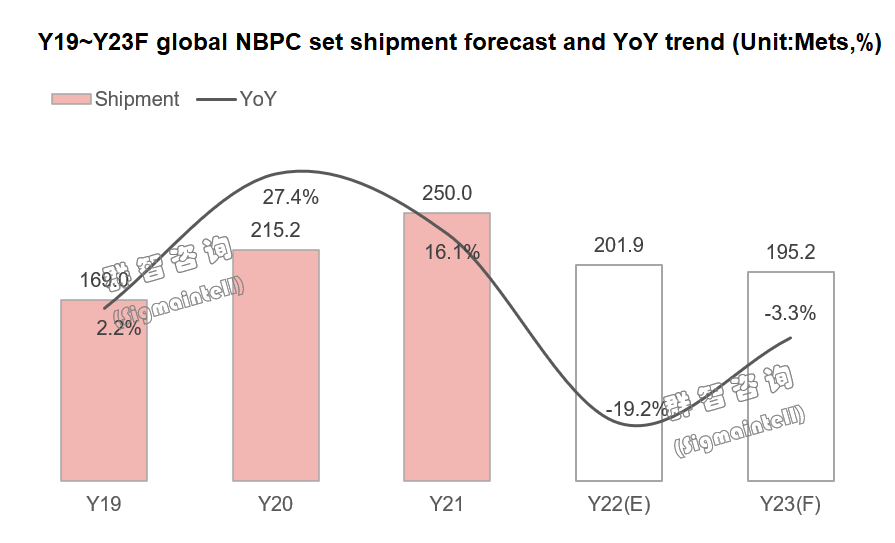

Market: Global PC demand is “cooling down” due to the dual impact of the fading dividend of the epidemic and the “scar effect.”

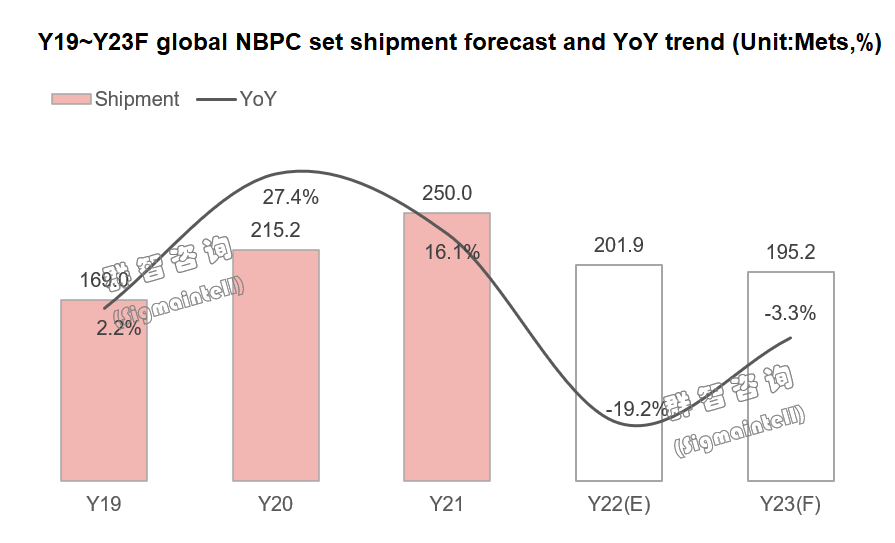

In 22H1, affected by the gradual fading of the epidemic dividend, the shipment performance of NBPC set shrank sharply; in 22H2, 22Q3 showed a slight recovery from the previous quarter due to the 22Q2 delayed demand, but when the main brand channels inventory entered a high level in 22Q4. The momentum of shipments has been compressed to a certain extent, superimposed with the sluggish overall demand, resulting in a two-way sharp QoQ and YoY decline in 22Q4. According to Sigmaintell’s data, global shipments of NBPC set in 2022 were about 202 Mets, a sharp decline of 19% YoY.

Looking forward to 2023, the outlook for the NBPC end market is not optimistic. "Scar effect" can be used as a keyword to understand the current demand for consumer electronics. Under the influence of the "scar effect,” the commercial demand in the global NBPC market is still difficult to pick up, while the consumer demand will continue to fall. Although educational NB may usher in a small demand for replacements, the global NBPC market is showing a continuous downward trend in shipments. Sigmaintell predicts that the global NBPC set market size will be about 195 Mets in 2023, a YoY decline of about 3%.

Product trend: Refined product, detailed functional differentiation, and product lines entering a period of change

Product trend: Refined product, detailed functional differentiation, and product lines entering a period of change

Affected by the overall market, Sigmaintell analyzed that the main strategy of top PC brands to cope with market pressure is as follows: focusing on functional differentiation and more detailed division of PC product lines. In this process, the functions of PC products are closer to the needs of users, and products continue to evolve the performance and upgrade the structure. However, at the same time, the boundaries of commercial, educational, and consumer product lines are increasingly blurred, which aggravates product internal friction.

