Introduction: "Rebalancing" and "resilience" are the two keywords for the development of the global technology industry in 2023. In 2023, the industry will be in the process of rebalancing. After the supply chain and end market have experienced the severe impact of the epidemic and the profound impact of the macro environment, they are about to usher in a new balance. In this rebalancing process, in addition to efficiency and safety, the challenge for technology companies is to improve their resilience to the environment.

Trend 1: The global economy will be in a "weak growth" cycle from 2023 to 2024

From the perspective of the macro environment, among the changes in the economic growth rates of the world's major economies, the economic growth rates of major European countries are likely to be zero in 2023, while the economic growth rates of other developed countries have also rebounded. Under the background of the changes in China's epidemic policies and the new economic growth goals of modernization proposed by the 20th National Congress of the Communist Party of China, it is expected that the economic growth rate in 2023 will rebound from the bottom in 2022: China's economic growth in 2022 is expected to be about 3%. In 2023, based on the forecasts of many economic organizations, it is expected to be 4%-4.5%. Sigmaintell predicts that China’s economic vitality will fully recover. The recovery of the Chinese economy is expected to show a slow and tortuous trend, reaching the peak of recovery in 2024.

At the same time, Southeast Asian (SEA) countries will show stronger economic growth. Driven by factors such as demographic dividends, manufacturing transfers, and a favorable trade environment, it is expected that the economic growth rate of major SEA countries represented by India and Indonesia, two populous countries, will basically stabilize at more than 5% in the future.

Trend 2: Different economic and demand performances in N/A, Europe, SEA, China, and other regions

Trend 2: Different economic and demand performances in N/A, Europe, SEA, China, and other regions

Against the backdrop of high inflation and weak growth, the economies of various regions of the world performed differently. Sigmaintell predicts that developed and developing countries will show different characteristics, and some developing countries have shown strong resistance to exchange rate fluctuations and inflation. Compared with the characteristics exhibited by the financial crisis in 1998, the exchange rates of emerging countries in this round of global exchange rate fluctuations are relatively stable, while developed economies show weaker exchange rate stability. For example, the depreciation of the currencies of Indonesia, India, and Brazil is significantly milder than that of the euro, the yen, and the Yuan. Therefore, Sigmaintell predicts that despite the background of a weak growth economy, they still have stable or even growing demand, while some developed countries continue to perform weakly.

In addition, we expect that the performance of core economic indicators in N/A and Europe will diverge, and demand in N/A will recover moderately from 23Q2. The performance of some emerging markets will diverge, such as SEA countries, whose core economic indicators are solid, and consumer electronics demand will grow steadily. Regarding China, the government has fully reopened, but due to the current economic problems that cannot be resolved in the short term, the demand will show a U-shaped reversal, not a strong V-shaped reversal, but in the long run, we are optimistic about China economy, because the government will shift the focus of its work to stimulating economic growth and set higher growth targets for the future.

Trend 3: The semiconductor and display supply chain will usher in a "rebalancing" process, and developing resilience is crucial.

There are good news and bad news in the semiconductor and display industry. The good news is that the investment, financing, and incentive policies from the government will continue, but the bad news, obviously, the environment has undergone tremendous changes compared to the past. This change is turbulent and has a more profound fundamental impact. Under the current background of China's pursuit of technological independence and the improvement of technological capabilities, countries also have similar policies corresponding to China. Therefore, Sigmaintell predicts that competition among major powers in the field of science and technology will be a long-term process in the future. The technology industry needs to pay attention to the following two challenges or risks that may arise in the future in response to policy changes in various countries.

First of all, the brand and customer needs, the requirements for products and the technology itself will expand to the requirements for the supply chain. More and more brands will have more concrete requirements on the origin and source of suppliers, and an expanded and more diversified supply chain will appear in the future. This will require us to pay attention to how to adjust the supply chain in different regional markets, including the adjustment of the supply chain management organization.

Second, worrying about the oversupply of semiconductors, the competition of big countries will bring more investment that does not pursue economic goals, which has already happened in the field of display panels. The risk in the semiconductor field is extremely high, and the resulting investment return risk and business operation risk are related.

Sigmaintell believes that for technology companies, they need to remain flexible and cautious in the next few years. On the one hand, they need to balance the relationship between the needs of cooperative customers, and on the other hand, they need to balance the investment pressure from the government. Ultimately, we need to prudently manage cash flow and ROA in this challenging environment. In summary, Sigmaintell believes that technology companies should do three things well: 1. Strengthen the judgment of the future supply and demand environment and device prices; 2. Explore cost control in the context of more diversified supply chain demand; 3. Optimize the dispersion of regional investment risk. This has higher requirements for technology companies than in the past, and companies need to plan ahead in order to cope with this whole new change.

