Core points:

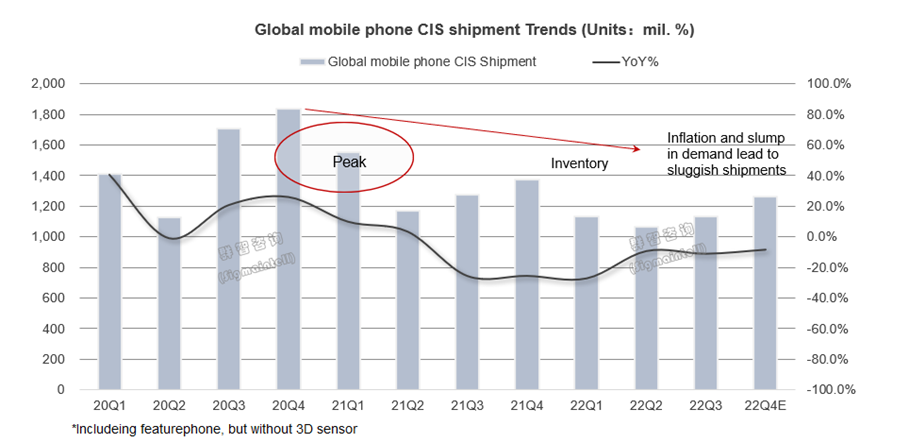

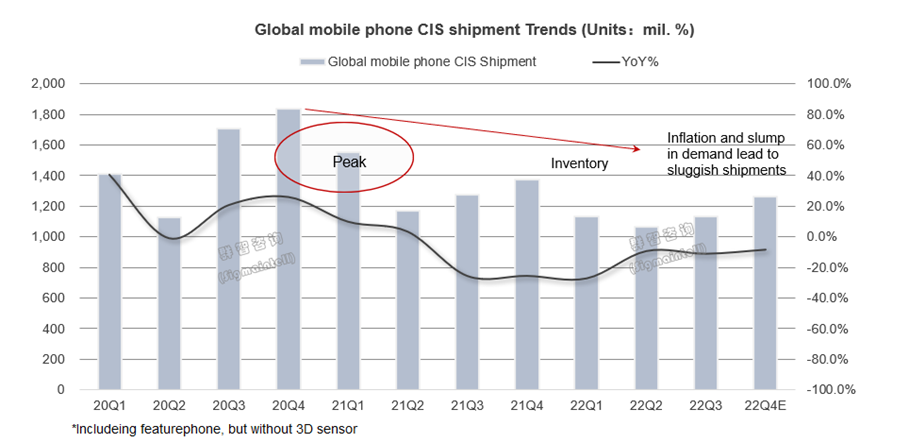

Mobile phone CIS shipments in 22Q3 were about 1,130 mil, a YoY decrease of about 10.9%

Overcapacity is transmitted to upstream foundries. The production cut is imperative, and capacity is gradually transferred to the mainland China

