核心观点:

2022年全球智能手机处理器芯片出货量约12.4亿颗,5G渗透率约为52%

头部厂商竞争优势明显,高通获利130亿美金,净利润率29%,同比提升2.4个百分点

国际头部厂商持续承压、国产芯片挑战加剧

2022年全球智能手机处理器芯片出货量约12.4亿颗,5G渗透率约为52%

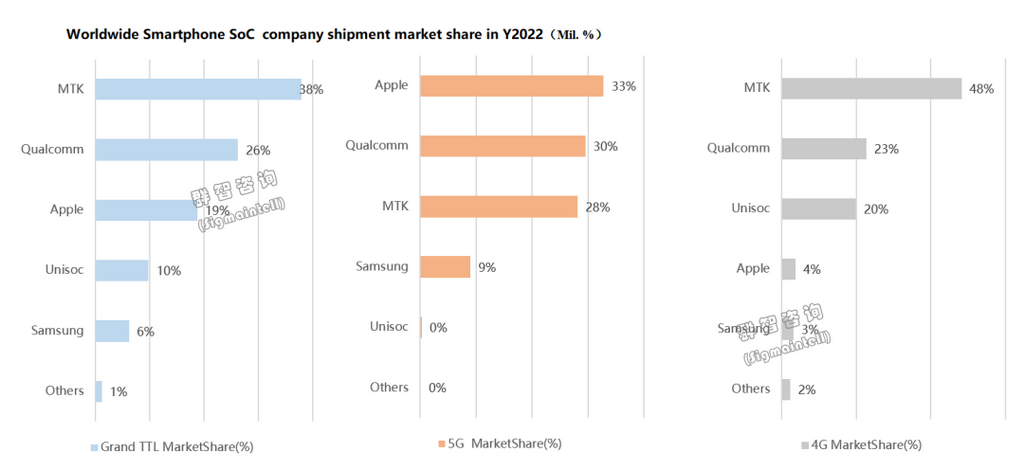

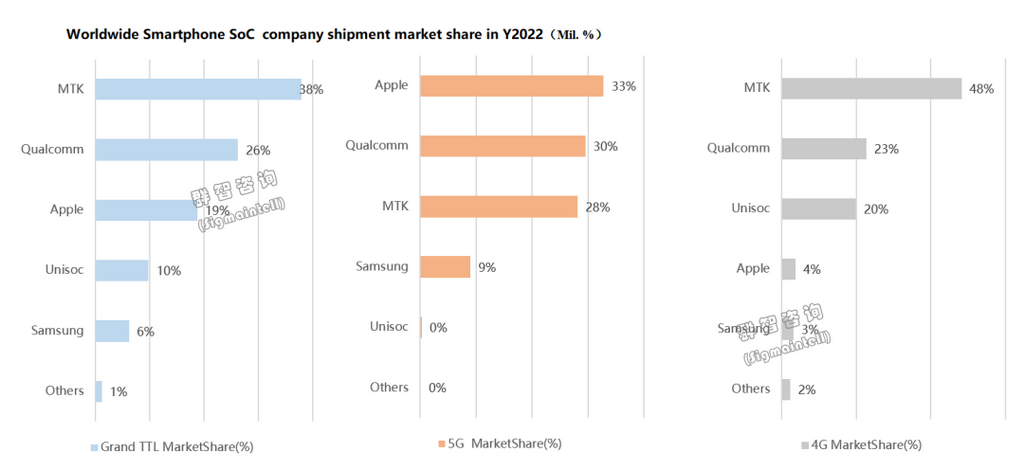

根据群智咨询(Sigmaintell)调查数据,2022年全球智能手机处理器芯片出货量约为12.4亿,其中4G处理器芯片出货量约为6.0亿颗,5G处理器芯片出货量约为6.4亿颗,全球5G处理器芯片的出货量的渗透率约为51.7%。受到处理器芯片库存及终端低迷需求等多因素影响,预计2023年全球智能手机处理器芯片出货将下滑到11.1亿颗,其中5G处理器芯片的渗透率预计将上升到62%左右。

头部厂商竞争优势明显,高通获利130亿美金,净利率29%,同比提升2.4个百分点

苹果(Apple):

头部厂商竞争优势明显,高通获利130亿美金,净利率29%,同比提升2.4个百分点

苹果(Apple):

从处理器厂商来看,苹果主要采用自研的A系列芯片,根据群智咨询(Sigmaintell)调查数据,2022年苹果的A系列处理器芯片出货量约为2.3亿颗,其出货量的市场份额约为19%。苹果不断稳固和台积电先进制程的代工关系,2023年的苹果A17处理器也会率先使用台积电的3nm先进制程,为iPhone 15新机的竞争力提供保障。

高通(Qualcomm):

