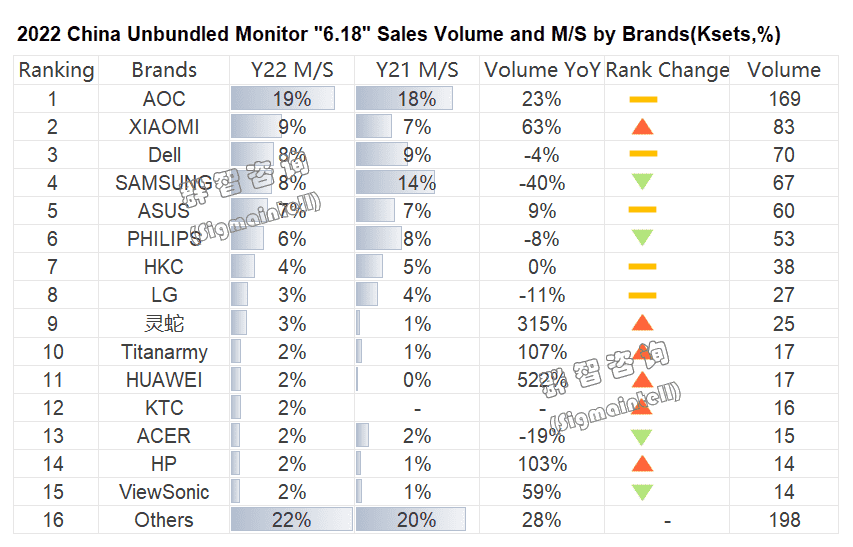

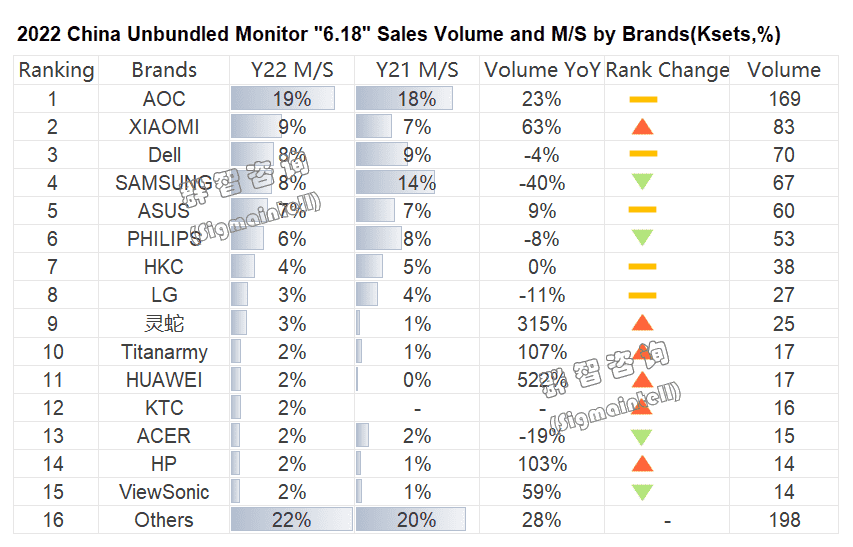

Influenced by the overall strategic differentiation and the difference in cost control ability, the brand competition pattern of Chinese unbundled monitor "6.18" market in 2022 shows obvious fluctuations, specifically characterized by the rise of local mid-range brands and the bright performance of new brands.

By brands:

AOC's head advantage is stable. As an important carrier of the TPV system to maintain the size of the group, AOC has obtained profit support from the group headquarters. Therefore, AOC has been active in its price strategy, achieving a considerable sales result. Its total sales volume was 169,000 units, up 23% YOY.

With the supply chain management concept of low inventory operation, the cost advantage of Xiaomi monitors is more significant than other major manufacturers during the market downturn, laying a good cost foundation for its consistent "cost performance" explosive strategy. During the "6.18”, Xiaomi sold 83,000 units, up 62% YOY, boosting to the 2nd in the market and being the main brand that has largest YOY increase.

Dragged down by inventory costs, Dell was unable to take an aggressive all-around strategy of its pricing strategy. Its sales of about 70,000 units, down 4% YOY. But Dell's layout in the unbundled gaming monitor market since last year has been quite effective. The hot-selling model S2721DGF has an active price strategy and a good sales situation, with more than 10,000 units sold on the whole internet.

Under the influence of the change of strategy contraction, Samsung's "6.18" price strategy was more negative in this year, sales momentum was weakened, sales of about 67,000 units, down 39% YOY, and market share also fell significantly.

Philips was affected by the decline of product competitiveness and ambiguous market strategy, this year's "6.18" market layout is more passive, which limited market performance, sales of about 53,000 units, sales fell 18% YOY.

Asus has been deeply involved in the unbundled gaming monitor market for a long time, despite the cost pressure in 2022, the sales strategy was right and the performance was solid, with sales reaching about 60,000 units, up 9% YOY.

