核心观点:

预计2023年全球显示驱动芯片需求约80亿颗,同比微增2.7%

库存调整将持续至下半年,Fabless盈利能力减弱,晶圆厂价格策略分化

受成本因素驱动,Ramless方案倍受终端厂商关注

TDDI价格触底回升,OLED DDIC价格有望在23年二季度趋稳

预计2023年全球显示驱动芯片需求约80亿颗,同比微增2.7%

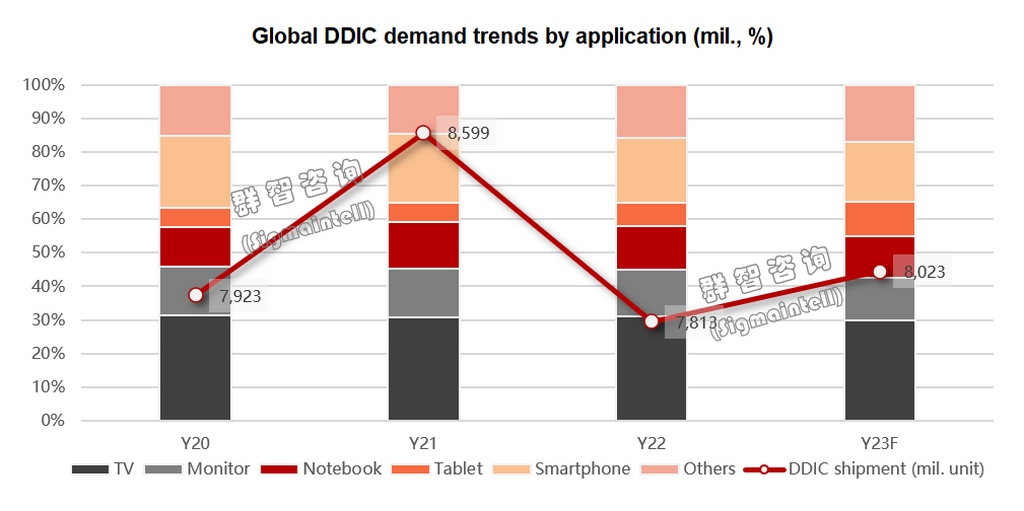

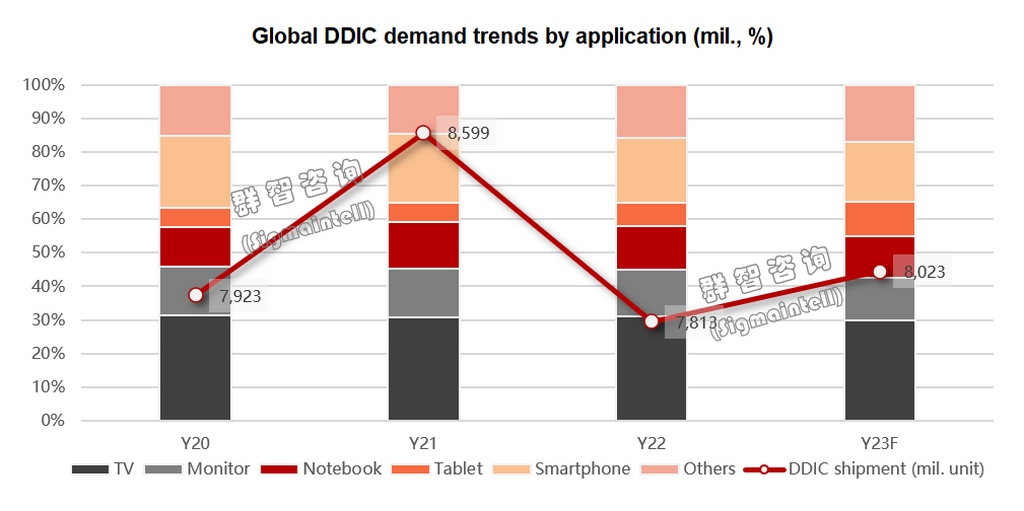

在2022年全球经济增长动力不足、地缘政治事件频发、新冠疫情反复等诸多因素的影响下,终端市场需求持续疲软,智能手机、PC等消费电子应用品牌和器件库存相继走高,显示驱动芯片(Display Driver IC, DDIC)也受到影响。根据群智咨询(Sigmaintell)数据,2022年全球显示驱动芯片需求约为78.1亿颗,同比下降约9.1%,其中以电视、笔电、显示器等为主的大尺寸驱动芯片需求约占60%,同比基本持平。进入2023年,除了新能源汽车等创新赛道应用的需求呈现持续增长外,传统主流终端需求仍未明显起色,预计2023年全球驱动芯片的需求规模约为80.2亿颗,同比微增约2.7%。