1. Diversified development of product forms, more detailed research on application scenarios

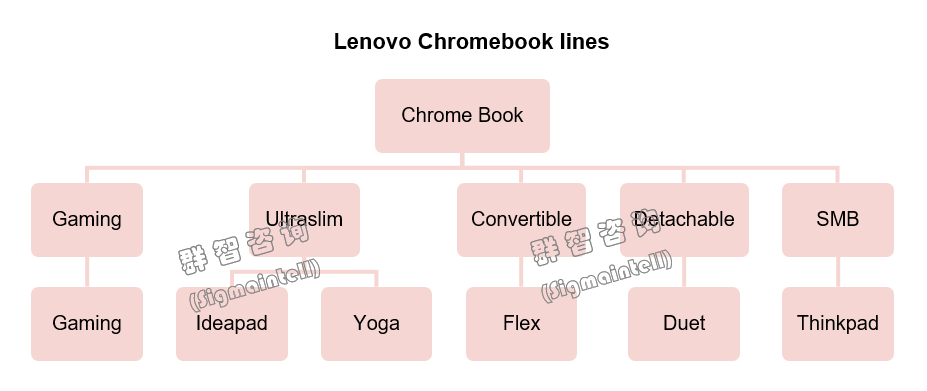

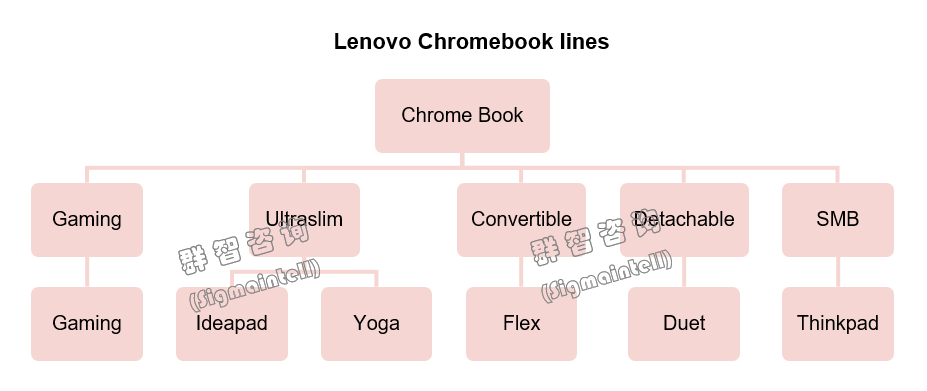

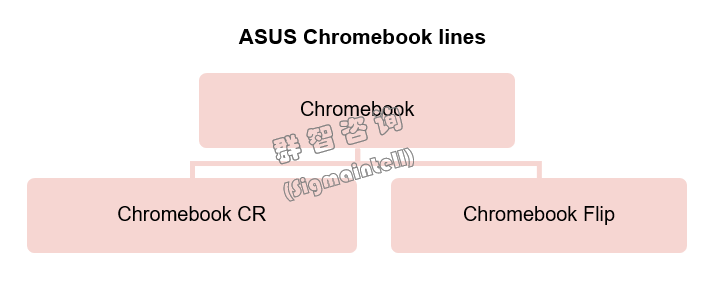

Sigmaintell believes that PC product forms are showing a trend of diversification, especially consumer product lines showing a layout of diversified product forms. Taking the product layout of Lenovo and ASUS as an example (as shown below), Sigmaintell found that: In terms of market segmentation, Lenovo not only continues to use the IdeaPad (Xiaoxin) and YOGA brands as the inherent strategy to distinguish between mainstream and mid-to-high-end market, the two sub-brands are also promoting further product segmentation. For example, YOGA and Xiaoxin have laid out Pro&Air separately to distinguish product price ranges. At the same time, Duo is added to the new series and continues to be deployed, reflecting the brand's deep thinking about the form of NB and detailed application scenarios. Among them, ASUS is actively deploying (Lingyao/fold) high-end folding screens thin and light NB. This market trend intuitively shows the brand's determination and desire to gain potential user recognition under a sluggish overall market by positioning in the segment market. The specified product lines are as follows:

Lenovo:

Consumer Market Series

Traditional thin and light NB series

oThin and light NB are still dominated by the IdeaPad (Xiaoxin) 3 series and 5 series, which are mainstream and cost-effective.

oYOGA 7 series/9 series are dominant, and YOGA is positioned as a mid-to-high end.

Flip series

oDifferentiate the market by YOGA and IdeaPad Flex

Gaming series

oThin and light gaming notebook

oRegular gaming notebook

2-in-1 NB series

The dual-screen series is still waiting, and it is expected to launch in 2024

Business series

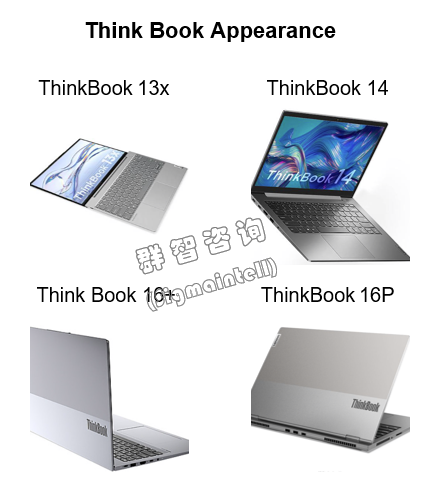

The appearance of the ThinkPad series is mostly black and classic, plus unique signs such as pointing stick and keyboard light;

The appearance of the ThinkBook series focuses on thinness and portability, and is attractive with high-value features.

ASUS:

Chromebook

oChromebook CR standard notebook appearance

oChromebook CR supports 360° flip screen

Thin and light

oZenbook Digital & Pro series hold

oZenbook S (Lingyao X) high-end flagship high-performance thin and light notebook

oZenbook Duo (Lingyao dual-screen) high-end dual-screen thin and light notebook

oZenbook Fold (Lingyao fold) high-end folding screen thin and light NB added

gaming NB

oZephyrus duo (Bingren Dual-screen) flagship

oZephyrus M/H (Huan 16/15/14 series) mainstream thin and light gaming NB

oStrix (Moba) high-performance gaming notebook / Strix Scar (Qiangshen) high-performance gaming notebook flagship

oFlow (Huan X/13) 2-in-1

2. The Chromebook product line is independent, getting rid of the education-based setting, or it may make a difference

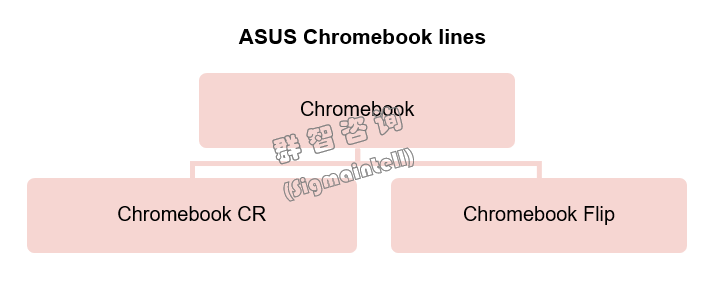

Sigmaintell found that in the product line trend of some major PC brands, the Chromebook product line has been adopted as an independent approach. For example, in Lenovo's product line planning, the Chromebook series of educational NB realizes the independence of the product line, and ASUS' Chromebook has also made the same independent planning. The core idea of this approach is to build a self-contained and fully functional new PC product based on an independent Chromebook. On the one hand, its position is based on the cost performance, and the product price and function run through the product line; on the other hand, it shows the brand's practical screen functionality. Based on this, Sigmaintell believes that the performance of Chromebook in the future is worthy of in-depth observation.

Such as a Chromebook game NB. The model, IdeaPad Gaming Chromebook, equipped with 12th generation Core, optional i3-1215U and i5-1235U, equipped with 8 GB LPDDR4x-4266 memory, optional 128GB eMMC flash memory and 256/512GB M.2 PCIE 2242 SSD. In terms of screen, this notebook is equipped with a 16-inch 2560 x 1600 resolution IPS screen, 120Hz frequency, 100% sRGB color gamut, and 350 nit brightness. From the configuration, we can intuitively feel the setting beyond the positioning of education.