Trend 4: The technology industry cycle is highly correlated with the economic cycle. In 2023, there will be weak growth in the panel or a downturn in the semiconductor. In 2024, "digitalization" and “replacement cycle" will drive the industry to regrow.

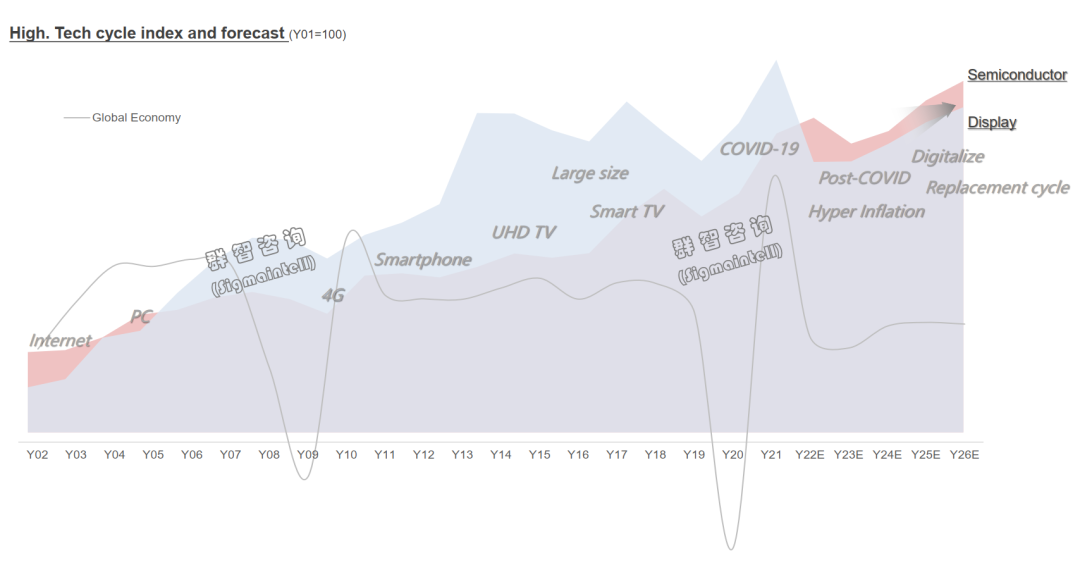

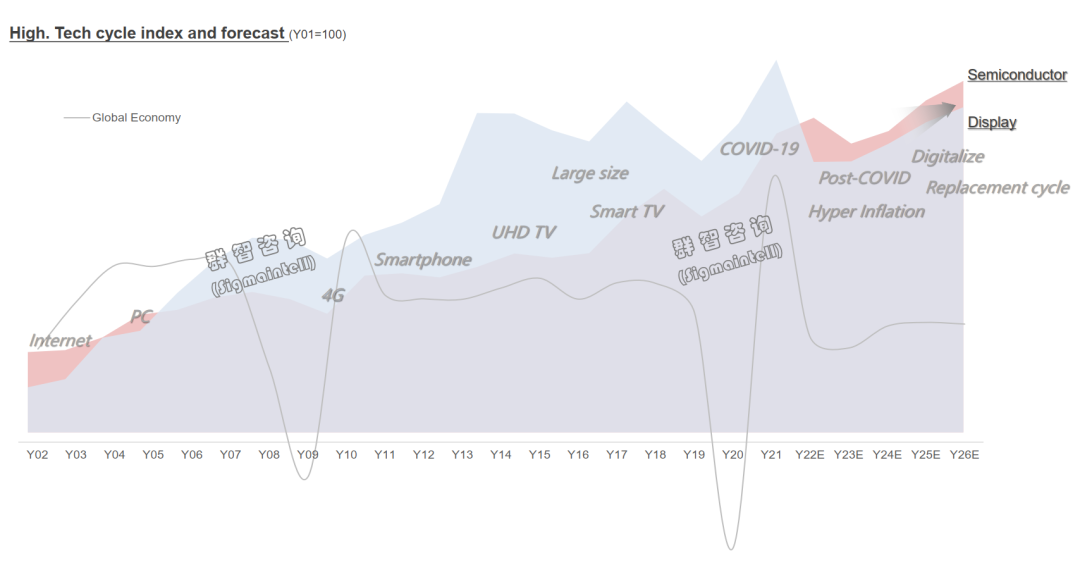

We put an analogy between the economic cycle and the cycle of the technology industry. From a historical perspective, we can find that the cycle curves of semiconductors and display panels are completely correlated with the economic cycle. When the economy goes down, the two industries also go down, and many cycles have illustrated this problem. Therefore, referring to historical experience, Sigmaintell predicts that in the context of a weak cycle, the cycle curve of the panel will be correlated with it, but semiconductors are lagging behind the panel cycle by about 2-3 quarters. Therefore, semiconductors are still in a weak economic cycle in 2023, and panels have a chance to stabilize in 2023 because they reflect the impact of demand changes ahead of semiconductors.

