发布时间: 2022/03/14 关注度: 1252

Core points:

The global mobile CIS shipments in 2021 is approximately 5.37 billion units, a YoY decrease of about 11.8%; it is estimated that the global mobile CIS shipments will be about 5.50 billion in 2022, an increase of about 2.5% YoY.

Capacity: In 2021, the overall capacity increased significantly, but there was a temporary structural supply and demand imbalance. In 2022, the top makers will focus on expanding the production of high-end pixels, while the capacity of low-end pixels will decrease sharply. Be alert to price fluctuations caused by emergencies.

Competition: Sony grows against the trend, OmniVision's high-pixel share stands out.

Technology: Three main cameras in parallel, high-magnification zoom, and self-developed ISP plug-in to enhance competitiveness.

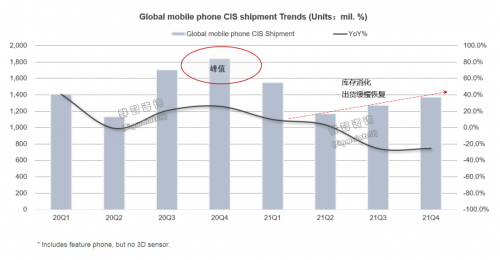

After experiencing the supply and demand panic and peak shipments in 21Q1, affected by the epidemic in Southeast Asia and the shortage of long and short materials such as main control sensors, the set market demand has returned to rationality. Starting from the second quarter, the inventory of camera parts began to rise, the overall shipment volume declined sharply, and the upstream capacity supply gradually increased, resulting in a backlog of inventory, the price of CIS began to gradually decline, and the set demand continued to be sluggish. According to the survey data of Sigmaintell, the global mobile CIS shipments in 2021 is approximately 5.37 billion units, a YoY decrease of about 11.8%; among them, the global mobile CIS shipments in 21Q4 is approximately 1.37 billion units, down about 25.3% YoY. At the same time, it is estimated that the global mobile CIS shipments will be about 5.50 billion in 2022, an increase of about 2.5% YoY.

Capacity: In 2021, the overall capacity increased significantly, but there was a temporary structural supply and demand imbalance. In 2022, the top makers will focus on expanding the production of high-end pixels, while the capacity of low-end pixels will decrease sharply. Be alert to price fluctuations caused by emergencies.

In 21H1, due to the long ramp-up cycle of ultra-high pixel capacity and the squeeze of low-end pixel capacity by other applications, there will be short-term structural imbalances and market price fluctuations. In 21H2, the capacity of Samsung and Sony's external foundries was released steadily and significantly, but the sales in the set market were lower than expected and the stocking plan was lowered again, resulting in an oversupply in the overall CIS market. At the same time, the purchasing plan of low-end pixels was too aggressive in the early stage, resulting in a large amount of inventory, forcing sensor makers and some fabs to reconsider and adjust their capacity strategies, gradually reducing the capacity of low-end pixels, and turning to OEM for other scarce materials.

In 2022, although market demand is limited by factors such as the epidemic and international political turmoil, smartphone makers remain aggressive in upgrading their overall image specifications. Therefore, top sensor makers will spare no effort to continuously expand the capacity of high-end pixels, but their expansion strategies will be different. In addition to the expansion of their factories, Samsung and Sony still seize each other's superior external fab foundry capacity, and influence supply chain strategies by controlling capacity. On the one hand, mainland Chinese sensor makers continue to expand the capacity of high-end pixel products to TSMC, and on the other hand, they cooperate with domestic fabs to simultaneously develop the capacity of mid-end pixel products.

In terms of the foundry, in 2022, in addition to mainland fabs, Taiwan and South Korea and other fabs will significantly reduce low-end pixel capacity. It is expected that the low-end pixel capacity will be adjusted to the lowest level in the second quarter. Because of the significant reduction in the supply of low-end pixel capacity and the gradual decline in inventory, with the arrival of the peak stocking season in the second half of the year, it is not ruled out that there may be a structural tight supply and demand. It is recommended to release the demand and stocking plan reasonably in advance.

Competition: Sony grows against the trend, OmniVision's high-pixel share stands out.

Sony:

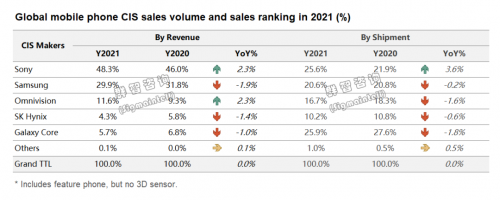

In 2021, Sony CIS's performance growth was higher than expected, especially in 21H2, when the overall environment was extremely poor, its performance still maintained high-speed growth. In particular, its large pixel products have been recognized by major customers, and 50M (1.0um and above) products occupy more than 90% of the market share, prompting Sony's rapid revenue growth. At the same time, its active expansion of external wafer foundry capacity has become a key factor for its growth. In addition to ensuring the stable exclusive supply of Apple, it can also continue to improve the research and development progress of new products to meet the rapid product iteration needs of customers in mainland China. It is expected that Sony will maintain a steady growth trend in 2022.

