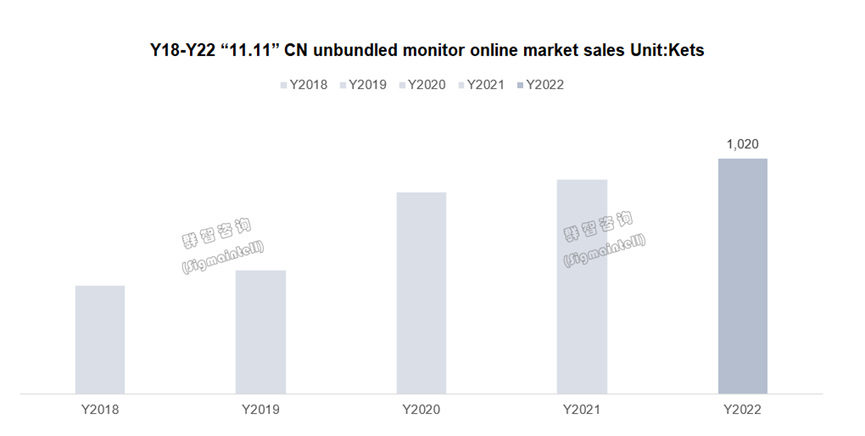

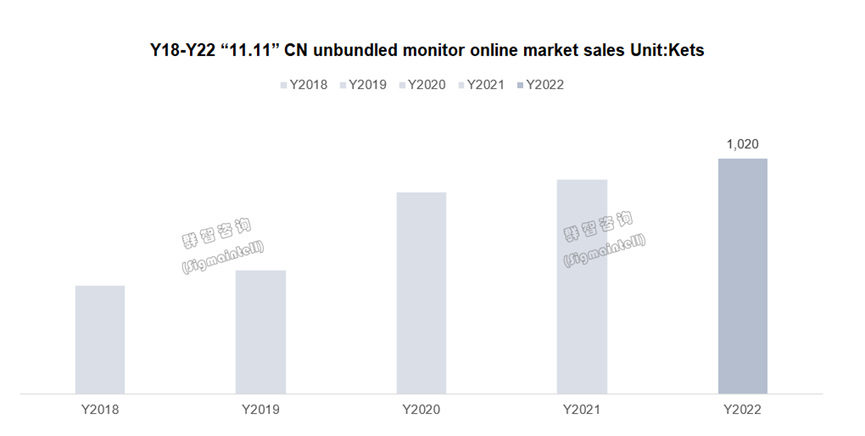

During the "11.11" in 2022, the volume of unbundled monitors in China's online market has significantly grown. Compared with the “11.11” in 2021, the brand and platform promotions strengthened in 2022. A series of promotional methods, such as price cuts for hot-selling models, low prices for new products, and upgraded money-off policies, have enhanced the cost-effective advantage and stimulated consumers' purchasing and replace demand. According to Sigmaintell’s data, the total volume of online 2022 “11.11” CN unbundled monitor was 1,020 Kets, a YoY increase of 10%, but different platforms showed differences.