According to the above cycle research, Sigmaintell predicts that the overall output value growth of the technology industry will show a negative trend in 2023, and it is expected to rebound in 2024-2025. First of all, we saw changes in the demand side of panels and semiconductors. In 2002, the popularity of the Internet; then the popularity of PCs; in 2009, the issuance of 4G licenses; Smartphones, smart TVs, and large-scale popularization stages; In 2020, Covid-19 outbroke, and then entered a fluctuating cycle; now we are experiencing what we call the post-epidemic period and hyperinflation changes.

Sigmaintell predicts that, under the condition that the macro unfavorable factors are eliminated, starting from 2024, especially 2025, digitization and the advent of the replacement cycle will become the main driving force for the growth of demand in the technology industry.

Trend 5: Panel makers and semiconductor makers will continue to control the UT. Panel makers need to continue to control UT until 2023, and foundry UT will be reduced to about 75%.

Trend 5: Panel makers and semiconductor makers will continue to control the UT. Panel makers need to continue to control UT until 2023, and foundry UT will be reduced to about 75%.

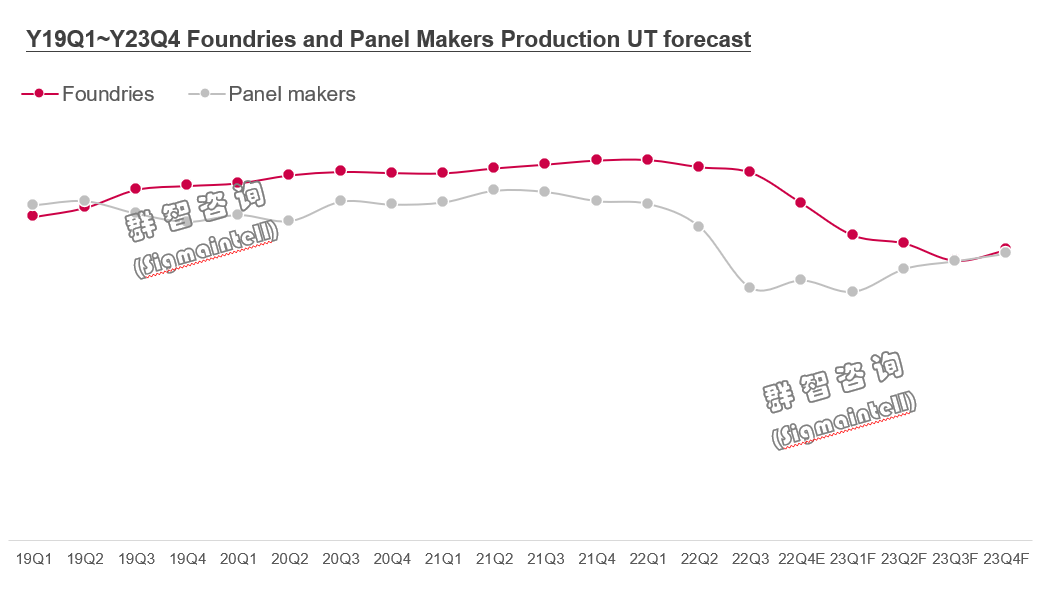

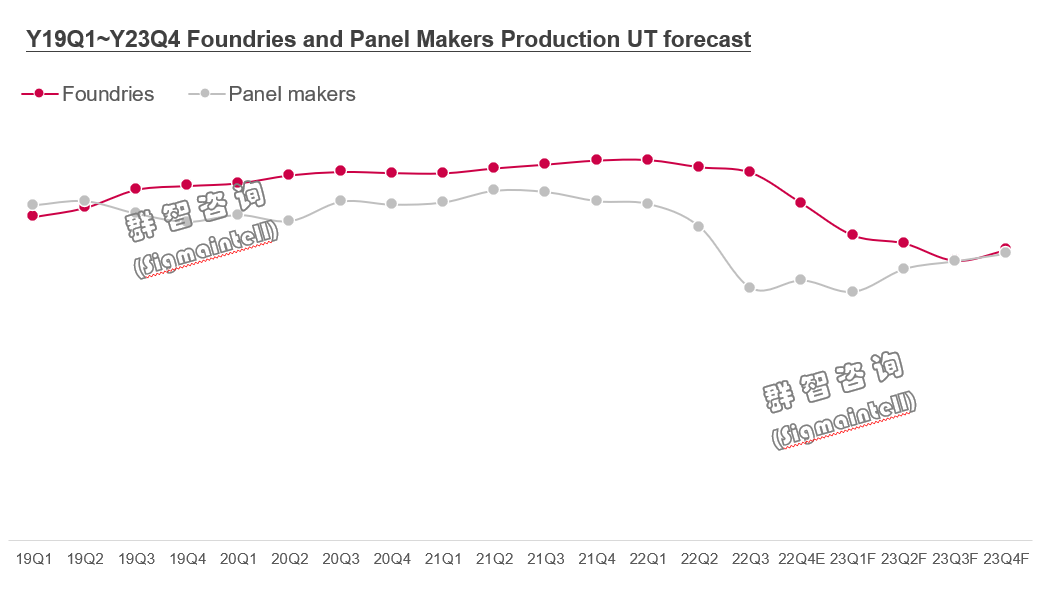

