Entering 22Q4, the end demand for consumer electronics still has no recovery momentum, and the price of display driver chips (DDICs) continues to decline. At the same time, the pressure of order cuts has been fully transmitted from downstream to the foundry OEM. Sigmaintell believes that the supply and demand relationship of DDICs has reversed. The industry needs a long inventory adjustment cycle to adapt to the rapid decline in demand. The cold winter in the DDIC market may continue until the end of 2023.

Demand side: end demand is weak, and destocking is the main tune

Since the beginning of 2022, affected by factors such as the epidemic and geopolitics, the global economic growth rate has slowed. The International Monetary Fund once again lowered its global economic growth forecast. The October report forecasts the global economy to grow by 3.2% in 2022 and 2.7% in 2023. Compared with the forecast in January, the forecast has been lowered by 1.2 and 1.1 %, respectively.

Due to the current overdraft of demand, followed by low consumer confidence, end demand for consumer electronics became weak, and inventory levels of end brands were also high. Downstream makers had to cut orders to digest inventory levels. Considering the long-term contract and partnership with the foundry, fabless companies‘ action of order-cuts was late. However, as consumer electronics and the overall semiconductor market have turned into a downward cycle, fabless was also facing inventory pressure and has begun to adjust its price strategy and wafer volume. According to Sigmaintell’s data, in 2022, the demand for DDICs for TVs, monitors, PCs, and smartphones will all show a YoY decline of more than 10%. As the set, panel, and chip makers are all destocking. In terms of end inventory, it is expected that after entering the traditional peak season of the end in 22Q4, the end inventory of consumer electronics will gradually decrease.

Despite the gradual decline in inventory levels, end-brand demand has not recovered enough in the short term. According to Sigmaintell’s research data, the global wafer demand for DDICs in 2022 will be 252K/month, a significant decline from 286K/month in 2021. In 2022, the supply-demand ratio of the global DDIC market will be 11.6%, compared with -0.6% in 2021, and the supply-demand relationship has changed from a shortage of supply to a situation of oversupply. Sigmaintell forecasts that demand will rebound and the supply-demand ratio will ease slightly in 2023. However, the supply and demand relationship tends to balance will be after 23Q3.

Supply side: foundry utilization rate declines, OEM prices loosen

Driven by the shortage of chips brought about by the epidemic in 2021, the foundry industry has launched a new round of production expansion. From 2022 to 2024, the main process capacity expansion will be 28/40nm. According to Sigmaintell’s data, by the end of 2024, the global 28/40nm wafer capacity will increase by about 40%. Due to the continuous growth of new capacity and the time required for production line adjustment affected by customer order cuts, the capacity utilization rate of the mature process of foundries has gradually loosened.

According to Sigmaintell’s research data, since 22Q2, the capacity utilization rate of foundries has begun to decline due to the impact of order cuts by downstream customers. Due to the relatively single product structure, 8-inch foundries are more affected than 12-inch foundries. World Advanced (VIS) and PSMC's 22Q3 capacity utilization rate dropped to about 90%, and there is expected to be a similar decline in 22Q4. Hefei Nexchip (Nexchip) has a relatively high proportion of DDICs in its product structure, which led the capacity utilization rate to fall to about 75% in 22Q3, and may fall below 70% in 22Q4. UMC also gave a conservative forecast of 90% capacity utilization in 22Q5. In contrast, TSMC is less affected due to the competitive advantages of advanced processes and the diversification of product structures.

There are currently two main options for foundries to maintain healthy capacity utilization. One is to cut prices (or offer discounts equivalent to price cuts) to keep customer orders. The other is to transfer capacity to other applications with relatively strong demand, such as industrial chips and automotive chips.