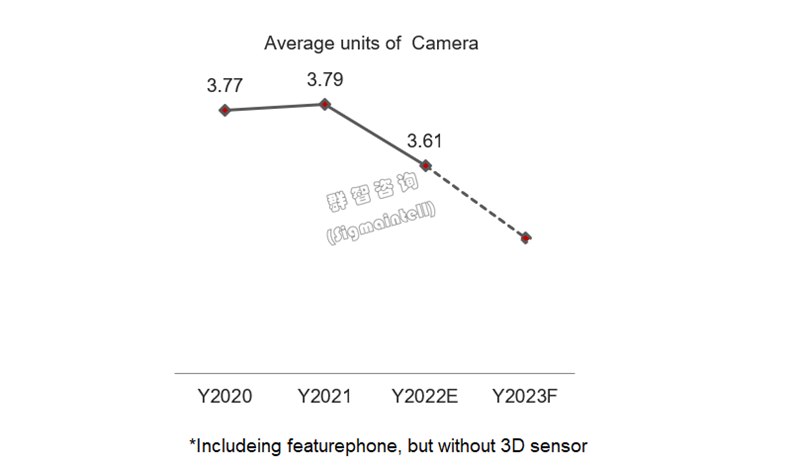

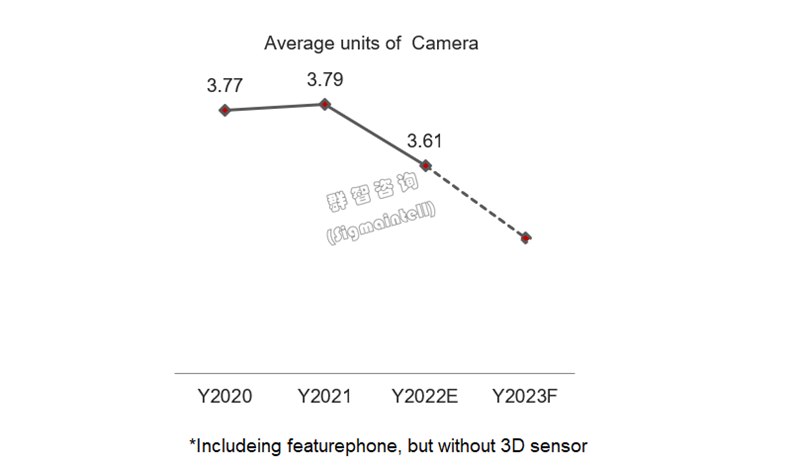

Multi-camera continues to fall, and optical size continues to upgrade

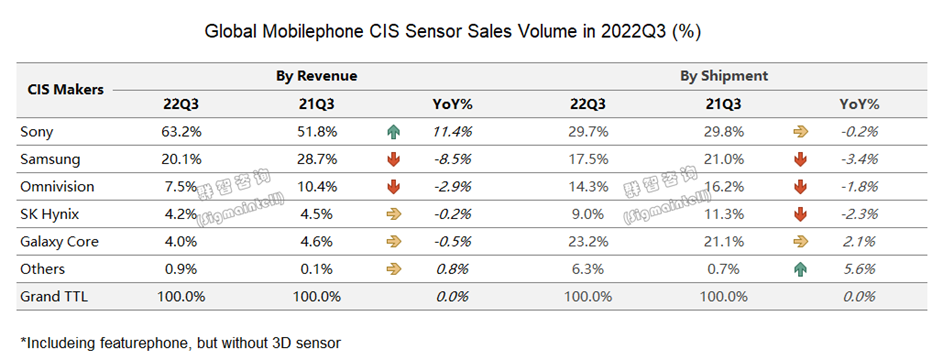

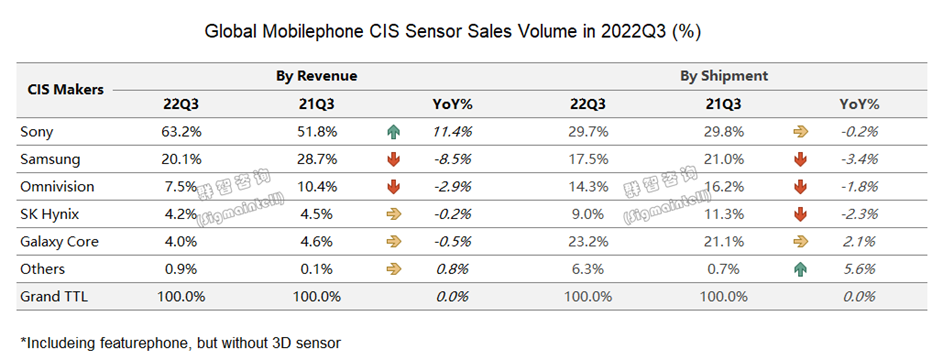

The concentration of the supply chain has increased, and Sony is the only one in the high-end market

High-end Competition Intensified, Industry has a Profit-Oriented Transfer

The demand continued to be sluggish. Mobile phone CIS shipments in 22Q3 were about 1,130 mil, a YoY decrease of about 10.9%

Affected by inflation and the Covid-19 pandemic, the consumer electronics industry continued to slump in Q3. Samsung’s mobile phone alerted of high inventory and stopped production in the short term to reduce the inventory level. Mainland China mobile phone brands are also actively implementing inventory control measures. The market generally believes that after the launch of new iPhones, it will drive an increase in purchases deman, but the prolonged delivery of the iPhone 14 pro has led to poor sales. So far, the sales and demand of sets in Q3 have declined again, directly leading to a decline in the shipment of mobile phone CIS.

According to Sigmaintell’s data, global mobile phone CIS shipments in 22Q3 were about 1,130 mil, a YoY decrease of about 10.9%; it is expected that by the end of 2022, the demand for mobile phone CIS will continue to decline.

Overcapacity is transmitted to upstream foundries. The production cut is imperative, and capacity is gradually transferred to mainland China.