The head of the six major brands have their own performance, but the comprehensive share shows a contraction trend, and the market space shifts to the promising brand (Beside the performance of LINGSHE).

Represented by the local Titanarmy and KTC, the mid-range brands has emerged since the beginning of the year. Relying on the group's entire manufacturing capability and development strategy adjustment behind the brand, both brands have achieved market scale breakthroughs by creating the ultimate cost-effective market segement explosive product. Titanarmy sales reached 17,000 units, an exponential growth YOY; KTC sold about 16,000 units, vigorously refreshing its market performance.

In addition, we can also see Huawei's development strategy shift, under the downward trend of its overall PC product line, the market price of monitor items has been positively adjusted, thus promoting Huawei this year's "6.18" also won a lot, sales of about 17,000 units.

What cannot be ignored is that behind this change in the landscape is also the will to develop China's e-commerce platforms. The epidemic continues to strengthen the influence of online platforms, further changing and reshaping the competitive landscape and demand trends in China's monitor market. Through the manifestation of brand gaming, Sigmaintell reminds industry chain companies to pay attention to examine this in-depth change and its impact on their brand operations.

The third question: why unbundled gaming monitor market continue to grow?

The third question: why unbundled gaming monitor market continue to grow?

Looking at the performance of Chinese "6.18" monitor segment market, unbundled gaming monitor market stands out obviously. According to Sigmaintell’s data, the unbundled gaming monitor market has maintained high growth YOY, with total sales of 362,000 units, an increase of 21% YOY, and a penetration rate of 40%. Where is the growth momentum of unbundled gaming monitors coming from? What are the future demand trends? What is the competitive landscape of gaming tech? What are the market opportunities? For these questions, Sigmaintell will respond through a detailed analysis.

It is worth pointing out that this year's "6.18" Chinese unbundled gaming monitor growth is basically consistent with Sigmaintell's forecast. From the market momentum’s aspect, the bright results of this market have their necessity and rationality. This necessity stems from:

First, the improvement in the supply situation of gaming graphics cards and the fall in price of graphics cards drived the inevitable YOY growth of Chinese gamers' demand for unbundled gaming monitor replacement demand this year.

Second, for gamers, hardware equipment upgrade to enhance the gaming experience is a hard demand rather than a flexible demand;

Third, since the fourth quarter of last year, gaming panel prices have continued to decline, IC costs have also fallen back, and the overall cost of unbundled gaming monitors has improved significantly compared to last year.

Fourth, set makers in 22Q2 had poor shipment target rate, offline demand was low, the channel inventory was high, with an urgent need through the "6.18" to de-stocking and to revitalize the product circulation chain appeared. Gaming is a must for this strategy. Therefore, most of the makers in the case of cost improvement, have adopted an aggressive price strategy, and had a echo with consumer demand.

The above four factors not only drive the growth of the "6.18" unbundled gaming monitor market, but also drive the overall growth of Chinese unbundled gaming monitor market this year. From the perspective of the offline market, with the improvement of the epidemic situation and the adjustment of strong policies, the demand for offline Internet cafes will also actively recover. Sigmaintell expects that China's unbundled gaming monitor shipments will reach 4 million units this year, up 10% YOY.

Along with the growth of market scale, the technical competition pattern of China's unbundled gaming monitor market is also undergoing significant adjustment. This is mainly reflected in:

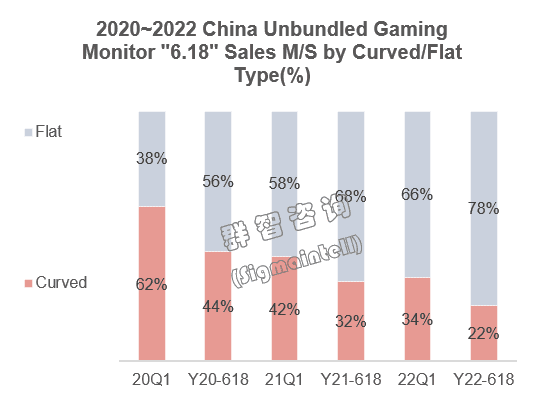

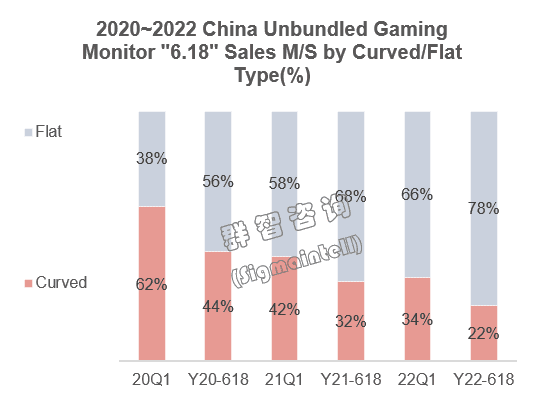

First, IPS flat gaming formed a crushing trend, VA curved unbundled gaming monitor market to be rebuilt.

