发布时间: 2022/03/08 关注度: 857

Core points:

Affected by inventory and manufacturers' strategy adjustments, OLED display technology is accelerating its penetration in medium and large-size applications such as notebooks and TVs, while its penetration in the smartphone market is gradually slowing down. From the perspective of the supply of OLED driver ICs for smartphones, Korean and Taiwanese makers are still in an absolute leading position in 2021, and mainland makers are actively following up.

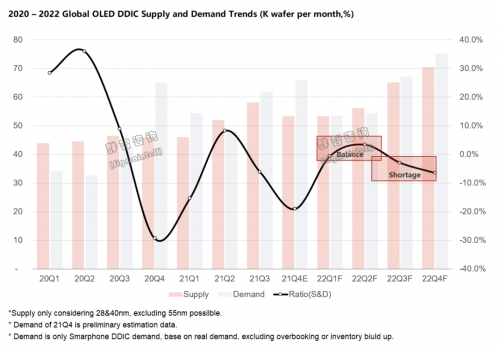

Driven by the active downstream demand, the global OLED display driver ICs faced an unprecedented phenomenon of shortages and price increases in 2021. Looking forward to 2022, according to the supply and demand model of Sigmaintell, it is expected that the global supply and demand ratio of OLED driver ICs will reach -2.1% in 2022, and the supply and demand will be significantly improved compared with 2021. Especially in 22H2, when the peak season for consumer electronics demand comes, the demand for OLED DDIC will increase significantly. Sigmaintell predicts that the global OLED DDIC price will be dominated by a stable trend in 2022, and it is recommended that downstream makers still adopt an active procurement strategy.

OLED display technology is accelerating its penetration in medium and large-size applications such as notebooks and TVs.

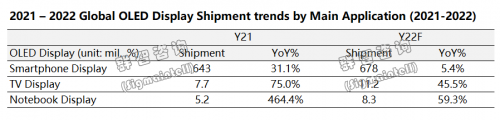

Affected by inventory and manufacturers' strategy adjustments, OLED display technology is accelerating its penetration in medium and large-size applications such as notebooks and TVs, while its penetration in the smartphone market is gradually slowing down. According to Sigmaintell data: in 2021, the global OLED smartphone panel shipments are about 640 million units, a YoY increase of about 31.1%, and the YoY growth rate is expected to decline to about 5.4% in 2022. At the same time, the global OLED TV panel shipments reach 7.6 million in 2021, a YoY increase of about 75.0%, and it is expected to exceed 10 million in 2022. The global OLED notebook panel shipments are about 5.25 million pieces in 2021, a YoY increase of about 464.4%, and it is expected to maintain a YoY growth rate of nearly 60% in 2022. In the fields of smart cars and smart wear, OLED display panel technology is also showing a rapid penetration trend.

Korean and Taiwanese makers are still in an absolute leading position in 2021, and mainland makers are actively following up.

From the perspective of the supply of OLED driver ICs for smartphones, Korean and Taiwanese makers are still in an absolute leading position in 2021, and mainland makers are actively following up.

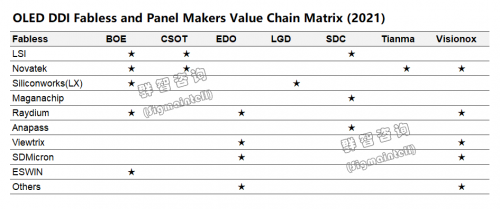

Let’s first look at the performance of Korean makers: According to Sigmaintell data, benefited from Samsung Display’s leadership in the OLED field, its brother company Samsung LSI is still the largest supplier of OLED driver ICs. In 2021, its shipments of smartphone OLED driver IC accounted for about 56.1%, and its main wafer production comes from Samsung fab and Taiwan UMC. In the long run, it will gradually increase its foundry ratio in Taiwan to reduce the proportion of its production and achieve the maximum economic interests of the overall group. At the same time, Sliconworks (LX) of Korea mainly benefited from the strong demand for OLED panels for Apple's new iPhone. Its OLED driver IC shipment share was about 10.4%, ranking third in the industry, mainly in TSMC 40nm for foundry production. Despite being affected by mergers and acquisitions, Managachip is being separated from Samsung's supply chain system, but it still supplied a large number of driver ICs for Samsung Display in 2021.

