1.The semiconductor chip industry is gradually cooling down, and the industry is gradually returning to rationality.

As we all know, the semiconductor chip industry has been out of stock since 2021. In this state, chip prices continue to rise, set makers face high-cost pressures, and semiconductor practitioners receive lucrative returns. However, since 2022, the above market situation has begun to reverse, the trend of supply and demand has changed, and the market inflection point has come.

On the whole, the semiconductor chip industry will gradually cool down after being pushed up in 2021. Sigmaintell believes that the development of the semiconductor chip industry has begun to gradually return to rationality.

2.The semiconductor chip industry has stronger anti-risk and anti-cycle capabilities.

2.The semiconductor chip industry has stronger anti-risk and anti-cycle capabilities.

Looking at the development of the semiconductor chip industry, it is significantly different from the development of the display industry. According to Sigmaintell’s data, the global display industry revenue is expected to decline by about 20% Y-o-Y in 2022, and it is expected to meet a rebound of about 5% Y-o-Y growth in 2023. At the same time, according to SIA’s data, the revenue of the semiconductor chip market is expected to increase by about 16.3% Y-o-Y in 2022 and 5% Y-o-Y in 2023, which will be a sharp contrast to the development of the display industry.

Why is the market-driven logic of the semiconductor chip industry so different from that of the display industry? According to Sigmaintell’s data, the difference is mainly affected by two factors; one is due to the signing of long-term agreements (LTA) and other factors. Although the downstream demand is weak, the market response of upstream semiconductor makers is still lagging behind. Then, the difference in the coverage between semiconductor chips and new display industries is obvious: the coverage and penetration rate of chips in various fields are stronger than those of the display industry. Compared with the display industry, the semiconductor chip industry has stronger anti-risk and anti-cycle capabilities.