As shown in the figure below, from 20Q1 to 2022 "6.18", VA curved unbundled gaming monitor market share has shrunk significantly, IPS flat gaming has been the absolute majority.

There are three key components behind this change:

1. SDC's exit strategy has had a significant negative impact on the VA curved gaming supply chain.

2. Tight supply and rising costs in 2021, with many constraints on the development of alternative suppliers to SDC and further erosion of VA curved gaming's price advantage at the end.

3. The divergence of IPS and VA gaming tech iteration capabilities. In recent years, IPS flat gaming has made significant progress in response time, image quality performance and cost optimization, especially Nano IPS, and the new generation of products has established an excellent market reputation. On the contrary, VA curved gaming, in the existing mainstream configuration of 2K+165Hz, has not developed a competitive tech iteration capability, and the curvature upgrade failed to hit the core demands of gamers directly. However, it can also be seen that since 21H2, curved gaming has been actively pushing the 240Hz market and rebuilding the market by promoting refresh rate upgrades. But the refresh rate upgrade is not an overnight process, so it will take time for the competitiveness of the curved gaming monitor market to rebound.

However, the reconstruction strategy of the curved gaming monitor market has gradually paid off. Sigmaintell’s data shows that this year's "6.18" sales of 240Hz curved gaming monitors exceeded 15,000 units, an increase of nearly four times YOY, and the proportion of the unbundled gaming monitor market also increased to 4.3%.

Second, 165Hz replaced 144Hz as the mainstream of the market, and 240Hz is rapidly rising.

As shown in the figure below, the refresh rate structure of this year's "6.18" unbundled gaming monitor market has shown a steady upgrade trend, and the majority of 165Hz has also been highlighted. 165Hz (including 170Hz overclocking) has a market share of about 47%, replacing 144Hz and holding "half of the unbundled gaming monitor market". Although 144Hz is the starting point of gaming high refresh rate tech, but to a certain extent, the product layout of the main gaming panel makers and set makers around high refresh rate, wide screen and fast response time at 165Hz is the key driving force for the strong development momentum of high refresh rate tech. In this process, the mainstream specifications of unbundled gaming monitors have also completed the evolution from FHD+144Hz to QHD+165Hz.

Looking at the competitive technology trends of unbundled gaming monitors, the exploration of the future has already been unveiled. With the evolution of graphics card performance, both ultra-high refresh rate and ultra-HD resolution have the potential for development. Due to the IC and fast response and other technical bottlenecks, the two technical routes are difficult to balance. The current development of 240Hz has two routes: The first is to take the FHD+240Hz+VA screen as the representative, and launch an impact on the mainstream market with a low-price strategy, which is an important step in the reconstruction of the VA gaming market; the second is represented by QHD + 240Hz + IPS screen, based on high-end unbundled gaming monitor market, to strengthen the IPS technology in the the high-end market-leading ability. The two routes combine to enhance the penetration of 240Hz in the unbundled gaming monitor market and will continue to grow in the future.

Fourth question: Why is the continuous decline of unbundled curved monitor?

Fourth question: Why is the continuous decline of unbundled curved monitor?

According to Sigmaintell's data, China unbundled curved monitor market was still in a cold winter in 2022, and the brand's curved strategy is not active, with total sales of 103,000 units, down 22% YOY.

Combined with the overall situation in recent years, the decline of the unbundled curved market is comprehensive. On the one hand, the rapid rise of 23.8-inch IPS office models with cost and supply chain advantages has rapidly eroded the market share of unbundled curved monitor in the 23~24-inch segment market of office models; on the other hand, as analyzed above, in the background of supply chain adjustment and tech iteration, IPS gaming tech has also greatly eroded the market space of curved unbundled gaming monitors online and in Internet cafes.

Is there still a chance for curved technology to grow in China? Looking back at the history of curved tech's entering the Chinese market and gradually growing, and then declining. It can be intuitively seen that the vitality of monitor panel tech is affected by the combination of supply strategy, tech iteration capability and its market transformation capability, which are three indispensable factors. It is not difficult to achieve the re-development of curved monitor tech. Rather, the key lies in whether the leader of the technology has the determination and ability to deploy from technology to supply to end market.

The fifth question: why unbundled ultrawide monitor first decline?

