发布时间: 2021/10/25 关注度: 966

Entering the second half of 2021, the impact of the epidemic's dividend has gradually weakened, and market demand for consumer electronics has begun to decline. The display panel ended the longest upward cycle in history, and the panel price also experienced various degrees of correction. The changes in the prosperity of the display panel market have an important impact on the display driver IC (DDIC) market. According to the latest data from Sigmaintell, the global demand for DDIC is expected to be 8.51 billion in 2021, an increase of 7.4% YoY. Looking forward to next year, as panel demand gradually declines, the growth rate of DDIC demand will further callback. The demand for DDIC is expected to be approximately 8.62 billion in 2022, a slight increase of approximately 1.3% YoY.

View 1: The overall supply and demand tend to be balanced, but there are still structural risks.

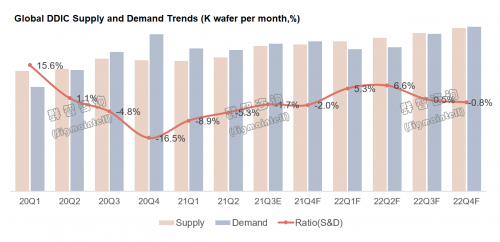

From the perspective of supply and demand, according to Sigmaintell's supply and demand model calculations, with the gradual release of new wafer capacity by mainland and Taiwan manufacturers, and the possibility of demand callbacks increasing, it is expected that the global supply-demand ratio of DDIC will turn to positive from 22Q1 (the supply-demand ratio for the whole year will be changed from -4.4% this year to 2.7% next year), and the supply-demand relationship will gradually ease. The overall state is in balance, but there are still seasonal fluctuations and structural risks. In the second half of 2022, with the arrival of the consumer electronics peak season, the supply-demand ratio of DDIC is expected to narrow to a tight balance. In terms of structure, the supply and demand risks of OLED are worthy of attention.

View 2: Despite the slowdown in demand growth and ongoing supply growth, overall OLED driver IC supply and demand are still tight.

As the demand for OLED panels has strengthened year by year, the supply and demand of OLED driver IC have attracted much attention. From an application perspective, smartphones are still the main application market for OLED driver IC. According to Sigmaintell's calculation data, the demand of smartphone OLED driver IC in 2021 will account for approximately 66% of the overall global demand of OLED driver IC, which is the main application market for OLED driver IC. As we all know, OLED driver IC for smartphones mainly use 28/40(45)nm process technology, which can produce a wider product line at this process node. In addition to OLED driver IC, it also includes CMOS chips, WiFi module chips, Bluetooth chips, etc. At present, the global capacity foundry is mainly concentrated in fabs such as Samsung, UMC, TSMC, GlobalFoundries, and SMIC.

1. Demand: Affected by high inventory, it is expected that the growth rate of overall OLED panel demand will slow down next year.

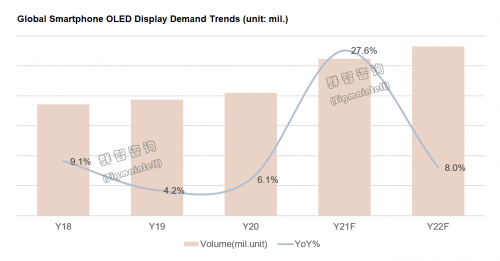

Driven by leading brands such as Apple and Xiaomi, the overall demand for smartphone OLED panels is expected to maintain a positive growth trend in 2022. However, due to the accumulation of high inventory this year, the demand for OLED panels of some mobile brands in 2022 is lower than expected. According to Sigmaintell data, the global demand for OLED smartphone panels is estimated to be approximately 660 million in 2022, a YoY growth rate of about 8.0%, which is lower than the growth rate in 2021.

2. On the supply side: wafer foundries in Taiwan and the mainland have increased their 28nm/40nm capacity supply, and the supply of OLED driver IC has gradually increased.

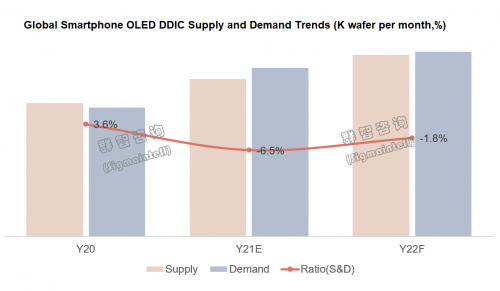

The supply change of driver IC is closely related to the capacity allocation strategy of the foundry. With UMC, TSMC, SMIC, and other fabs increasing 28/40nm capacity, it is estimated that the global OLED driver IC capacity supply will increase by approximately 15.2% in 2022, and overall supply and demand will be significantly improved compared to 2021.