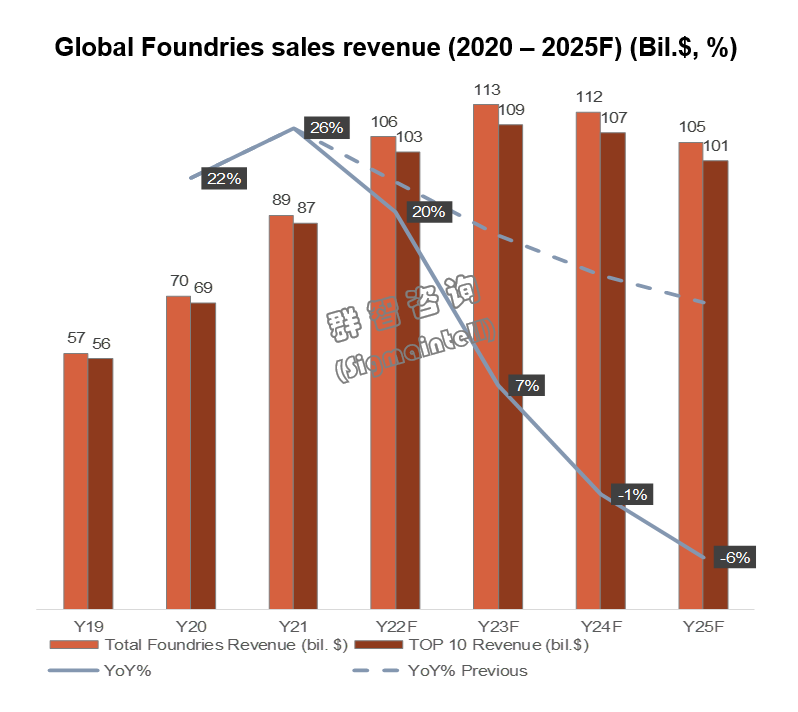

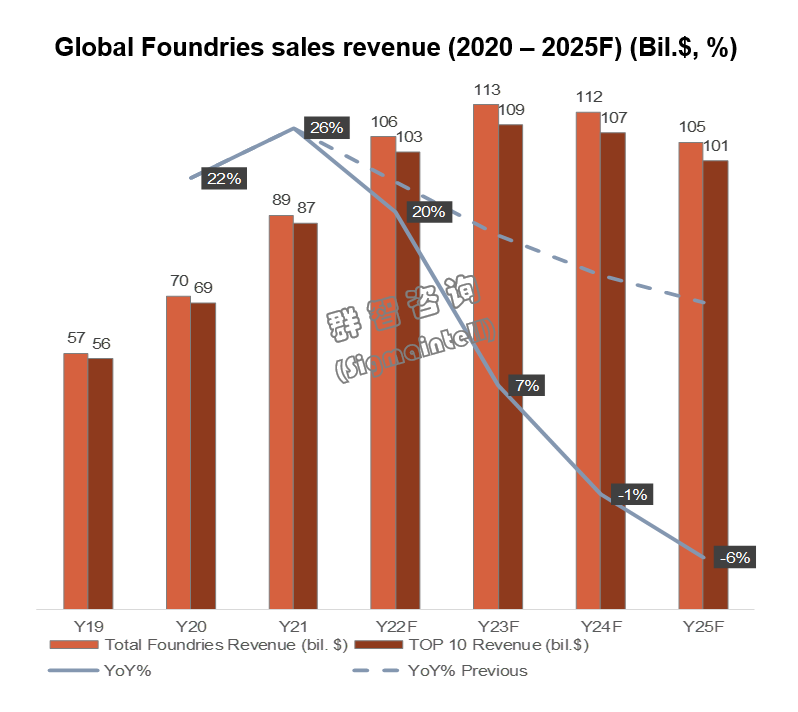

3.From 23F to 25F, the growth rate of the global foundries sales revenue will enter a downward channel.

In terms of cyclicality, the semiconductor chip industry has a cycle of about 2-3 years. According to Sigmaintell’s data, from 2020 to 2022, the revenue of the top 10 factories in the world will maintain an average annual growth rate of about 20% and will reach a peak in 2021. With the gradual release of new foundry capacity, the growth rate of global foundries sales revenue will enter a downward channel.

4.Process upgrades and localization support have become the two main directions of foundry development.

4.Process upgrades and localization support have become the two main directions of foundry development.

Sigmaintell analyzed the revenue data of various foundries and found that process upgrades and localization support have become the two main directions of foundry development.

The advanced process is represented by TSMC. In recent years, TSMC's revenue has been in a stage of rapid growth, showing strong anti-cyclical ability, mainly due to the strong competitiveness of its advanced process on a global scale. Therefore, for TSMC, in a relatively turbulent external environment, it can still maintain its revenue capability and is more resistant to risks. Therefore, R&D and expansion of advanced processes have become a long-term competitive strategy for foundry expansion.

At the same time, with the instability of geopolitics, including the signing of the "Chip 4" in the United States, self-sufficiency production has become another strategy for foundry development. Foundries represented by SMIC, Hua Hong (Huali), Hefei Nexchip, YMTC, and CXMT can follow the trend of self-sufficiency and will continue to maintain rapid growth.