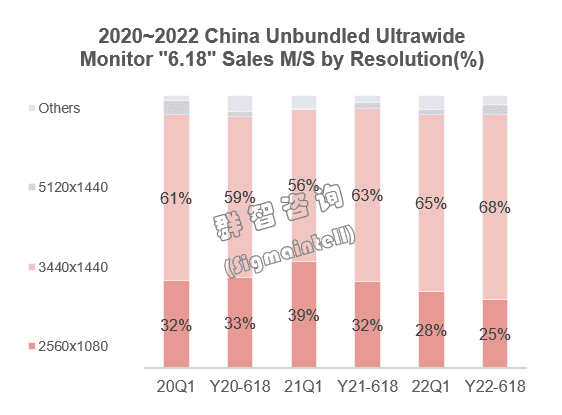

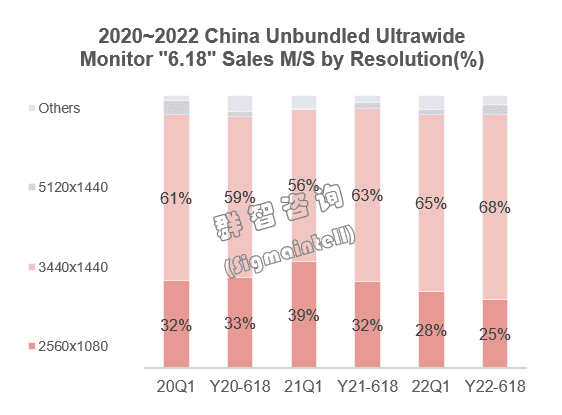

The unbundled ultrawide monitor market in this year's "6.18" delivered a surprising answer. Sigmaintell’s data show that 2022 "6.18" unbundled ultrawide monitor sales was only 45,000 units and the first YOY fall in recent years, about 17%.

In the development of the unbundled ultrawide monitor market, the first and foremost problem is singularization of product structure. Sigmaintell has repeatedly warned of this in previous studies. The over-reliance on 34-inch WQHD products has gradually overdrawn the vitality of unbundled ultrawide monitor products in the mass consumer market. The current situation of downward market demand makes this overdraft effect happen in advance.

In addition to the singularity of the product, the slow iteration of unbundled ultrawide monitor products and the lack of technological innovation are both the important reasons to limit the attractiveness of the unbundled ultrawide monitor market at present. Unbundled ultrawide monitor not only failed to learn a lesson on curved monitor products but showed the tendency to follow in its footsteps.

If the unbundled ultrawide monitor market is to break through the development bottleneck subsequently, Sigmaintell believes that there are two points to consider:

First, accelerate ultrawide technology innovation, especially for small and medium size beyond 34 inches and larger ultrawide monitor specifications. Develop new products from multiple dimensions such as image quality performance ability and refresh rate parameters, and enrich the unbundled ultrawide monitor product structure

Second, develop commercial ultrawide products for the commercial market, not just the consumer market. From the application scenario of ultrawide monitor, the demand for large screens and split screens in the professional office commercial market is gradually increasing. In the post-epidemic era, commercial demand also has the momentum of sustained recovery. For the professional office commercial scene, opening up the supply chain to layout ultrawide monitor products is also a step with great potential for development.

Sixth question: why unbundled 4K monitor growth is strong?

Sixth question: why unbundled 4K monitor growth is strong?

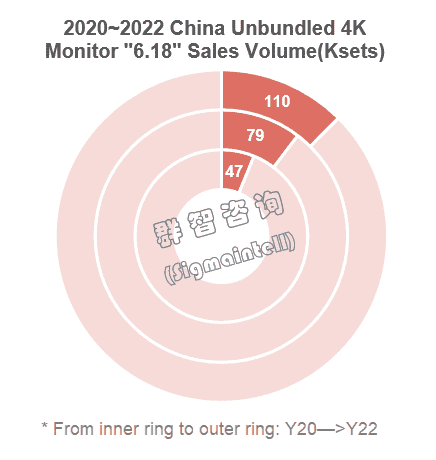

High refresh rate market is second only second to the unbundled gaming monitor market and has become the mainstream of this year's "6.18" market structure upgrade.

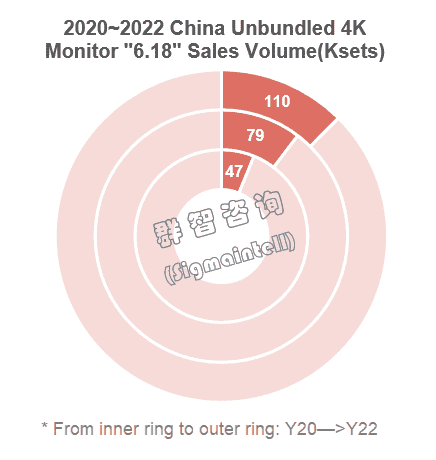

Sigmaintell’s data show that the high refresh rate monitor sales of about 380,000 units, up 13% YOY. Among them, the market size and penetration rate of unbundled 4K monitor also showed a rapid increase trend. Unbundled 4K monitor sales reached 110,000 units, up 38% YOY, occupying nearly 30% of the market share of the high refresh rate market.

In the above analysis on the development trend of gaming tech, the development potential of 4K has been mentioned. 4K is an important direction in the upgrade of gaming tech, and 4K+144Hz is equal to QHD+240Hz as the representative specification of high-end unbundled gaming monitors. Under the linkage of the unbundled gaming monitor market, the sales of 4K+144Hz unbundled gaming monitors have increased nearly 2.5 times YOY, accounting for about 4% of the unbundled gaming monitor market. More notably, although 4K+144Hz is positioned at the high-end, the sales of "6.18" accounted for nearly 10% of the overall turnover of unbundled gaming monitors, which undoubtedly shows the consumption power of Chinese gamers in high-end gaming products.

