发布时间: 2022/03/24 关注度: 794

Key points:

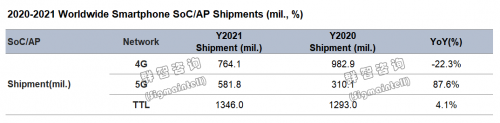

After the production of HiSilicon Kirin chipsets was discontinued, the supply pattern of smartphone SoCs has changed in 2021, forming a competition pattern between MediaTek and Qualcomm duopoly. On the demand side, set makers overstocked in the first half of the year. Under the circumstance of tight upstream foundry capacity, the smartphone SoC market was in short supply and prices rose throughout the year. According to the survey data of Sigmaintell, the global smartphone SoC shipments (including AP) in 2021 is about 1.35 billion, a YoY increase of about 4.1%. From the perspective of capacity and supply, it is estimated that the global smartphone SoC (including AP) shipments will be about 1.4 billion in 2022, a YoY increase of about 4%. At present, the Russian-Ukrainian war has broken out, the domestic epidemic has repeated, and the global economic growth in 2022 may be lower than expected. Various factors have led to the continuous weakening of set demand, and the tight supply and demand of smartphone SoCs have eased. The overall supply of 5G SoCs is abundant and good, but there is still a structural shortage of 4G SoCs.

Although the construction of 5G base stations has slowed down, the general trend of upgrading smartphones from 4G to 5G has not changed. With the active promotion of operators, the coverage of 5G base station signals has become wider and wider, and 5G has gradually become the basic demand of consumers for new smartphones. According to Sigmaintell survey data, the global 5G SoC (including AP) shipments in 2021 is about 580 million, a YoY increase of about 87.6%. It is expected that 5G SoC shipments will continue to grow in 2022 as 5G smartphone prices decline. Global 5G SoC (including AP) shipments are about 760 million units, a YoY increase of about 30.6%, and 5G SoC shipments will surpass 4G SoC shipments for the first time.

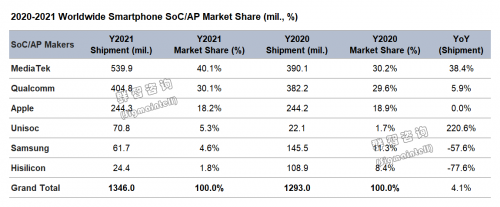

With the discontinuation of the HiSilicon Kirin SoC, currently, only Apple and Samsung use self-developed main chipsets among the top set makers. In addition, the largest suppliers of smartphone SoCs are MediaTek and Qualcomm. According to Sigmaintell survey data, in 2021, Qualcomm and MediaTek accounted for about 70% of the smartphone SoC market, gradually forming a duopoly competition pattern.

MediaTek: With the dense product lines layout of the 5G Dimensity series and the solid position of the superimposed 4G SoC, MediaTek's smartphone SoC shipments maintained a growth trend, which also led to a continuous increase in the revenue share of mobile applications. According to Sigmaintell data, in 2021, MediaTek’s smartphone SoC shipments ranked first with about 540 million units, with a YoY increase of about 38.4% and a market share of about 40.1%. With the mass production release of the flagship 5G SoC Dimensity 9000, it is expected that MediaTek will also occupy a place in the high-end flagship series this year. At the same time, its product series covers all gears, and its SoC shipments are expected to continue to lead the smartphone market in 2022.

Qualcomm: The Qualcomm Snapdragon 800 series has always been the best choice for most flagship smartphones. Although Qualcomm has strategically reduced the supply of entry-level 4G SoCs in 2021, it has benefited from the development of 5G and the release of iPhone 5G smartphones. As the volume of goods increased, Qualcomm, as the only supplier of iPhone 5G modem, also showed a continuous growth trend in QCT revenue. According to Sigmaintell data, in 2021, Qualcomm's smartphone SoC shipments were about 400 million (excluding 5G Modem), a YoY increase of about 5.9%, ranking second in the world with a 30.1% share. In 2022, as the supply of 4G chipsets shrinks, the overall shipments of Qualcomm SoCs may decline slightly. However, with the launch of its Snapdragon 8 Gen1 and the mass production of the 4nm Snapdragon 700 series, Qualcomm's 5G SoC and modem shipments will continue to grow.

Apple: Apple's smartphone AP is only used by the iPhone, and the 4G modem still uses Intel, and Qualcomm's modem has been introduced into 5G smartphones since the iPhone 12. It is expected that Apple's self-developed modem are expected to be mass-produced next year, but the entire series will not be imported for the time being. The flagship models are expected to still use Qualcomm's 5G modem. After the HiSilicon Kirin chipset was banned, Apple benefited from the high-end market. According to Sigmaintell data, in 2021, Apple's mobile phone AP shipments were about 240 million, ranking third with a share of 18.2%. It is expected that Apple's smartphone AP shipments will remain at around 240-250 million in 2022.