Samsung: In 2021, Samsung adjusted its product strategy and focus on expanding the development and capacity expansion of high-pixel and small-pixel products. The reduction in the supply of low-end pixel capacity and the price increase has resulted in the loss of a large portion of low-end pixel orders. Its market share in smartphone small pixels (0.8um and below) is close to about 60%. However, as the competition from mainland Chinese makers catches up, its small pixel market share will be squeezed. Therefore, Samsung will more aggressively accelerate the development of smaller and higher-pixel products and use cost-effective processes to control costs and widen the competition gap. In 2022, Samsung will mass-produce 108M (0.5xum) and cost-effective sensors using 65nm process technology at the logic layer.

Omnivision: In 2021, OmniVision will make significant progress in the high-pixel market, especially in high-pixel products of 48M and above. Its market share has gradually increased from less than 10% in 2020 to about 20%. With this competitive advantage, its revenue scale squeezed into the top three in the world and became the most competitive sensor solution provider in mainland China. In 2022, its product line will be more abundant and competitive, and the high-pixel 200M will soon reach mass production. If its high-end pixel capacity grows steadily, it is believed that its share in the high-pixel market will still have the opportunity to further increase in the future.

Technology: Three main cameras in parallel, high-magnification zoom, and self-developed ISP plug-in to enhance competitiveness.

Upgrading the image specifications of smartphones has become one of the must-have options, and consumers have more diverse demands for daily photography. In addition to taking pictures clearly, different scenes have different requirements for taking pictures. For example, high-magnification zoom is required to see more clearly in long-range shooting; stable and smooth video shooting, wide-angle and non-distorted, and layered background structure; close-up photos cannot be distorted, and the primary color output is maintained, etc.

Set customers are constantly upgrading their imaging systems in the face of ever-escalating consumer demands. However, based on the limited stacking space of the whole smartphone, how to realize the optimal solution has become necessary homework for high-end models. According to the research and analysis of Sigmaintell, in 2022, the upgrades in three major directions will continue:

1. The multi-camera trend of high-end models will focus on three cameras, and the three main cameras will be parallel. The main camera will not only upgrade the optical size but also will be the largest in the mobile phone industry. The lens and motor will be upgraded differently, such as variable aperture/five-axis optical zoom.

2. Non-destructive continuous high-magnification zoom (high magnification refers to 10 times or more) has always been the planning direction of high-end models. Due to the technical difficulties of lenses/motors/modules and the need for software collaboration, the currently released smartphones are segmented optical zooms, and there is no real sense of lossless continuous high-magnification zoom. With the accumulation of supply chain technology reserves, this technology will have the opportunity to be mass-produced in 2022.

3. The imaging hardware specifications have reached the top configuration, and the underlying image processing capabilities also need to be improved simultaneously. Therefore, set customers have begun to invest more in the development of their independent ISP sensors, which can improve their computing power and better display their unique image effects.

中文:

核心观点 :

2021年全球手机图像传感器出货量约为53.7亿颗,同比下滑约11.8%,预计2022年将达到55.0亿颗,同比增长约2.5%。

产能篇:2021年整体产能提升显著但存在短暂性结构供需失衡,2022年头部厂商侧重扩产高阶像素,低阶像素产能骤减,警惕突发状况而导致价格波动。

竞争篇:Sony逆势增长,豪威科技高像素份额突出重围。

技术篇:三主摄并行,高倍率变焦,外挂自研ISP提升竞争力。

经历2021年一季度供需恐慌及出货高峰后,受到东南亚疫情以及主控芯片等长短料缺货影响,终端市场需求回归理性。二季度开始,摄像头零部件库存开始走高,整体出货量急剧下滑且上游产能供应逐步上升从而积压一定库存,图像传感器价格开始逐步下行,终端需求持续低迷。根据群智咨询(Sigmaintell)调查数据显示,2021年全球手机图像传感器出货量约为53.7亿颗,同比下滑约11.8%;其中,2021年四季度全球手机图像传感器出货量约为13.7亿颗,同比下降约25.3%。同时,预计2022年全球手机图像传感器出货约为55.0亿颗,同比增长约2.5%。