Secondly, Taiwanese makers, Novatek and Raydium are the main suppliers of OLED driver ICs for panel makers in mainland China. According to Sigmaintell data, the market share of their smartphone OLED driver ICs in 2021 were 11.3% and 4.9%. In 2021, Novatek's customers mainly came from BOE, CSOT, Tianma, Visionox, etc. Novatek's capacity mainly came from UMC foundry. After October 2021, UMC's foundry strategy for OLED driver ICs was gradually shifted from 40nm to 28nm, which enable Novatek to continue to expand the promotion of 28nm OLED driver ICs in 2022. Domestic set makers such as Honor have gradually begun to use advanced 28nm OLED driver ICs. Overall, the market share of Novatek's OLED driver ICs is expected to further increase in 2022.

Raydium's main profit in 2021 came from mainland China, and its customers were mainly EDO, Visionox, BOE, etc. In 2021, the process nodes of Raydium's OLED driver ICs are all 40nm high-voltage processes, and its wafer foundry is mainly in TSMC and SMIC. Affected by the tight capacity of TSMC, the subsequent foundry of Raydium will continue to increase the OEM cooperation in SMIC, including SMIC's 28nm high-voltage process, and there is positive cooperation progress.

In 2021, the proportion of fabless makers in mainland China supplying OLED driver ICs is still low (less than 10%), but the growth rate is fast. Fabless makers including Viewtrix, SDmicron, Hisilicon, Eswin, Omnivision, Chipone, etc. are actively developing the OLED driver IC business. Looking forward to 2022, with the strategic cooperation of the 28nm/40nm high-voltage process capacity of fabs such as SMIC, Nexchip, and HLMC, the follow-up OLED driver IC shipments in mainland China are expected to grow rapidly, and the market share further increased.

The overall supply and demand has eased, and the whole year will show a trend of "stable first and then tense"

Driven by the active downstream demand, the global OLED display driver ICs faced an unprecedented phenomenon of shortages and price increases in 2021. Looking forward to 2022, although the external environment is relatively turbulent and set demand continues to be sluggish, the penetration rate of OLED display technology in the smartphone field continues to rise. From the demand side, OLED display driver ICs are still showing an upward trend. At the same time, from the supply side, the global semiconductor supply chain still suffers from unstable geopolitical influences such as the "Russian-Ukrainian conflict", and the pace of 28/40nm capacity expansion is still limited. According to the supply and demand model of Sigmaintell, the global supply and demand ratio of OLED driver ICs is about -9.0% in 2021, and the supply and demand are tight and out of stock throughout the year. It is expected that the global supply and demand ratio of OLED driver ICs will reach -2.1% in 2022, and the supply and demand will be significantly improved compared with 2021. Especially in 22H2, when the peak season for consumer electronics demand comes, the demand for OLED DDIC will increase significantly. The whole year will show a trend of "stable first and then tense".

In summary, the demand for OLED DDIC will still maintain a growth trend in 2022, while the progress of wafer capacity expansion is limited. In addition, under multiple pressures such as upstream wafer price increases, it is expected that the global OLED driver IC price will be dominated by a stable trend in 2022. It is recommended that downstream makers adopt an active procurement strategy.

中文:

导读:

受到库存及厂商策略调整影响, OLED显示技术正加速在笔记本电脑、电视等中大尺寸应用领域渗透,而在智能手机市场的渗透速度逐步放缓。从智能手机OLED驱动芯片供应情况来看,2021年韩系和台系厂商仍处在绝对领先地位,大陆厂商积极跟进。

在下游需求积极带动下,2021年全球OLED显示驱动芯片面临了前所未有的缺货涨价现象。展望2022年,根据群智咨询(Sigmaintell)的供需模型测算,预计2022年全球OLED驱动芯片的供需比来到-2.1%,供需比较2021年有大幅改善,尤其是进入2022年下半年随着消费电子需求旺季备货来临,OLED DDIC需求将大幅提升,全年总体呈现“先平后紧”态势。群智咨询(Sigmaintell)预计,2022年全球OLED驱动芯片价格以稳定趋势为主,建议下游厂商仍然采取积极采购策略。

OLED显示技术加速在笔记本电脑、电视等中大尺寸应用领域渗透

受到库存及厂商策略调整影响, OLED显示技术正加速在笔记本电脑、电视等中大尺寸应用领域渗透,而在智能手机市场的渗透速度逐步放缓。根据群智咨询(Sigmaintell)数据显示,2021年全球OLED智能手机面板出货约6.4亿片,同比上升约31.1%,预计2022年同比增速下降到5.4%左右;同时2021年全球OLED TV面板出货数量达到760万片,同比增长约75.0%,预计2022年将超过1000万片;2021年全球OLED笔记本电脑面板出货量约525万片,同比增长约 464.4%,预计2022年也仍将维持近60%的同比增速。在智能汽车、智能穿戴等领域OLED显示面板技术也呈现快速渗透趋势。

