发布时间: 2021/12/30 关注度: 706

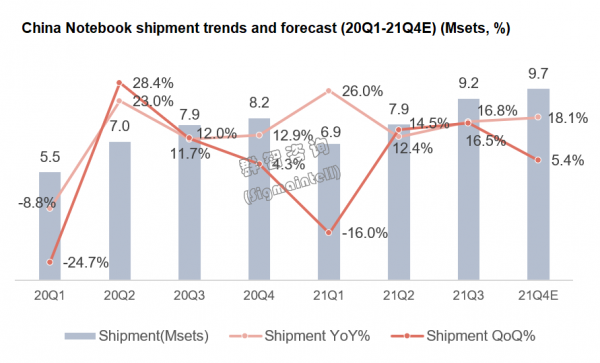

In 2021, the Chinese notebook market shows a positive growth trend. The shipment performance in 21H2 is better than that in 21H1. In 21H2, the overall supply situation of the domestic notebook market has improved. At the same time, with the slowdown in global market growth, the supply situation of top brands in China has gradually improved. In addition, in the post-epidemic era, people's demand for high-end, comfortable, and superior-performance notebooks is expanding, and the demand for High-performance Ultrabook is strong, and new product iterations are surging in the market. At the same time, the mining market continues to be hot, bringing a certain amount of consumer demand for gaming. Driven by multiple factors, according to statistics from Sigmaintell, China’s notebook market has seen positive growth in the shipment scale of the end market in 21Q3, with an increase of approximately 16.8% YoY. The fourth quarter has a stable market and the full-year shipment scale in 2021 is expected to reach more than 33.8 million units, a significant increase of about 18.1% YoY.

In 2022, mid-to-high-end models with both work productivity, learning and entertainment will continue to maintain high demand, and the iteration of new products will accelerate to promote more demand for replacement. Therefore, the growth trend will continue until next year, but the growth rate will slow down. Mining demand will slow down in the second half of next year, and the strong thrust for Chinese gaming notebooks will also weaken in the second half of the year. Sigmaintell predicts that China’s notebook market will ship about 34.6 million units in the next year, and the market space is considerable.

Competitive landscape: Incremental scale promotes win-win development, and main brands have their strengths.

In the process of rapid market growth, all brands have performed well. Top brands continue to consolidate their first-mover advantages, and late-coming brands are also stepping up technological upgrades and product iterations, speeding up the pace of shipments, and the development of the entire market is becoming more and more complete. In response to the needs of consumers and the focus of the company's development, their respective brands are making active and effective strategic adjustments.

Lenovo: Lenovo firmly occupies the No. 1 position in the Chinese market in terms of shipments, with about 3.3 million units shipped in Q3, an increase of 12.1% YoY. It is expected that the annual shipments this year will reach 12.1 million units, an increase of about 18% YoY. As a top brand, Lenovo has a good market enthusiasm and response. It has good supply chain stability and online operation capabilities. In addition, Lenovo’s rapid deployment of new product lines has quickly responded to market hotspots and consumer needs and accelerated improved the iterative speed of new products.

Dell: Dell’s shipment performance is still positive. It shipped approximately 1.4 million units in 21Q3, an increase of 56.7% YoY. It is expected that shipments for the whole year will reach 4.8 million units this year, a significant increase of about 55% YoY. Dell's overall market acceptance is high. With the cooperation of good supply chain control and marketing mechanisms, the product line has made more active and effective adjustments. The new product layout strategy began to be more equipped with AMD, which complemented the product line, and shipments have been significantly improved.

ASUS: Asus is currently gaining momentum and its shipping strategy is particularly active. Its Q3 shipments are about 1 million units, an increase of about 10.5% YoY. It is expected that the shipments for the whole year will reach 3.7 million units this year, an increase of about 16% YoY. ASUS's shipping strategy this year is very directional, with gaming notebooks and Ultrabook being the main battlefield. ASUS is also actively adjusting its product line and has continued to update OLED products since the second half of the year. As a strategic partner of SDC, ASUS can quickly introduce SDC's latest mass-produced panel specifications and launch a variety of OLED models to actively seize the OLED market and strengthen its competitiveness in the OLED market. The new product's value-for-money route has received a good market response, and shipments have been rising steadily.