Overcapacity is transmitted to upstream foundries. The production cut is imperative, and capacity is gradually transferred to mainland China.

After half a year of precipitation and conduction, the order cuts and demand reductions of downstream ends have affected the utilization rate of upstream foundries' capacity. At present, upstream foundries will face the risk of vacant capacity and bear the financial pressure brought about by high investment in advanced processes. As the semiconductor industry enters a downward cycle, foundries will also enter a capacity correction cycle.

Since 22Q3, some chip manufacturers have begun to significantly reduce their foundry capacity in 22H2, and the capacity supply plan for 2023 will also focus on "prior destocking" with no new capacity plans. In addition, the competition in the upstream wafer foundry has intensified, especially the capacity structure of mature processes, which will be affected by the expansion of foundries in Mainland China. Among them, the foundry capacity of CIS will gradually transfer to Mainland China. In 2023, only high-end CIS will have an expansion plan, but this plan can still be adjusted depending on the sales performance of high-end mobile phones.

Multi-camera continues to fall, and optical size continues to upgrade

With the improvement of the computing power of mobile phones and the development of multi-camera fusion computing photography, the functions of macro and depth of field are gradually compatible or replaced by cameras with other functions. Mobile phone end makers consider more factors such as design aesthetics, cost, and actual value output, which will cause the development speed of multi-camera to show a downward trend for three consecutive years. At the same time, end makers prefer optimizing and upgrading the photo quality and details. Therefore, the optical size upgrade of the wide-angle main camera and ultra-wide-angle or telephoto functions will maintain an orderly upward growth trend.

The concentration of the supply chain has increased, and Sony is the only one in the high-end market.

The concentration of the supply chain has increased, and Sony is the only one in the high-end market.

Sony: Sony insists on the “high resolution+large pixel” tech-oriented strategy, which raises the high-end image of the set and enhances the overall value of flagship models for brand customers in Mainland China. Mobile phone customers in Mainland China hope that the function of the ultra-differentiated image can form a check and balance with iPhone, so it is crucial to get Sony’s supply chain support and cooperation, which also contributed to Sony’s well performance in Q3 against downward market.

Samsung: Samsung’s “high resolution+small pixel” strategy presents two extreme trends. First, in the mid-to-high-end market, after a period of experience feedback in the Mainland China market, based on consumer research and comprehensive product planning considerations, end customers no longer blindly increase the planning of ultra-high-resolution small pixels, but provide different image upgrade directions according to the actual needs of different markets, which leads to the market share of ultra-high pixel small pixel being squeezed by the direction of high resolution+large pixel, which directly affects Samsung's sales performance in Q3. Second, in the mid-to-low-end market, high resolution+small pixel are highly accepted as an iterative upgrade, and Samsung’s 50M small pixel specification has an absolute advantage in capacity. According to Sigmaintell’s data, in Q3, Samsung’s CIS shipments in the 50M market segment accounted for about 77%, with an obvious market advantage.

High-end Competition Intensified, Industry has a Profit-Oriented Transfer.

There are polarized differences in the demand for mobile phone CIS in different price ranges.

In the low-end market, the upgrade iteration of CIS is cautious, and the cost is strictly controlled. The supply chain mainly prefers inventory and capacity control, and there is little room for growth.

In the high-end market, image upgrading has become a driving factor that equals monitor screens and main platforms. Therefore, continuous upgrades with larger CMOS or improvements in video frame rate and optimized power consumption are all must-have options for wide-angle main cameras. When the main camera upgrade reaches a bottleneck, the sub-camera upgrade will become a more eye-catching selling point. According to Sigmaintell statistics, the global market share of 1/2” and above mobile phone main cameras will reach 30% in 2022, a YoY increase of about 8 %. At the same time, this upgrading trend will continue until 2023.

The supply chain is also actively stocking up corresponding products and capacity supplies on the premise that high-resolution large CMOS CIS will continue to increase. In addition to the top two suppliers, suppliers in Mainland China will develop more high-end CIS next year, and it will be equipped with new models and released early next year.