Fabless: Generally declines in profit and seeking new growth points

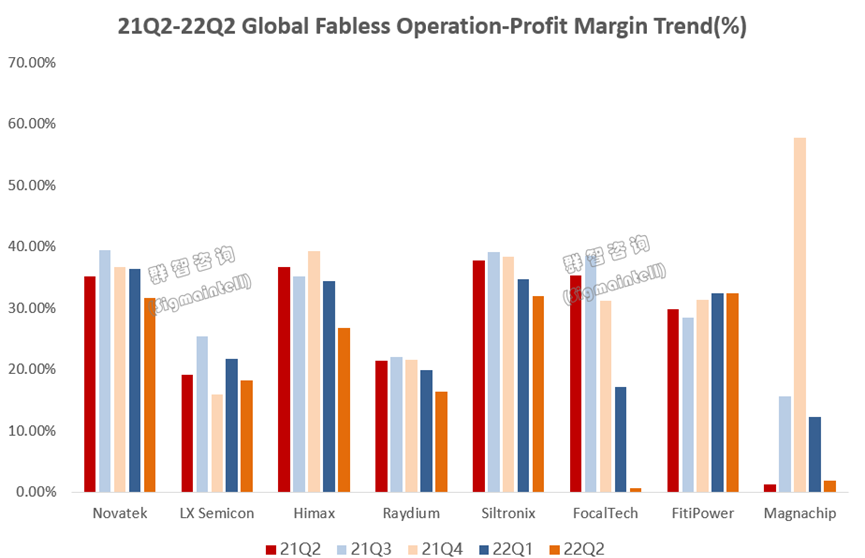

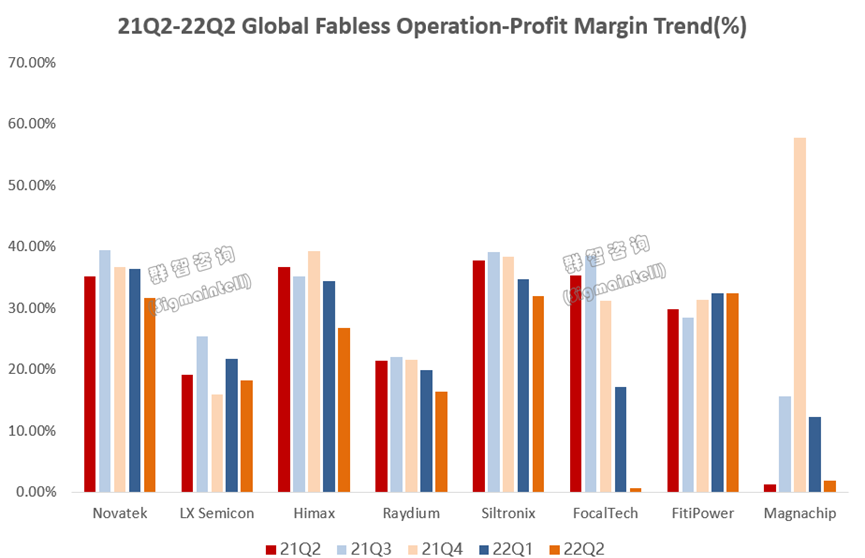

In the context of a cold-winter market, Fabless began to experience hard times. According to Sigmaintell’s data, in 22H1, the operating profit margin of Fabless generally declined. The response strategies still focus on promoting technology upgrades and application expansion, such as accelerating the penetration of TDDI into automotive applications.

Novatek's performance in the second and third quarters of 2022 showed a significant decline. In 22Q2, its revenue was TWD 31.461 billion, down 13.8% from the previous quarter and its revenue in 22Q3 was only TWD 19.564 billion, a decrease of 37.8% from Q2. Profit margins also decreased to 21.7%. Despite the current sluggish market, Novatek remains confident in the mid-to-long-term market. In 2023, Novatek will switch OLED DDI from the 40nm process to the more cost-effective 28nm process, increasing the gross profit margin by increasing the added value of products.

Himax’s revenue in 22Q2 was USD 3.126 billion, down 24.2% from the previous quarter. Himax’s inventory level is still rising and will reach the highest level of the year in 22Q3. However, the expected demand for automotive display and tablet chips may recover in Q4, helping revenue recover again.

Raydium's revenue in 22Q2 was TWD 7.024 billion, down 8.8% from the previous quarter. According to the market assessment, it will take at least two to three quarters to reduce inventory levels. Raydium's performance forecast for 22H2 is not optimistic and is expected to continue declining.

