Core point:

Many weak factors dragged down end demand, so the global shipments of smartphones decreased by about 9.2% YoY in 22H1

The domestic folding smartphone shipments were nearly one million in 22H1, the YoY growth has doubled

Many weak factors dragged down end demand, so the global shipments of smartphones decreased by about 9.2% YoY in 22H1

Many weak factors such as the conflict between Russia and Ukraine, the domestic Covid-19 policy, and high inflation overseas have dragged down the smartphone market demand in 22H1. According to Sigmaintell’s data, the global smartphone shipments in 22H1 will be approximately 580 mil., a YoY decrease of 9.2%. Among them, shipments in Q2 were about 280 mil., a YoY decrease of about 7.8%. Whether overseas or domestic, the smartphone market lacks obvious drivers. It is difficult to see obvious signs of recovery in the short term. Based on this, global smartphone shipments in 2022 are expected to be approximately 1200 mil., a YoY decrease of approximately 7.4%.

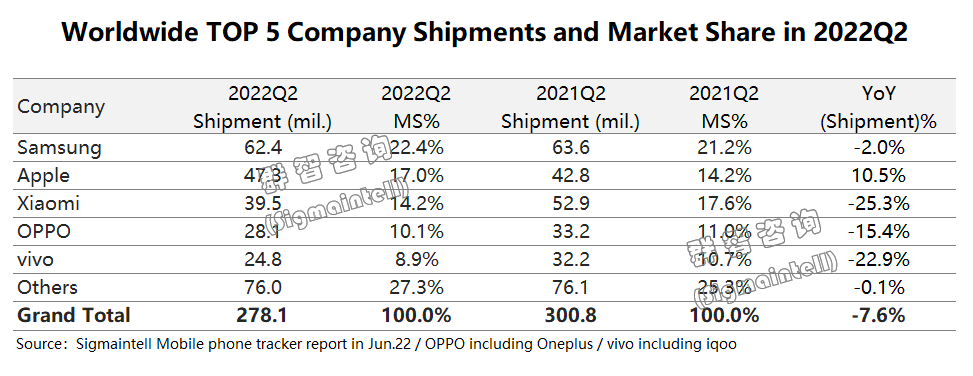

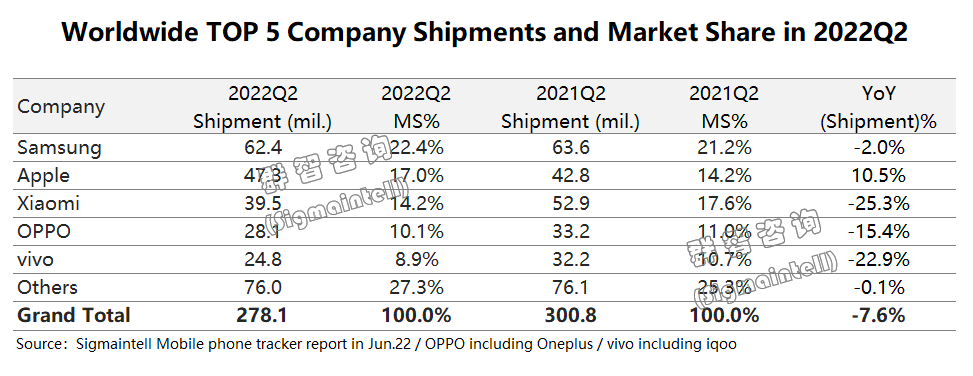

From the performance of set makers, despite the impact of the external environment, Samsung is still No.1 in the industry depend on its global stability of channels and production capacity. Samsung's shipments are the same as last year, which also reflects its strong anti-risk ability. At the top of the high-end smartphone market, Apple's shipment data in Q2 was exciting. Its smartphone shipments were about 47.3 mil., a YoY increase of about 10.5% in 22Q2. At the same time, the data also reflects the limited impact of the economic downturn on high-end users. In 22Q2, Domestic makers were severely affected by the epidemic risk. Due to the obstruction of overseas export channels and domestic transportation, and the decline of consumers’ replacement demand, makers including Xiaomi, oppo, vivo and other makers have shown a significant decline. As the upstream delivery continues, the downstream export is blocked, and the channel inventory of the set makers is also gradually increasing. Inventory pressure has become a priority for set makers in 22H2.