In addition, 4K + 60Hz products have also gained considerable market increments with price advantages. Sigmaintell’s data show that sales of 4K + 60Hz monitors in this "6.18" increased by 28% YOY. Among them, AOC/Samsung/Dell/HKC/LGE as the main brands leading the market, respectively play an active role in the professional office and audio-visual entertainment scene.

Overall, in the short and medium term, 4K monitors will continue to expand the market of the general home and professional office market through lower price strategy. In the medium and long term, 4K unbundled gaming monitors will also continue to make an impact and compete with 240Hz for the next generation of mainstream gaming tech.

The seventh question: why there are still hidden worries under the prosperity?

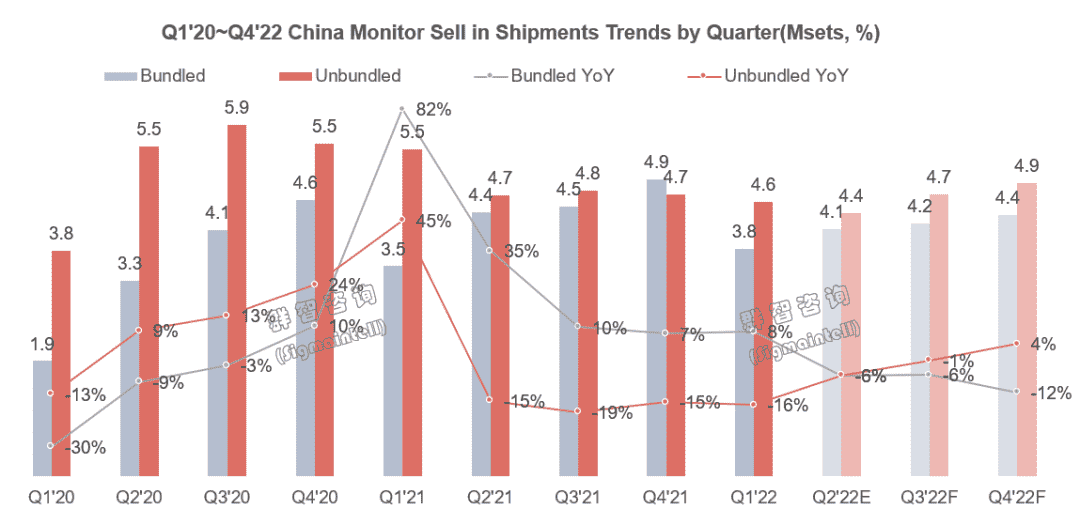

Although the "6.18" market has delivered a bright answer in terms of both scale growth and structural upgrade, the market situation is still not optimistic from the performance of China's unbundled monitor shipments in 22Q2. Sigmaintell expects that the market size of China's unbundled monitor market will be about 4.4 million units in 22Q2, with a double decline in YOY and MOM.

The performance of the "6.18" market did help to de-stocking the backlog in 22H1 of the channel, but there is also the risk of overdrawing the online market demand. Looking ahead to 22Q3, the online market will contract cyclically, while the offline DIY market is still difficult to rejuvenate. However, the market also has the opportunity to recover the demand for Internet cafes and line orders. Overall, the market size of China's unbundled monitor market in 22Q3 was 4.7 million units, down 1% YOY and up 3% MOM. From a full-year dimension, the Chinese unbundled monitor market will also show a YOY decline, with an expected decline of about 5%.

Therefore, in terms of market layout, 22Q4 will be particularly important, 11.11 promotion will undoubtedly be the market heights in 22H2, which will lead to more intense market competition. How to seize this competition, we can use the performance of this year's "6.18" as a "mirror" of demand, reflecting the trend of market changes. Combined with the supply side of the situation, Sigmaintell suggests: 1. With the pace of production reduction of panel makers, the fluctuation trend of panel cost will tend to be stable, and set makers can flexibly prepare goods according to the cost trend of different specifications, and seize the channel space at the right time. 2. Consumer demand is difficult to boost during the year, but the unbundled gaming monitor market continues to have growth momentum. Price stimulus can still work, and it is necessary to grasp the trend of structural adjustment of gaming products.

中文:

“七问”2022年中国显示器“6.18”市场

随着疫情红利的消退以及超级通胀负面影响的放大,全球显示器行业市场需求前景出现了极大的不确定性。在面板供应端,显示器品牌客户陆续下调订单需求,面板价格亦持续下行,面板厂商营利能力承压;在需求端,海外消费市场复苏不力,消费类品牌内耗严重。放眼中国市场,上半年受疫情影响,国内终端消费需求疲软。叠加国内物流运力的限制,二季度中国显示器市场出货状况不佳,4~5月份市场表现尤为低迷。

受此影响,2022年中国“6.18”市场表现格外引人瞩目,直接影响到业内对于中国市场以及中国品牌客户需求的信心与趋势判断。通过观察中国市场大促表现,群智咨询(Sigmaintell)认为有以下假设亟待得到检验:

第一,在成本下行大势之下,终端消费需求能否在积极的价格策略下得到提振?