3. Actively deploy OLEDs, and the specifications of gaming NB continue to expand the boundaries

3. Actively deploy OLEDs, and the specifications of gaming NB continue to expand the boundaries

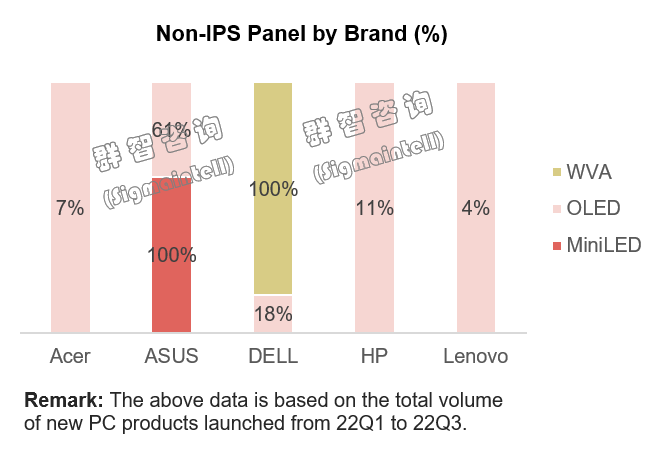

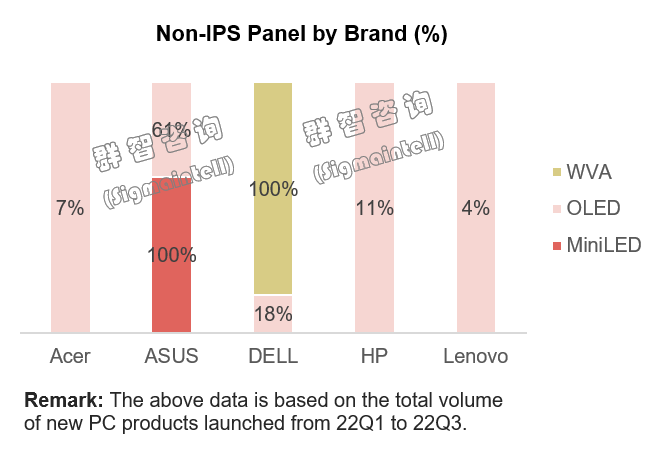

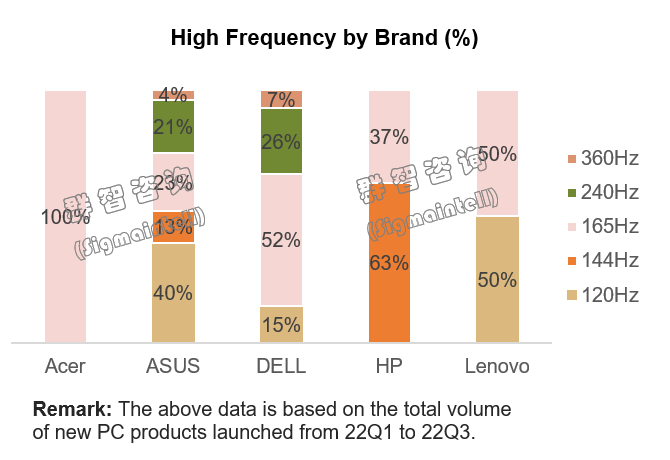

At present, various PC brands have shown higher enthusiasm for the introduction of new technologies. For OLED, almost all of them have OLED layouts. ASUS has more in-depth applications, and the trend of OLED has emerged. For the Mini LED layout, Lenovo has mass-produced a 14.5-inch 3K 165Hz game screen in 22Q4. Besides, it is expected to introduce another 16-inch 240Hz 3.2K Mini LED product in early 2023. For super large size + super high frequency, Dell is laying out an 18-inch gaming notebook.

