发布时间: 2022/03/01 关注度: 1166

Core points:

· In the post-smart phone era, the driving force for replacement is weakened and the growth of market demand slows down.

· It is expected that in 2022, "health and stability" will become the primary appeal of the brand strategy.

· Foldable mobile phones become a wave, and shipments increased by 172% YoY.

In the post-smart phone era, the driving force for replacement has weakened and the growth of market demand has slowed down.

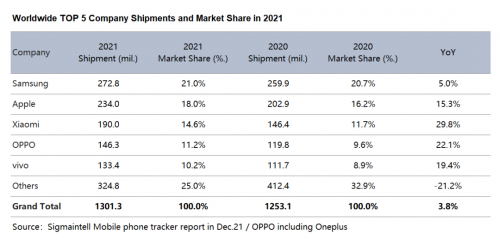

The smartphone market is gradually entering the middle and late stages of development. Whether it is from the hardware upgrade of products to the breakthrough of software application scenarios, all of them are gradually entering the upgrade bottleneck period, superimposed on the global epidemic and the fluctuation risk of the supply chain, which makes consumers enthusiastic about the replacement of smartphones gradually weakening. The overall industry is facing the objective fact that "the driving force for replacement is weakened and the growth of market demand is slowing down". According to data from Sigmaintell, the global smartphone shipments in 2021 were approximately 1.30 billion units, with a YoY increase of about 3.8%. It is estimated that the global smartphone shipments will be approximately 1.35 billion units in 2022, with a YoY increase of about 4.1%. In 2021, smartphone shipments in mainland China were approximately 324 million units, a YoY increase of about 5.5%. At the same time, affected by the industry inventory adjustment and the weakening of replacement driving force, it is estimated that China's smartphone shipments will be approximately 319 million units in 2022, with a slight decline of about 1.5%.

It is expected that "health and stability" will become the primary appeal of the brand strategy in 2022.

Looking back on 2021, the overall brand strategy is slightly aggressive. Apple, Xiaomi, OPPO, and vivo all benefited more or less from Huawei's withdrawal. Shipments all increased YoY to varying degrees, but they also created a "high inventory of components" scenario. Looking forward to 2022, Samsung and Apple will still rank first in the industry with their stable and robust supply chains. Domestic set makers will enter a period of strategic adjustment, with healthy and stable operation as their primary appeal.

Foldable mobile phones became a wave, and shipments increased by 172% YoY.

Recently, BOE released the f-OLED flexible "N"-shaped foldable display technology, which supports both inward and outward folding on one screen. With the maturity of flexible OLED technology, the plasticity of the panel shape has been enhanced, bringing opportunities for changes in the shape of the smartphone. The world's major smartphone set makers have begun to gradually penetrate the field of foldable mobile phones, and foldable mobile phones have become a wave, bringing bright color to the smartphone market with weak innovation.

In 2021, Samsung canceled its Galaxy Note product line and shifted the focus of its highest-end flagship to the Galaxy Z series of foldable phones. Although Huawei’s shipments have decreased sharply due to external factors, to maintain its high-end image and its position in the foldable phone market, it has iterated the series of foldable mobile phones and released its first "clamshell-type" foldable smartphone P50 Pocket. Xiaomi entered the folding mobile phone market in March 2021 and released its first foldable smartphone Mix Fold, which lowered the starting price of folding mobile phones to less than 10,000 yuan. OPPO, Honor, and vivo have all accelerated the development process of their foldable smartphones. OPPO released its first foldable smartphone Find N at the end of 2021. In addition to the differentiated design, hinge, and crease control upgrades, the price has declined to ¥7699. According to the data from Sigmaintell, the global shipment of foldable smartphones in 2021 is about 7.21 million units, with a YoY increase of about 171.9%. The maturity of technology and the decline in prices drive the market of foldable smartphones to continue to heat up. With the further maturity of foldable upstream devices, set makers have also begun to pre-research various forms of smartphones.

