Core Points:

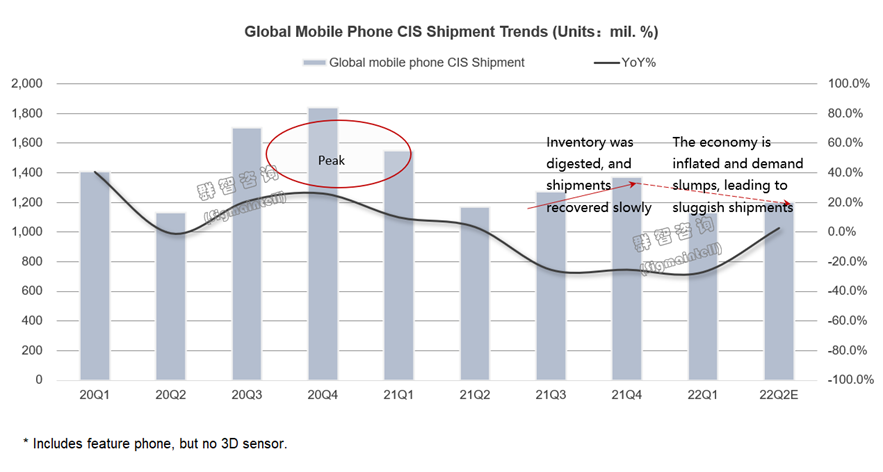

• In 2022Q1, the global mobile phone CIS' shipments were about 1.13 billion units, a YoY decrease of approximately 27.0%.

• Capacity: In 22H1, mobile phone pixel capacity was sufficient, and low-end pixel capacity sought localization.

• Demand: Market demand in Europe and mainland China has suffered multiple blows, and the Latin American and Africa market may be able to stand out.

• Products: The upgrade of pixel format shows polarization, "The main camera goes up, Sub-camera goes down."

• Competitions: Leading makers will use capacity advantages to control supply or change the adversity, and local makers will seek opportunities through differentiation.

• Suggestions: Improve product functional value, upgrade product structure, and be cautious in large-scale expansion.

With the gradual loosing of overseas epidemic control, market demand has begun to recover. However, the outbreak of the Russian-Ukrainian conflict and the multiple rounds of sanctions imposed by Western countries on energy have made the original "high inflation" situation in many European and American countries even more severe. Those factors have aggravated consumers' living pressure and inhibited the purchasing power of non-essential goods. At the same time, China's repeated epidemics and strict epidemic prevention policies have had a significant impact on the production and demand in the domestic market, which has increased the instability of the mobile phone CIS markets' demand and supply, and the supply-demand relationship has also increased significantly due to short-term factors.

Based on the above factors, since the beginning of this year, the global smartphone market demand has continued to decline; Downstream ends have gradually begun to adjust their shipments, procurement plan, and product strategies. These impacts have also been transmitted to the CIS market. According to the survey data of Sigmaintell, the global mobile phone CIS shipments in 22Q1 were about 1.13 billion, down about 27.0% YoY, and the shipments in the second quarter will either be pessimistic. Next, we will analyze its dynamic changes in supply and demand.

Capacity: In 22H1, mobile phone pixel capacity was sufficient, and low-end pixel capacity sought localization.

In early 2022, upstream wafer foundries' prices have risen to the highest level, and the capacity of the mature process of the head fabs has also increased slightly. TSMC, UMC, LSI, and others are all actively expanding the production process of 40nm/28nm and below. TSMC and UMC's plan to build a new 28nm factory is also on schedule, and it is expected to release capacity by 2023 gradually. Sigmaintell predicts that the global 28nm capacity for CIS applications will increase by about 12.1% YoY in 2022, which also means that the capacity of high-end CIS used in smartphones is in a steady growth state. Without emergencies, the global supply relationship of high-end CIS for smartphones is expected to show a relatively balanced or slightly surplus status in 2022.

Sigmaintell follow up and analysis the upstream capacity plan of low-end CIS and found that the capacity of 8-inch foundries tends to accelerate the transfer to 12-inch, and the acceleration of the transfer to mainland China fabs is pronounced, mainly due to the following factors: First, the price of 8-inch wafer foundries such as Samsung, TSMC, and DB Hitek has increased several times since 2021, making the sensor makers' cost pressure exceed expectations. The profit margin began to decline, so they had to consider transferring capacity. Second, the fabs in mainland China are gradually improving the capacity of CIS products, the BSI and Stack technical capabilities, and the industry chain is also being improved rapidly. Coupled with the stimulation of relevant preferential policies, localized sensor makers accelerate transfer capacity to domestic foundries. Third, Chinese mainland fabs attract some overseas leading sensor fabless maker with muscular technical strength by their cost and industrial chain advantages.