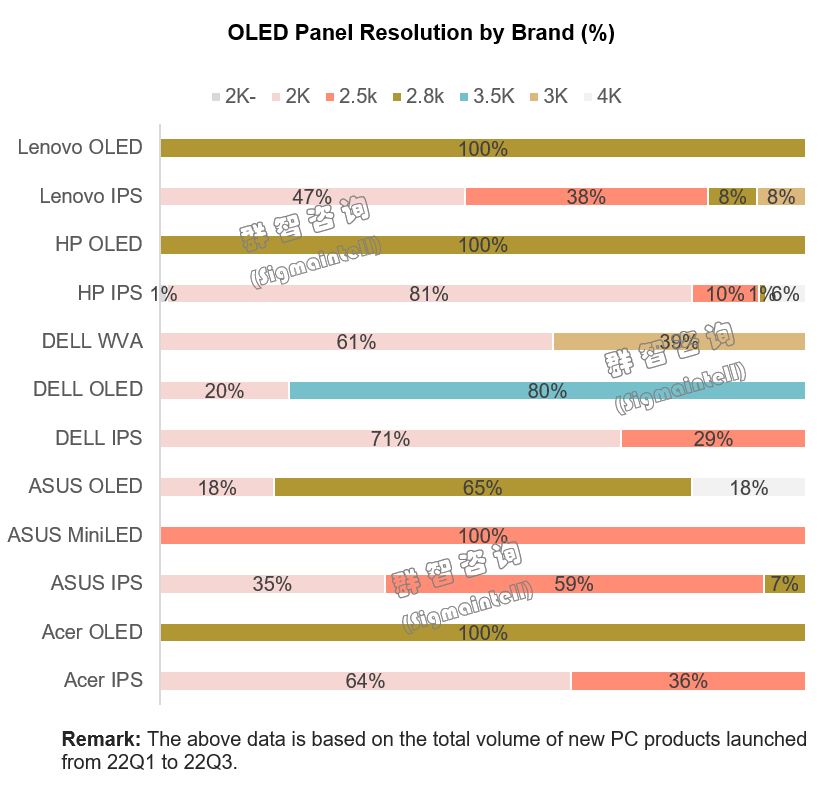

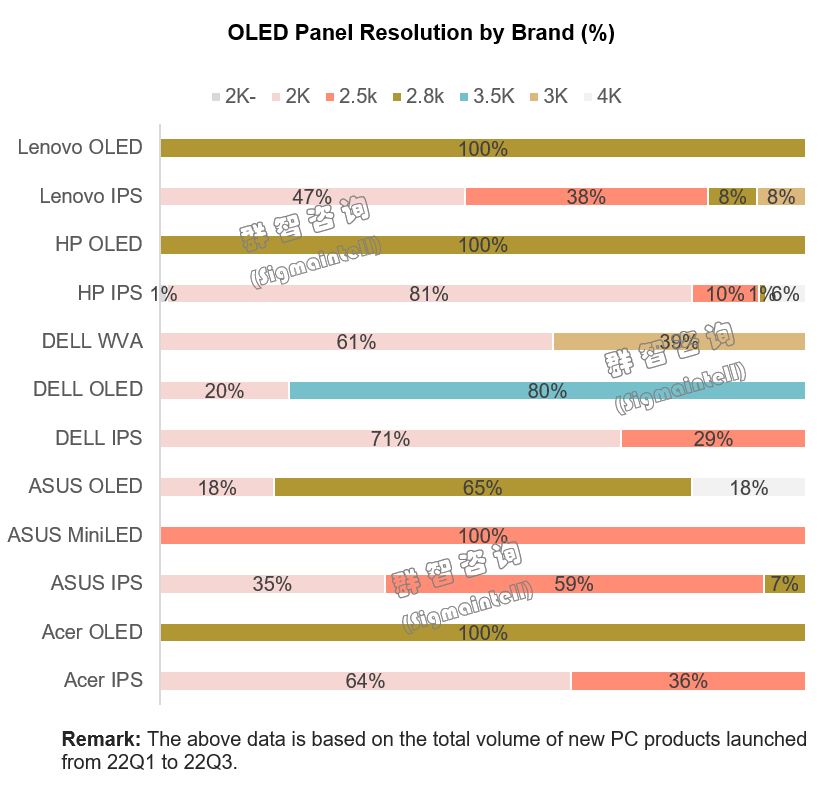

In summary, it is expected that the product trends of OLED, Min LED, high-resolution, and high frequency gaming NB will further accelerate in the future. In terms of differentiation, due to the high cost of Mini LED displays technology, high-end NB is currently the main type. OLED panel technology is gradually maturing, and the pressure to reduce costs has begun to spread to mid-to-high-end consumer and commercial NB. ASUS is the most aggressive, with more than 60% of its new OLED products distributed.

ASUS Zenbook (Lingyao) X Fold, the world's first 17.3-inch folding screen notebook, is an innovative product that solves the pain points of NB by using folding screens. This screen is 17.3 inches, 4:3 ratio, and when folded, it becomes 12.5 inches, 3:2 ratio, and the resolution becomes 1920X1280. Based on the two forms of unfolding and folding, Zenbook (Lingyao) X Fold can evolve into 6 application scenarios with one product. Laptop mode with a virtual keyboard, notebook mode with Bluetooth keyboard, desktop mode, tablet mode, reading mode, and extended mode, it can have extremely high efficiency at any time.

Connecting the two folding screens in the middle is ASUS's new engineering hinge, which has a folding life of more than 30,000 times opening and closing. For the screen material, the opening and closing angle of the notebook’s counterweight and cooling software applications are not small challenges. It can be seen that ASUS has a strong vision for the application of OLED products. At the same time, the requirements for whether the screen can still maintain no creases and no damage remind makers to continue to pay attention.

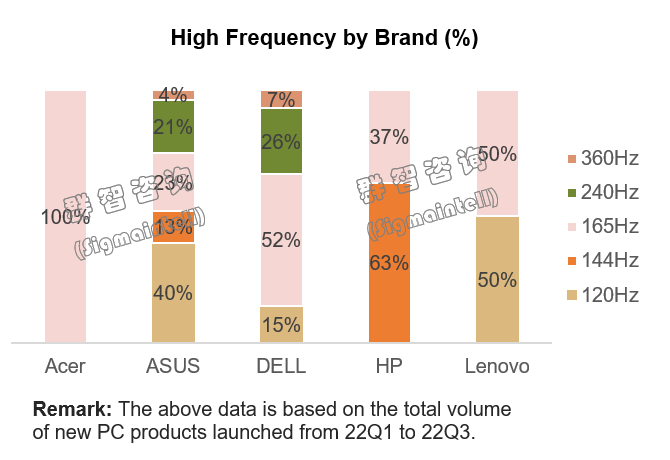

For frequency, the demand for 90Hz for thin and light NB continues to grow. Gaming NB is generally dominated by the demand for 165Hz. This market is led by Lenovo and will continue to enrich the product configuration portfolio of mainstream gaming NB around the direction of resolution upgrades and large sizes. For the mid-to-high-end gaming notebook product line, in order to attract high-end consumer demand, brands have made bolder breakthroughs in ultra-high frequency, such as Asus equipped with 240Hz in the main product line, Dell is more active in introducing 360Hz and 480Hz products in the Alienware series, and Dell’s 240Hz high frequency products also have 26% share in the new product release.

4. High-end high resolution helps OLED widen the gap and reduce internal friction

4. High-end high resolution helps OLED widen the gap and reduce internal friction

As mentioned above, all brands are actively deploying OLEDs. To continue to promote the development of OLEDs, high resolutions are preferred for OLEDs. Top brands use 2.8K as the main resolution to allocate OLED panels for NB products. In order to further improve the competitiveness of OLED, 80% of Dell products have equipped 3.5K main OLED products. The brand has high expectations for OLED, and with the support of the high resolution, it also enhances the attractiveness of users to OLED.

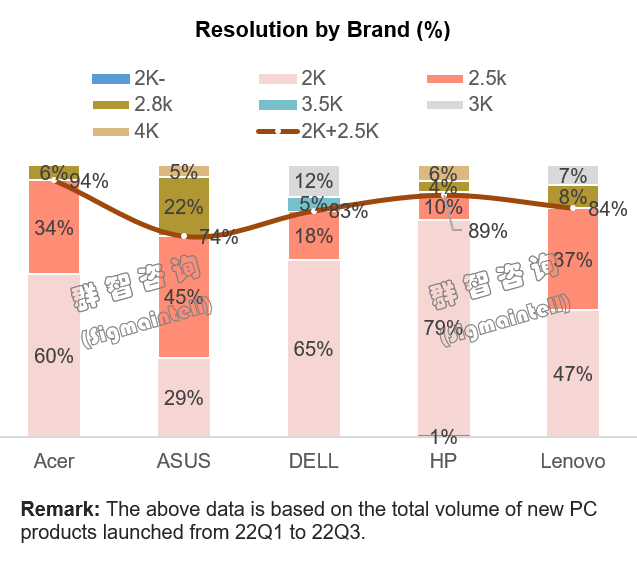

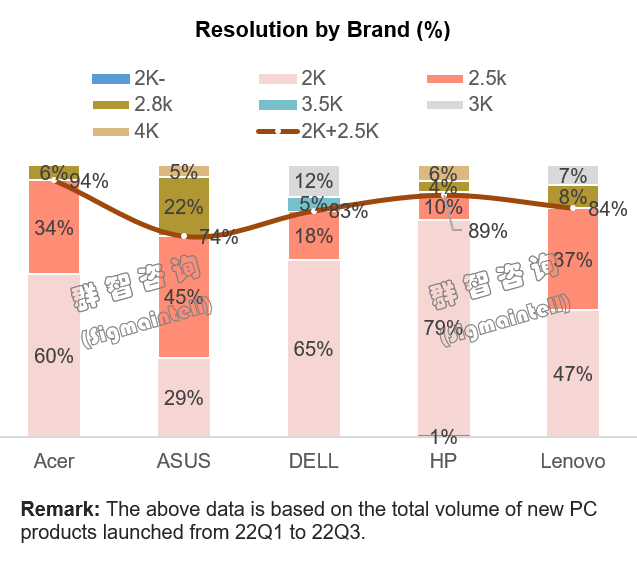

At the same time, looking at the share of the resolution of new products in 2022, 2K+2.5K has become the absolute mainstream, and all brands are about 80%, among which Acer is as high as 94%. In the configuration of 2K+2.5K, 2K is also the main model. Each brand is close to or more than 30% of the new products equipped with 2K resolution.