HP: HP's shipment performance in China is not as impressive as in overseas markets. HP shipped about 600,000 units in 21Q3, an increase of about 23.2% YoY. It is expected that the annual shipments this year will reach 2.3 million units, a slight increase of 3% YoY. HP's performance in the Chinese market is quite satisfactory, but HP's overall product line layout is comprehensive, and it has been more active and faster in product iteration than before. The overall performance of the Omen series has greatly improved, and it is also actively deploying 16:10 new product development. The layout is mostly concentrated in 13.3 inches.

Apple: Apple’s overall shipments in China are relatively stable. Thanks to the improved supply environment, Apple shipped about 500,000 units in 21Q3, an increase of about 21.2% YoY. It is expected that the shipments will reach 2 million units this year, an increase of approximately 24% YoY. Apple stabilizes its shipment direction and actively explores product promotion routes. The new Miniled notebooks launched in 21Q3 have reactivated the market’s attention to Miniled notebooks and opened up the curiosity of ordinary consumers towards Miniled products. In 21Q4, new notebook products equipped with Apple's self-developed M1 PRO and M1 MAX processors were launched, ushering in a new wave of sales.

The market segment is prosperous, and products with a high-frequency usher in the best development opportunities.

Nowadays, consumers have higher and higher requirements for product performance and experience. The continuous introduction of new products and the upgrade of the original basic parameters are particularly important. The screens of notebooks are rapidly upgraded towards large sizes, and the overall resolution has begun to upgrade. The proportion of FHD and above levels has rapidly increased, and the frequency rate has also come to the upgrade node of the collective 60Hz to 90Hz and above specifications. The market sinking route of OLED products is still advancing in an orderly manner, superimposed on the rapid rise of MiniLED, the stable development of 16:10, and the expansion of the proportion. The market continues to develop in different segments.

The development of large-size structures is accelerating. The 14-inch merging downwards will reduce the market share below 13 inches; the market share of 13 inches and below is currently only about 15%. With the current popularity of the gaming notebook market, the overall domestic market share of 16 inches will grow rapidly, and its sale reached 1.04 million units in 21Q3, with a market share of 11%, compared with only 3% in the same period last year. At present, the overall development trend of the market is moving towards large screens. Larger screens can bring a better audio-visual experience. It is expected that the proportion of 16 inches will further increase in the future.

The overall resolution began to upgrade to 2K. The market share of traditional HD resolution has been closed to 0 in 21Q3, and the market is dominated by FHD. The current share of 2K specifications has reached 18% in 21Q3, close to 20%, and 3K specifications also have a 5% share. So, the entire 2K+ has reached a share of about 24%, and it has a good performance. More high-resolution products carried by mid-to-high-end products will appear, and the market has begun a collective upgrade of resolution.

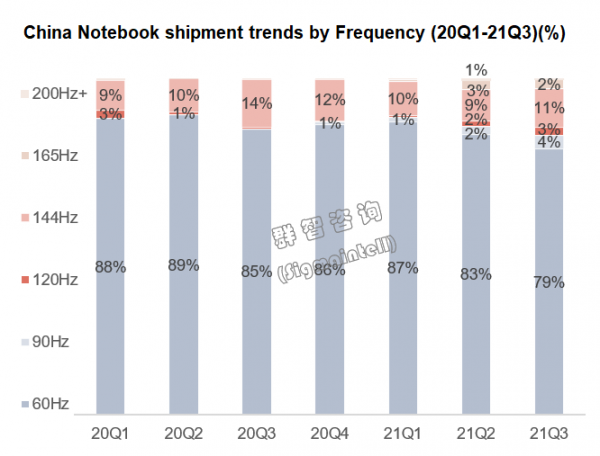

The frequency ushered in an important upgrade node. This year, the specifications of high-frequency have become more abundant, and the share of high-frequency has also increased. The Ultrabook took the lead in starting the 90Hz upgrade route. In 21Q3, the overall market with 90Hz and above high-frequency accounted for more than 20%, about 1.94 million units. The scale of shipments this year will exceed 6 million units, a significant increase of 62% YoY.