At present, the design houses supplying OLED driver IC for smartphones are mainly Korean fabless (including Samsung/Siliconworks/Magnachip/Anapass, etc.) and Taiwan fabless (including Novatek/Raydium, etc.). Mainland design houses including Hisilicon, Chipone, Eswin, and others are speeding up the mass production process of OLED driver IC.

Looking forward to 2022, the main partners of Korean design houses are still Korean panel makers, and the main sources of OLED driver IC supply for mainland panel makers are Taiwanese makers Novatek and Raydium.

Novatek

According to its disclosed data, Novatek's revenue in 21Q2 is approximately US$1.22 billion, an increase of about 82.3% YoY. Benefited from the increase in the price of DDIC, its operating profit is approximately US$430 million, an increase of nearly three times YoY. In addition, relying on UMC's capacity, Novatek's 28/40nm process OLED driver IC products have gradually increased shipments since 21Q2, and shipments will be more in 21Q3. Looking forward to 2022, with the gradual release of UMC 28nm capacity, Novatek will obtain more 28nm capacity for the production of OLED driver IC, thereby increasing the effective supply of OLED driver IC throughout the year.

Raydium

According to its disclosed data, in the first half of 2021, its operating income reaches approximately US$410 million, its operating profit is about US$79 million, and its operating profit margin is about 19.1%. Benefited from the verification of its latest high-frequency OLED driver IC, Raydium is also actively striving for the production of TSMC and domestic SMIC. It is expected that it will contribute at least 10 million OLED driver IC, becoming one of the main suppliers of OLED driver IC.

In summary, the continuous supply and demand imbalance in the first half of 2021, superimposed on the supply chain run-on effect, the price of OLED driver IC has risen sharply QoQ. Entering the fourth quarter, OLED panels are still in high demand driven by the stocking of iPhone13. According to the calculation data of Sigmaintell, the global demand for OLED smartphone driver IC wafers is expected to be approximately 753,000 (Equi.12 inch) in 2022, an increase of about 9.6% YoY. At the same time, it is estimated that the global supply of 28/40(45)nm DDIC wafers will be about 74 million wafers (Equi.12 inch) in 2022, an increase of about 15.2% YoY. The overall supply-demand ratio in 2022 is expected to be -1.8%. Based on this, Sigmaintell predicts that because of the slowdown in demand growth and the continuous increase in the supply side, it is expected that the supply and demand situation in 2022 will be better than in 2021, but it will remain tight. The price of OLED driver IC will also continue to remain high, and the possibility of price reductions in the short term is low. It is recommended that downstream manufacturers still adopt an active supply chain strategy.

中文:

进入2021年下半年,疫情红利的影响逐步减弱,消费电子终端市场需求开始走低,显示面板结束了历史上最长上行周期,面板价格也出现了不同程度回调,显示面板市场景气度变化对显示驱动IC市场有着深远影响。根据群智咨询(Sigmaintell)最新数据显示,预计2021年全球显示驱动IC(DDIC)需求量85.1亿颗,同比上涨7.4%。展望明年,随着面板需求逐步回调,显示驱动IC需求增速进一步回调,预计2022年显示驱动IC的需求量约为86.2亿颗,同比微幅增长约1.3%。

观点一:整体供需趋平衡、但仍存结构性风险

从供需角度分析,根据群智咨询(Sigmaintell)供需模型测算,随着大陆及台厂的新增晶圆产能逐步释放以及需求回调可能性增大,预计全球显示驱动IC的供需比有望在2022年一季度开始转正 (全年供需比从今年的-4.4%转为明年的2.7%),供需关系逐步得到缓解,总体呈现平衡状态,但仍存季节性波动和结构性风险;预计2022年下半年随着消费电子旺季备货来临,显示驱动IC供需比将收窄到平衡偏紧水平。在结构方面,OLED的供需风险值得关注。