整体供需关系逐步改善,“季节性、技术性”等结构性缺货风险仍然存在

整体供需关系逐步改善,“季节性、技术性”等结构性缺货风险仍然存在

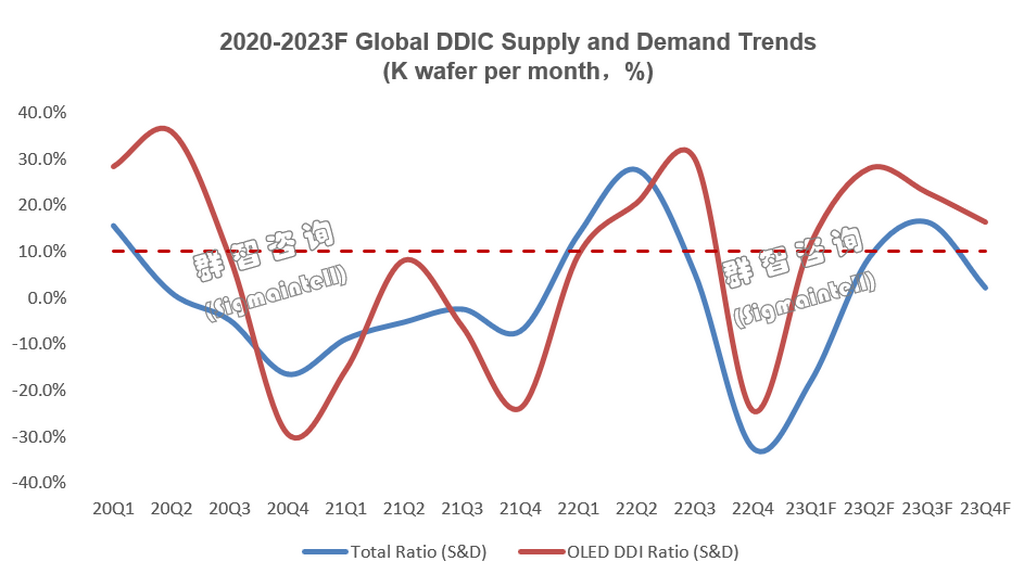

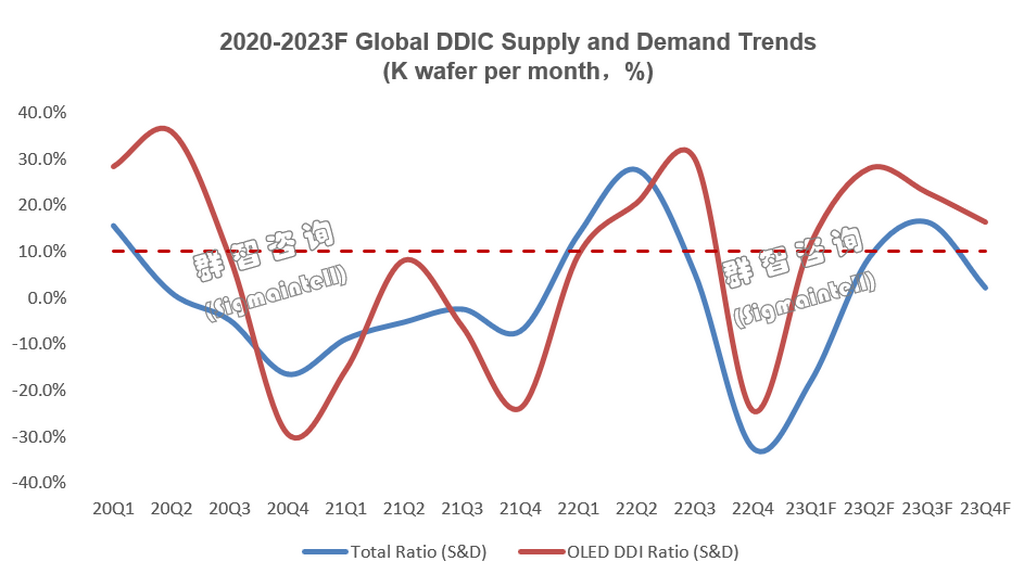

上游供应方面,由于2020年下半年开始的缺芯潮带动的投资扩产热潮,晶圆厂新增产能将在近几年内持续释放。2021-2024年,全球纯晶圆代工(不含IDM)产能年复合增长率约9.6%。与此同时,叠加下游需求并未明显转好的大背景下,整体供应充裕的产业特点将持续存在。从显示驱动芯片的高压制程供应来看,随着2022年产业零组件库存促销力度的加大,行业整体库存逐步下降,市场需求预期下半年逐步好转,驱动芯片的供需关系将得到明显改善。考虑结构性供需错配在半导体市场的常态存在,2023年全球驱动芯片的整体供需逐步改善,“季节性、技术性”等结构性缺货风险仍然存在。群智咨询(Sigmaintell)数据显示,2023年全球显示驱动芯片的晶圆供应约270K片/月,整体行业供需比约为3.5%,供需状况较2022年有明显好转。同时OLED面板在不断往手机及笔电等中尺寸产品渗透,需求逐步走高,由于28/40nm制程新增产能较多,对应的OLED DDIC供应相对充足。