Among them, 90Hz has seen significant growth this year, and new 90Hz products from ASUS, Lenovo, and other brands have been turned into explosive models, which have a certain pulling effect on the market. In the high-frequency market, in addition to the outstanding performance of 144HZ, sales exceeded 1 million units, and more growth came from 165Hz. In 21Q3, 165Hz accounted for about 2%. The rapid growth of the high-frequency is due to the rise of High-performance Ultrabook and the overall performance upgrade of gaming notebooks. With the popularity of Ultrabook this year, people's performance requirements for thin and light notebooks are getting higher and higher. With intel/AMD standard voltage, RAM16G high-performance Ultrabook began to appear more. In China's online notebook sales, the penetration rate of Ultrabook has reached about 70%, and there is huge room for growth in high-performance Ultrabook. In 2020, the proportion of high-performance Ultrabook in the online market for Chinese notebook will be about 4%, this year it will increase to about 8%, and it is expected to reach 10% next year.

In 2021, Lenovo Yoga 14s, XiaoXin 14pro, and ASUS’ Intrepid Pro14 are all hot new high-performance Ultrabook. The warming of the gaming environment and the increase in consumer demand for leisure and entertainment have led to the overall performance upgrade of gaming notebooks. The frequency rate has begun to rise collectively. The proportion of frequency rates of 144Hz and 165Hz gaming notebooks is increasing. Popular products include ASUS Flying Fortress 9 and Lenovo R9000P.

The OLED market has gradually expanded and the penetration rate has increased. About 160,000 OLED products were shipped in 21Q3, and the Chinese market penetration rate reached 1.7%. This year there are a wide variety of OLED products, and the overall price of the products is declining, and the market is further expanding. Brands such as Lenovo and ASUS have launched a lot of OLED products. Panel makers are also actively producing. OLED folding screens will be mass-produced next year. It is expected that OLED products will reach a new height next year. The continuous development of OLED has also led to the progress of related screen technology. This year, Apple’s two new notebooks equipped with MiniLED screens came out, which detonated the market, but the cost of MiniLED is relatively high, and the supply cycle is unstable. The follow-up growth of leading Mini-led products will slow down, and the main theme of market development is still on OLED.

The development trend of 16:10 is obvious, and the market is gradually getting bigger. Under the influence of supply chain strategy, the ratio of 16:10 has quickly entered the hands of consumers this year. In 21Q3, China's notebook market is expected to account for 16.6% of 16:10, an increase of nearly two times YoY; 3:2 accounted for 6.1%, an increase of 18% YoY. 16:10 product development is more rapid. In terms of size, the 16:10+large size+high resolution scheme is quite popular; in terms of frequency rate, 16:10 is more mounted on high-frequency , and both 120HZ and 165HZ have a considerable ratio. But in terms of differentiation, in the 16:10 market, Lenovo, as a leader, is actively planning for the 16:10 product line with complete coverage. HP, Dell, and Asus are all actively following up. All new ASUS Zenbook series are equipped with a 16:10 screen. In 2022, unlike the full bloom of the 2K+ market at 16:10 this year, it is expected that 16:10 will sink to WFHD entry-level products, which is expected to gain more market increments.

Grasp the changes in the segments, focus on the layout of the gaming track, and welcome new opportunities for developing the following year.

In the post-epidemic era, China's overall economic growth has slowed down, and people need enough entertainment and pastimes to release their pressure to survive. In the coming year, new upgrades in the notebook consumer and commercial sectors will bring vitality to the market. The biggest growth point is the increase in people's investment in games. When the price of discrete graphics cards is high, mid-to-high-end notebook products such as good gaming notebooks will still be the first choice. On the panel side, panel supply is expected to be loose in 2022, and panel costs will have more room for adjustment, and the market will usher in a batch of cost-effective products.