Xiaomi have launch its folding smartphone Mi Fold2 on August 11. Folding smartphones will become a hot spot for future industry growth. According to Sigmaintell’s data, in 2022, the global shipment of folding smartphones is estimated to be 14.3 mil., a YoY increase of about 98.0%. Among them, the shipment of small folding smartphones was about 9 mil., a YoY increase of about 138.1%, and the growth rate exceeded the large folding smartphones.

The domestic folding smartphone shipments were nearly one million in 22H1, the YoY growth has doubled

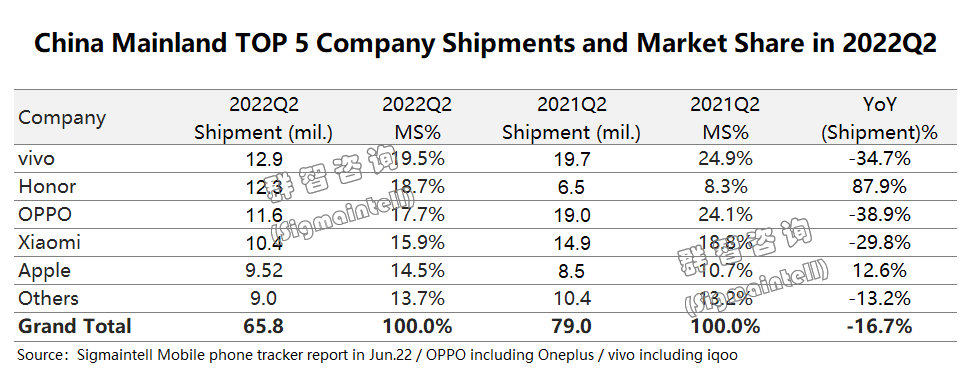

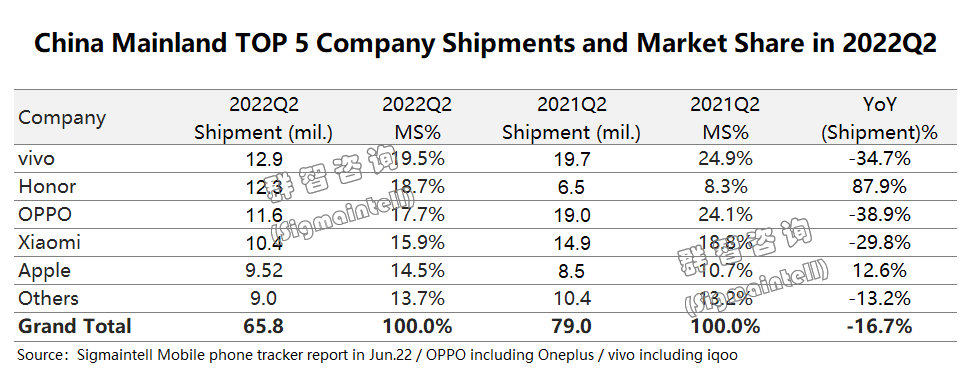

The domestic epidemic has undoubtedly become an important factor affecting the mainland's economy and smartphone demand. According to Sigmaintell’s data, in 22H1, the domestic smartphone shipments were about 140 mil., a YoY decrease of about 18.1%. Among them, the shipments in Q2 were about 65.78 mil., a YoY decrease of about 16.7%. With the adjustment of epidemic policies, the smartphone demand gradually returned after June. The smartphone demand of domestic is estimated to be about 280 mil. in this year, a YoY decrease of about 13.2%.

In terms of 5G, the domestic market still maintains a high penetration rate. About 120 mil. 5G smartphones were shipped on the mainland in 22H1, with a penetration rate of about 83.4%, a YoY increase of about 6.1%.

In terms of display, the penetration rate of flexible OLED panels has increased significantly. In 22H1, the shipment of flexible OLED panels in China Mainland was about 56 mil., and the penetration rate reached 39.8%, a YoY increase of about 10.9%.

In terms of CIS, the average number of cameras showed a downward trend. In 22H1, the average number of rear cameras in China Mainland was about 2.77, a YoY decrease of about 7.0%, of which the proportion of triple cameras (rear camera) was about 48.9%, a YoY decrease of about 6.3%.