Comparing the panel index and the semiconductor index, based on 2001, the growth rate of the panel index is higher than that of the semiconductor index for a long period of time because in this historical period from 2011 to 2019, the panel index was mainly pulled by TV products. Large-size TVs pulled the panel industry. At the same time, the effect of the semiconductor industry is not so obvious in the same period. However, the current feature of the panel industry is that the panel index and the semiconductor index appear to be changed to a situation that one growth offsets a decrease in the other. In the short term, in the weak cycle in 2023, we predict that both panel makers and semiconductor makers need to control utilization rates.

Based on this, we still estimate and call on technology companies to exercise restraint and control utilization rates. Since 22Q2, Panel makers have gradually revised down until the current utilization rate is less than 70%. Semiconductors will lag behind the panel as a whole by 2-3 quarters. That is to say; we will not see semiconductor makers will start to lower the utilization rate until 22Q4. And we predict that this downward process will continue until 23Q3. Therefore, 23H2 is a stage of stabilizing demand. Sigmaintell predicts that the utilization rate of panels and even semiconductors will pick up slightly, but the overall annual demand needs to be controlled at 80%, which is a relatively reasonable and healthy level.

Trend 6: Radical investment in foundries and oversupply concerns are becoming a reality.

Trend 6: Radical investment in foundries and oversupply concerns are becoming a reality.