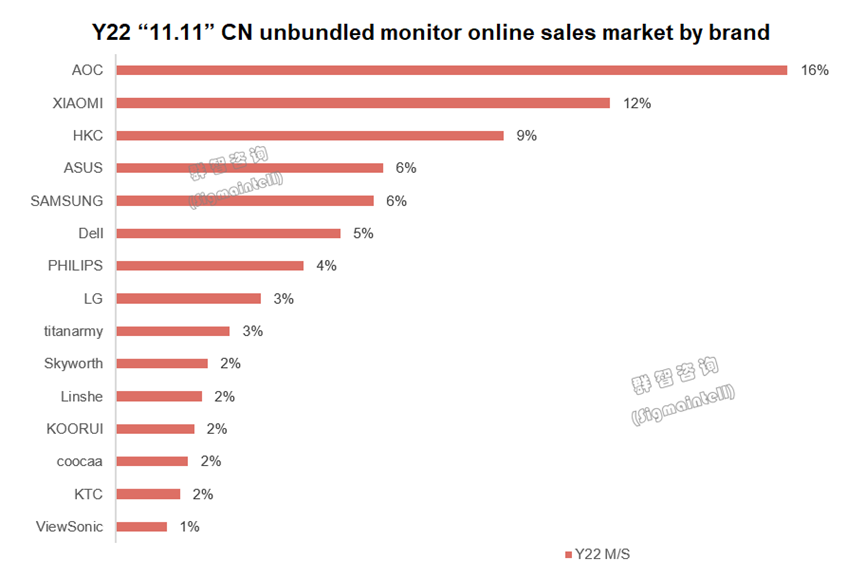

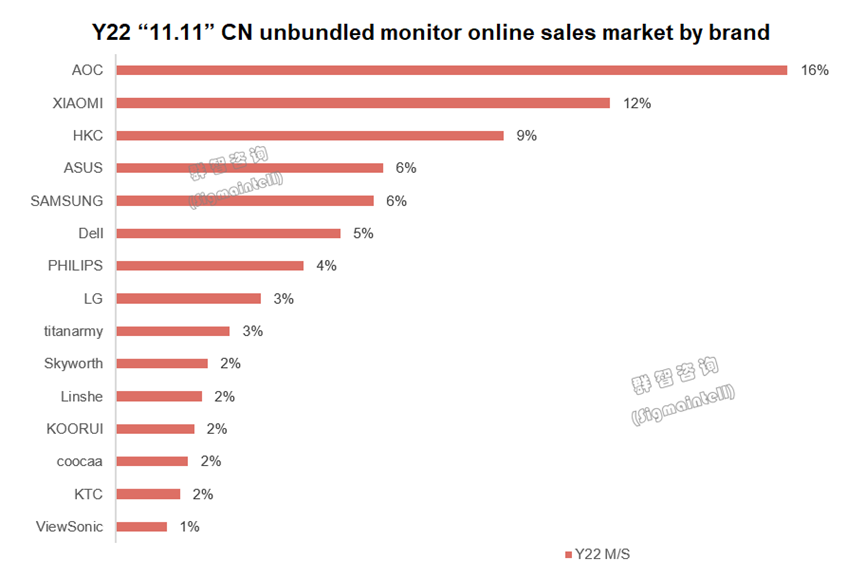

The brand structure fluctuates, the share of top brands shrinks, and local brands grow rapidly.

The 11.11 online brand structure has shown significant changes: brands have different attitudes towards promotion, the share of top brands has shrunk, and the share of medium and waist brands has increased.

Among them, the total volume of AOC decreased slightly YoY. The volume of Xiaomi increased by 11% YoY, ranking 2nd in the market. The discount of Redmi 1A (Redmi brand) was significantly higher than that of products of the same specification during the “11.11” promotion, and it continued to be the TOP1 online selling product. The ultra-cost-effective gaming model G24 launched has won the TOP2 online. HKC has shown a strong recovery momentum and returned to the TOP3, with a 1.6 times YoY growth. Its sub-brand KOORUI also has a good performance. The volume of ASUS rose 46% YoY. SAMSUNG and DELL had small promotions on Y21 “11.11”, so the volumes dropped YoY.