零组件库存逐步回归正常水位,晶圆厂价格策略分化

零组件库存逐步回归正常水位,晶圆厂价格策略分化

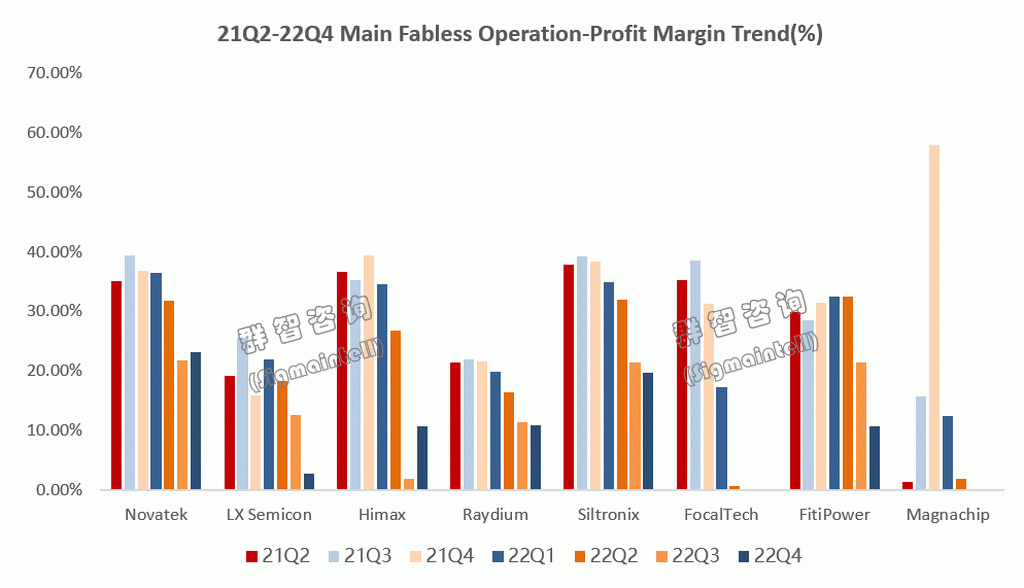

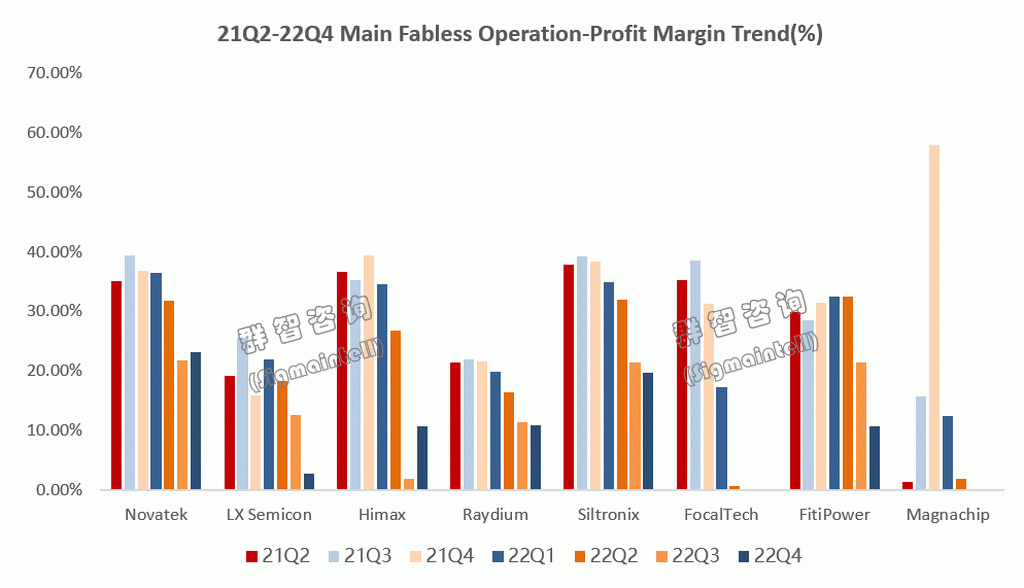

经过2022年下半年行业整体的控产动作,目前显示驱动行业库存相比22下半年已有一定改善。目前中国台湾地区及海外主要设计公司库存水位约4-5个月,中国大陆设计公司约4-6个月,预计库存调整至安全水位仍将持续1-2个月,预计2023年二季度末零组件库存有望回归健康水平。尽管有设计公司如联咏(Novatek)在近期法说会等场合透露出对2023年全年的乐观展望,但从数据来看,经历行业下行的各Fabless盈利能力均有不同程度减弱。显示相关Fabless的营收利润比已从21Q2的平均27%下降至22Q4的平均9%,且如敦泰(Focaltech)、Magnachip等公司已从22Q3起连续两个季度陷入亏损,经营状况不容乐观。寒冬的持续将使得从业厂商在选择赛道和决定资本支出时更加谨慎,下半年市场能否及时回暖,将一定程度上影响后续芯片设计厂商的竞争格局。

在上述背景下,晶圆厂采取的对应策略不一。由于22Q3起,晶圆厂自身产能利用率也承受下滑压力,如三星、力积电等厂商已明确将降价,以鼓励客户下单,三星将针对成熟制程提供10%左右的降价幅度,其他厂商降价幅度也在8%-12%左右,不过降价策略并未得到更多晶圆厂追随。