中文部分:

三季度智能手机图像传感器市场总结:高端竞争加剧,产业转向“获利盘”

核心观点 :

三季度手机图像传感器出货量约11.3亿颗,同比下滑约10.9%

产能过剩传导至上游晶圆厂,大幅减产势在必行,产能代工逐步向大陆转移

多摄持续回落,光学尺寸持续升级

供应链集中度提升,高端市场索尼一家独大

产业转向“获利盘”,高端市场竞争加剧

需求持续低迷,三季度手机图像传感器出货量约11.3亿颗,同比下滑约10.9%

受通胀及疫情等影响,三季度消费类电子行业持续低迷。三星手机提示高库存警报,接连短期停产以降低库存水位;中国大陆手机品牌也积极实施控制库存措施;原计划苹果新机发布后,有望带动一波购机需求回升,但iPhone14pro机型交期延长导致销量不佳。至此,三季度的整机销量及需求再度下滑,进而直接致使手机图像传感器出货量一路下滑。

根据群智咨询(Sigmaintell)数据,2022年三季度全球手机图像传感器出货量约为11.3亿颗,同比下滑约10.9%;预计到2022年年底,手机图像传感器需求仍将继续下行。

产能过剩传导至上游晶圆厂,大幅减产势在必行,产能代工逐步向大陆转移

经过半年时间的沉淀及传导,下游终端砍单及下调需求量已经影响到上游晶圆厂产能的利用率。目前上游晶圆厂不仅即将面临产能空置风险,还将承受先进制程高投入所带来的资金压力,随着半导体行业进入下行周期,晶圆厂也将进入产能修正周期。

自2022年三季度开始,部分芯片商已经开始大幅下调其下半年的晶圆代工产能,并且2023年的产能供应计划也将以“优先去库存”为主,无新增产能计划。另外,上游晶圆代工竞争加剧,尤其是成熟制程的产能结构,将会受到中国大陆晶圆厂扩产影响,其中图像传感器的代工产能将逐步向中国大陆转移。2023年仅高端图像传感器拥有一定幅度的扩产计划,但该项计划仍存在调整的可能性,主要取决于高端智能手机销量表现。

多摄持续回落,光学尺寸持续升级

随着智能手机运算能力的提升,多摄融合计算摄影发展,微距和景深功能逐渐被其他功能的摄像头兼容或替代。手机终端厂商考虑整机设计的美观性及成本和实际价值产出等因素,促使多摄发展速度将会呈现连续三年回落趋势。与此同时,终端厂商更加关注整体拍照画质及细节的优化升级。因此,不管是广角主摄还是超广角或长焦功能的光学尺寸升级,都将保持有序向上增长趋势。

供应链集中度提升,高端市场索尼一家独大

索尼(Sony):索尼坚持的“大pixel高画质”的技术优势策略,成为中国大陆品牌客户拉高整机高端形象、提升旗舰机型整体价值中不可或缺的一环。中国大陆智能手机客户寄希望于极致差异化影像能与Apple iPhone手机形成制衡,因此得到索尼的供应链支持与合作显得尤为重要,这也促使索尼三季度的业绩逆势增长。

三星( Samsung):三星主导的“高像素小pixel”方向呈现两种极端的趋势变化。其一,中高端市场,在中国市场经过一段时间的体验反馈后,终端客户基于消费者调研结果及综合产品规划考量,不再一味加码超高像素小pixel规划量,而是针对于不同市场实际需求提供不同的影像升级方向,导致超高像素小pixel市场份额被高像素大pixel方向挤压,直接影响了三星三季度的业绩表现。其二,在中低阶市场对高像素小pixel作为迭代升级后的市场接受度较高,且三星50M小pixel这一规格拥有绝对产能优势。群智咨询(Sigmaintell)数据显示,三季度三星在50M细分市场的图像传感器出货量占比约为77%,市场优势非常明显。

产业转向“获利盘”,高端市场竞争加剧

智能手机图像传感器的需求在不同价位档市场存在两极化差异。

低端市场方面,对于图像传感器的升级迭代谨慎且严控成本,供应链主要以清库存控产能优先,增量空间较小。

高端市场方面,影像升级成为与显示屏和主平台并驾齐驱的驱动型因素。因此,不管是广角主摄持续升级更大底或是提升视频帧率和优化功耗都是必选项,且在主摄升级达到一定瓶颈状态时,副摄升级将会成为更加亮眼的卖点。根据群智咨询(Sigmaintell)初步统计,预计2022年全球智能手机主摄1/2”及以上市场份额达到30%,同比去年增长约8个百分点,与此同时,这一升级趋势将会延续至2023年。

在高像素大底图像传感器有望继续增量的前提下,供应链也在积极储备相对应的产品及产能供应。除了头部两家以外,中国大陆供应商将会在明年开发出更丰富的高端像素图像传感器,预计明年年初将会陆续搭载新机发布。