For the foldable smartphone market, the upgrade of technology and user experience brings market demand, and the price decline helps expand the market scale. With the maturity of the supply chain, the cost of foldable smartphones still has a certain room for decline. The positioning of foldable smartphones will also gradually change from super flagship to mainstream flagship. According to the latest data from Sigmaintell, it is estimated that the global shipment of foldable smartphones will reach about 14.4 million units in 2022, with a YoY increase of about 99.6%. It is estimated that in 2025 the annual number will exceed 70 million. At present, more and more manufacturers will use the trend of foldable screens to enhance their brand image and base themselves on the high-end market. It is expected that soon, there will be more foldable smartphones including scrolls and "N" forms entering the market, allowing consumers to truly experience the life brought by technology.

中文:

核心观点:

o 后智能机时代,换机驱动力减弱、大盘需求增长放缓。

o 预计2022年“健康稳健”成品牌策略的首要诉求。

o 折叠手机成一朵浪花,出货同比增长172%。

后智能机时代,换机驱动力减弱、大盘需求增长放缓。

智能手机市场逐步进入发展中后期,无论从产品的硬件升级到软件的应用场景突破均都逐步步入升级瓶颈期,叠加全球疫情以及供应链的波动风险,使得消费者对于智能手机的换机热情逐步减弱,整体行业面临着“换机驱动力减弱、大盘需求增长放缓”的客观事实。根据群智咨询(Sigmaintell)数据显示,2021年全球智能手机出货量约为13.0亿部,同比增长约3.8%,预计2022年全球智能手机出货量约为13.5亿部,同比增长约4.1%。2021年中国大陆智能手机出货量约为3.24亿部,同比增长约5.5%,同时受到行业库存调整以及换机动力减弱影响,预计2022年中国智能手机出货量约为3.19亿部,微幅下降约1.5%。

预计2022年“健康稳健”成品牌策略的首要诉求。

回顾2021年,整体品牌策略略显激进,苹果、小米、oppo、vivo都或多或少受益于华为的退出,出货量同比均有不同程度的增长,但是也造就了“零部件高库存”的情景。展望2022年,三星、苹果仍然会凭借其稳定、强健的供应链位列行业首位,国内厂商进入战略调整期,以健康稳健经营为首要诉求.

折叠手机成一朵浪花,出货同比增长172%。

近日,京东方发布了f-OLED柔性“N”形折叠显示技术,支持在一块屏幕上既能实现内折,又能实现外折。随着柔性OLED技术的成熟,增强了面板形态的可塑性,给智能手机整机形态的变化带来机会。全球各大智能手机终端厂商开始逐步向折叠屏手机领域渗透,折叠手机成一朵浪花,为整体创新乏力的智能手机市场带来了一抹亮色。

2021年,三星取消其Galaxy Note产品线,将其最高端旗舰重心向折叠屏手机Galaxy Z系列转移;华为虽然受外部因素影响出货锐减,但为了维持其高端形象,保持其在折叠屏手机市场的地位,正常迭代了折叠屏手机系列,并发布了其首款“贝壳式”折叠屏手机P50 Pocket;小米于2021年3月份入局折叠屏手机市场,发布其首款折叠屏手机Mix Fold,并将折叠屏手机起售价打至万元以下;OPPO、荣耀、vivo均加快了各自折叠屏手机开发进程,OPPO在2021年底率先发布其首款折叠屏手机Find N,除了在屏幕尺寸上做了差异化设计,铰链和折痕控制升级外,更是将价格下探至¥7699起步。根据群智咨询(Sigmaintell)调查数据显示,2021年全球可折叠智能手机出货规模约为721万部,同比增长约171.9%,技术的成熟以及价格的下探带动折叠屏手机市持续升温,随着折叠上游器件的进一步成熟,终端厂商也开始预研各种形态的智能手机。

对于折叠屏手机市场来说,技术和用户体验升级带来市场需求,价格下探有助于扩大市场规模,随着供应链的成熟,折叠屏手机的成本还有一定的下降空间,各品牌的折叠屏手机定位也会逐步从超旗舰向主流旗舰转变,根据群智咨询(Sigmaintell)最新数据,预计2022年全球可折叠智能手机出货规模约达1440万部,同比上涨约99.6%,预计2025年将突破7000万部。目前越来越多的厂商将借助折叠屏的趋势,提升品牌形象,立足高端市场。预计不久的未来,将会有更多包括卷轴及“N“形态在内的折叠手机走进消费者,让用户真正体验到科技带来的生活。

提交右侧信息,了解更多会员服务方案;

或直接联系我们:

+86 151-0168-2530