第二,显示技术竞争格局是否跟需求表现一致?

第三,中国市场的品牌博弈是否在发生明显变化?

第四,下行期的中国市场是否仍旧具有发展潜力?

围绕以上问题,市场给出的答案将有助于业内在市场下行期理解需求变化的特点,并寻找合适的发展机会。为了检验上述假设,群智咨询(Sigmaintell)对今年的“6.18”中国显示器市场进行了详细剖析,并对相关的七个重要问题展开具体分析。

第一问:为何市场“量增额减”?

群智咨询(Sigmaintell)数据显示,2022年“6.18”期间,中国线上独立显示器市场呈现“量增额减”的特点:总销量约88.5万台(京东+天猫商城),同比积极增长15%;总销额约为12.2亿元,同比下滑2%。

进一步结合均价变化趋势可见,2022年独立显示器市场均价约为1376元,同比下滑约15%,均价回归到与2020年市场基本相当的水位。与此同时,市场结构升级显著,尤其体现在电竞市场。由此可见,销售额的下滑并不是由于市场结构逆向转移中低端市场所带来的,而是受整体成本下降带来的价格下调所推动,其所产生的正向影响便是销售量的积极增长。因此,以价格刺激需求的策略,在当前中国显示器消费市场是奏效的。

需要注意的是,价格策略对需求的提振影响具有一定的市场背景,主要指向今年4~5月由疫情所影响的电商运力下滑所带来的“补偿消费”效应。因此该策略对于全球市场的参考性有限。

第二问:为何品牌格局波动明显?

既然价格刺激策略具有一定的有效性,为何品牌在当前的市场博弈中却表现不一。群智咨询(Sigmaintell)认为利润与规模难以两全,进或者退,不再是单一品牌意志的体现,也检验着各大整机厂商集团层面的战略眼光和供应链能力。

受整体战略分化以及成本管控能力差异的影响,2022年中国独立显示器“6.18”品牌格局呈现明显波动,具体特征为:本土腰部品牌崛起,新晋品牌表现亮眼。

分品牌表现看:

AOC头部优势稳定,作为TPV系维持集团体量的重要载体,AOC获得了集团总部的利润支持,因此在价格策略上表现积极,从而达成了可观的销售成绩。其总销量16.9万台,同比增长23%。

凭借低库存运转的供应链管理理念,Xiaomi显示器的成本优势在市场下行期相较于其他主力厂商更为显著,为其一贯的“性价比”爆款策略奠定了良好的成本基础。此次“6.18”期间,小米销量8.3万台,同比增幅62%,跃居市场第二位置,为同比增幅最大的主力品牌。

受库存成本拖累,Dell未能在价格策略上采取全线激进的策略。其销量约7万台,同比小幅下滑4%。但Dell自去年开始在电竞市场的布局颇显成效。热销机型S2721DGF价格策略积极,销售状况颇佳,全网单品销量超过一万台。

在策略收缩变化影响下,Samsung今年“6.18”价格策略较消极,销售动能受到削弱,销量约6.7万台,同比下滑39%,市场份额亦明显下滑。

Philips受产品竞争力减退与市场策略模糊的影响,今年“6.18”市场布局较被动,限制了市场表现,销量约为5.3万台,销量同比下滑18%。

Asus长期深耕电竞市场,今年虽然成本压力大,但销售策略得当,表现稳健,销量约达6万台,同比增长9%。

头部六大品牌此消彼长,综合份额则呈收缩态势,市场空间向腰部品牌转移(灵蛇的表现另当别论)。

以本土的Titanarmy和KTC为代表,腰部势力自年初开始异军突起。依托于品牌背后的集团整机制造能力与发展策略调整,这两个品牌均通过打造极致性价比的细分市场爆款产品实现了市场规模的突破。泰坦军团销量达1.7万台,同比成倍增长;KTC销量约1.6万台,大力刷新了其市场成绩。

除此之外,还能看到Huawei的发展策略转向,在其整体PC产品线下沉的趋势下,显示器单品的市场价格均有积极调整,从而推动华为今年“6.18”也斩获颇丰,销量约为1.7万台。

不可忽略的是,这一格局变动的背后也体现着中国电商平台的发展意志,疫情持续强化了线上平台的影响力,进一步改变和重塑了中国显示器消费市场的竞争格局以及需求趋势。透过品牌博弈的表现,群智咨询(Sigmaintell)提醒产业链企业要注意审视这种深层次的变化及其对自身品牌经营的影响。

第三问:为何电竞持续增长?