Unisoc: Based on the cooperation with Transsion, Moto, and ZTE, Unisoc successively received 4G SoC orders from top set makers such as Honor, Realme, and Samsung in 2021, and its shipment volume entered a new round period of rapid growth. According to Sigmaintell data, in 2021, Unisoc's smartphone SoC shipments were about 70.8 million, a YoY increase of about 220%. As Samsung's project using Unisoc's 4G SoC is gradually mass-produced in ODMs, it is expected that Unisoc's shipments will still maintain a rapid growth trend in 2022. Unisoc’s main supply is still 4G SoC at present, and the 5G SoC market has ample supply, and it is still necessary to find suitable opportunities to introduce top set makers.

Samsung: Samsung's main customers of Exynos are still Samsung Electronics and vivo. According to Sigmaintell data, Samsung's smartphone SoC shipments in 2021 were about 61.7 million, a YoY decrease of about 57.6%. In 2022, as Samsung Electronics increases the proportion of Exynos, Samsung SoC shipments are expected to grow slightly.

2022 Outlook: Smartphone SoC supply and demand reverse, but there is still a risk of structural shortage. It is recommended to adopt a dual-platform solution for the main stage.

The demand in the smartphone market is gradually falling, and the installation plans of set makers are also gradually cooling down. Looking forward to the smartphone SoC market in 2022, supply and demand will reverse after the demand declines. 5G SoCs are currently oversupplied, but 4G SoCs still face the risk of structural shortages. In the face of supply chain fluctuations, Sigmaintell's recommendations are as follows:

The inventory level of mid-to-high-end 5G SoCs needs to be cautious. At present, 5G smartphones are still in the process of upgrading and iteration, and mid-to-high-end smartphones are iterated every six months, and the same chipset can be used for up to two generations of products at the same level. While operating with high inventory in a turbulent environment, it is necessary to avoid excessively high inventory levels of mid-to-high-end 5G SoCs.

4G SoCs can adopt an aggressive procurement strategy. At present, the upgrade of 4G SoC is slowing down. Although Qualcomm has launched a 6nm 4G SoC, MediaTek's 6nm 4G SoC is about to be mass-produced, and the 4G SoC that runs in the thousand-yuan range is currently slowing down. Under the circumstance that there are still uncertain factors such as price increase and the tight supply of upstream wafers, it is recommended that set makers can adopt an active procurement strategy.

It is recommended that the main stage should adopt a dual-platform solution to avoid risks, while the stage position with high sales volume chooses two chipsets from different suppliers. Although the dual-platform solution increases the cost of research and development, it can seize market opportunities more quickly when faced with a series of uncertain factors such as supply chain capacity, price, and a ban on sales.

中文:

核心观点:

市场规模:2021年全球智能手机SoC出货量约为13.5亿颗,同比增长约4.1%。预计2022年出货量约为14亿颗,同比增长约4%。

竞争格局:智能手机SoC供应格局重构,联发科跃居榜首,2021年联发科和高通市占约70%;紫光展锐高速增长,同比增长约220%。

2022展望:智能手机SoC供需反转,但仍有结构性短缺风险。主力阶位,建议采用双平台方案。

海思麒麟芯片停产之后,2021年智能手机SoC供应格局发生变化,形成联发科和高通双寡头的竞争格局。需求侧,上半年终端厂商超额备货,在上游晶圆代工产能吃紧的情况下,智能手机SoC市场缺货和涨价贯穿全年。根据群智咨询(Sigmaintell)调查数据显示,2021年全球智能手机SoC出货量(含AP)约为13.5亿颗,同比增长约4.1%。从产能供应侧角度,预计2022年全球智能手机SoC(含AP)出货量约为14亿颗,同比增长约4%。目前俄乌战争爆发,国内疫情反复,2022年全球经济增长恐低于预期,多方因素导致终端需求持续走弱,智能手机SoC供需紧张局面有所缓解, 5G SoC整体供应状况充裕良好,但4G SoC仍存结构性短缺风险。

尽管5G基站建设进度趋缓,但智能手机从4G向5G升级的大趋势没有改变,在运营商的积极推动下,5G基站信号覆盖范围越来越广,5G逐渐成为消费者换机的基本诉求。根据群智咨询(Sigmaintell)调查数据显示,2021年全球5G SoC(含AP)出货量约为5.8亿颗,同比增长约87.6%。预计2022年随着5G智能手机价格下探,5G SoC出货量仍将保持增长趋势,全球5G SoC(含AP)出货量约7.6亿颗,同比增长约30.6%,5G SoC出货量将首超4G SoC。