Due to the high inventory pressure, Focaltech's performance in 22Q2 considerably declined, especially the operating profit margin, which is only 0.7%. However, Focaltech said it is currently actively deploying automotive TDDI products and has optimistic expectations for revenue recovery in 22H2.

Trend Outlook: Display driver chip (DDIC) prices will fall to the level in early 2021, and foundries should actively control production

Trend Outlook: Display driver chip (DDIC) prices will fall to the level in early 2021, and foundries should actively control production

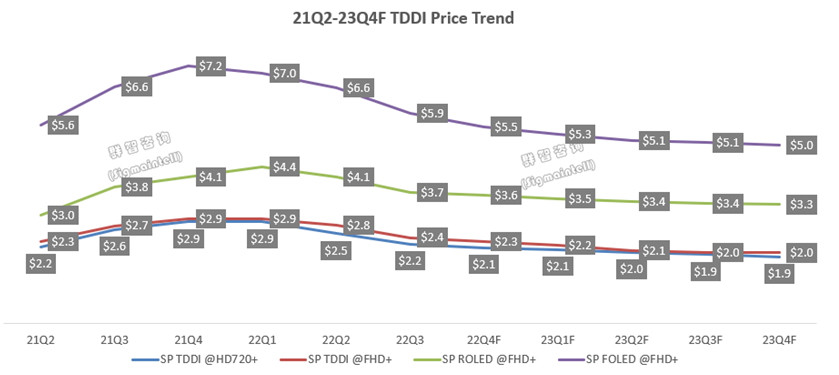

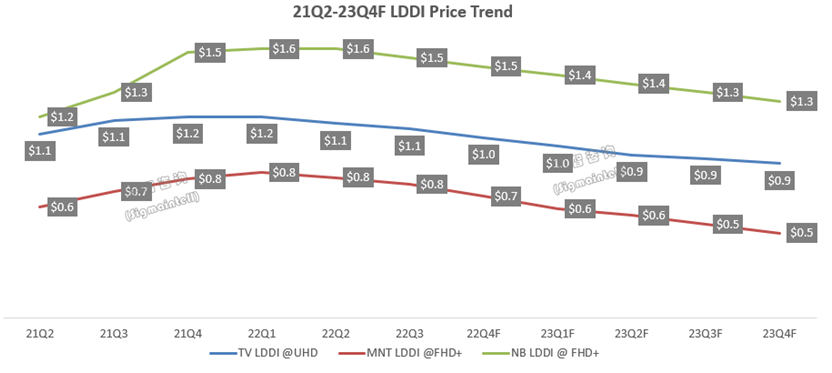

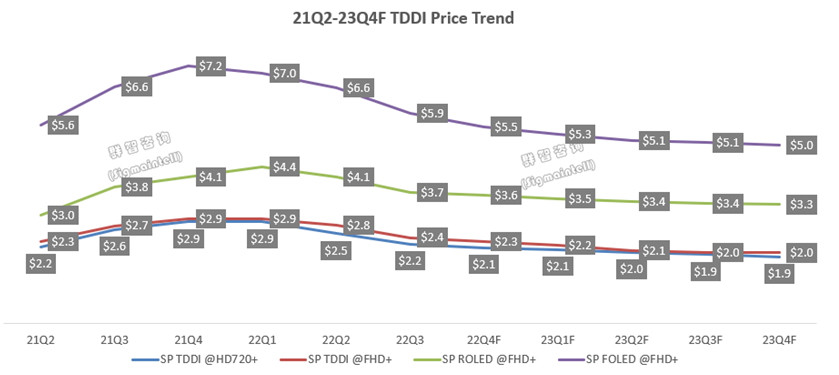

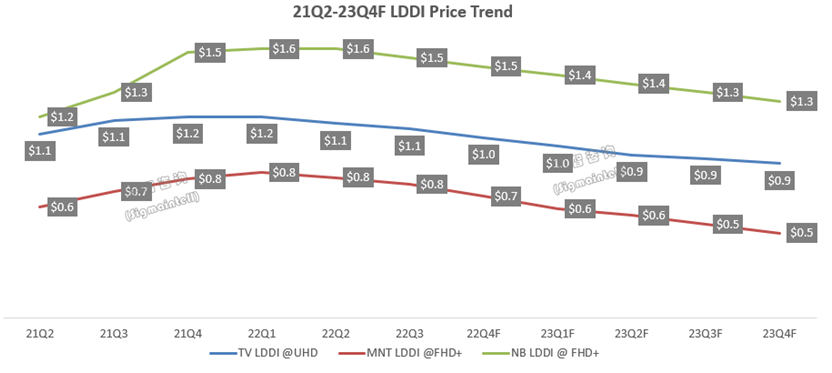

Under the pressure of destocking in the overall market, the price of DDICs fell significantly in 22H1. According to Sigmaintell's analysis and forecast, the industry inventory level will return to normal in 23H2 at the earliest. However, due to the lack of a short-term boost in demand, the price of DDICs will remain on the decline until the end of 2023. Sigmaintell suggests that foundries should focus on reducing production and controlling capacity, supplemented by price cuts, to narrow the range of price declines.

Sigmaintell forecasts that by the end of 2023, the price of DDICs will fall to the level of early 2021. As the relationship between supply and demand tends to balance, the trend of DDIC prices will gradually return to the traditional off-peak season cycle.