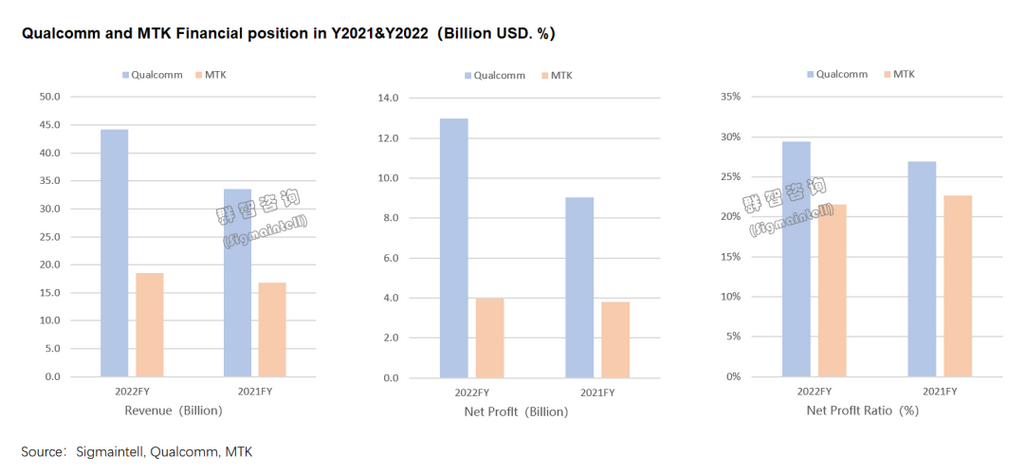

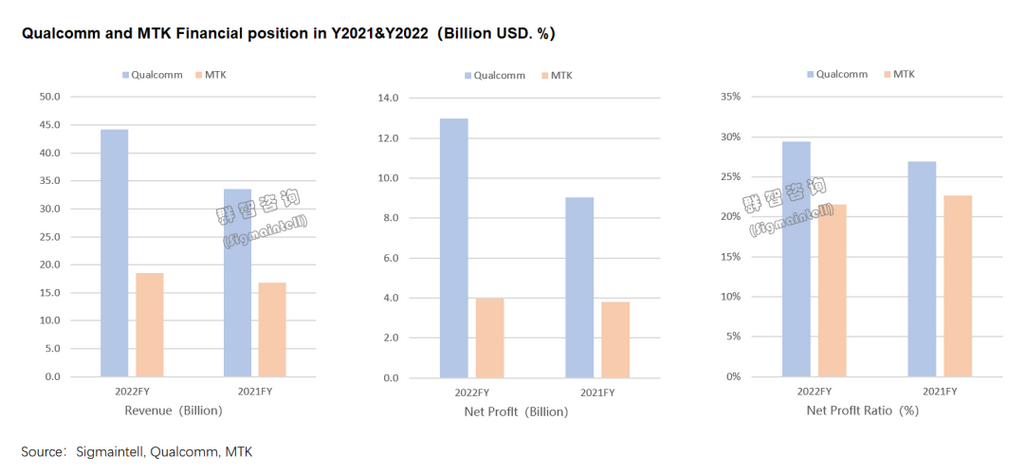

尽管受到芯片库存的影响,高通依然坚守“获利导向”。根据公司财报显示,高通2022财年营收442亿美元,净利润达到130亿美元,对比2021年增长40亿美元,主要得益于其不断优化自身产品结构,减少4G等成熟芯片的产出,同时在高附加值的高端旗舰芯片上持续占据稳固地位。2022年其净利润率约为29.4%,同比上升约2.4个百分点。根据群智咨询(Sigmaintell)调查数据,2022年高通智能手机处理器芯片的出货量约为3.3亿颗,其中5G芯片的出货量约为1.9亿颗,5G芯片的贡献率约为58%,高于市场平均水平。

联发科(MTK):

除了中低阶芯片的优势外,2022年联发科也不断在高端芯片上发力,先后发布了D9000/D8000等中高端手机处理器芯片,与高通在高端芯片上展开正面竞争。根据群智咨询(Sigmaintell)调查数据显示,2022年联发科的智能手机处理器芯片出货量约为4.7亿颗,其中5G芯片的出货量约为1.8亿颗,5G芯片的贡献率约为38%,低于行业平均水平。毋庸置疑,从处理器芯片的出货量绝对值来看,联发科的处理器芯片出货量较高通多出约1.4亿颗,具备一定的规模优势,但是从获利方面,仍然逊色于高通。根据财报显示,联发科全年营收约185亿美元,利润为40亿美元,营收对比2021年有将近20亿美元的提升。获利性方面,2022年其净利润率约为21.5%,随着库存压力以及芯片价格下行,其利润率同比却下降了1个百分点。单从净利润率考量,2022年其净利润率较高通差距约为7.9个百分点,同比2021年的4.3个百分点,差距在不断拉大。

三星(Samsung):