韩系台厂仍处于绝对领先地位,中国大陆厂商积极跟进

从智能手机OLED驱动芯片供应情况来看,2021年韩系和台系厂商仍处在绝对领先地位,大陆厂商积极跟进。

首先来看韩系厂商的表现:根据群智咨询(Sigmaintell)数据,得益于三星显示在OLED领域的领导地位,其兄弟公司三星LSI仍然是最大的OLED驱动芯片的供应商,2021年其智能手机OLED驱动芯片的出货占比达到约56.1%,其主要晶圆生产来自于三星晶圆厂生产以及台厂联电 (UMC), 长期来看,其会逐步加大在台厂的代工比例,降低自身的生产比重,来达到整体集团的最大经济利益。与此同时,韩厂的Sliconworks(LX)主要得益于苹果新机iPhone 对于OLED面板的强劲需求,其OLED驱动芯片的出货份额约为10.4%,位列行业第三位,其主要在台积电的40nm进行代工生产。尽管受到并购事宜影响,Managachip正在从三星供应链体系脱离,但2021年仍然为三星显示供应大量的驱动芯片。

其次,台系厂商联咏(Novatek)和瑞鼎(Raydium),是中国大陆面板厂OLED 驱动芯片的主要供应商,根据群智咨询(Sigmaintell)数据,2021年其智能手机OLED驱动芯片的市占率分别为11.3%和4.9%。2021年,联咏的客户主要来自京东方(BOE)、华星光电(CSOT)、天马(Tianma)、维信诺(Visionox)等,联咏的产能则主要来自联电代工。2021年10月后,联电的OLED驱动芯片的代工策略逐渐从40nm转移到28nm, 使得2022年联咏持续扩大28nm OLED 驱动芯片的推广,包括国内终端厂商荣耀等逐渐开始采用先进的28nm的OLED驱动芯片,整体来看,2022年联咏OLED 驱动芯片的市场份额有望进一步提升。

瑞鼎2021年主要的盈利来自中国大陆,客户主要为和辉光电(EDO)、维信诺、京东方等。2021年瑞鼎的OLED 驱动芯片的制程节点均为40nm高压制程,其晶圆代工主要在台积电及中芯国际(SMIC),受到台积电产能紧张原因影响,后续瑞鼎的晶圆代工将持续加大在中芯国际的代工合作力度,包括中芯国际的28nm的高压制程均有积极的合作进展。

2021年中国大陆的Fabless厂商供应OLED驱动芯片的占比仍然较低(不足10%),但成长速度较快。包括云英谷(Viewtrix)、昇显微(SDmicron)、海思(Hisilicon)、奕斯伟(Eswin)、豪威(Omnivision)、集创北方(Chipone)等在内的Fabless厂商都在积极开发OLED 驱动芯片业务。展望2022年,随着中芯国际(SMIC)、晶合(Nexchip)和华力(HLMC)等晶圆厂的28nm/40nm高压制程产能的策略配合下,后续大陆本土的OLED驱动芯片出货有望快速成长,市场占比有望进一步走高。

整体供需缓解,全年恐呈现“先平后紧”趋势

在下游需求积极带动下,2021年全球OLED显示驱动芯片面临了前所未有的缺货涨价现象。展望2022年,尽管外围环境相对动荡,终端需求持续低迷,但OLED显示技术在智能手机领域的渗透率持续攀升,从需求侧来看,OLED显示驱动芯片仍然呈现上升趋势。同时,从供给侧来看,全球半导体供应链仍然承受着“俄乌冲突“等不稳定的地缘政治影响,28/40nm的产能扩充节奏仍然有限。根据群智咨询(Sigmaintell)的供需模型测算,2021年全球OLED驱动芯片的供需比约为-9.0%,全年呈现供需紧张及缺货状态,预计2022年全球OLED驱动芯片的供需比来到-2.1%,供需比较2021年有大幅改善,尤其是进入2022年下半年随着消费电子需求旺季备货来临,OLED DDIC需求将大幅提升,全年总体呈现“先平后紧”态势。

综上所述,2022年OLED DDIC需求仍保持增长态势,而晶圆产能扩产进度有限,全年呈现“先平后紧”趋势,整体仍存在供需偏紧的情况。此外,在上游晶圆涨价等多重压力下,预计2022年全球OLED驱动芯片价格以稳定趋势为主,建议下游厂商仍然采取积极采购策略。

提交右侧信息,了解更多会员服务方案;

或直接联系我们:

+86 151-0168-2530