同时,以晶合为代表的代工厂商则通过主动控产来稳定价格,尤其是对于过剩情况较为严重的80/90nm HV制程,晶合通过进一步下调产能稼动来稳定代工价格。群智咨询(Sigmaintell)预测,2023年上半年,高压制程晶圆代工平均价格将基本持平,部分厂商和制程有局部调涨策略,下半年随着订单需求逐步增加,代工价格以趋稳为主。

受成本因素驱动,Ramless方案倍受终端厂商关注

随着技术不断成熟以及定价下沉策略,OLED DDIC的渗透率在稳定提升,特别是智能手机应用。根据群智咨询(Sigmaintell)数据,预计2023年全球智能手机OLED DDIC占整体OLED驱动芯片出货量约61%,同比呈现微幅下降趋势,中大尺寸OLED 驱动芯片需求加速。在消费降级的终端形势下,小米、联想、传音等品牌厂商正在积极导入Ramless OLED DDIC方案。由于去掉了Display RAM,Ramless OLED DDIC相比常规2-RAM OLED DDIC多了约25%-30%的切片量,因此单片价格上约有1-1.5美元的优势。在Ramless OLED DDIC上,目前联咏、奕力(Ilitek)等厂商使用28nm制程,瑞鼎(Raydium)、云英谷(Viewtrix)等其他厂商则使用40nm制程。尽管Ramless方案相比2-RAM方案,在图像质量、功耗等方面有所不足,但由于成本优势,品牌厂商对其关注度较高。