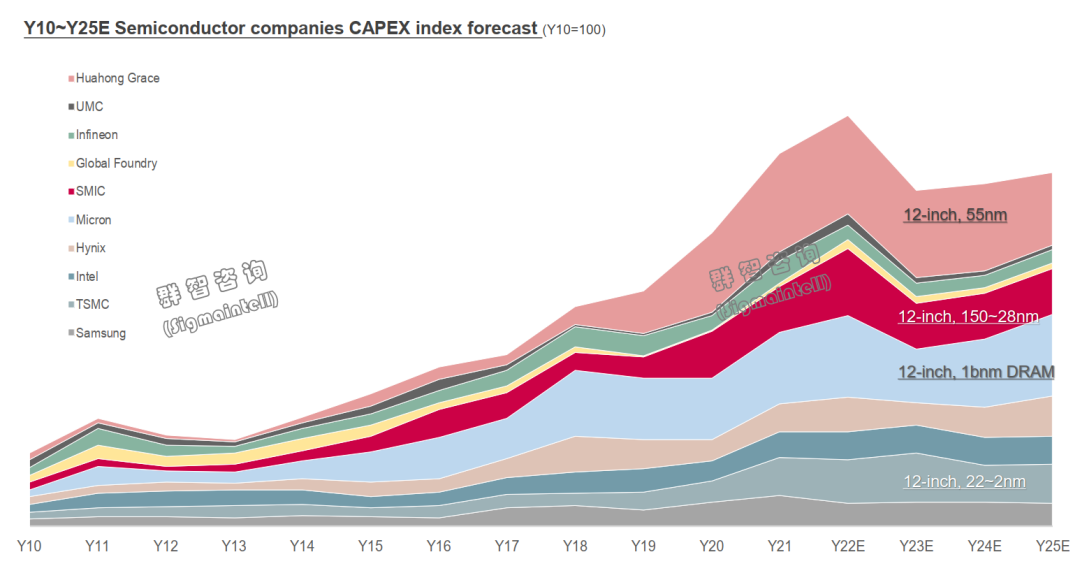

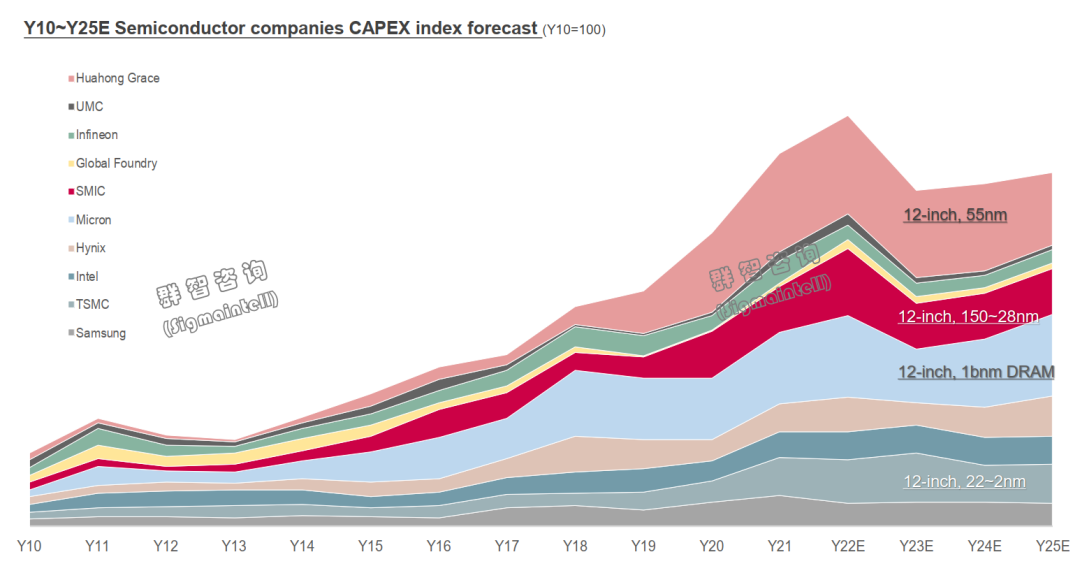

As the true demand in 2023 gradually reveals, we see that some makers have lowered their production capacity, especially those medium-scale makers. However, on the whole, the CAPEX level of foundries is still at a historic high.

TSMC's investment is mainly in advanced process capacity, including investment plans in Taiwan, China, Japan, and the United States. But Micron is mainly in the United States. Similarly, the production capacity of major foundries in mainland China mainly invests in mature processes because behind the localization, the first thing to do is to pursue the localization of mass production capabilities. Therefore, it is imperative to expand the production capacity of mature processes in mainland China.

Although we see that the overall investment is declining from the peak in 2023, the investment index has not shrunk significantly from the historical curve and is still expanding. Therefore, in mature manufacturing processes, we are more worried that overcapacity will last for a long time, which is one of the biggest challenges facing the entire industry.

In terms of investment, panels are relatively in a better position than semiconductors. First of all, the scale of investment in panel production capacity is shrinking. Whether it is a Panel maker in mainland China or other regional makers, everyone is now prudently evaluating a future investment, which has become more rational than in the past few decades.