In summary, in the short term, the DDIC market will focus on destocking, and prices will continue to decline. The decline depends on the rhythm of the foundries' production control. In the long term, assuming macro factors such as epidemic lockdown and geopolitical sanctions will no longer escalate, end demand will gradually return to normal. But the global consumer electronics market in the "post-epidemic era" will still take time to recover to regular demand. Alleviating the oversupply problem in the next few years will require foundries and fabless to upgrade products and seek potential application markets.

中文部分:

进入库存调整期,显示驱动芯片(DDIC)供应过剩,晶圆厂稼动率下修

进入2022年第四季度,消费电子终端的需求仍无回升势头,显示驱动芯片(DDIC)价格持续走低。同时订单减少的压力已由下游全面传导至晶圆代工行业。群智咨询(Sigmaintell)认为,显示驱动芯片供需关系已经出现反转,业界需要相当长的库存调整周期来适应需求的快速减退,显示驱动芯片市场寒潮可能延续至2023年底。

需求端:终端需求疲软,库存去化为主基调

2022年初以来,受到新冠疫情和地缘政治等因素影响,全球经济增长速度持续放缓,国际货币基金组织(IMF)再下调全球经济增长预期,IMF的10月份世界经济展望报告预计2022年全球经济将增长3.2%、2023年全球经济将增长2.7%。相比1月份已分别下调1.2和1.1个百分点。

需求透支叠加消费者信心低下,当前消费电子终端需求疲软,终端品牌库存水平高企,下游厂商纷纷砍单以消化库存水平。Fabless厂商出于与晶圆代工厂的长约及合作关系考虑,订单下修动作启动较晚,但随着消费电子以至整体半导体市场转入下行周期,Fabless也面临库存压力,开始调整价格策略和晶圆投片量。根据群智咨询(Sigmaintell)数据,2022年全年,电视、显示器、笔电、智能手机应用的显示驱动芯片需求量均将呈现超过10%的同比下跌。随着整机、面板、芯片厂商均努力消耗库存,终端库存预计进入2022年四季度终端传统旺季后,消费电子各品类终端库存逐步减少。

尽管库存水平在逐步下降,但终端品牌需求在短期内复苏力度不足。群智咨询(Sigmaintell)调研数据显示,2022年全球显示驱动芯片每月晶圆需求量为252K/月,相比2021年的286K/月有明显下滑。2022年全球显示驱动芯片市场供需比预计为11.6%,相比2021年的-0.6%,供需关系由供不应求转变为供大于求。预计2023年需求量将有一定回升,供需比将有微幅缓解,但预计供需关系趋于平衡的时间点在2023年三季度之后。

供应端:晶圆厂稼动率下滑,代工价格松动

受2021年新冠疫情带来的缺芯风潮驱动,晶圆代工行业启动了新一轮扩产。2022年~2024年新增主力制程为28/40nm,根据群智咨询(Sigmaintell)数据,到2024年底,全球28/40nm晶圆产能将提升约40%。由于新增产能持续开出,而客户砍单后产线调整转向其他应用需要时间,晶圆代工厂成熟制程产能利用率陆续出现松动。