5. 16:10 has become a new development trend and gradually strengthened

5. 16:10 has become a new development trend and gradually strengthened

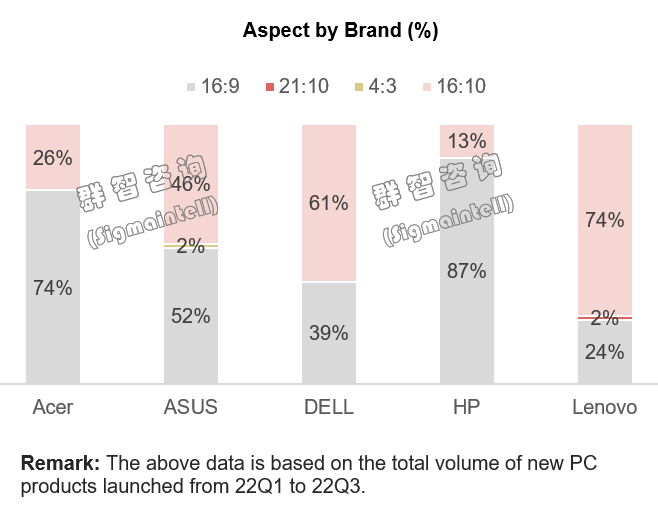

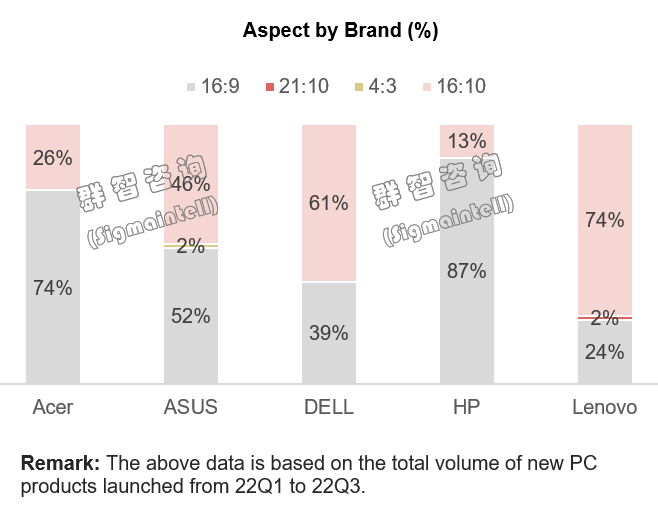

With its golden section advantage, 16:10 has significantly increased the proportion of notebook display screens, and there are more vertical displays in the office, which is more in line with the trend of thin and light offices. 16:9 is gradually being eroded, except for the more conservative HP. Other brands have a large proportion of 16:10. Lenovo is more active in promoting the update of the screen aspect ratio, followed by Dell and ASUS.

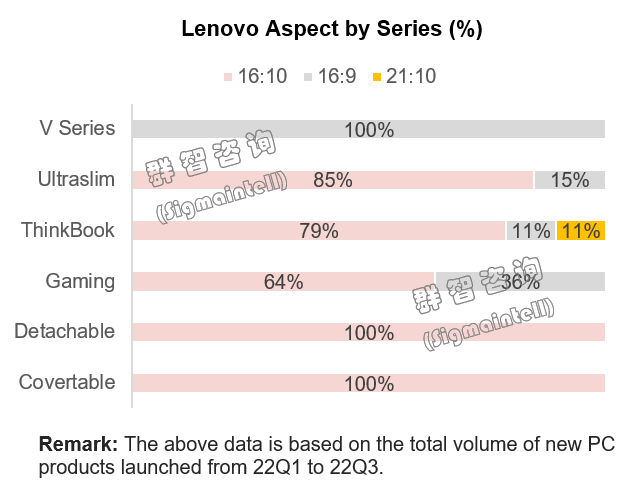

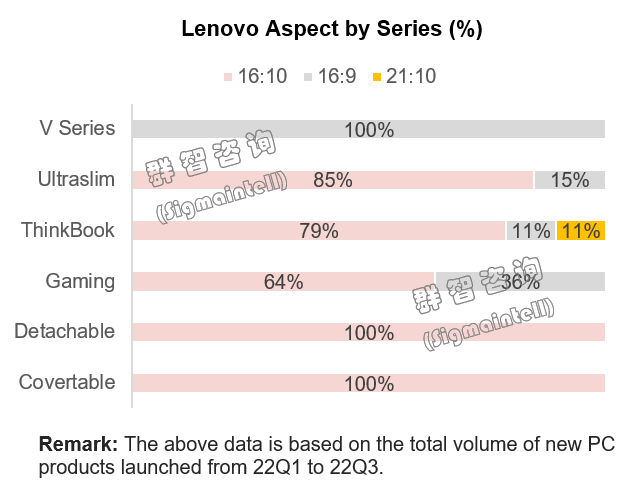

In Lenovo's product trends, 16:10 is rapidly penetrating all series, and the trend of 16:10 replacing 16:9 is obvious. The performance of commercial and consumer brands tends to be consistent, and 16:9 is gradually shrinking. As shown in the figure below, Lenovo has actively deployed 16:10 specifications in almost all of its product lines. Among the new products of the Ultraslim and Thinkbook series, 16:10 accounts for about 80%. Among the high-end new products of Detachable and Convertible, 16: 10 is as high as 100%.

In the product trend of ASUS, the proportion of 16:10 is gradually increasing. The new PortArt series deploys 100% 16:10, and 16:9 does not appear in the TUF (Tianxuan) series. In the new series, Zenbook Fold launched a 4:3 panel.

Dell also favors the 16:10 product aspect ratio. Especially in the new XPS series, which has a 100% share. At the same time, in the new specifications of the Latitude commercial workstation series, the 16:10 share is also 100%. As a division, Dell keeps the 16:9 aspect ratio specifications mainly in the precision product line.

In addition, 16:10 has penetrated into various series of other brands. Acer, Huawei, and Xiaomi mainstream product lines can see 16:10 products.