产能篇:2021年整体产能提升显著但存在短暂性结构供需失衡,2022年头部厂商侧重扩产高阶像素,低阶像素产能骤减,警惕突发状况而导致价格波动。

2021年上半年,由于超高像素产能爬坡周期长及低阶像素产能被其他应用挤压等影响,出现短期性结构失衡且市场价格波动上涨。2021年下半年,三星(Samsung)和索尼(Sony)的外部晶圆代工厂产能稳定大幅释放,但终端市场销量低于预期进而再度下调备货计划,导致整体图像传感器市场出现了供过于求的现状。与此同时,低阶像素在前期备货计划过于激进而产生大量库存,迫使芯片商及部分晶圆厂不得不重新考量调整产能策略,逐步减少低阶像素产能,转而代工其他紧缺性物料。

2022年,尽管市场需求受限于疫情及国际政治动荡等因素影响,但智能手机对于整体影像规格的升级策略保持激进,因此头部芯片商将会不遗余力持续扩大高阶像素产能但扩产策略有所差异。三星和索尼除了自身工厂扩产以外,依旧互相抢占优势外部晶圆厂代工产能,通过控制产能来影响供应链策略。中国大陆芯片商一方面向台积电(TSMC)持续扩产高阶像素产能,另一方面携手国内晶圆厂同步开发中阶像素产品的产能。

晶圆代工方面,2022年,除大陆晶圆厂外,台韩等晶圆厂均大幅缩减低阶像素产能,预计二季度低阶像素产能将会调整至最低水位。鉴于低阶像素产能供应大幅减少以及库存的逐步下降,随着下半年的备货旺季到来,不排除将有可能出现结构性的供需紧张,建议提前合理释放需求及备货计划。

竞争篇:索尼逆势增长,豪威科技高像素份额突出重围。

索尼(Sony):2021年索尼CIS业绩增量高于预期,尤其是下半年整体大环境极差情况下,业绩依旧保持高速增量。尤其是其大pixel产品获得主要客户的认可,50M(1.0um及以上)产品占据90%以上的市场份额,促使索尼营收快速增长。与此同时,其积极扩产外部晶圆代工产能成为其增量的关键助力因素。在保证苹果(Apple)客户的独家供应稳定外,还能持续提升新产品的研发进度,满足中国大陆客户的产品快速迭代需求,预期2022年索尼将会保持稳中增长趋势。

三星(Samsung):2021年三星调整其产品策略,专注于扩大高像素小pixel产品的开发及产能扩充。通过减少低阶像素产能供应且高涨价幅度,使得其丢失很大一部分低阶像素订单。在智能手机小pixel(0.8um及以下)像素市场份额接近约60%。但随着中国大陆厂商的竞争追赶,其小pixel像素市场份额将会受到挤压。因此,三星将会更加激进的加速开发更小更高像素产品,且利用性价比较为优势制程去控制成本,拉开竞争差距。2022年三星将会量产108M(0.5xum)且逻辑层使用65nm制程工艺的高性价比芯片。

豪威科技(Omnivision):2021年豪威科技在高像素市场进步明显,尤其是48M及以上高像素产品中,从2020年不到10%市场出货份额逐步上升到约占20%,凭借该竞争优势,其营收规模成功挤进全球前三,成为竞争实力较强的中国大陆芯片方案商。2022年其产品线将会更加丰富且具有竞争力,高像素200M也即将达到量产状态。如果其高端像素产能稳定增长,相信其未来在高像素市场份额仍将有机会进一步提升。

技术篇:三主摄并行,高倍率变焦,外挂自研ISP提升竞争力 智能手机升级影像规格已成为必备选项之一,且消费者对于日常拍照诉求更为多样化。

除了拍照清晰以外,不同场景对于拍照需求皆是不同的。例如:拍摄远景需要高倍率变焦能够看得更为清晰;拍摄视频时需要稳定流畅,广角且不变形,背景结构层次化;近景状态下照片不能失真,保持原色输出等等。

终端客户在面对不断升级的消费者需求时,也在不断提升影像系统。但在整机堆叠空间有限的基础上,如何实现最优化方案成为高端机型的必备功课。根据群智咨询(Sigmaintell)研究分析,2022年三大方向升级将会持续进行:

1. 高端机型多摄趋势将集中于三摄,且三主摄并行。主摄不仅升级光学尺寸,势必要做手机界最大底,镜头及马达将会进行差异化升级,例如:可变光圈/五轴光学变焦等。

2. 无损化连续高倍率变焦(高倍率是指10倍或以上)一直是高端机型的规划方向,由于镜头/马达/模组等技术难度大以及需要软件协作互补,导致目前已发布的机型都是分段式光学变焦,并没有真正意义上的无损化连续高倍率变焦。随着供应链技术储备积累,该项技术将有机会在2022年得以量产。

3. 影像硬件规格已达到顶级配置,底层图像处理能力也需要同步提升,因此终端客户开始加大投入研发自身特色的独立ISP芯片,提升算力的同时,能够更好的表现出特色的影像效果。

提交右侧信息,了解更多会员服务方案;

或直接联系我们:

+86 151-0168-2530