TDDI价格触底回升,OLED DDIC价格有望在23年二季度趋稳

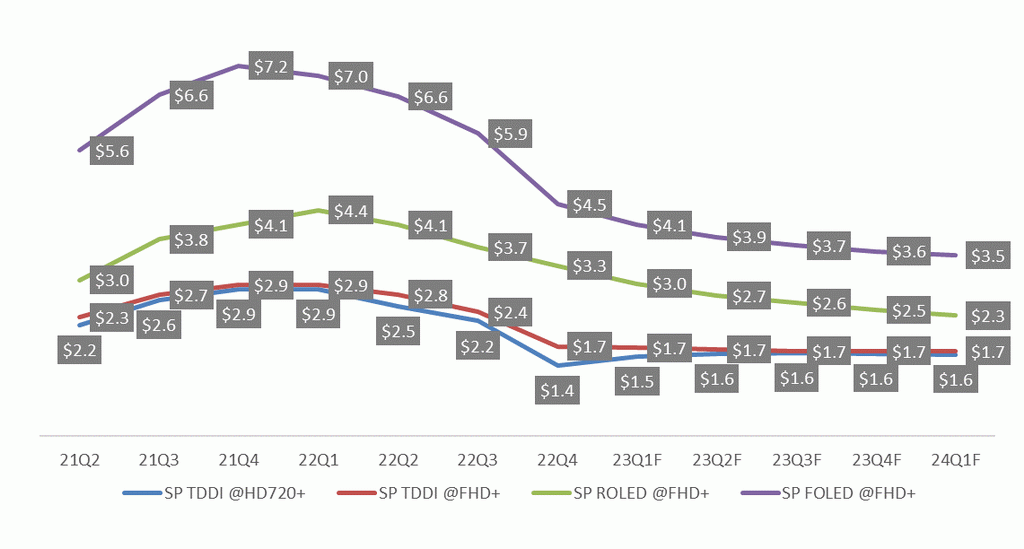

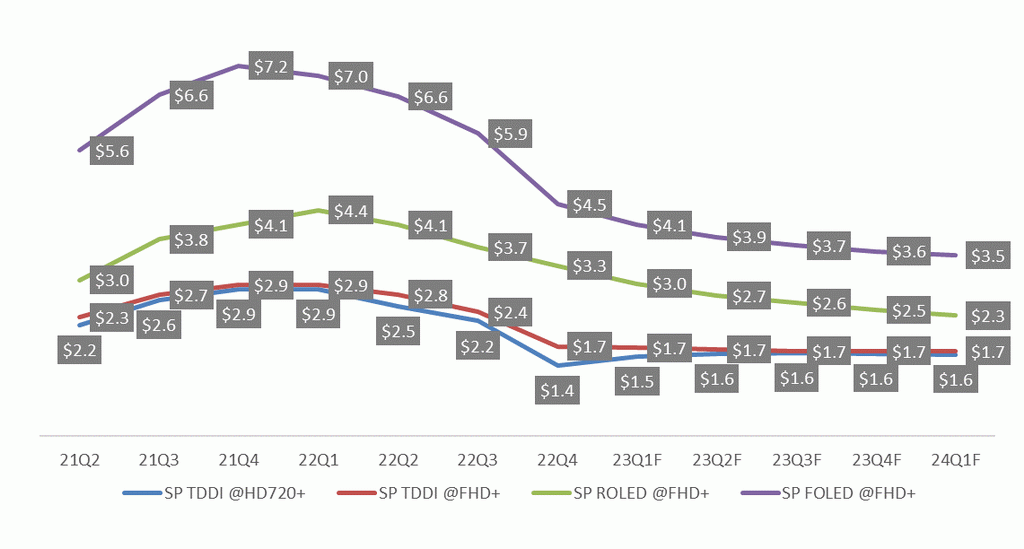

中小尺寸应用方面,对于LCD TDDI来说,一方面,目前LCD TDDI由于价格已经接近成本线,部分华南厂商开始在价格低位拉货补充库存;另一方面,晶圆厂控产力度明显,供需关系逐渐平衡,价格已呈现止涨回升趋势,预计在2023年上半年小幅回升后,下半年晶圆产能供应将随着需求回稳逐渐释放,芯片价格基本保持平稳。对于OLED DDIC来说,由于越来越多手机OLED DDIC转向28nm制程,28nm的产能稼动逐渐走高;但由于国内厂商价格策略较为积极,且Ramless方案也在牵制2-RAM OLED DDIC价格,预计将从2023年二季度起趋于平稳。