6. Low power consumption screen has better competitiveness

6. Low power consumption screen has better competitiveness

In February 2022, with the introduction of the 12th generation Intel Core mobile processors, the Intel Evo platform based on the 3rd edition of the specification will also be released, and requires and has the following characteristics:

oPowerful performance: Equipped with 12th generation Intel Core processors,

oUltra-fast wake-up: In the sleep state, wake up immediately, always online.

oUltra-long battery life: No need to bring a power supply when you go out to work for a day. Charge for half an hour, and use it for 4 hours.

oAt least 9 hours of real-world use with an FHD resolution screen, Wi-Fi connection, and high screen brightness

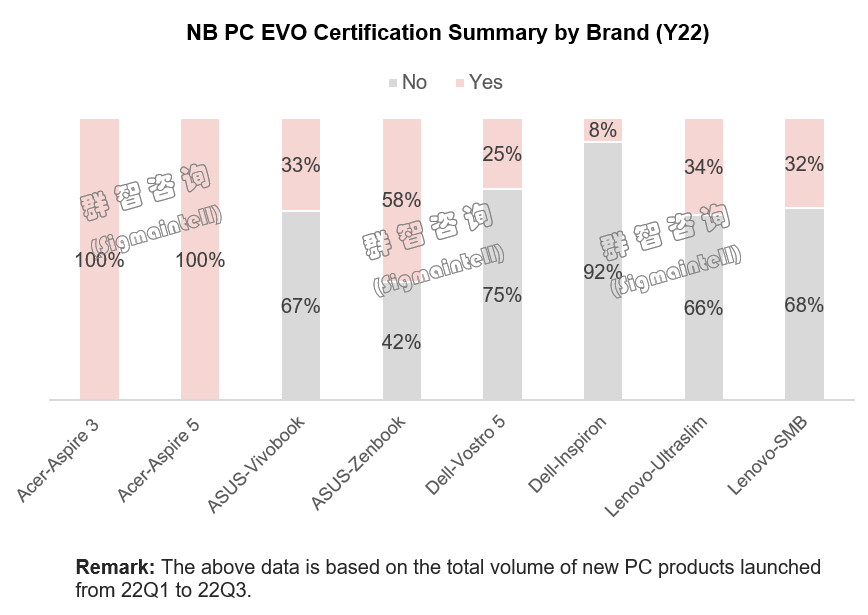

It can be found that the Intel Evo certification process has strict certification standards, which are equivalent to the "Michelin Guide in the PC world.” Intel's extremely detailed division, screening, and optimization of key functional components such as laptops, as well as inspection and certification of performance, power consumption, cost, and battery life.

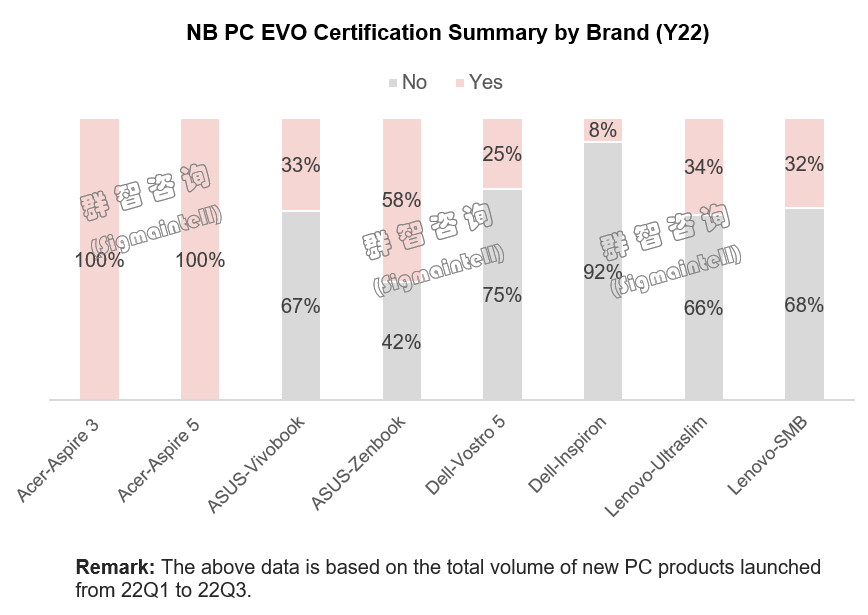

The launch of the Intel Evo platform is a revolution in the NBPC market, redefining thin and light NB, and will bring users a comprehensive experience of fast, long, and dazzling. A great plus item for notebook competitiveness. As shown in the figure below, it can be seen that all brands attach great importance to obtaining EVO certification, especially the double-A brand and Lenovo. Therefore, Sigmaintell believes that low-power consumption products and power consumption reduction technologies will be more competitive in the future (such as VRR products). Sigmaintell suggests that supply chain makers can continue to support the development and investment of this technology.

7. Increased internal friction, commercial & consumer brands erode each other

7. Increased internal friction, commercial & consumer brands erode each other

The detailed product line division reflects the brand's concerns about market pressure and also increases the pressure of internal competition within the brand. For example: the thin and light IdeaPad (Xiaoxin) series for the consumer market is very close to the mainstream configuration of the Thinkbook for business. In order to distinguish them, we start with the appearance of workmanship. Comparing the Thinkbook 14P with the IdeaPad (Xiaoxin) Air 14 Plus, it is easy to find that they have the same resolution, frequency, and DC dimming, and also have the same interface settings. Thinkbook 14P leaves a security keyhole for business demand.

Sigmaintell predicts that the blurring of commercial/consumer product boundaries will also lead to mutual erosion of the commercial/consumer market, increased internal friction among brands, and the business demand for free purchases will continue to squeeze the consumer market demand.

The cooling market still needs to gain momentum, and PC market has shifted from “quantitative development” to “qualitative development.”

The cooling market still needs to gain momentum, and PC market has shifted from “quantitative development” to “qualitative development.”

In summary, it can be seen that in the face of market pressure, major PC brands have defined their target customer groups with refined product lines. During a period of declining market demand, this strategy helps to dig the potential demand of users and promote the "qualitative development" of the PC market. But in this process, it is extremely important to grasp new product trends. Sigmaintell suggests:

Firstly, there are new opportunities for non-educational Chromebook products. Although due to the sharp decline in demand for educational NB and slowed down demand brought about by the end of the educational bidding, Chromebooks in the channel are under pressure to destock. However, brands continue to explore new application fields for Chromebooks. Chromebooks are ambitious, and brands have not reduced their confidence in Chromebooks. Therefore, it is recommended that supply chain makers continue to pay attention to non-educational Chromebook products.

Secondly, the brand continues to support the OLED layout. It is suggested that the PC supply chain can improve the technical pain points of OLED and improve costs, product yield, and technical solutions, and strengthen cooperation with brands to optimize display solutions to meet future market demand.