Sigmaintell recommends:

1. Grasp the changes in the segment. OLED continues to sink the market, and the richness of OLED notebooks is rapidly increasing. It is recommended to grasp the market trend and better occupy the system niche. Mini-led will usher in the best development opportunity under the leadership of Apple. The technology can also be introduced in due course to broaden the breadth of the brand's new technology. The 16:10 screen has the advantage of a high screen proportion, bringing a better user experience, and the market is increasing rapidly. The market is upgrading to larger sizes. The ratio of 14-inch and 16-inch are rapidly increasing, the resolution has also been upgraded from FHD to 2K, and the frequency rate has also begun to leap to 90HZ. The above changes will be more prominent in the market in the coming year, and it is recommended to actively follow up.

2. Focus on the layout of the gaming track. The development of gaming is in full swing, and the value of the industry is increasing year by year. Capital and consumers from all over the world are flocking to it. It is recommended that all parties in the supply chain can actively deploy to seize this wave of gaming dividends. Gaming consumers prefer high scores and high-frequency , and 144Hz and 165Hz are paid more attention. At the same time, there is a higher preference for response time, and the millisecond response time becomes an important screening mechanism. Regarding screen performance, OLED also has a considerable amount of market attention, and its excellent screen properties bring a different gaming experience. Do a good job of upgrading the screen and performance parameters to improve the overall experience of using the notebook, and bring new tool pleasure to gamers.

中文:

2021年中国笔电市场呈现积极增长态势,下半年出货表现好于上半年,进入下半年,国内笔电市场整体的供应情况有所改善,同时伴随着全球市场增速放缓,头部品牌在中国区的供应形势逐渐好转。加上后疫情时代,人们对于高端舒适、性能优越的笔记本需求扩大,性能轻薄本需求旺盛,市场上新品迭代热潮涌动。同时挖矿市场持续火热,带来一定量的游戏本消费需求。多重因素带动下,根据群智咨询(Sigmaintell)数据统计,中国笔电市场三季度整机出货规模积极增长,同比有约16.8%的增幅;四季度市场热度稳定,2021年全年出货规模有望达到3380万台以上,同比大幅增长约18.1%。

2022年,工作生产力、学习娱乐两不误的中高端机型将继续保持高需求,新品迭代加速,促进更多的换机需求。因此增长趋势到明年还会延续,但是增速有会有所放缓。明年下半年挖矿需求将会减缓,对于中国游戏本产生的强劲推力到了下半年也会转弱。群智咨询(Sigmaintell)预计,明年中国笔电市场出货规模约为3460万台,市场空间比较可观。

竞争格局:规模增量推动多赢发展,主力品牌表现各有所长

在市场规模快速成长的过程中,各家品牌都有着不俗的表现。头部品牌继续夯实自己的先发优势,后进品牌也在加紧技术升级和产品迭代,加快出货的步伐,整个市场的发展越发完善。针对着消费者的需求和公司发展的着力点,各自品牌都在做着积极有效的策略调整。

联想(Lenovo):联想牢牢占据着中国市场出货量第一的位置,Q3整体出货约330万台,同比增长约12.1%。预计今年全年出货量将达到1210万台,同比增长约18%。联想作为头部品牌的市场热度和反响力较好,拥有着良好的供应链稳定性和线上运营能力,加之联想在新产品线的布局迅速,快速的呼应了市场热点和消费者需求,加快了自己的新品迭代速度。

戴尔(Dell):戴尔的出货表现还是非常积极,Q3出货约140万台,同比增加约56.7%,预计今年全年出货量将达480万台,同比大幅增长约55%。戴尔整体市场接受度高,在良好的供应链管控和营销机制的配合下,产品线做了更多的积极有效的调整,在新品布局策略上开始更多的搭载上AMD后,补全了自己的产品线短板,出货量得到了明显的提升。