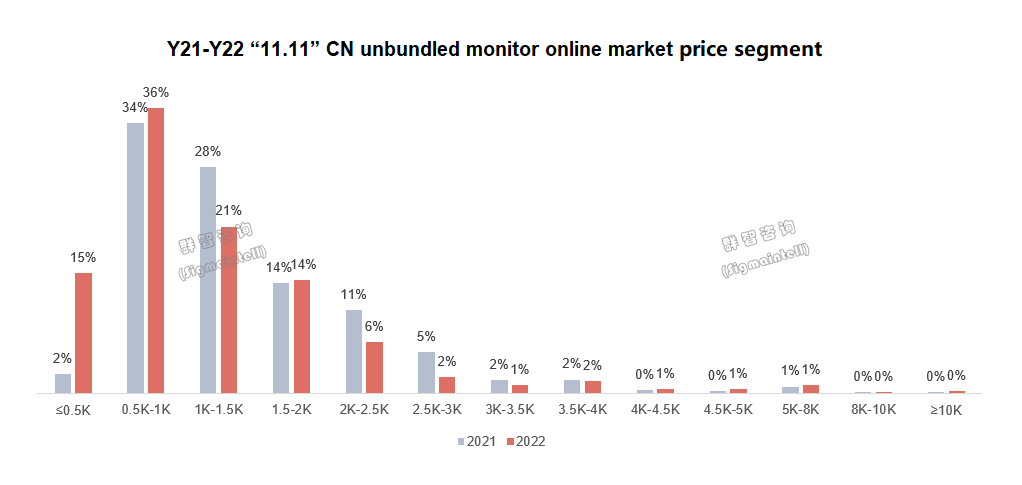

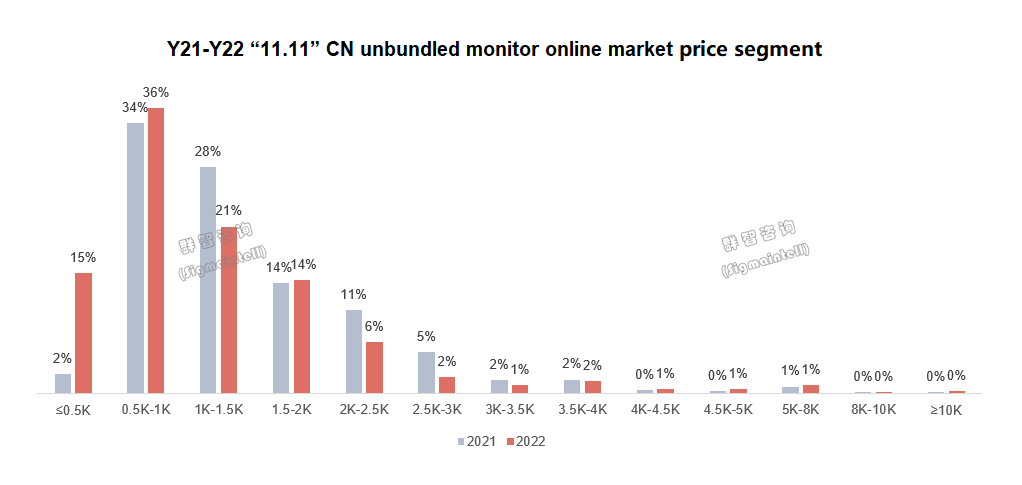

The mid-to-high-end market share declined, and the price war stimulated consumers of entry-level models, and the share of below 1,000 RMB models had a large increase.

With the decrease in cost, the end price is also decreasing, and the purchasing power of consumers is weak. Brands use low-price strategies in destocking to maintain volume, so the price range of models has dropped. At present, the shopping habits of Mainland China consumers have changed from "impulsive" to "rational.” The market share of mid-to-high-end models has shrunk, while the entry-level and mid-to-low-end models have increased.

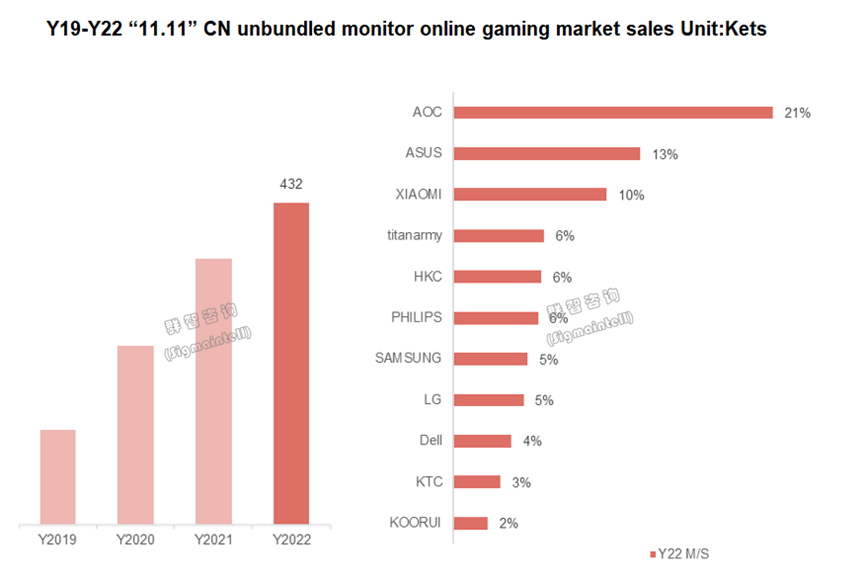

The structure continues to upgrade, gaming and high resolutions show the same upward trend.