Finally, 16:10 has become a typical new product trend. It is recommended that panel makers focus on cost optimization and specification research to provide more cost-competitive screen solutions. In addition, the high frequency has not stopped yet, and ultra-high-end gaming NB leads 240Hz/360Hz/480Hz, which deserves further attention. At the same time, it is recommended to increase attention to the improvement of screen power consumption and related technologies.

中文:

蛰伏仍需蓄势,PC市场发展从“量变”转向“质变”

市场:疫情红利消退与“疤痕效应”双重影响,全球PC需求 “降温”

2022年上半年,受疫情红利逐步消退影响,笔记本PC整机出货表现大幅萎缩;进入下半年,三季度在上一季度的需求延递拉动下呈现环比的小幅复苏,但四季度主力品牌渠道库存高起,在一定程度上压缩了出货动能,叠加整体需求的低迷,使得四季呈现环比同比双向大幅下滑。综合全年,群智咨询(Sigmaintell)数据显示,2022年全球笔记本电脑整机出货规模2.02亿台左右,同比大幅下滑19%。

展望2023年,笔记本PC终端市场前景不容乐观。“疤痕效应”可以作为一个关键词,用来理解电子消费品的需求现状。在“疤痕效应”的影响下,全球笔记本PC市场的商用需求仍难有起色,而消费需求也将持续回落。尽管教育本或将迎来小幅的换机需求,但全球笔记本PC整机市场的出货规模呈连续性下滑趋势。群智咨询(Sigmaintell)预测,2023年全球笔电整机市场规模约为195M,同比约下滑3%。

产品趋势:精耕细作,功能区分细致化,产品线进入变革期

受到市场大盘影响,群智咨询(Sigmaintell)分析认为,PC头部品牌应对市场压力的主要策略体现在:着眼于功能性区分,对PC产品线进行更细致的划分。在这个过程中,PC产品功能更加贴近用户需求,性能持续进化,结构明显升级,但与此同时商用、教育、消费的产品线界限日渐模糊化,加重了产品内耗。

1. 产品形态多样化发展,应用场景研究更加精细

群智咨询(Sigmaintell)认为,PC产品形态正在呈现多样化发展趋势,尤其是消费类产品线呈现出产品形态多样化的布局。以联想(Lenovo)与华硕(ASUS)的产品布局为例(如下所示),群智咨询(Sigmaintell)发现:在市场细分上,联想除了持续以IdeaPad(小新)与YOGA品牌区分主流与中高端市场的固有策略外,在这两大子品牌内部也推动着进一步的产品细分。例如,YOGA 小新均分别布局Pro air 以区分产品价格定位。与此同时且持续布局新的系列新增Duo,反应品牌对于笔记本形态以及细致应用场景的深思。其中华硕更是积极布局(灵耀fold)高端折叠屏轻薄本。这种市场趋势直观表现出品牌在整体行情低迷的情况下,立足细分市场,抓取潜在用户需求的决心与愿望。如下所示:

联想:

消费市场系列

传统轻薄本

o轻薄本仍以IdeaPad(PRC 小新)3系、5系列主打入门主流性价高。

oYOGA7系/9系为主导,YOGA定位中高端。

翻转系列

o由YOGA与IdeaPad Flex区分市场

游戏本系列

o轻薄游戏本

o常规游戏本

二合一可拆卸本

双屏系列可拭目以待,预计2024年将登场

商务用系列

ThinkPad系列的笔记本电脑外观多为黑色的经典外观,再加上独特的指点杆和键盘灯等标志;

ThinkBook系列的笔记本电脑外观则是主打轻薄性和便携性,以高颜值的特色吸引人。

华硕:

Chromebook

oChromebook CR标准的笔记本外形

oChromebook CR支持 360° 翻转屏幕

轻薄本

oZenbook 数字&Pro系列保持

oZenbook S(灵耀X)高端旗舰高性能轻薄本

oZenbook Duo(灵耀双屏)高端双屏轻薄本

oZenbook Fold (灵耀 fold)高端折叠屏轻薄本新增

游戏本

oZephyrus duo(冰刃双屏) 旗舰

oZephyrus M/H (幻16/15/14系列)主流轻薄游戏本

oStrix (魔霸) 高性能游戏本/ Strix Scar(枪神)高性能游戏本旗舰

oFlow (幻X/13)二合一

2. Chromebook产品线独立,摆脱教育本设定,或有作为

群智咨询(Sigmaintell)研究发现,在部分主力PC品牌的产品线趋势中,采取了将Chromebook产品线独立的做法。如在联想产品线规划中教育本的Chromebook系列实现产品线的独立,华硕的Chromebook也做了同样独立的规划。这一做法的核心思路在于以独立化的Chromebook为依托,建设自成体系并且功能性完备的新PC产品,一方面以性价比定位,产品纵横贯穿产品线;另一方面显现出品牌实用屏幕功能性规划。据此,群智咨询(Sigmaintell)认为,Chromebook在未来的表现值得深入观察。

如Chromebook 游戏本,型号为 IdeaPad Gaming Chromebook。搭载了 12 代酷睿, 可选 i3-1215U 和 i5-1235U,配备 8 GB LPDDR4x- 4266 内存,可选 128GB eMMC 闪存和 256/512GB M.2 PCIE 2242 SSD。屏幕方面,这款笔记本搭载 16英寸 2560 x 1600 分辨率 IPS 屏,120Hz 刷新率,100% sRGB 色域,350 nit 亮度。从配置上我们可以直观感受到超越教育本定位的设定。

3. 积极布局OLED,游戏本规格不断拓展边界

目前各PC品牌在新技术导入上展现了更高的热情。在OLED方面,几乎均有OLED的布局,华硕更为深入应用,OLED的趋势化已经崭露头角;在Mini LED的布局上,联想除22年Q4量产一支14.5英寸的3K 165Hz的游戏屏之外,预计在2023年初还会再导入一支16英寸240Hz 3.2K的 Mini LED新品;在超大尺寸+超高刷新率上,戴尔(Dell)在18英寸的游戏本上进行布局。

总体上看,预计未来OLED、Min LED、高解析度、高刷游戏本的产品趋势会进一步加快。区分来看,由于Mini LED显示技术成本较高,目前以高阶笔电机种为主;OLED面板因技术逐步成熟,降低成本的压力开始往中高阶消费性及商用笔电领域传导。华硕则最为激进,新品分布六成以上的OLED新品。

华硕灵耀X Fold,是全球首款 17.3 英寸折叠屏笔记本,是一款通过折叠屏解决笔记本痛点的创新产品。这块屏幕是 17.3 英寸,4:3 比例,折叠后则变成 12.5 英寸,3:2 比例,同时分辨率变为 1920X1280。基于展开和折叠的两种形态,灵耀X Fold 可以演化出一机六用的 6 种应用场景。笔记本模式搭配虚拟键盘、笔记本模式搭配蓝牙键盘、桌面模式、平板模式、阅读模式、延伸模式,任何时候都能拥有极高的效率。