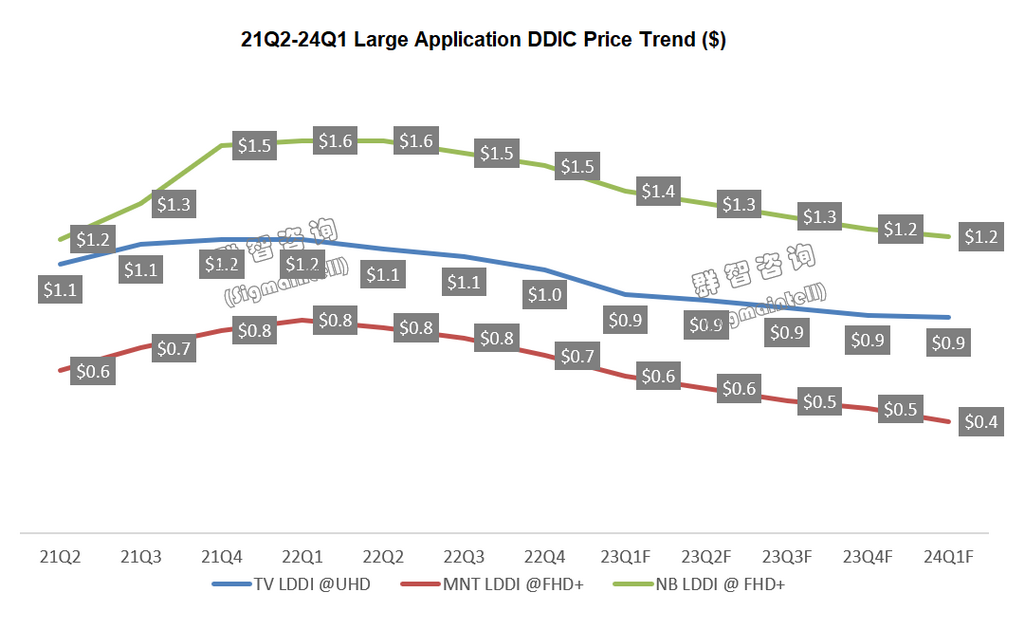

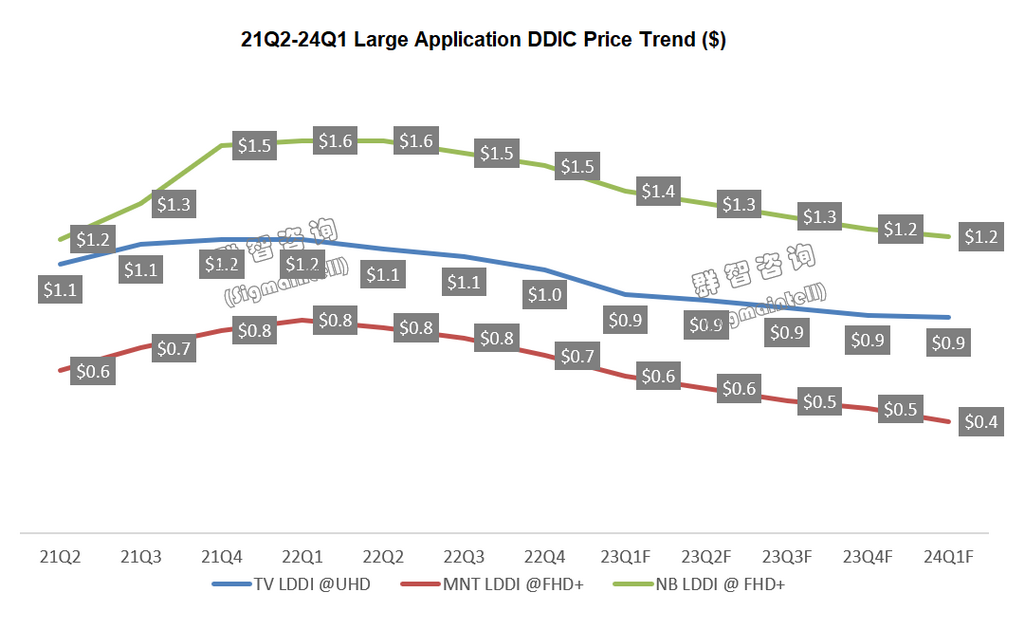

大尺寸方面,尽管TV面板价格回升,但由于大尺寸应用DDIC晶圆供应宽松,且市场竞争依然激烈,大尺寸各应用驱动芯片价格在2023年仍将有小幅度下跌。

展望2023年,在经历了连续三到四个季度的降价、减产、去库存的调整周期之后,显示驱动芯片价格逐步趋向稳定。随着下半年国内市场“618”、北美市场“黑五”等传统旺季到来,终端市场需求将有望恢复,显示驱动厂商一方面需密切注意市场节奏,与晶圆厂协同合作,规划产能应对下半年潜在需求。同时,需要审视未来一段时期品牌厂商对低成本化的需求,规划自身技术路线,从而在不确定的市场周期中提高竞争力。

英文:

DDIC prices have stopped dropping and stabilized, and low cost has become the mainstream competitive strategy during the market recovery period

Core Topics:

It is estimated that the global DDIC demand will be about 8 Bil in 2023, a slight increase of 2.7% YoY

The overall supply and demand relationship is gradually improving, and structural shortage risks such as "seasonal shortage and technical shortage" still exist

Component inventory is gradually returning to normal levels, and foundry pricing strategies are diverging

Driven by cost factors, the Ramless solution has attracted much attention from end makers

TDDI prices bottom out, OLED DDIC prices are expected to stabilize in 23Q2

It is estimated that the global DDIC demand will be about 8 Bil in 2023, a slight increase of 2.7% YoY

Under the influence of many factors, such as insufficient global economic growth momentum in 2022, frequent geopolitical events, and continuous epidemic, the demand in the end market continues to be weak, and the inventories of consumer electronics application brands and devices such as smartphones and PCs are rising one after another. DDICs are also affected. According to Sigmaintell’s data, the global DDIC demand was about 7.81 Bil in 2022, a YoY decrease of about 9.1%, of which the demand for large-size DDIC mainly for TVs, NBs, and monitors accounted for about 60%, which was basically flat YoY. Entering 2023, in addition to the continuous growth of demand for innovative track applications such as NEVs, the demand for traditional mainstream ends has not improved significantly. It is estimated that the global DDIC demand will be about 8.02 Bil in 2023, a slight increase of about 2.7% YoY.