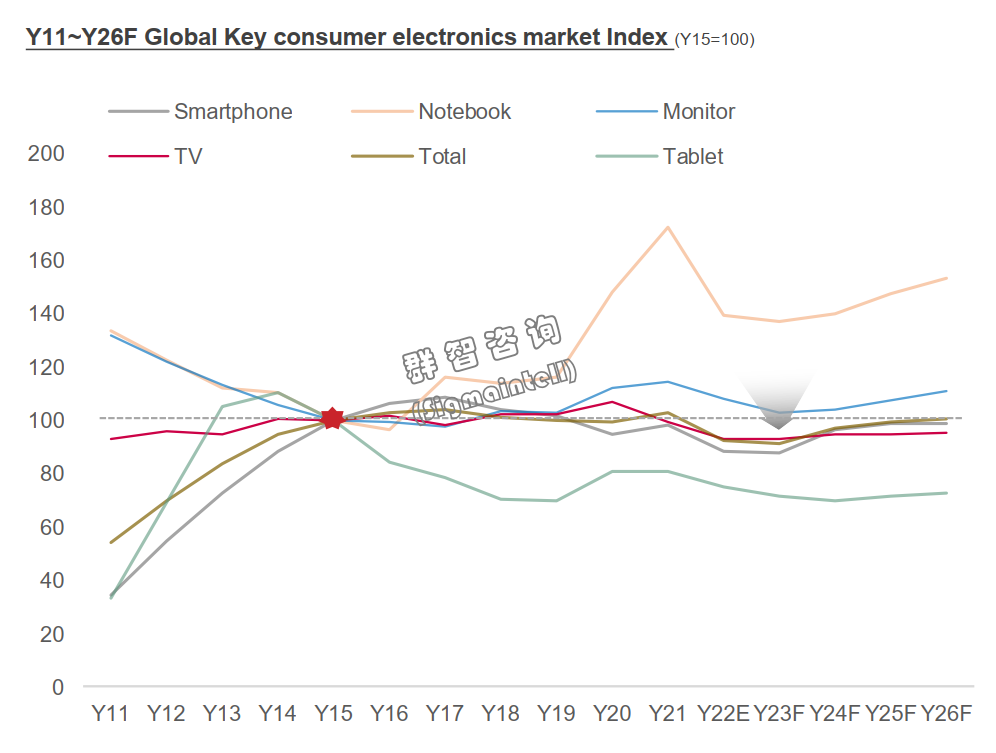

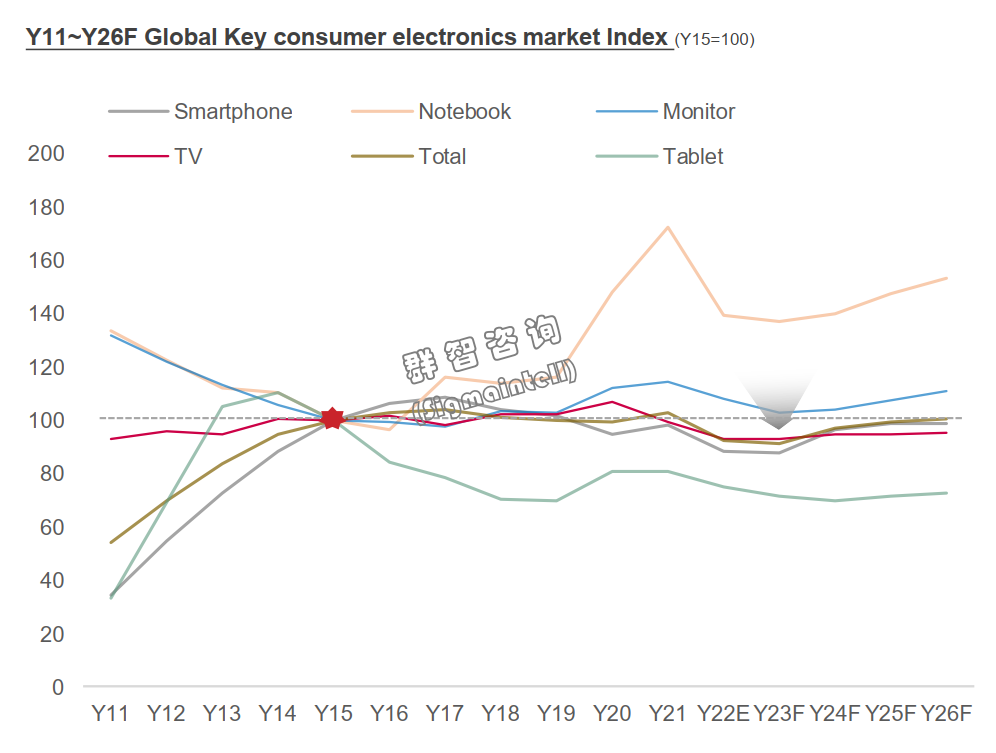

Trend 7: The consumer electronics market is expected to recover moderately from 23H2

As the inventories of consumer electronics brands return to health in 23Q2, Sigmaintell predicts that demand will recover moderately in 223H2. Overall, 2023 will be a relative trough for both the consumer electronics market and the panel market, and the overall market will be weak. However, starting from 2024, driven by the demand for various applications, the demand will gradually rebound. Among them, the automotive market is worth looking forward to in the future, and it will grow into the largest application of a single category in the medium and large size market in 2026.

Looking ahead, Sigmaintell believes that OLED will continue to grow in the long run. First, user acceptance is gradually expanding from mobile phones to TPCs and notebooks, and the future growth will be an overall upward trend. Second, major brands have more positive plans for OLED in their future product line planning. Demand is always the driving force for technological growth, so if the technical characteristics can meet the needs of users and be recognized by users and brand customers, it will become the driving force for the growth of this technology.

Trend 8: Under the environment of "weak growth" and "rebalancing,” flexibility and segmentation competition strategies are equally important.

Sigmaintell believes that the end market is in a rebalancing process, and a new balance will begin in 23Q2 after inventory consumption. In the "weak growth" and "rebalancing" environment, flexibility and segmentation competition strategies are equally important. In this process, returning to the perspective of enterprises as the core, in the process of supply chain and demand rebalancing, customer needs will become more personalized, requiring technology companies to adopt a more flexible and resilient attitude to respond to the needs of customers. In this case, companies can achieve more stable development.