从中国“6.18”显示器细分市场的表现来看,电竞可谓是一枝独秀。群智咨询(Sigmaintell)数据显示,电竞市场同比维持高增长,总销量36.2万台,同比增幅达21%,渗透率提升至40%。电竞显示器的增长动能来自于哪里?未来的需求趋势如何?电竞技术竞争格局如何?市场机会有哪些?对于这些问题,群智咨询(Sigmaintell)将通过详细剖析来回应。

值得指出的是,今年“6.18”中国电竞显示器的增长与群智咨询(Sigmaintell)的市场预测是基本一致的,因为从市场动能来看,这一市场的亮眼成绩有其必然性和合理性。这种必然性源于:

第一,电竞显卡供应形势的好转以及显卡价格回落,推动着今年中国游戏玩家对电竞显示器换购机需求同比必然增长;

第二,对于游戏玩家而言,硬件设备升级,提升游戏体验,是硬性需求,而不是弹性需求;

第三,自去年四季度开始,电竞面板价格持续下滑,IC成本亦回落,电竞显示器的整机成本相较去年得到了显著改善;

第四,整机厂商二季度出货目标达成率差,线下需求低迷,渠道库存高涨,急需通过“6.18”这个时机去化库存,盘活产品流通链条。电竞则是这一策略中的必争之地。因此,大部分厂商在成本改善的情况下,都采取了积极的价格策略,与消费需求形成了呼应之势。

上述四因素不仅推动着“6.18”电竞市场的增长,也会推动着今年中国电竞显示器市场的整体增长。从线下市场看,随着疫情形势的改善和防控政策的调整,线下网咖的换购机需求也会积极恢复。群智咨询(Sigmaintell)预计,今年中国电竞显示器的出货规模将达400万台,同比增长10%。

在市场规模增长的同时,中国电竞市场的技术竞争格局也在发生明显调整。主要体现在:

第一,IPS平面电竞形成碾压之势,VA曲面电竞市场有待重建。

如下图所示,从2020年一季度到2022年“6.18”,VA曲面电竞市场份额大幅萎缩,IPS平面电竞已是电竞市场绝对主力。

这种变化的背后,有三个关键环节:

1. SDC的退出策略,对VA曲面电竞供应链造成明显的消极影响;

2. 2021年的供应紧张和成本上涨,SDC的替代性供应商发展掣肘颇多,VA曲面电竞在终端的价格优势进一步削弱;

3. IPS与VA电竞技术迭代能力分化。近年来IPS平面电竞在响应时间、画质表现与成本优化上进展显著,尤其Nano IPS,新一代产品建立了优秀的市场口碑。反观VA曲面电竞,在2K+165Hz的现有主流配置中,没有发展出有竞争性的技术迭代能力,曲率升级未能直击游戏玩家的核心诉求。但也可以看到,从去年下半年开始,曲面电竞积极发力240Hz市场,通过推动刷新率升级来重建市场。但刷新率的升级也并非一蹴而就的过程,因此曲面电竞市场竞争力的回弹尚需时日。

不过,曲面电竞市场的重建策略已逐渐产生成效。群智咨询(Sigmaintell)数据显示,今年“6.18”240Hz曲面电竞显示器的销量超过1.5万台,同比增长近4倍,在电竞市场的占比也提升到4.3%。

第二,165Hz取代144Hz成为市场主流,240Hz快速崛起。

如下图所示,今年“6.18”电竞市场的刷新率结构呈现稳步升级趋势,而165Hz主体地位也得到了彰显。165Hz(含170Hz超频)的市场份额约为47%,取代了144Hz,掌握了电竞市场的“半壁江山”。144Hz虽然是电竞高刷技术的起点,但在一定程度上,主力电竞面板厂商与整机厂商在165Hz上围绕着高分、宽屏以及快速响应时间等方面所进行的产品布局才是电竞高刷技术具有强劲发展动能的关键推动力。在这个过程中,电竞显示器的主流规格也完成了从FHD+144Hz到QHD+165Hz的进化之路。

展望电竞显示器的技术竞争趋势,对未来的探索已然揭开序幕。随着显卡性能的进化,超高刷新率和超清分辨率均有发展潜能。由于IC以及快速响应等技术上的瓶颈所限,两种技术路线难以两全。当前240Hz的发展出现两种路线:其一是以FHD+240Hz+VA屏为代表,以低价策略向主流市场发起冲击,是VA电竞市场重建的重要一步;其二是以QHD+240Hz+IPS屏为代表,立足高端电竞市场,强化IPS技术在高端市场上的引领能力。两种路线合力,共同提升了240Hz在电竞市场的渗透率,未来也将持续增长。

第四问:为何曲面连续下滑?