华硕(Asus):华硕目前势头正盛,出货策略特别积极。Q3出货约为100万台,同比增幅约10.5%,预计今年全年出货量将达370万台,同比增长约16%。华硕今年的出货策略非常有指向性,游戏本和轻薄本都是主战场。华硕也在积极调整自己的产品线,下半年以来持续更新OLED产品。作为SDC的战略的合作伙伴,对SDC最新量产的面板规格,华硕均能快速导入,多款OLED机型上市,积极抢占OLED市场,强化OLED市场竞争力。新品的超值性价比路线,市场反响很好,出货量节节攀升。

惠普(HP):惠普在中国的出货表现没有在海外市场那么亮眼,Q3出货约60万台,同比上涨约23.2%,预计今年全年出货量将达230万台,同比略微增长3%。惠普在中国市场表现中规中矩,但惠普的整体产品线布局全面,在产品的迭代上较以往表现得积极且迅速,Omen系列整体性能大幅提升,同时也在积极布局16:10的新品发展,但该布局多集中在13.3英寸。

苹果(Apple):苹果在中国的出货量整体比较稳定,得益于供应环境改善,Q3出货约50万台,同比上涨约21.2%,预计今年全年出货量将达200万台,同比增长约24%。苹果稳固自己的出货方向,积极探索产品的推进路线。三季度推出的新款Miniled笔记本,重新激活了市场对Miniled笔记本的关注度,也打开了普通消费者对Miniled产品的好奇心。Q4搭载苹果自研M1 PRO、M1 MAX处理器新款笔记本产品上市,将迎来新一波销售热潮。

细分市场繁荣,高刷迎来最好的发展机会

现在的消费者对产品的性能和体验的要求越来越高,新品的不断推出,以及在原有基础参数上的升级就显得尤其重要。笔电的屏幕朝着大尺寸的快速升级,分辨率整体开始升级,FHD及以上级别占比迅速攀升,刷新率也来到了集体60Hz向90Hz及以上规格的升级节点。OLED产品的市场下沉路线还在有序推进,叠加着MiniLED的快速兴起,16:10的稳定发展,占比扩大。市场在各自不同的细分领域里不断发展。 大尺寸化结构发展加快。14英寸向下吞并,压缩13英寸以下的市场份额;13英寸及以下市场份额目前仅为15%左右,16英寸借着目前游戏本市场的火热,整体的国内市场份额快速增长,2021年Q3的销量达到了104万台,市场份额占比11%,去年同期的份额占比仅为3%。目前市场整体的发展趋势朝着大屏前进,更大的屏幕能够带来更好的视听体验,预计未来16英寸占比会进一步提升。

分辨率整体开始向2K升级。传统的HD分辨率在2021年Q3的市场份额占比已经趋近为0,市场以FHD为主,且在2021年三季度,目前2K规格的占比已经达到18%,接近两成,而3K也有5%的占比,因此整个2K+已经达到24%左右的份额,有不错的表现。中高端产品所搭载的高分辨率产品将会更多的出现,市场开始了分辨率的集体升级。

刷新率迎来重要的升级节点。今年高刷的规格变得更加丰富,同时高刷份额也在增长。轻薄本率先开始了90Hz的升级路线,三季度市场整体90Hz及以上高刷占比超过2成,约为194万台。今年全年出货规模将超过600万台,同比大幅增长62%。

其中,90Hz今年得到明显成长,华硕、联想等品牌的90Hz新品被打造成爆款,对市场产生一定的拉动作用。高刷市场中,除却144HZ的亮眼表现,销量超过了100万台,更多的成长来自于165Hz,今年三季度165Hz占比是达到2%左右。高刷如此快速的增长,得益于性能轻薄本的兴起和游戏本的整体性能升级。今年轻薄本的火热下,人们对轻薄本的性能要求越来越高。搭配intel/AMD标压,RAM16G的高性能轻薄本开始更多的出现。在中国线上笔记本的销量中,轻薄本的渗透率达到约70%,高性能轻薄本的增长还有巨大的成长空间。2020年中国笔电线上市场性能轻薄本的占比处在4%左右,今年提升到了8%左右,明年预计达到10%。