中文:

李亚琴|全球宏观环境及科技产业趋势洞察——“再平衡”和“韧性”是2023年的两大关键词

前言:“再平衡”和“韧性”是2023年全球科技产业发展的两大关键词。2023年产业将是一个再平衡的过程,供应链以及终端市场经历了疫情的重创和宏观环境的深刻影响后,即将迎来再度的平衡。在这个再平衡的过程中,除了效率和安全以外,对科技企业的挑战更多的是提升应对环境的韧性。

趋势一:2023年~2024年全球经济将处于“弱增长”周期

从宏观环境看,全球主要经济体的经济增速变化中,2023年欧洲主要国家的经济增速很可能为零增长,而其他的发达国家的经济增速也有回调。而中国在疫情防控政策的变化以及二十大提出的现代化建设的经济增长目标两大背景下,2023年预期经济的增速会在2022年的谷底的基础上有所反弹:2022年中国经济增速预期约为3%,2023年结合目前众多经济组织的预测来看,预计为4%-4.5%,群智咨询(Sigmaintell)预测,中国的经济活力完全恢复会有滞后期,2023年的中国经济的复苏预计将呈现缓慢曲折态势,2024年达到复苏高峰。

与此同时,东南亚国家会表现出更强的经济增速。人口红利、制造业转移和有利的贸易环境等因素推动下,预计以印度和印尼两个人口大国为代表的东南亚主要国家,经济增速预期未来基本上稳定在5%以上。

趋势二:北美、欧洲、东南亚、中国等区域间经济和需求表现不一

在高通胀和弱增长等的背景下,全球各区域经济表现不一。群智咨询(Sigmaintell)预计,发达国家和发展中国家会展现出不一样的特点,一些发展中国家表现出了较强的抗汇率波动和抗通胀能力。相较于1998年的金融危机所展现的特点,此轮全球汇率波动中新兴国家汇率相对稳定,而发达经济体反而表现出较弱的汇率稳定性。比如:印尼、印度以及巴西货币的贬值幅度相较于欧元、日元以及人民币的波动幅度明显温和。因此,群智咨询(Sigmaintell)预计, 尽管在弱增长经济的背景下,他们仍然有着稳定甚至增长的需求,而一部分发达国家反而持续表现疲弱。

此外,我们预计,北美和欧洲经济核心指标表现走向分化,北美需求将从2023年Q2开始温和复苏。一些新兴市场的表现会出现分化,如东南亚国家,其核心经济指标稳健,消费电子需求将稳定增长。关于中国,政府已全面再开放,但由于目前存在的经济问题无法在短期内解决,需求将会呈一个U型的反转,并不是强烈的V型反转,但是长期来讲,我们看好中国经济,因为政府会把工作重心重新转移到对经济增长的拉动,为未来设定更高的增长目标。

趋势三:半导体和显示供应链将迎来“再平衡”过程,发展韧性至关重要

身处半导体及显示产业之中,有喜有忧,喜的是来自政府的投资、融资以及鼓励政策会持续,但是环境比以往发生了巨大的改变,这变化不仅仅是动荡,而是会有更深远的、根本性的影响。当前中国在追求科技自主和科技能力的提升的背景下,各国也有着与中国相应的类似政策。因此,群智咨询(Sigmaintell)预计,未来大国之间围绕科技领域的竞争是一个长期的过程。科技产业需要关注到因应各国的政策的变化未来可能会出现以下两方面挑战或风险。

首先,品牌和客户需求,对于产品、技术本身的要求会扩大到对供应链的要求。越来越多的品牌会对供应商的产地、来源有着更具象化的要求,未来会出现更扩大的、更多元化的供应链。这将要求我们在供应链方面,要关注到对不同区域市场如何开展供应链的调整,包括供应链管理组织的调整。

其次,担忧半导体的供应过剩,大国的竞争将带来更多不以追求经济目标的投资,这在显示面板领域已经发生过。半导体领域的风险性是极大的,由此引发的投资回报风险以及企业经营风险具有相关性。

群智咨询(Sigmaintell)认为,对于科技企业而言,未来的几年需要保持弹性和谨慎,一方面是平衡合作客户之间需求的关系,另一方面是平衡来自政府方面的投资压力。最终,我们需要在这个充满挑战的环境中,谨慎地管理好现金流、投资回报率。归结来看,我们认为科技企业做好三点:1、需要加强对未来供需环境和器件价格的判断;2、在更多元化供应链需求背景下探索成本管控;3、优化地域化投资分散风险。这对科技企业有着不同以往的更高要求,企业需要提前未雨绸缪,以应对这一全新的变化。

趋势四:科技产业周期与经济周期高度同步,2023年将迎来弱增长(面板)或下行(半导体),2024年开始“数字化”和“新一轮换机周期”将推动产业恢复增长

我们把经济周期与科技行业的周期做类比,从历史的维度看,可以发现基本上半导体和显示面板的周期曲线,与经济周期是完全同步的。当经济下行的时候,这两个产业同样也是下行,多次的周期都是说明了这个问题。因此参考历史的经验,群智咨询(Sigmaintell)预测,在弱周期的背景下,面板的周期曲线会与之同步,但半导体是滞后性的,相较于面板周期大概滞后2-3个季度,因此,半导体在2023年仍然处于一个弱经济周期,面板2023年有机会获得持稳,因为它提前于半导体反映了需求变化的影响。