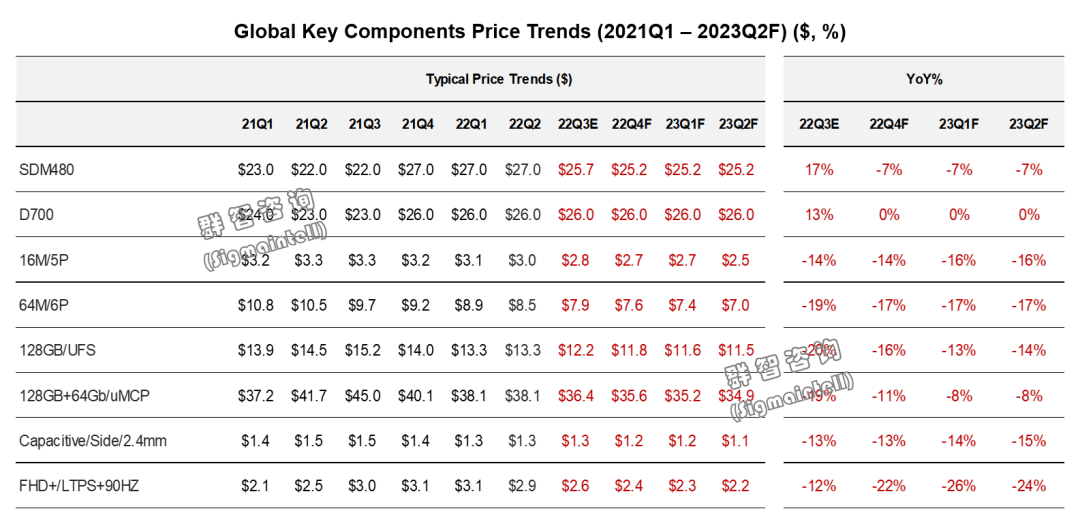

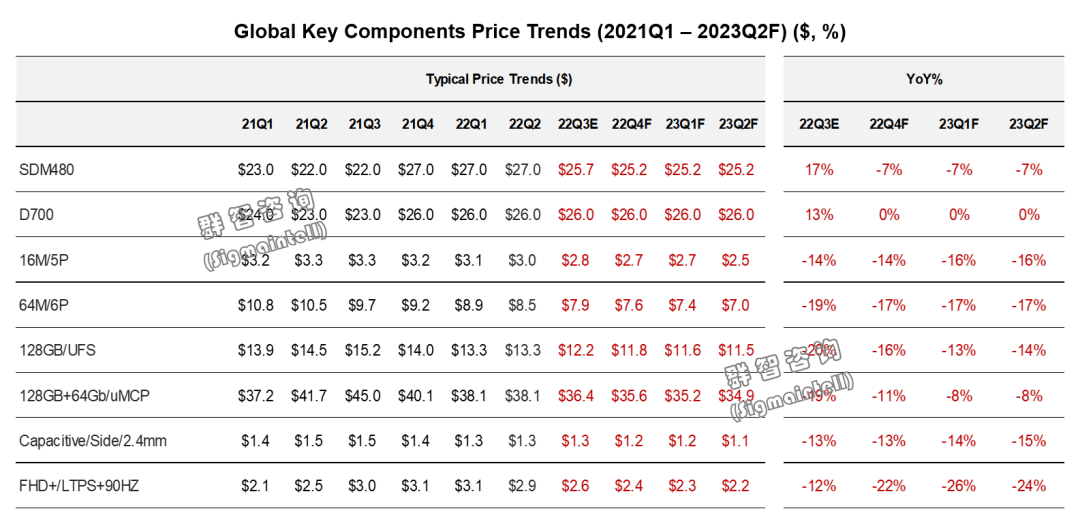

5.Due to the weakening demand for consumer electronics and the easing of tight supply and demand, it is expected that some foundry prices will decline.

In terms of supply and demand, take 8-inch wafers as an example. From the demand side, the global demand for semiconductor chips is about 6 million pieces per month. This mainly comes from driver chips, power management chips, industrial control chips, etc. From the supply side, the current global supply of semiconductor chips is about 6.2 million pieces per month, and the overall supply and demand situation is improving. This is mainly due to the decline in demand for consumer electronics products, which has significantly eased the tight supply and demand situation for semiconductor chips.

In terms of price, it is expected that the price performance of foundries in 22Q3 will be different between China Mainland foundries and foreign foundries, advanced processes and non-advanced processes.

Overall, as demand for consumer electronics weakens, Sigmaintell forecasts that some foundry prices will decline. Take the foundry price of driver chips as an example. The China Mainland foundry price is expected to drop steadily in Q3 and decline in Q4. This price decline will continue into the first half of next year. For foreign foundries such as TSMC and UMC, the price decline will be significantly lower than that of China Mainland foundries.

6.The transfer of demand from the automotive industry and the continuous upgrading of the process are the keys to improving the anti-risk capability of foundries.

6.The transfer of demand from the automotive industry and the continuous upgrading of the process are the keys to improving the anti-risk capability of foundries.

Sigmaintell suggested that the first step should be to actively move to non-consumer electronics. Specifically, it is transferred to non-consumer electronic product applications such as automobiles and industrial servers. Secondly, it should be transferred to the advanced process. According to the current capacity rhythm of the entire wafer, 28nm is gradually strong, and more and more products are produced based on 28nm such as ISP for car cameras, DDIC for OLED, WiFi modules, etc. In addition, consumer electronics products are also being upgraded. It is shifting from 8-inch capacity to 12-inch capacity to enhance the competitiveness of foundry products.