中间连接两块折叠屏的是华硕的新型工程铰链,折叠寿命大于30000次开合。对于屏幕材料,笔记本的配重开合角度散热软件应用等均有不小挑战,可见华硕对于OLED产品应用强烈的愿景。与此同时对于屏幕是否还能保持无折痕、无损坏的要求提示厂商需要持续关注。

刷新率方面,轻薄本对90Hz需求持续增长。游戏本总体以165Hz需求为主导,该市场由联想所引领,将围绕分辨率升级和大尺寸化方向,不断丰富主流游戏本的产品配置组合;而中高阶游戏本产品线中,为吸引高端用户需求,品牌们在超高刷新率作了更大胆的边界突破,如华硕在主力产品线搭载240Hz,戴尔在外星人系列更积极的导入360Hz和480Hz产品,戴尔的240Hz高刷产品也占据新品发布体量中26%的份额。

4. 高端高配的解析度助力OLED,拉开差距减少内耗

正如前文提到的从各品牌均积极布局OLED,为了持续推进 OLED发展,在解析度的配置上高分对于OLED则更为偏爱,头部品牌以2.8K作为主力解析度分配给配备OLED面板的产品。戴尔为了进一步提升OLED的段位则配备了高达八成的3.5K主力OLED产品。由此可见品牌对于OLED寄予厚望,有了高分辨率的加持,也提升了用户对于OLED的吸引力。

与此同时,纵观2022新品解析度的配重,2K+2.5K成为绝对主流配置,各品牌均在八成左右,其中Acer高达94%,2K+2.5K的配置中,2K又作为主力机型的配置,各品牌占比接近或者超过三成的新品为2K分辨率。

5. 16:10成为新的发展趋势,且逐步强化

16:10以其黄金分割优势在笔记本显示屏占比提升明显,办公纵向显示更多,更符合轻薄化办公化趋势。16:9逐步被蚕食,除了较为保守的惠普之外,其他品牌16:10均有不小占比。联想则更为积极推动更新屏幕长宽比,戴尔、华硕紧随其后。

在联想的产品趋势中,16:10在所有系列中快速渗透,16:10 取代16:9 趋势明显;商用、消费品牌表现趋于一致化,16:9呈逐渐萎缩趋势。如下图所示,联想几乎在其所有产品线中均积极布局了16:10规格,其中Ultraslim和Thinkbook系列的新品中,16:10的占比约八成,Detachable和Convertible的高阶新品中16:10更是高达100%。

在华硕的产品趋势中,16:10占比也逐渐增大,PortArt系列新品为100%,且16:9在TUF(天选)系列中未出现;在新系列中Zenbook Fold推出4:3面板。

戴尔在产品长宽比方面也颇为青睐16:10,特别是在XPS系列中新品呈现占比100%的特点,同时在Latitude商用工作站系列的新品规格中,16:10占比也是100%。作为区隔,戴尔将16:9的长宽比规格主要保留在precision产品线。

此外,16:10在其他品牌的各个系列均有渗透,如宏碁(Acer)、华为(Huawei)、小米(Xiaomi)的主流产品线均能见到16:10身影。

6. 低功耗屏幕具备更加优秀的竞争力

2022 年 2 月,随着第 12 代英特尔酷睿移动处理器的推出,基于第 3 版规范的英特尔Evo平台也随之发布,并且需要并具备以下特性:

o超强性能: 搭载第 12 代英特尔酷睿处理器,

o超快唤醒: 睡眠状态下, 即刻唤醒, 时时在线。

o超长续航: 一天外出办公无需带电源。充电半小时, 畅用 4 小时。

o至少FHD 分辨率屏幕, 无线网络连接和高屏幕亮度的真实使用场景下, 至少可持续 9 小时

可以发现,英特尔 Evo认证过程有着其严苛的认证标准,相当于是 “PC 界的米其林指南”。英特尔对于笔记本电脑等关键功能部件极其细致的划分、筛选与优化,以及对性能、功耗、成本、续航等方面的考察认证。

英特尔Evo平台的推出,是笔记本电脑市场的一次变革,是对于轻薄电脑笔记本重新定义,将会给用户带来快、长、炫的全面体验。对于笔记本竞争力的极大加分项目。如下图所示,可以发现各家品牌均十分重视获取EVO认证,其中双A品牌以及联想更甚。因此,群智咨询(Sigmaintell)认为,未来低功耗产品和降低功耗技术将更加具备竞争力(如:VRR产品),建议供应链厂商可以持续加持这一技术的开发和投资。

7. 内耗加重,商用&消费品牌互相侵蚀

细致的产品线分工折射品牌对于市场压力的担忧,也使得品牌内部竞争压力增大。例如:消费市场定位的轻薄本IdeaPad小新系列与商务定位的Thinkbook 主流配置十分接近,为了区分则从做工外观方面着手。以Thinkbook 14P与小新Air 14 Plus对比不难发现,他们有着相同的分辨率、刷新率以及拥有同样的DC调光,另外在接口方面也有相同的设定,Thinkbook 14P出于商务的需求增加预留安全锁孔。

群智咨询(Sigmaintell)预计,商用/消费产品界限的模糊化,也导致商用/消费市场的互相侵蚀,品牌的内耗加重,自由购机的商务需求持续挤压消费市场需求。

“蛰伏”仍需蓄力,PC市场发展从“量变”转向“质变”

综上可见,面对市场压力,PC主力品牌以精细化的产品线划分明确目标客户人群。在市场需求下行期,这一策略有助于挖掘用户的潜在需求,推进PC市场的“质变”进程。但在这一过程中,把握产品新趋势变得格外重要,群智咨询(Sigmaintell)建议:

首先,非教育类Chromebook产品蕴含新机遇。虽然由于教育标案结束所带来的教育本需求的急剧下降,需求放缓,渠道中的Chromebook具有去库存的压力。但品牌持续探索Chromebook新的应用领域,Chromebook雄心勃勃,并未降低对于Chromebook的信心,因此建议供应链厂商持续关注非教育类Chromebook产品。

其次,品牌对于OLED布局持续加持,建议PC供应链可针对性改进OLED的技术痛点并改善成本、提升产品良率、改进技术方案以及与品牌加强合作优化显示方案以应对未来市场需求。

最后,16:10成为典型的新品趋势,建议面板厂关注成本优化和规格研究,提供更有成本竞争力的屏幕方案。另外,高刷仍未止步,超高端游戏本引领 240Hz/360Hz/480Hz值得进一步关注。与此同时,建议提高对于屏幕功耗改善以及相关技术的关注度。