Demand: European and Chinese market demand has suffered multiple blows, and the Latin American and Africa market may be able to stand out

According to Sigmaintell's latest forecasted data in May, the global CIS' set-market demand is expected to be about 4.95 billion in 2022, a YoY decrease of about 2.7% and a 3.4% drop from the forecast data at the beginning of the year.

On the one hand, Europe and mainland China's market demand declined, profoundly impacting domestic set markers. Since March, domestic set markers have lowered their procurement plans for the whole year and adjusted their product plan, focusing on a stable and profitable image upgrade strategy, which has caused the proportion of multi-cameras in domestic set markers to shrink further. The ratio of quad-cameras has dropped to less than 10%, and three cameras dominate mid-to-high-end models.

On the other hand, set marker enterprises have begun to increase their weight in the Latin American and Africa market, planned a variety of ultra-low-end models, and been ready to seek breakthroughs in the Latin American and Africa market. Regarding image specifications, the cost is highly controlled, VGA and QVGA are reproduced in the secondary camera of smartphones, and there is a trend of squeezing 2M. It is not ruled out that the average unit price of CIS in smartphones in 2022 may show a downward trend.

Product: The upgrade of pixel format shows polarization, "The main camera goes up, Sub-camera goes down."

Last year's high inventory affected low-end pixel products, especially 2M pixel sensor. In 22Q1, the shipment of smartphones' 2M pixel sensor was about 220 million, a YoY decrease of approximately 41.6%. Next, the demand for 2M pixel products will be squeezed by lower pixel products such as VGA and QVGA, and the demand will further decline.

The development trends of high-end pixel products were divided into two directions. First, the demand for large-high pixel products used as the main camera was gradually improving and had an upgrading trend; they also became the leading solution for upgrading high-end flagship smartphones. In 22Q1, the global smartphone 50M (1.0u and above) sensor shipments were about 24 million, a YoY increase of approximately 271.4%. Second, as for small-high pixel products, their optical effects are not as good as large pixel products, and there are some differences in consumer experience, so the overall demand is slightly lower than that of 50M (1.0u and above), but the overall sales volume in the first quarter are still considerable. In 22Q1, the shipment of smartphones' 108M (0.8u and below) chips was about 22 million, a YoY increase of approximately 191.8%.

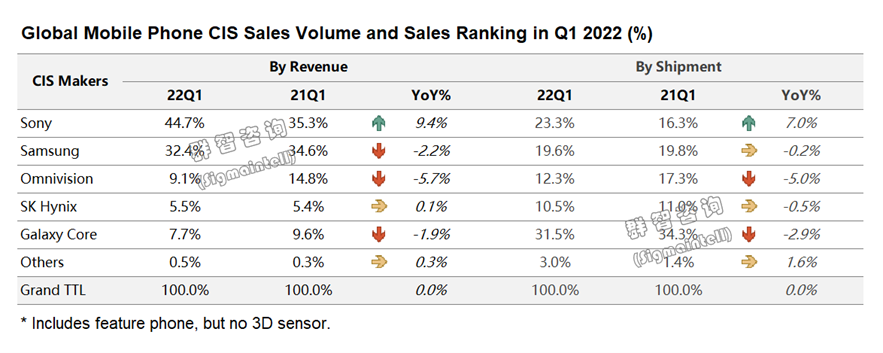

Competition: Leading makers will use capacity advantages to control supply and may have the ability to change the adversity, and local makers will seek opportunities through differentiation

In 22Q1, with the continued growth of Sony's customer Apple, Sony still leads the industry in a declining market environment. At the same time, among set markers in mainland China, Sony has deployed multi-structured product lines and specially customized strategies, which have been highly recognized by customers. The excellent performance at the customer level has laid a good demand foundation for Sony's continuous expansion of 28nm process capacity. In 22Q1, its global shipments of 50M (1.0u and above) pixel chips increased by 324.3% YoY, maintaining a solid position in the large pixel market.

In 22Q1, Samsung's 50M (0.64u) products, with absolute advantages in capacity and price, quickly occupied the main camera share of low-end and mid-end sets and became the leading supplier of 50M main cameras' small pixel. In 2021, Samsung will increase the price of low-end pixel products aggressively. With sufficient capacity and supply, Samsung is expected to adjust its price strategy to gain more market share this year.

