核心观点:

2022年手机图像传感器出货量年减至约45.2亿颗,同比下滑约15.8%

中低阶像素平均库存高达6个月以上,晶圆产能进入修正周期

50M&+像素同比增长两成,1/1.6"&+同比增长超六成

受益于大客户需求强劲,索尼营收份额占比约60%,同比增长12个点。

影像系统竞争更加激烈,可变光圈或将成为出圈利器

2022年手机图像传感器出货量年减至约45.2亿颗,同比下滑约15.8%

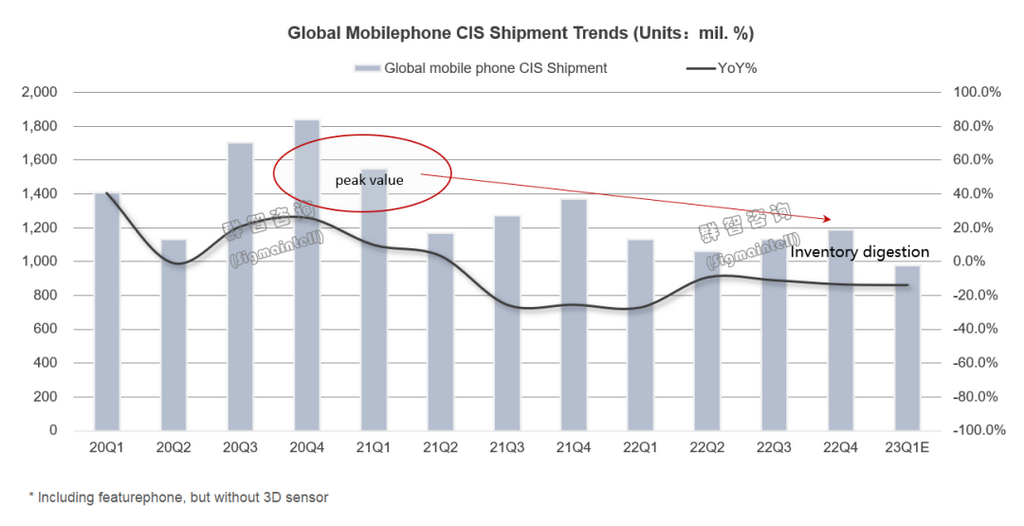

2022年国际政治冲突及疫情反复等因素影响,全球经济持续低迷不振,需求动力一路下滑。叠加上游图像传感器库存溢出以及多摄趋势回落的冲击,致使2022年整个手机图像传感器市场寒气凛冽。根据群智咨询(Sigmaitnell)数据统计,2022年全球手机图像传感器出货量达到约45.2亿颗,同比下滑约15.8%。进入2023年后,尽管中国疫情管控政策已经放开,生活逐步恢复常态,但消费水平的提升需要一定时间恢复。从当前来看,市场景气暂无明显转好迹象,预计2023年一季度手机图像传感器出货量仍将继续下跌,得益于政府投资利好等经济政策的陆续出台,市场信心将逐步恢复,展望市场转机有望在2023年下半年出现。

中低阶像素平均库存高达6个月以上,晶圆产能进入修正周期

中低阶像素平均库存高达6个月以上,晶圆产能进入修正周期

根据群智咨询(Sigmaintell)调查,截至1月份,中低阶像素(例如:2M/8M/13M/16M等)在渠道成品及半成品的库存量已达到6个月以上,因此芯片商在2023年年初果断选择暂停投片或大幅减少投片,进而直接影响到上游晶圆厂的图像传感器产能稼动情况。

尽管上游晶圆厂在2023年一季度已经主动调价努力维持客户投片量,但处在市场大环境下行周期,“调价”或“转移产能”短期内无法改善现状,直接减产及降低供应将加速行业库存下降及促进产业尽快恢复正常的一剂“苦口良药”,基于此2023年上半年,中低阶像素晶圆厂代工的压力陡增。

50M&+像素同比增长两成,1/1.6"&+同比增长超六成

2022年智能手机图像传感器市场产品结构升级趋势主要集中在高像素部分,尤其是中高端智能手机对于高像素/大底/高画质等需求较为激进。尤其是在2022年手机图像传感器出货规模中,有两个特点较为显著:第一,50M及以上像素出货量达到约5.7亿颗,同比增长约20.6%;第二,光学尺寸逐步扩大,1/1.6"及以上尺寸出货量达到约3.4亿颗,同比增长66.0%。预估2023年,这两大升级趋势将会继续保持增长。