The overall supply and demand relationship is gradually improving, and structural shortage risks such as "seasonal shortage and technical shortage" still exist

In terms of upstream supply, due to the upsurge of capex driven by the wave of chip shortages that began in 20H2, new capacity in the foundry will continue to be released in recent years. From 2021 to 2024, the CAGR of global pure wafer foundry (excluding IDM) capacity is about 9.6%. At the same time, under the background that the superimposed downstream demand has not improved significantly, the industrial characteristics of sufficient overall supply will continue to exist. From the perspective of high-pressure process supply of DDICs, with the intensification of industrial component inventory promotion in 2022, the overall industry inventory gradually declined, and the market expected demand improved in 22H2, and the DDIC supply and demand relationship was significantly improved. Considering the normal existence of structural supply and demand mismatches in the semiconductor market, the overall global DDIC supply and demand will improve in 2023, but structural shortage risks such as "seasonal shortage and technical shortage" still exist. According to Sigmaintell’s data, the global supply of DDIC will be about 270K wafers per month in 2023, and the overall industry supply and demand ratio will be about 3.5%. The supply and demand situation has improved significantly compared to 2022. At the same time, OLED panels continue to penetrate into medium-sized products such as mobile phones and notebooks, and the demand is gradually rising. Due to the large new production capacity of the 28/40nm process, the corresponding supply of OLED DDICs is relatively sufficient.