根据群智咨询(Sigmaintell)调研数据,自2022年Q2起,受到下游客户砍单影响,晶圆代工厂产能利用率开始出现下滑。由于产品结构相对单一,8英寸晶圆厂相比12英寸晶圆厂受影响更大。世界先进(VIS)、力积电(PSMC)22Q3产能利用率下降至90%左右,预计2022年四季度仍将有同等幅度下滑;合肥晶合(Nexchip)由于显示驱动芯片在产品结构中比重较大,2022年三季度产能利用率下滑至约75%,预计2022年四季度可能跌破70%。联电(UMC)也对2022年四季度的产能利用率给出了90%的保守预测。相比之下,台积电(TSMC)则由于先进制程的竞争优势以及产品结构的多样化,受到影响较小。

晶圆厂目前主要采取两种方案来维持产能利用率健康,一是降价(或提供等同于降价优惠)以维持客户订单;二是将产能转移到其他需求相对旺盛的应用,例如工控芯片和汽车芯片。

Fabless:业绩普遍下滑,厂商各自寻求新增长点

在市场降温的大环境下,Fabless厂商开始经历困难时期。群智咨询(Sigmaintell)统计数据显示,2022年上半年,Fabless厂商营业利润率普遍下滑。各家厂商的应对策略仍以推动技术升级和应用拓展为主,例如:加速TDDI向车载等应用方向渗透。

联咏(Novatek)2022年二季度和三季度业绩出现明显下滑,2022年三季度营收314.61亿新台币,环比下降13.8%,而22Q3营收仅195.64亿新台币,环比降幅达到37.8%,营业利润率也下滑至21.7%。尽管目前市场疲软,联咏仍对中长期市场抱有信心。在2023年联咏将把OLED DDI由40nm制程转向性价比更高的28nm制程,通过提高产品附加价值来提升毛利率。

奇景(Himax)2022年二季度营收为31.26亿美元,环比下降24.2%。奇景的库存水平仍在上涨,预计22Q3将达到全年最高水平。但车载显示芯片和平板电脑芯片的预期需求在Q4可能恢复,有助于营收重新回升。

瑞鼎(Raydium)2022年二季度营收70.24亿新台币,环比下降8.8%。根据法说会评估,需要至少两到三个季度来降低库存水平。对2022年下半年的业绩,瑞鼎的预测并不乐观,预计仍将持续下滑。

敦泰(Focaltech)由于库存压力较大,2022年二季度业绩大幅度降低,特别是营业利润率仅0.7%。但敦泰表示目前正在积极布局车载TDDI产品,并对2022年下半年营收恢复有较为乐观的预期。

趋势展望: 显示驱动芯片(DDIC)价格将跌至2021年初水平,晶圆厂应积极控产

在整体市场库存去化压力之下,显示驱动芯片价格在2022年上半年出现较大降幅。根据群智咨询(Sigmaintell)分析预测,行业库存水平最快将于2023年下半年恢复正常,但由于需求短期缺乏提振动力,显示驱动芯片价格至2023年底前仍将保持下探,建议未来晶圆代工厂应以减产控量为主,降价为辅,推动价格降幅收窄。

群智咨询(Sigmaintell)预测,至2023年底,显示驱动芯片价格预计将降至2021年初水平。随着供需关系趋于平衡,显示驱动芯片价格变化趋势将逐步回归传统淡旺季周期。

综上,短期来看, 显示驱动芯片市场将以库存去化为主基调,价格将保持下行,下行幅度取决于晶圆代工厂的控产节奏。长期来看,在宏观因素如:疫情管控、地缘政治的干扰不再升级的前提下,终端需求将逐步回归正常,但处于“后疫情期”的全球消费电子市场仍需要一定时间才能重新回归正常需求水平。而未来几年内的供应过剩难题,需要晶圆代工和芯片设计厂商进行产品升级和寻求潜力应用市场来缓解。