今年联想的yoga 14s、小新14pro以及华硕的无畏pro14都是大热的高性能轻薄本新品。电竞环境升温以及消费者对休闲娱乐需求的提高,带动了游戏本的整个的性能升级,刷新率开始集体攀升,刷新率144Hz和165Hz的游戏本占比越来越大,热门机型有华硕飞行堡垒9和联想R9000P。

OLED市场逐步扩大,渗透率增加。OLED产品在三季度出货约为16万台,中国市场渗透率达到了1.7%。今年的OLED产品种类繁多,产品价格整体下探,市场在进一步向下拓展,品牌方联想华硕等都上了很多的OLED产品。面板厂商也在积极生产,OLED折叠屏将于明年集中量产,预计明年OLED产品将会达到一个新的高度。OLED的不断发展,也带动了相关屏幕技术的进步,今年苹果新推出的两款搭载MiniLED屏的笔电问世,引爆了市场热度,但MiniLED的成本比较高,外加供货周期不稳定,以苹果为首的miniled产品后续的增长会有所放缓,市场发展的主旋律还是在OLED上。

16:10的发展趋势明显,市场逐步变大。在供应链策略的影响下,16:10的比例今年开始快速进入到消费者手中。2021三季度中国笔电市场预计16:10占比达到16.6%,同比增长近两倍;3:2占比6.1%,同比增长18%。16:10的产品发展更为快速。在尺寸上,16:10+大尺寸+高分辨率的方案颇受青睐;刷新率上,16:10更多的搭载在高刷上,120HZ,165HZ都有相当大的比例。但区分来看,16:10市场中,联想作为领先者,针对16:10的产品线规划积极、覆盖完整。惠普、戴尔、华硕都在积极跟进。华硕Zenbook系列新品全部配置16:10的屏幕。2022年,不同于今年16:10在2K+市场的全面开花,预计16:10会下沉到WFHD入门级产品,从而有望获得更多市场增量。

抓住细分领域变化,重点布局电竞赛道,次年迎接发展新机会

后疫情时代,中国整体经济增长放缓,人们需要足够的娱乐消遣方式来释放自己的生存压力。来年在笔电消费领域以及商用领域,以旧换新的全新升级,将给市场带来活力。最大的增长点,还是人们对游戏投入度的增加,在独立显卡价格高企的时候,好的游戏本等中高端笔电产品依然会是首要选择。在面板端,2022年面板供应预期宽松,面板成本将会有更大的调整空间,市场将会迎来一批高性价比产品。

群智咨询(Sigmaintell)建议:

1. 抓住细分领域的变化。OLED持续下沉市场,OLED笔电丰富度快速提升,建议把握该市场趋势,更好地占据系统生态位。MiniLed将在Apple的带领下迎来最好的发展机会,对该技术也可适时导入,拓宽品牌的新技术广度。16:10的屏幕比例具有高屏占比优势,带来更好的使用体验,市场增量迅速。市场整体都在向大尺寸升级,14英寸和16英寸的比例迅速攀升,分辨率上也由FHD开始向2K升级,刷新率也开始了向90HZ整体跃升的路线。以上变化在来年市场将会更为突出,建议积极跟进。

2. 重点布局电竞赛道。电竞发展如火如荼,产业价值逐年提高,各地资本和消费者都蜂拥而至。建议供应链各方都可以积极布局,抓住这波电竞红利。电竞消费者更加青睐高分和高刷,144Hz和165Hz的关注度更高。同时对响应时间也有一个更高的偏好,毫秒级响应时间成一个重要筛选机制。对于屏幕性能上,OLED也有相当一部分市场关注度,优良的屏幕属性,带来不一样的游戏体验。做好屏幕和性能参数双升级,整体改善笔电的使用体验,为游戏玩家带来新的工具愉悦感。

提交右侧信息,了解更多会员服务方案;

或直接联系我们:

+86 151-0168-2530