观点二:尽管需求增速放缓、供应持续增长,但整体OLED驱动IC供需仍偏紧

随着OLED面板的需求逐年走强,OLED驱动IC的供需备受关注。从应用层面来看,智能手机仍然为OLED驱动IC主要应用市场。根据群智咨询(Sigmaintell)测算数据显示,2021年智能手机应用类OLED驱动IC的需求量约占全球整体OLED驱动IC需求量的66%,为OLED驱动IC的主要应用市场。众所周知,智能手机用OLED驱动IC主要采用28/40(45)nm制程工艺,该制程节点可生产的产品线较广,除OLED驱动IC外,还包括图像传感器CMOS芯片、WiFi模块芯片、蓝牙芯片等。目前全球产能代工主要集中在三星(Samsung)、联电(UMC)、台积电(TSMC)、格芯(GlobalFoundries)、中芯国际(SMIC)等晶圆厂。

1. 需求方面:高库存影响,预计明年整体OLED面板需求增速放缓

在苹果、小米等头部品牌的积极带动下,预计2022年整体智能手机OLED面板需求仍然维持正增长趋势,不过受到今年高库存累积的影响,部分手机终端品牌2022年的OLED面板需求低于预期。根据群智咨询(Sigmaintell)数据显示,预计2022年全球OLED智能手机面板需求规模约为6.6亿片,同比增速约为8.0%,较2021年的增速有所下调。

2. 供应层面:台系及大陆晶圆厂增加28nm/40nm产能供应,OLED驱动IC供应逐步增加

驱动IC的供应变化与晶圆厂的产能分配策略紧密相关,随着台积电、联电、中芯国际等晶圆厂加大对28/40nm产能扩产放量,预计2022年全球OLED驱动IC的产能供应增幅约为15.2%,整体供需较2021年有显著好转。

目前智能手机OLED驱动IC供应的设计公司以韩系(包括三星、Siliconworks、Magnachip、Anapass等)、台系【包括联咏(Novatek)、瑞鼎(Raydium)等】为主,包括海思(Hisilicon)、集创北方(Chipone)、奕斯伟(Eswin)等大陆设计公司也纷纷流片加快量产OLED驱动IC的进程。

展望2022年,韩系设计公司主要合作伙伴仍然以韩国面板厂为主,大陆面板厂的OLED驱动IC供应来源的主要以台厂联咏(Novatek)、瑞鼎(Raydium)等为主。

联咏(Novatek)

根据其披露数据显示,2021年二季度营收规模约为12.2亿美金,同比增长约82.3%,受益于显示驱动IC价格上涨,营业利润约为4.3亿美金,同比增长近3倍。此外,依靠联电产能支撑,联咏在28/40nm制程的OLED驱动IC产品从二季度开始出货量渐增,三季度出货量可创新高。展望2022年,随着联电28nm产能的逐步释放,联咏将获得更多28nm的产能用于生产OLED驱动IC,增加全年OLED驱动IC的有效供应。

瑞鼎(Raydium)

根据其披露数据显示,2021年上半年其营业收入达到约4.1亿美金,营业利润约为7900万美金,营业利润率约为19.1%。得益于瑞鼎最新一颗高刷的OLED驱动IC的验证通过,其也积极争取在台积电及国内中芯国际的投产流片,预计其2022年也将贡献OLED驱动IC至少在1000万颗以上,成为OLED驱动IC主要供应商之一。

综上所述,2021年上半年持续的供需失衡,叠加供应链挤兑效应,OLED驱动IC价格连续数个季度环比大幅上涨。进入四季度,OLED面板在苹果新品iPhone13的备货带动下仍然维持高需求。根据群智咨询(Sigmaintell)的测算数据显示,预计2022年全球OLED智能手机驱动IC的晶圆需求约为75.3万片(以12英寸为基准),同比增长约为9.6%。同时,预计2022年全球28/40(45)nm显示驱动IC的晶圆供应约为74.0万片(以12英寸为基准),同比增长约为15.2%,2022年的整体供需比预计为-1.8%。基于此,群智咨询(Sigmaintell)预测,鉴于需求增长放缓以及供应端的持续增加,预计2022年供需状况较2021年有所好转,但仍为偏紧状态,OLED驱动IC的价格也将持续维持在高位,短期内价格下调的可能性偏低,建议下游厂商仍然采取积极供应链策略。

提交右侧信息,了解更多会员服务方案;

或直接联系我们:

+86 151-0168-2530