In 22Q1, both shipments and sales were weak due to the lack of competitiveness of their product portfolios and the price increase of upstream wafer foundries. Sigmaintell suggests that in the context of declining overall market demand this year, it is necessary to appropriately adjust products and sales strategies based on its own products' characteristics.

Summary: Improve products' functional values, upgrade product structure, and be cautious in large-scale expansion

In the face of multiple unfavorable factors such as repeated domestic epidemics, geopolitical conflicts, and continued inflation, the market will remain weak in the short term, especially after smartphone CIS have undergone upgrades and adjustments and gradually enter the stock market. Facing the complex and challenging CIS market in 2022, Sigmaintell has three suggestions:

First, enhance the functional values of products and develop more optical fusion technologies. When the pixel upgrade reaches a certain peak, the supply chain may need to consider embedding intelligent algorithms and differentiated (such as multi-spectral) functions based on existing sensors to compete for homogeneous products.

Second, actively explore new application scenarios, and develop segmented application products based on the advantages of its resources and R&D capabilities. With the rapid development of 5G networks, industrial Internet, short video, live broadcast, and other application scenarios have emerged. It is necessary to consider the characteristics of the application scenarios and develop targeted video modes or photo modes.

Third, expand production reasonably and comply with the trend of upgrading capacity structure. Next, expand the production reasonably, in line with the upgrading trend of capacity structure. In the context of declining market demand, it is necessary to control the capacity utilization rate carefully and, at the same time, actively gain insight into the opportunities and timing of future product structure upgrades and transfers.

中文:

群智研究|全球手机图像传感器市场下行,建议布局多层次产品线,结合产能优势,冲击市场份额

核心观点:

2022年一季度全球手机图像传感器出货量约为11.3亿颗,同比下滑约27.0%。

产能篇:2022年上半年手机类像素产能充足,低端像素产能寻求本土化

需求篇:欧洲和中国大陆市场需求遭受多重打击,拉非市场或能突出重围

产品篇:像素规格升级呈现两极分化,“主摄向上、副摄向下”

竞争篇:头部厂商将以产能优势调控供应或将改变逆境,本土厂商以差异化寻求契机

建议:提升产品功能价值,升级产品结构,谨慎进行大幅扩产

随着海外疫情管控的逐步放开,市场需求开始有所恢复。但俄乌冲突的爆发以及西方国家对能源的多轮制裁,使得欧美多国原本的“高通胀”形势更显严峻,加重消费者的生活压力进而抑制非必需品的购买动力。与此同时,中国的疫情反复以及严格的防疫政策对国内市场生产及需求产生较大冲击,使得手机图像传感器市场需求和供给的不稳定性增加,供需关系受短期因素影响明显上升。

综合以上因素影响,今年以来全球智能手机市场需求持续下滑,下游终端开始陆续调整出货、备货及产品策略,这种影响也传导到摄像头图像传感器市场。群智咨询(Sigmaintell)调查数据显示,2022年一季度全球手机图像传感器出货量约为11.3亿颗,同比下滑约27.0%,二季度的出货情况也将不容乐观。下面我们从供需两方面分析其动态变化。

产能篇:2022年上半年手机类像素产能充足,低端像素产能寻求本土化

2022年初上游晶圆代工价格涨至最高水位,且头部晶圆厂成熟制程的产能也有微幅提升。台积电(TSMC)、联电(UMC)、三星(LSI)等都积极扩产40nm/28nm及以下制程,并且台积电、联电新建的28nm新工厂计划也按期进行中,预计到2023年逐步释放产能。群智咨询(Sigmaintell)数据预测,2022年全球28nm用于图像传感器用途的产能将同比增长约12.1%。这同时也意味着用于智能手机的高端图像传感器的产能处于稳定增长状态,如果没有突发事件的影响下,预计2022年全球智能手机的高端图像传感器供应关系整体将呈现较为平衡或略有盈余的态势。

群智咨询(Sigmaintell)对低阶图像传感器上游的产能规划跟踪及分析发现,8英寸代工的产能有加速向12英寸转移的倾向,尤其是向中国大陆晶圆厂转移加速明显,主要受以下影响因素:第一,三星、台积电、东部高科(DB Hitek)等8英寸晶圆代工价格自2021年多次涨价后,促使芯片商的成本压力超过预期且利润率开始下滑,以至于不得不考虑转移产能;第二,中国大陆晶圆厂不仅在图像传感器类产品产能及BSI、Stack技术能力逐步提升,并且产业链也在加速完善中,加之相关优惠政策刺激等,本土化芯片商加速向国内晶圆代工转移产能;第三,中国大陆晶圆厂利用成本及产业链优势,吸引了一些技术实力雄厚的海外头部芯片设计公司。