受益于大客户需求强劲,索尼营收份额占比约60%,同比增长12个点。

受益于大客户需求强劲,索尼营收份额占比约60%,同比增长12个点。

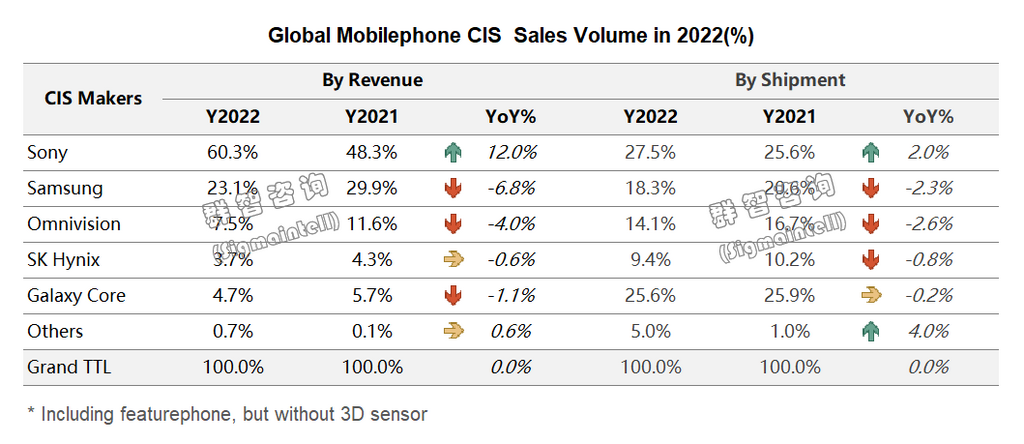

从产品维度来看,索尼(Sony)坚持的“大pixel高画质”的技术优势策略,成功帮助中国大陆品牌客户拉高了高端手机形象,索尼产品聚焦于高端市场,通过高性能及高质量维系高端市场的粘性。三星( Samsung)及中国大陆芯片商在大pixel技术线的技术能力受限,其主推小pixel技术路线,主要收割中低端市场需求,利润率相对较低。其主要聚焦于通过扩大市场体量收获一定的市场份额转化为营收的提升。从客户角度来看,索尼与苹果(Apple)客户紧密绑定合作为双方都获得了双赢的机会,并且其最新技术都将优先供应其头部客户,保证头部客户的产品竞争力及产能稳定。三星、豪威科技(Omnivision)及格科微(Galaxycore)等中国大陆芯片商主要与中国大陆品牌厂商合作紧密,而大陆终端客户受到国际政治因素等影响了销量景气,导致对应的合作芯片商连带失利。伴随着中国大陆终端品牌在高端智能手机市场针对于极致影像的突破及升级,2023年下半年对应的芯片厂商将有机会随之共同成长。

影像系统竞争更加激烈,可变光圈或将成为出圈利器

影像系统竞争更加激烈,可变光圈或将成为出圈利器

在图像传感器光学尺寸升级到一定的顶点后,受限于智能手机整机堆叠的限制,很难再继续扩大芯片尺寸。因此,供应链纷纷将目光转向了光学系统的升级。

首先,头部终端客户与资深光学设计厂商达成战略合作,例如:vivo与蔡司(ZEISS),小米(Xiaomi)与徕卡(Leica),oppo与哈苏(Hasselblad)等,通过与专业的光学设计厂商及搭配专业的光学镜头,建立多样化的色彩数据库,打造单反相机的手机影像质感。

其次,主摄的升级效果最为直观,因此各品牌除了升级光学尺寸之外,控制光圈大小也可以产生差异较大的成像效果。可变光圈的优点有控制景深来调整背景和前景虚实程度;光圈影响光量,白天强光下小光圈可以控制画面不过爆,晚上暗光下大光圈可以增强画面解析力;因此,2023年将会有众多品牌商陆续发布新的可变光圈方案,提升影像成像质量。

英文:

Y22 global mobilephone CIS shipments were 4.5 Bil, a YoY decrease of about 16%, variable aperture may become widely known

Core Topics:

In 2022, the shipment of mobilephone CIS decreased to approximately 4.52 Bil, a YoY decrease of about 15.8%

The average inventory of low- and mid-level pixels is more than six months, and wafer production capacity has entered a correction cycle

50M&+ pixels increased by 20% YoY, 1/1.6"&+ increased by more than 60% YoY

Benefiting from the strong demand from major customers, Sony's revenue share accounted for about 60%, a YoY increase of 12%

The competition of imaging systems is more intense, and the variable aperture may become widely popular

In 2022, the shipment of mobilephone CIS decreased to approximately 4.52 Bil, a YoY decrease of about 15.8%