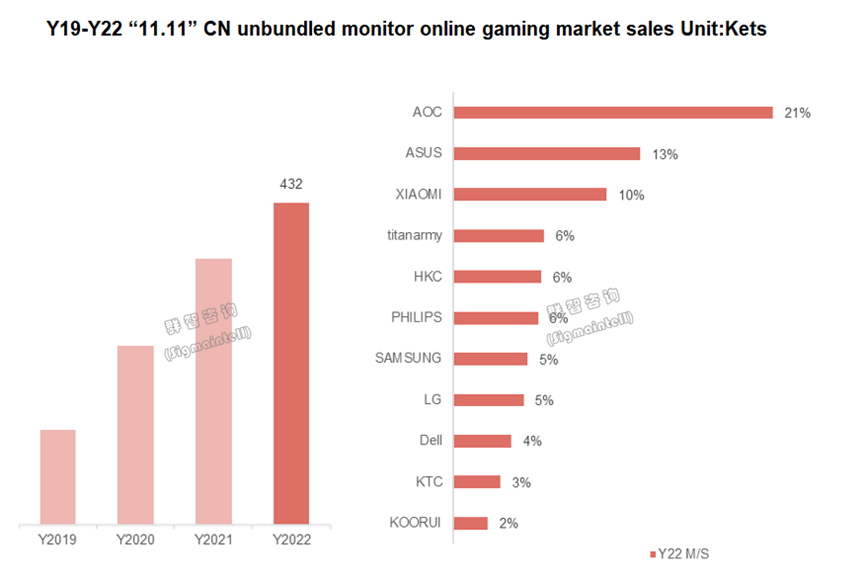

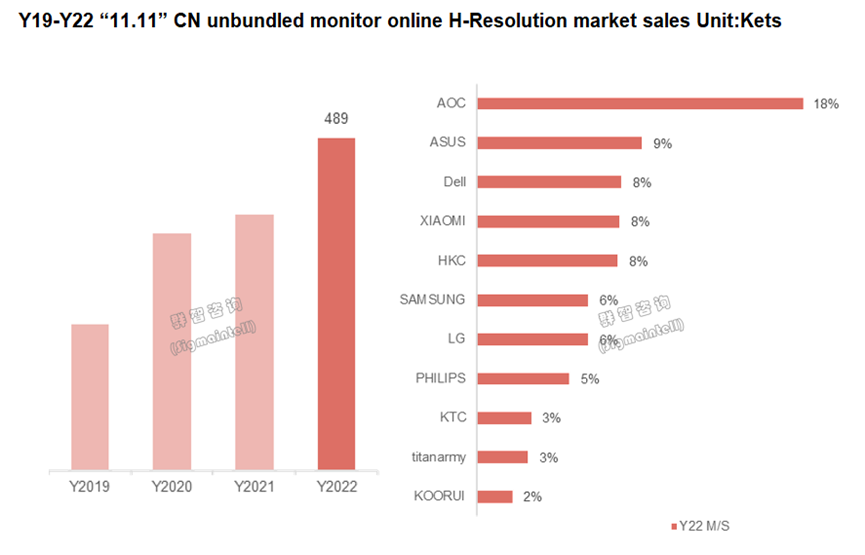

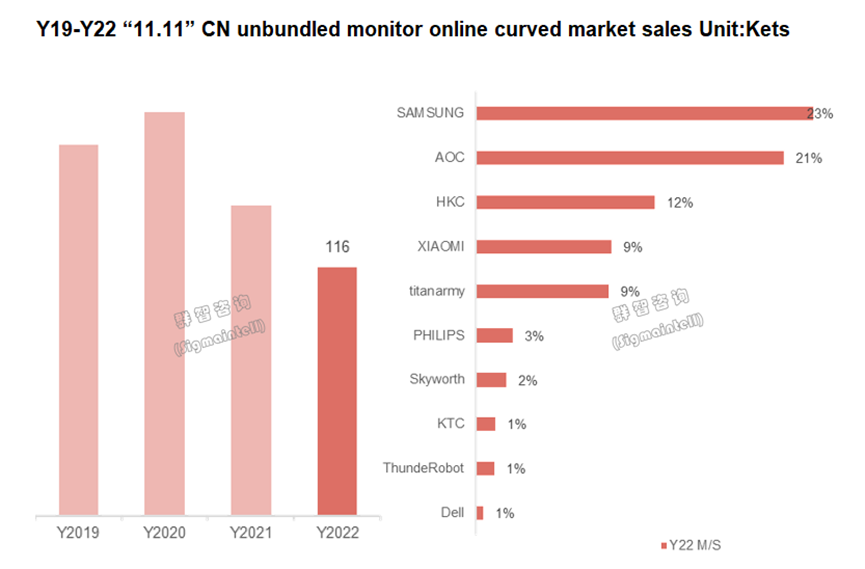

Driven by the structural upgrading of product resolution and refresh rate, the gaming and high-resolution market is actively growing. In contrast, the curved and ultrawide monitor markets continue to decline.