根据上述周期研究,群智咨询(Sigmaintell)预测,2023年科技行业整体的产值增长将呈现一个负向的,预计2024-2025年或将反弹。首先,我们看到的面板和半导体所面向的需求端的变化,2002年是互联网的普及;接着是进入了PC的普及;2009年迎来了4G牌照的发放;接着进入了长达近十年的智能手机、智能电视以及大尺寸化普及阶段;2020年迎来了新冠,接着进入了一个新冠的波动周期中;现在经历的我们称之为后疫情期以及超级通胀的变化中。

群智咨询(Sigmaintell)预计,在宏观不利因素消除的条件下,从2024年特别是2025年开始,数字化以及下一轮换机周期的来临将成为科技产业需求增长的主要动力。

趋势五:面板厂商和半导体厂商将继续控制稼动率,面板厂需持续控制UT至2023年,晶圆厂UT将下调至75%左右

比较面板指数和半导体指数,以2001年为基准来看,在很长一段历史时间内面板指数的增长速度是要高于半导体指数,因为在2011年至2019年的这一历史时期,面板指数主要由TV拉动,TV用大尺寸化在拉动面板产业,同期对于半导体的拉动不如这么显著。但是目前面板行业所面临的特点是,面板指数和半导体指数出现了此消彼涨。短期而言,在2023年的弱周期中,我们预测面板厂商和半导体厂商都需要控制稼动率。

基于此,我们还是预估并呼吁科技企业必须要保持相应的克制,控制稼动率。面板厂商从2022年第二季度开始已经逐渐下修直至目前在七成以内的稼动率,半导体会比面板整体滞后2-3个季度,也就是说从2022年四季度我们才看到半导体厂商开始下修稼动率,我们预测这个下行的过程会一直持续到2023年三季度。因此,在正常的淡旺季中,2023年下半年是一个需求的企稳阶段,群智咨询(Sigmaintell)预测,面板乃至半导体的稼动率会略有回升,但整体全年是需要控制在80%左右这样一个相对合理和健康的水准。

趋势六:晶圆厂投资激进,供应过剩隐忧正在变成现实

随着2023年的需求逐步显露它真实状态,我们看到一些厂商已经明显下修产能,特别是来自中部的厂商。但是,整体来说晶圆厂商的CAPEX的水准仍处于历史高位。

台积电的投资主要是先进制程产能,包括在中国台湾的本土、日本以及美国都有投资计划。而美光主要是在美国本土。同样,中国大陆的主要晶圆厂商产能主要投资在成熟制程,因为自主化的背后首先要追求量产能力的自主化,因此,在本土的成熟制程的产能扩充是势在必行的。

尽管我们看到2023年整体投资在从高峰下行,但从历史曲线来看投资指数没有明显收缩,仍在扩张。因此,在成熟制程中,我们比较担忧产能过剩会持续相当长一段时间,这是整个行业面临的最大的挑战之一。

在投资方面,面板比半导体相对处于更好的局面。首先面板的产能投资规模正在收缩,不管是中国大陆面板厂商还是其他区域厂商,大家现在都在审慎的评估未来的投资,比过去数十年变得更理性。

趋势七:预计2023年下半年开始消费电子市场将温和复苏

随着消费电子品牌在2023年二季库存回归健康,群智咨询(Sigmaintell)预测,下半年的需求会有温和的复苏。整体而言,2023年对于消费电子市场和面板市场都是一个相对的低谷,大盘较疲弱。但从2024年开始,在各个应用需求拉动下,需求会逐步回升。其中,车载市场是我们认为未来长期值得期待的一个市场,并且在2026年会成长为中大尺寸市场中单一品类最大的一个应用。

放眼未来,群智咨询(Sigmaintell)认为,长远来看OLED将持续成长。第一,用户的接受度正在从手机逐渐扩大到平板电脑、notebook,未来的成长是整体性往上的趋势。第二,主要品牌在未来产品线规划中对OLED有着趋于积极的规划。需求始终是技术成长的拉动力,因此技术特性如果能够满足用户的需求、被用户以及品牌客户认可,将变成这一技术成长的动力。

趋势八:“弱增长”和“再平衡”环境下,弹性和细分化竞争策略同等重要

群智咨询(Sigmaintell)认为,终端市场处在一个再平衡中,在库存消耗之后2023年二季度开始会重新迎来一个平衡。在“弱增长”和“再平衡”环境下,弹性和细分化竞争策略同等重要。在此过程中,回到以企业为核心的视角,在供应链和需求再平衡的过程中,客户需求会变得更为个性化,要求科技企业以更有弹性、更有韧性的姿态,去回应客户的需求,才能实现更稳健的企业发展。