Component inventory is gradually returning to normal levels, and foundry pricing strategies are diverging

After the industry's overall production control actions in 22H2, the current inventory of the DDIC industry has improved compared to 22H2. At present, the inventory level of major fabless makers in Taiwan and overseas is about 4-5 months, and that of fabless makers in mainland China is about 4-6 months. The inventory will continue to be adjusted to a safe level for 1-2 months. It is estimated that by the end of 23Q2, component inventories are expected to return to healthy levels. However, some fabless makers, such as Novatek have revealed their optimistic outlook for 2023 in recent legal conferences. But judging from the data, the profitability of each fabless that has experienced a downturn in the industry has weakened. It shows that the revenue-to-profit ratio of related fabless has dropped from an average of 27% in 21Q2 to an average of 9% in 22Q4, and fabless makers such as Focaltech and Magnachip have suffered losses for two consecutive quarters since 22Q3, and their operating conditions are not optimistic. The continuation of the cold winter will make makers more cautious in choosing tracks and deciding on Capex. Whether the market can recover in time in 23H2 will affect the competitive landscape of subsequent chip fabless makers to a certain extent.

Against the above background, foundries have adopted different strategies. Since 22Q3, the capacity UT of foundries is also under downward pressure. For example, makers such as Samsung and PSMC have made it clear that they will cut prices to encourage customers to place orders. Samsung will provide a price reduction of about 10% for mature processes. Other makers’ price reduction rate is also around 8%-12%, but the price reduction strategy has not been followed by so many foundries. At the same time, the foundries represented by Nexchip are actively controlling production to stabilize prices, especially for the 80/90nm HV process with a serious surplus, Nexchip will further reduce production capacity to stabilize foundry prices. Sigmaintell predicts that in 23H1, the average price of high-pressure process wafer foundry will be basically flat, and some makers and processes will have a partial increase strategy. In 23H2, with the gradual increase in order demand, foundry prices will gradually stabilize.

Driven by cost factors, the Ramless solution has attracted much attention from end makers

With the continuous maturity of technology and the strategy of sinking pricing, the penetration rate of OLED DDIC is steadily increasing, especially for smartphone applications. According to Sigmaintell’s data, it is estimated that global smartphone OLED DDICs will account for about 61% of the overall OLED DDIC shipments in 2023, showing a slight decline YoY, and the demand for medium and large-sized OLED DDICs will accelerate. Under the end situation of downgraded consumption, brand makers such as Xiaomi, Lenovo, and Transsion are actively introducing Ramless OLED DDIC solutions. Due to the removal of Display RAM, Ramless OLED DDIC has about 25%-30% more slices than conventional 2-RAM OLED DDIC, so the single chip price has an advantage of about USD 1-1.5. For Ramless OLED DDIC, makers such as Novatek and Ilitek currently use a 28nm process, while other makers such as Raydium and Viewtrix use a 40nm process. Although the Ramless solution is inferior to the 2-RAM solution in terms of image quality and power consumption, brand makers pay more attention to it due to its cost advantage.

TDDI prices bottom out, OLED DDIC prices are expected to stabilize in 23Q2

In terms of small and medium-sized applications, for LCD TDDI, on the one hand, as the current price of LCD TDDI is close to the cost line, some South China makers have begun to buy inventory at low prices; On the other hand, the production control of foundries is obvious, the relationship between supply and demand is gradually balanced, and the price has shown a trend of rebounding. It is expected that after a slight rebound in 23H1, the supply of wafer capacity in 23H2 will be gradually released with the stabilization of demand, and chip prices will remain stable. For OLED DDICs, as more and more smartphone OLED DDICs switch to the 28nm process, the UT of 28nm is gradually increasing; however, due to the aggressive pricing strategies of mainland makers, the Ramless solution is also restraining the price of 2-RAM OLED DDICs, it is expected that OLED DDIC price will stabilize from 23Q2.

In terms of large size, although the price of TV panels has rebounded. But due to the loose supply of DDIC wafers for large-size applications and fierce market competition, the prices of DDIC for large-size applications will still drop slightly in 2023.

Looking forward to 2023, after three to four consecutive quarters of adjustment cycles of price cuts, production cuts, and destocking, the price of DDICs gradually stabilized. With the arrival of traditional peak seasons such as "618" in the mainland market and "Black Friday" in the N/A market in 23H2, demand in the end market is expected to recover. On the one hand, DDIC makers need to pay close attention to the market rhythm, cooperate with foundries, and plan production capacity to meet potential demand in 23H2. At the same time, it is also necessary to examine the demand of brand makers for low cost in the coming period and plan their own technical route so as to improve their competitiveness in an uncertain market cycle.