The total volume of the gaming market was 432 Kets, a YoY increase of 21%, and the penetration rate increased to 42%. For specification, IPS has the leading share, and VA gained a share increase due to the low price during the promotion. The share of curved gaming monitors continued to decline, the share of QHD models increased, and 165Hz products performed well.

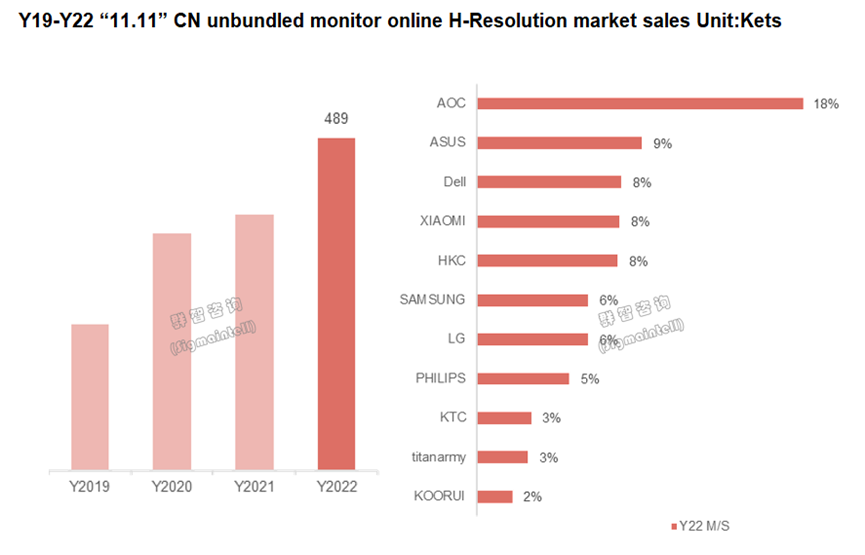

In the high-resolution market, the "gaming+high-resolution" attribute of high-resolution and high refresh rate has become a critical growth point. For high-resolution, UHD upgrades have slowed down, the growth rate of high cost-effective QHD products has increased rapidly, and the sales performance of ultrawide high-resolution products has gone down. The price strategies of high-resolution products are quite different.

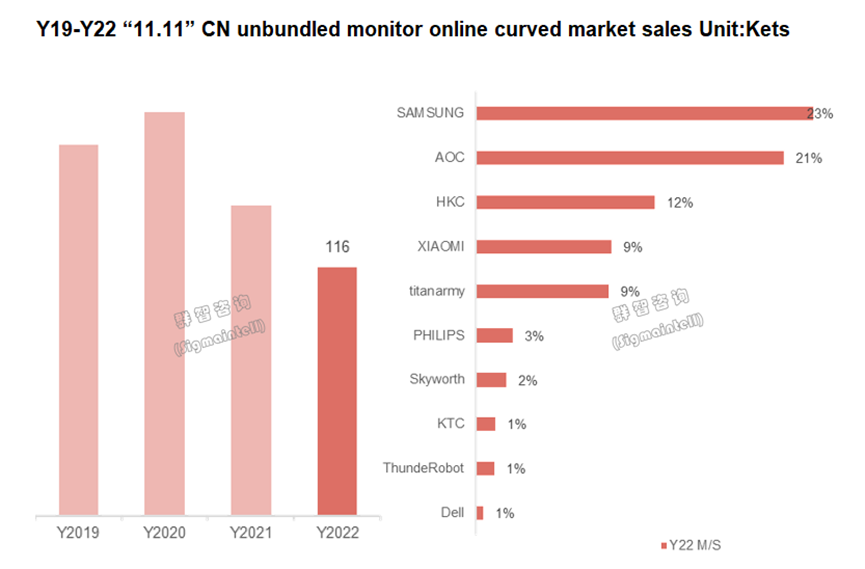

In the curved market, The curved models of each brand are conservative in pricing and marketing strategy. The total volume of curved monitors was 116 Kets, a YoY decrease of 20%.