In 2022, due to factors such as international political conflicts and continuous epidemics, the global economy continued to be sluggish, and demand continued to decline. Superimposed on the impact of the overflow of upstream CIS inventory and the decline of the multi-camera trend, the entire mobilephone CIS market was cold in 2022. According to Sigmaitnell’s statistics, global mobilephone CIS shipments reached approximately 4.52 Bil in 2022, a YoY decrease of approximately 15.8%. After entering 2023, although China's epidemic policy has been relaxed and society is returning to normal, the improvement in consumption will take some time to recover. From the current situation, there is no obvious sign of improvement in the market. It is expected that the shipment of mobile phone CIS will continue to decline in 23Q1. Thanks to the successive introduction of policies such as government investment, market confidence will gradually recover. The market turnaround is expected in 23H2.

The average inventory of low- and mid-level pixels is more than six months, and wafer production capacity has entered a correction cycle

According to Sigmaintell's survey, as of January, the inventory of low- and mid-level pixels (such as 2M/8M/13M/16M) in the channel for finished and semi-finished products has reached more than six months. At the beginning of the year, therefore, chip makers decisively chose to suspend production or significantly reduce production at the beginning of 2023, which affected the capacity UT of CISs in upstream foundries.

Although upstream foundries have actively adjusted prices in 23Q1 to maintain customer production, in the downward cycle of the market environment, "price adjustments" or "transfer capacity" cannot improve the status quo in the short term. The direct reduction of production and supply will accelerate the decline of industry inventory and promote the industry to return to normal as soon as possible. Based on this, in 23H1, the pressure on the foundry of the mid-to-low-end pixel will increase sharply.

50M&+ pixels increased by 20% YoY, 1/1.6"&+ increased by more than 60% YoY

In 2022, the product structure upgrade trend of the mobilephone CIS market mainly focused on the high-pixel part, especially for mid-to-high-end phones, which have more aggressive demands for high pixel/large bottom/high image quality. Especially in the shipment scale of mobilephone CISs in 2022, two characteristics are more significant: first, the shipment of 50M and above pixels reached about 570 Mil., a YoY increase of about 20.6%; second, the optical size gradually expanded, Shipments of 1/1.6" and above size reached about 340 Mil., a YoY increase of 66.0%. It is estimated that in 2023, these two upgrading trends will continue to grow.

Benefiting from the strong demand from major customers, Sony's revenue share accounted for about 60%, a YoY increase of 12%

From the perspective of products, Sony insists “high resolution + large pixel” technical advantage strategy, which has successfully helped brand customers in mainland China raise the image of high-end mobile phones. Sony products focus on the high-end market and use high performance and high quality to maintain the stickiness of the high-end market. Samsung and Mainland chip makers have limited technical capabilities in large pixel technology. They mainly promote the small pixel technology, mainly to harvest the low-end market demand, and the profit margin is relatively low. They gain a certain market share by expanding the market volume and transforming it into an increase in revenue. From the perspective of customers, the close cooperation between Sony and Apple has created a win-win opportunity for both parties, and its latest technology will be given priority to its top customers to ensure product competitiveness and stable production capacity of top customers. Samsung and Mainland chip makers such as Omnivision and Galaxycore mainly cooperate closely with Mainland brands. While, mainland end customers are affected by international political factors, which affected the sales boom, resulting in losses for the cooperative chip makers. With the breakthroughs and upgrades of Mainland end brands in the high-end mobilephone CIS marker, the corresponding chip makers in 23H2 will have the opportunity to grow together.

The competition of imaging systems is more intense, and the variable aperture may become widely known

After the optical size of the CIS has been upgraded to a certain grade, it is difficult to continue to expand the chip size due to the limitation of the stacking of the set phone. As a result, supply chains have turned their attention to optical system upgrades.

First, head-end brands reach strategic cooperation with senior optical design makers, such as vivo and ZEISS, Xiaomi and Leica, oppo and Hasselblad, etc., through cooperation with professional optical design makers and designing with a professional optical lens. To establish a diverse color database and create a similar quality to an SLR camera.

Second, the upgrade effect of the main camera is the most intuitive. Therefore, in addition to upgrading the optical size of each brand, controlling the size of the aperture can also produce greatly different imaging effects. The advantage of the variable aperture is to control the depth of field to adjust the virtual reality of the background and foreground. The aperture affects the amount of light, a small aperture in the daytime under strong light can control the picture from bursting, and a large aperture in the dark at night can enhance the resolution of the picture. Therefore, in 2023, many brands will release new variable aperture solutions to improve image quality.