需求篇:欧洲和中国市场需求遭受多重打击,拉非市场或能突出重围

根据群智咨询(Sigmaintell)5月最新数据预测,2022年预计全球图像传感器终端市场需求约为49.5亿颗, 同比去年下降约2.7%,较年初的预测数据下滑了3.4%。

一方面,欧洲和中国大陆市场需求下滑,对于国内终端品牌影响尤为深刻,在3月份开始国内终端厂商纷纷下调全年的备货计划并调整产品规划策略,侧重于稳健保利润的影像升级策略,由此造成了国内品牌终端的多摄比例进一步萎缩,四摄比例下降至占比10%以内,中高端机型多以三摄为主。

另一方面,终端品牌企业开始加码拉非市场,规划多款超低端机型,准备寻求拉非市场的突破。在影像规格上,极致控制成本,进而出现了VGA、QVGA重现于智能手机的副摄,并且有挤压2M的趋势,不排除2022年智能手机的图像传感器平均单价或将由此呈现下降趋势。

产品篇:像素规格升级呈现两极分化,“主摄向上、副摄向下”

低端像素产品,尤其是2M像素芯片受到去年高库存的影响。2022年一季度智能手机2M像素芯片出货量约2.2亿颗,同比下降约41.6%。接下来2M像素产品的需求将会受到VGA、QVGA等更低像素产品的挤压,需求量将会进一步下滑。

高端像素产品的发展趋势则将分化为两个方向。首先,作为主摄功能的大pixel高像素产品需求逐步趋好,且有升级的趋势,成为高端旗舰机升级的主力方案。2022年一季度全球智能手机50M(1.0u及以上)芯片出货量约0.24亿颗,同比增长约271.4%。其次,小pixel高像素产品,由于其光学效果不如大pixel产品且消费者体验也存在一些差异,因此,整体需求量相比50M(1.0u及以上)略低,但在一季度整体销量依然可观。2022年一季度智能手机108M(0.8u及以下)芯片出货量约0.22亿颗,同比增长约191.8%。

竞争篇:头部厂商将以产能优势调控供应或将改变逆境,本土厂商以差异化寻求契机

2022年一季度,凭借客户苹果(Apple)的持续增长,索尼(Sony)在市场大环境下滑时依旧处于行业领先地位。与此同时,索尼在中国大陆终端客户中,布局多结构化产品线及专项定制化策略,获得客户高度认可。客户层面的良好表现为索尼不断扩产28nm制程产能奠定了良好的需求基础。2022年一季度其50M(1.0u及以上)像素芯片全球出货量同比去年增长324.3%,在大pixel像素市场中保持强势地位。

2022年一季度,三星(Samsung)的50M(0.64u)产品凭借产能及价格等方面的绝对优势,快速占领中低阶整机的主摄份额,是50M小pixel主摄的主力供应商。2021年,三星对低阶像素产品涨价幅度激进,今年在产能供应充足情况下,预计三星会调整价格策略获得更多的市场份额。

2022年一季度,中国大陆芯片商受到自身产品组合缺乏竞争力及上游晶圆代工涨价等因素影响,出货量及销售额均表现疲软。群智咨询(Sigmaintell)建议,在今年整体市场需求量下降的环境下,需结合自身的产品特色适当调整产品及销售策略。

总结:提升产品功能价值,升级产品结构,谨慎进行大幅扩产

面对国内疫情反复,地缘政治冲突,通胀持续加剧等多重不利因素,短期内市场仍将表现疲软,尤其是智能手机图像传感器经历过升级与调整后,逐步进入存量市场。面对复杂且极富挑战的2022年图像传感器市场,群智咨询(Sigmaintell)有三点建议:

首先,提升产品功能价值,开发更多光学融合技术。在像素升级达到某一顶点时,供应链或许需要更多考虑在现有芯片基础上嵌入智能化的算法及差异化(如多光谱等)功能,以期在同质化产品竞争中脱颖而出。

其次,积极挖掘新应用场景,结合自身资源及研发能力优势,开发细分应用产品。随着5G网络快速发展,工业互联网、短视频、直播等应用场景兴起,需思考其中的应用场景特点,定向开发针对性的视频模式或者拍照模式。

再次,合理扩产,顺应产能结构升级趋势。在市场需求下行的背景下,需谨慎管控产能利用率,同时,积极洞察未来产品结构升级转移机会及时间点。