Compared with other markets, the iteration of models in the ultrawide market is still dominated by old models, which is reflected in the energy’s decline of TOP models, while the ultrawide products’ refresh rate has been structurally upgraded slowly. The total volume of ultrawide monitors was 4.1 Kets, and the penetration rate declined to 4%.

With the continuous increase in the share of online channels, the current online channel is critical to releasing demand in the unbundled monitor market. During the "11.11" promotion, although the overall market has grown steadily, the ASP has a large decline, and the mid-to-high-end market has shown decreasing features. Sigmaintell recommends that brands need a segmented positioning of the product line. On the one hand, it needs to meet the consumers’ characteristics of pursuing cost-effective products. On the other hand, it needs to meet the needs of middle and high-end consumers for product performance and functional differentiation through the segmented market and high-premium products.

中文部分:

2022年中国独立显示器“11.11”促销市场分析与总结——量增额减:市场承压,性价比当道

2022年“11.11”期间,中国线上市场独立显示器销售规模取得显著增长,与去年同期相比,此次品牌和平台促销力度均有加大,通过热销机型降价,新品低定价以及满减政策升级等一系列促销方式,增强性价比优势,刺激消费者购机换机热情。群智咨询(Sigmaintell)数据显示,2022年“11.11”中国线上独立显示器总销量102万台,同比积极增长10%,但不同平台表现出较大差异。

品牌格局波动,头部品牌份额收缩,本土品牌成长迅速

此次双11线上品牌格局出现明显变化,主要表现为:品牌对于大促的态度不一,头部品牌份额收缩,中腰部品牌份额增长。

其中,AOC总销量同比微降;小米(Xiaomi)销量同比增幅11%,居市场第二,小米红米(Redmi)品牌Redmi 1A 促销期间降价力度显著高于同规格产品,蝉联线上TOP1,同时推出的超高性价比电竞机型G24斩获线上TOP2;HKC表现出强劲的复苏劲头,重回TOP3,同比增长达到1.6倍,其子品牌KOORUI也具有良好市场表现。华硕(ASUS)销量同比增长46%。三星(SAMSUNG)和戴尔(DELL)此次双十一促销力度较小,销量同比大幅下滑。

中高端市场份额下行,价格战刺激入门机型用户,千元以下机型占比大幅提升

伴随成本回落,终端价格逐渐下降,同时用户购买力疲软,品牌厂商通过低价策略进行去化库存以维持销售体量,机型价格段出现下沉,另一方面,当下国内消费者购物习惯由“冲动”转为“理性”,中高端机型市场份额明显收缩,入门机型及中低端机型市场份额显著增加。

结构持续升级,电竞&高分齐头并进

在产品分辨率刷新率结构升级的驱使下,电竞市场和高分市场积极增长,曲面市场和宽屏市场持续衰退。

电竞市场总销量43.2万台,同比增长21%,渗透率提升至42%。IPS的规格份额领先,大促期间VA凭借低价获得份额回升;曲面电竞占比持续收缩,QHD机型占比提升,165Hz单品表现亮眼。

高分市场中,“电竞+高分”的高分高刷属性成为重要增长点,高分结构中UHD升级放缓,高性价比QHD产品增速提升,宽屏高分产品表现萎缩;同时品牌间高分产品的价格策略差异较大。

曲面市场中,品牌曲面机型在价格和营销策略两方面均较为保守,曲面显示器总销量11.6万台,同比下滑20%。

宽屏市场中相较其他市场的机型迭代而言,宽屏产品仍以旧有机型为主,突出体现为TOP机型活力下降,同时宽屏产品的刷新率结构升级缓慢。宽屏显示器总销量4100台,渗透率降至4%。

随着线上占比持续增加,目前线上渠道对于独立显示器市场的需求释放尤为关键,“11.11”线上大促中,市场整体表现虽稳定增长,但成交均价大幅下降,中高端市场呈现收缩态势。群智咨询(Sigmaintell)建议品牌对于产品线进行细分化定位,一方面满足消费者追求性价比的特点,另一方面通过细分市场产品和高溢价产品满足中高端人群对产品性能和功能差异化的需求。