In terms of folding smartphones, the shipments of folding smartphones in China Mainland in 22H1 were nearly 1 mil., which doubled compared to 21H1. As the Top brands have MP folding smartphones and the folding supply chains development rapidly, the ASP of folding smartphones will decline rapidly. This also enables more consumers to enjoy more portable and affordable folding products.

In terms of price segments, the products above 800USD show signs of reversal. In 22H1, there was a YoY growth of 14.4%, mainly due to Apple's substantial growth. Faced with an uncertain external environment, the high-end market has the strong anti-risk ability, and high-end breakthroughs have become an imperative action for makers.

中文:

中文:

预计2022年全球小折叠出货约900万部,同比增长约138.1%,增速超大折叠

核心观点 :

诸多利空因素拉垮终端需求,上半年全球智能手机出货同比下降约9.2%

上半年国内折叠手机出货近百万,同比增长翻倍

诸多利空因素拉垮终端需求,上半年全球智能手机出货同比下降约9.2%

俄乌冲突、国内疫情、海外高通胀等诸多利空因素拉垮上半年智能手机市场需求。根据群智咨询(Sigmaintell)统计数据, 2022年上半年全球智能手机出货量约为5.8亿部,同比下降9.2%。 其中二季度出货量约为2.8亿部,同比下降约为7.8%。无论是海外市场还是大陆市场,智能手机市场缺乏明显的驱动因素,短期内较难看到明显复苏迹象。基于此,预计2022年全球智能手机出货量约为12.0亿部,同比预计下降约7.4%。

从整机厂商的表现来看,尽管受到外部环境冲击,凭借全球稳定的渠道及生产能力,三星依然位列行业首位,出货量基本与去年持平,也体现了其较强的抗风险能力。站在高端市场的苹果,二季度表现抢眼,其智能手机出货量约为4730万部,同比实现约10.5%的增长,同时也反应了经济下行对高端用户的影响较为有限。国内厂商二季度受到疫情风控的冲击较为严重,海外出口渠道受阻,国内运输及消费者换机动能下降,使得包括小米、oppo、vivo等厂商均呈现较大幅度下降。随着上游补货持续,下游出海口受阻,产生的整机渠道库存也逐步堆高,库存压力成为下半年整机厂商优先处理重点。

小米昨天发布了其折叠智能手机 Mi Fold2,折叠智能手机成为未来行业增长的热点,根据群智咨询(Sigmaintell)调查数据,预计2022年全球折叠智能手机出货规模约为1430万部,同比增长约98.0%,其中小折叠出货约900万部,同比增长约138.1%,增速超大折叠。

上半年国内折叠手机出货近百万,同比增长翻倍

国内疫情无疑成为影响大陆经济和手机需求的重要因素,群智咨询(Sigmaintell)统计数据显示,2022年上半年中国大陆智能手机出货量约1.4亿部,同比下降约18.1%,其中二季度出货量约为6578万部,同比下降约为16.7%。随着疫情防控政策的调,智能手机在6月后需求逐步回归,预计今年中国大陆智能手机需求规模约为2.8亿部,同比下降约为13.2%。

5G方面,大陆市场仍然保持较高渗透率,今年上半年中国大陆5G智能手机出货量约为1.2亿部,渗透率约为83.4%,同比上升约6.1个百分点。

显示屏方面,柔性OLED面板渗透率显著提升,今年上半年中国大陆柔性OLED面板出货量约为5600万部,渗透率来到39.8%,同比上升约10.9个百分点。

影像方面,摄像头的平均颗数呈现下降趋势,今年上半年中国大陆后摄平均颗数约为2.77颗,同比下降约7.0%,其中三摄(后摄)比重约为48.9%,同比下降约6.3个百分点。

折叠手机方面,今年上半年中国大陆可折叠智能手机出货量约为99.1万部(近100万部),同比增长翻倍。随着头部品牌纷纷量产折叠手机,折叠供应链也快速成熟,势必会快速拉低折叠智能手机的零售均价,使得更多消费者享受到更便携和实惠的折叠产品。

分价格段来看,800USD以上价位段的机型出现了反转的迹象,今年上半年对比去年同期出现了14.4%的增长,主要是苹果今年上半年有大幅增长表现,面对不确定的外部环境,高端市场的抗风险能力较强,高端突破成为各厂商势在必行的举措。