竞争格局:2021年联发科和高通市占约70%,联发科跃居榜首;紫光展锐高速增长,同比增长约220%。

随着海思麒麟SoC停产,目前头部终端厂商中仅剩苹果和三星采用自研主芯片,除此之外,手机SoC最大的供应商是联发科和高通。根据群智咨询(Sigmaintell)调查数据显示,2021年,高通和联发科两家在智能手机SoC市场市占约70%,逐步形成了双寡头竞争的格局。

联发科(MediaTek):凭借着5G天玑系列密集的产品线布局,叠加4G SoC的稳固地位,联发科智能手机SoC出货量保持增长态势,同时也带动了手机应用的营收占比持续增加。群智咨询(Sigmaintell)数据显示,2021年联发科智能手机SoC出货量约5.4亿颗位居榜首,出货量同比增长约38.4%,市场份额约40.1%。随着旗舰5G SoC天玑9000的量产发布,预计今年联发科在高端旗舰系列也将占有一席之地,产品系列覆盖高中低全部档位,2022年其SoC出货量有望继续引领智能手机市场。

高通(Qualcomm):高通骁龙800系列一直是大多数旗舰智能手机的不二选择,尽管在2021年高通策略性收缩了入门4G SoC的供应,但受益于5G的发展,和iPhone 5G智能手机出货量增加,高通作为iPhone 5G基带芯片唯一的供应商,QCT(芯片业务)营收同样呈现持续增长的趋势。群智咨询(Sigmaintell)数据显示,2021年高通智能手机SoC出货量约4亿颗(不含5G Modem),同比增长约5.9%,以30.1%的份额位居全球第二。2022年,随着4G芯片供应缩减,高通SoC整体出货量有可能出现小幅回落,但随着骁龙8 Gen1的推出,以及4nm的骁龙700系列量产之后,高通5G SoC和基带芯片的出货量仍将保持增长趋势。

苹果(Apple):苹果的智能手机芯片(AP)仅供iPhone使用,4G基带仍采用英特尔,从iPhone 12开始在5G智能手机导入高通的基带芯片。预计苹果自研的基带芯片有望在明年量产,但暂时不会全系列导入,旗舰机型预计仍将采用高通的基带芯片。海思麒麟芯片被禁之后,苹果在高端市场获益。群智咨询(Sigmaintell)数据显示,2021年,苹果手机芯片(AP)出货量约为2.4亿颗,以18.2%的份额位居第三。预计2022年苹果的智能手机芯片(AP)出货量仍会维持在2.4~2.5亿颗左右。

紫光展锐(Unisoc):在与传音、摩托和中兴合作的基础上,2021年紫光展锐陆续拿到了头部终端厂商荣耀、Realme和三星的4G SoC订单,出货量进入了新一轮的高速成长期。群智咨询(Sigmaintell)数据显示,2021年紫光展锐智能手机SoC出货量约为7080万颗,同比增长约220%。随着三星采用紫光展锐4G SoC的项目在ODM逐步量产,预计2022年紫光展锐的出货量仍会保持高速增长趋势。紫光展锐目前主要供应仍是4G SoC,5G SoC市场供应宽裕,导入头部终端厂商仍需要寻找合适的契机。

三星(Samsung):三星的猎户座主要客户仍是三星电子和vivo。群智咨询(Sigmaintell)数据显示,2021年三星智能手机SoC出货量约6170万颗,同比下降约57.6%。2022年,随着三星电子提高猎户座的占比之后,预计三星SoC出货量有望出现小幅增长。

2022展望:智能手机SoC供需反转,但仍有结构性短缺风险,主力阶位建议采用双平台方案。

智能手机市场需求逐步回落,终端厂商装机计划也逐渐降温,展望2022年智能手机SoC市场,需求下行之后供需出现反转,5G SoC目前呈现供过于求的局面,但4G SoC仍面临结构性短缺的风险。面对供应链的波动,群智咨询(Sigmaintell)的建议如下:

中高端5G SoC库存水位需谨慎。目前,5G智能手机仍在升级迭代中,中高端智能手机基本上都是每半年迭代一次,同一颗芯片在同阶位最多应用两代产品。动荡环境中高库存运行的同时,需避免中高端5G SoC库存水位过高。

4G SoC可采用积极采购策略。目前4G SoC升级趋缓,尽管高通推出了6nm 4G SoC,联发科的6nm 4G SoC也即将量产,而千元档内跑量的4G SoC目前升级趋缓。在上游晶圆仍有涨价和供应吃紧等不确定因素的情况下,建议终端厂商可以采取积极采购策略。

主力阶位,双平台方案规避风险。跑量的阶位,建议可选择不同供应商的两颗芯片,双平台方案尽管增加了研发成本,但面对供应链产能、价格、禁售等一系列不确定因素影响时,能更快速的抓住市场机会。

提交右侧信息,了解更多会员服务方案;

或直接联系我们:

+86 151-0168-2530