从群智咨询的监测数据看,2022年中国曲面显示器市场仍处寒冬,品牌曲面策略并不积极,曲面显示器总销量10.3万台,同比下滑22%。

结合近年来的整体形势,曲面市场的衰退是全方位的。一方面,23.8英寸IPS办公机型凭借成本及供应链优势的快速崛起,迅速蚕食了曲面显示器在办公机型23~24英寸段的市场份额;另一方面,如上文所分析的,在供应链调整和技术迭代的背景下,IPS gaming技术也极大侵蚀了曲面电竞显示器在线上以及网咖的市场空间。

曲面技术在中国还有发展机会吗?回顾曲面技术进入中国市场并逐步壮大,然后衰落的发展历程,可以直观地看到,显示面板技术的生命能力是受供应策略、技术迭代能力以及其市场转化能力的共同影响,三因素缺一不可。曲面技术要重新获得发展,并非难以实现,关键在于该技术的引领者是否有决心和能力从技术到供应再到终端市场进行全方位布局。

第五问:为何宽屏首现衰退?

宽屏显示器市场在今年的“6.18”交出了一份出人意料的答卷。群智咨询数据显示,2022年“6.18”宽屏显示器销量仅为4.5万台,出现近年来同比首次下滑,降幅约为17%。

宽屏市场的发展问题,首当其冲的是其产品结构的单一化问题,群智咨询(Sigmaintell)在以往的研究中多次进行了提醒。对于34英寸WQHD产品的过分依赖,逐渐透支了宽屏产品在大众消费市场的生命力。市场需求下行的现状让这种透支效应提前发生。

除了产品的单一化,目前宽屏产品迭代慢,缺乏技术创新也是制约宽屏市场吸引力的重要原因。宽屏产品未能以曲面产品为前车之鉴,而有步其后尘之势。

宽屏市场后续若要突破发展瓶颈,群智咨询(Sigmaintell)认为,有两点需要考虑:

第一,加快推进宽屏技术创新,尤其是针对34英寸之外的中小尺寸以及更大尺寸宽屏规格,从画质表现能力和刷新率参数等多维度开发新产品,丰富宽屏产品结构;

第二,针对商用市场开发商用宽屏产品,而不局限于消费市场。从宽屏的应用场景看,专业办公类商用市场对大屏及分屏需求逐渐增长,在后疫情时代,商用需求也具有持续复苏的动能。针对专业办公类商用场景,打通供应链环节,布局宽屏显示器产品也是极具发展潜力的一步举措。

第六问:为何4K增势强劲?

高分市场仅次于电竞市场,为今年“6.18”市场结构升级的主要方向。群智咨询(Sigmaintell)数据显示,高分显示器销量约为38万台,同比增长13%。其中,4K显示器的市场规模和渗透率也呈现快速提升趋势。4K显示器销量达11万台,同比增长38%,占据了高分市场近30%的市场份额。

在上文有关电竞技术发展趋势的分析中,关于4K的发展潜力已经有所提及。4K是电竞技术升级中的重要方向,4K+144Hz与QHD+240Hz并列,同为高阶电竞显示器的代表性规格。在电竞市场的联动之下,4K+144Hz电竞显示器的销量同比增长近2.5倍,在电竞市场中的占比约为4%。更值得注意的是,4K+144Hz定位高端,而此次“6.18”销售额在电竞显示器整体营业额中占比近10%,无疑展现了中国游戏玩家在高端电竞产品上的购买力。

除此之外,4K+60Hz产品也凭借价格优势获得了可观的市场增量。数据显示,该规格的4K显示器此次“6.18”销量同比增长28%。其中,AOC/Samsung/Dell/HKC/LGE为引领该市场的主力品牌,分别在专业办公和影音娱乐场景中积极发力。

综合来看,在中短期内,4K显示器仍将持续通过价格下沉拓展普通家用和专业办公市场,提升市场规模;在中长期来看,4K电竞显示器也将持续发力,与240Hz共同角逐下一代电竞主流技术地位。

第七问:为何繁荣之下隐忧仍在?

尽管“6.18”市场在规模增长与结构升级两方面均交出了亮眼答卷,但从二季度中国独立显示器的出货大盘表现看,市场现状仍不容乐观。群智咨询(Sigmaintell)预计,2022年二季度中国独立显示器市场规模约为440万台,同环比双双下滑。

“6.18”市场表现确实有助于去化上半年渠道所积压的库存,但也存在透支线上市场需求的风险。展望三季度,线上市场将周期性收缩,与此同时线下DIY市场仍难以恢复活力。不过市场也存在网咖及行单需求复苏的机会。综合来看,2022年三季度中国独立显示器市场规模为470万台,同比下滑1%,环比周期性增长3%。从全年维度看,中国独立显示器市场也将呈同比下滑之势,预计降幅约为5%。

因此,就市场布局来看,四季度将格外重要,双11大促无疑将是下半年的市场高地,将产生更为激烈的市场竞争。如何把握这场竞争,今年的“6.18”表现可为需求之“镜“,反映市场变化之势。结合供应端的情况,群智咨询(Sigmaintell)建议:1. 随着面板厂商减产步伐推进,面板成本波动之势将趋于平稳,整机厂商可根据不同规格的成本趋势进行灵活备货,适时抢占渠道空间;2. 消费需求大盘年内难以提振,但电竞持续具有增长动能,价格刺激之策仍可奏效,同时需要把握电竞产品结构性调整的趋势。