中文:

全球半导体芯片行业的六个趋势

1、半导体芯片行业逐步退热降温,行业逐步回归理性。

众所周知,半导体芯片产业自2021年开始一直处于缺货状态,价格不断上涨,整机厂商面临高成本压力,半导体从业者获得丰厚利润回报,但进入2022年以来,上述市场局面开始发生反转,供需趋势改变,市场拐点来临。

整体而言,半导体芯片行业在2021年被推高热度后逐步退热降温,群智咨询(Sigmaintell)认为,半导体芯片行业发展开始逐步回归理性。

2、半导体芯片产业拥有更强的抗风险、抗周期能力。

纵观半导体芯片产业的发展,其与显示产业的发展存在显著差异。群智咨询(Sigmaintell)数据预测,2022年全球显示行业营收预计将同比下滑约20%,2023年预计将迎来同比约5%增长回升。同时,根据美国半导体协会(SIA)的统计数据,2022年半导体芯片市场营收预计将同比增长约16.3%,2023年同比增长5%, 与显示产业发展形成鲜明对比。

为什么半导体芯片产业的市场驱动逻辑与显示产业存在如此明显的差异呢?群智咨询(Sigmaintell)分析认为,这主要受到两大因素的影响;一是受到签订长约(LTA)等因素的影响,尽管下游需求疲软,但上游半导体厂商的市场反应仍然偏滞后;其次,半导体芯片与新型显示两大产业的覆盖面有所差异,即:芯片在各个领域的覆盖及渗透率要强于显示产业。相比显示产业,半导体芯片产业拥有更强的抗风险、抗周期能力。

3、预计2023-2025年,全球晶圆厂营收增速将步入下行通道。

就周期性而言,半导体芯片行业约2-3年一个周期。根据群智咨询(Sigmaintell)的统计数据,2020-2022年全球Top 10晶圆厂的营收平均维持每年约20%增长幅度,并且在2021年达到高峰;预计2023-2025年,随着部分晶圆厂新产能的逐步释放,全球晶圆厂营收增速将步入下行通道。

4、制程升级和本土化配套成为晶圆厂发展的主要两大方向。

群智咨询(Sigmaintell)通过分析各家晶圆厂营收数据发现,制程升级和本土化配套成为晶圆厂发展的主要两大方向。

先进制程以台积电为代表。近年来,台积电营收处于突飞猛进阶段,表现出很强的抗周期能力,主要得益于其先进制程在全球范围内都具有很强的竞争力。因此,对于台积电而言,在比较动荡的外部环境下,仍然能维持营收能力,抗风险更强,因此研发及拓展先进制程成为晶圆厂长期的扩产竞争策略。

与此同时,随着地缘政策的不稳定性,包括美国的《芯片法案》的签订,自给化生产成为另外一条晶圆厂发展的策略,以中芯国际、华虹(华力)、合肥晶合、长江存储及长鑫为代表的芯片厂商顺应自给化的趋势,势必将继续保持较快增长。

5、因消费电子需求走弱,供需紧局面缓解, 预计部分晶圆代工价格将下行。

供需方面,以8寸晶圆为例,从需求端来看,全球半导体芯片的需求约每月600万片,这其中主要是来自驱动芯片,电源管理芯片、工业控制芯片等。从供应端来看,目前全球半导体芯片供应约每月 620万片,整体供需情况正在好转。这主要是因为消费电子产品需求下降,使得半导体芯片供需紧张局面明显缓解。

价格方面,预计2022年三季度的晶圆代工的价格,国产和外资晶圆厂、先进和非先进制程将出现不同表现。

整体而言,随着消费电子的需求走弱,群智咨询(Sigmaintell)预计部分晶圆代工价格将下行。具体来看,以驱动芯片代工价格为例,国产晶圆代工价格预计第三季度稳中有降,第四季度下滑,这一价格下滑将延续到明年上半年。外资厂商如台积电、联电,其价格下滑幅度将明显低于国内晶圆厂。

6、汽车工业类需求转移及制程持续升级是晶圆厂提升抗风险能力的关键。

群智咨询(Sigmaintell)建议,首先应积极向非消费电子转移,即向汽车、工业服务器等非消费电子产品应用转移,其次应往先进制程转移。根据目前整个晶圆产能的支持节奏来看,围绕28nm的支持节奏逐渐增强,产出的产品越来越多,如车载摄像头的ISP、OLED用的DDIC、WiFi 模块等等,都是围绕28nm制成的产能。此外,消费类电子产品也在升级中,正从8英寸产能往12英寸的产能转移,以提升晶圆代工产品竞争力。