2022年三星的智能手机处理器芯片出货量约为7700万颗,其主要供应为三星手机,5G芯片的贡献率约为75%。其大陆客户主要为vivo,受到2021年的合作关系影响,2022年其出货大陆的芯片受到一定影响。展望2023年,受到三星晶圆技术代工等多因素影响,三星的Exynos 2300芯片从量产转为研发,其高端旗舰系列的处理器芯片也全部从高通采购,势必会影响到其2023年业务表现。

紫光展锐(Unisoc):

紫光展锐目前是唯一一家拥有4G和5G产品的国内手机处理器厂商,其2022年智能手机处理器芯片出货量约为2.2亿颗,其5G芯片出货贡献率不足2%,仍然以4G芯片为主。在2021年的“芯片缺货潮”中,紫光展锐获得了大量订单,4G的产品已被三星、传音、OPPO等客户使用,而其5G产品,T760、T770、T820也已推出,但终端品牌的反馈略微保守。处理器芯片由2021年的“缺货”转为2022年“过剩”的过程中,其受到的影响也略为显著,来自头部高通和联发科的竞争压力也在加大,如何在“供应过剩”的环境中,寻求有效的市场策略显得尤为重要。

国际头部厂商持续承压、国产芯片挑战加剧

国际头部厂商持续承压、国产芯片挑战加剧

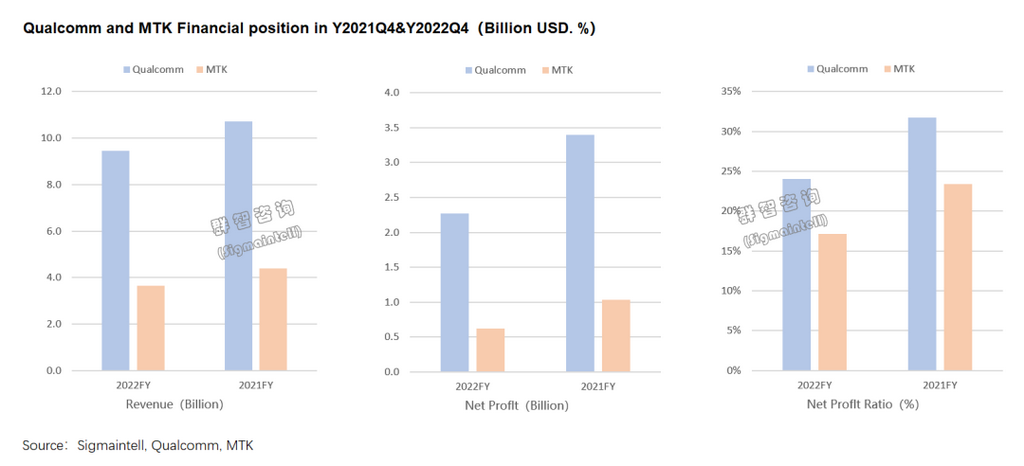

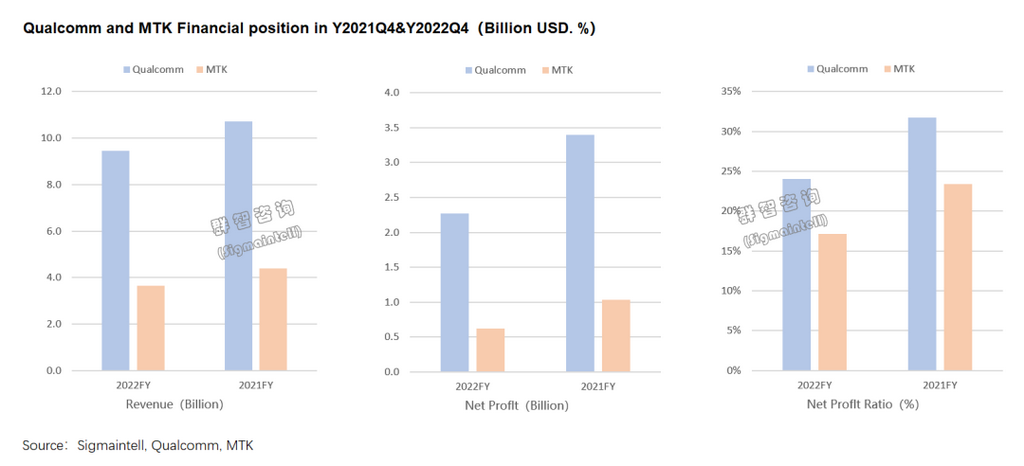

回看2022年,受俄乌战争,国内疫情封控,能源危机等影响,消费电子市场一直处于低迷的状态。尤其是进入下半年,终端厂商把重点放在清理库存上,对于手机处理器的提货时间也往后延,这一现象传导到手机处理器厂商,致使其四季度的财务数据出现了下滑。根据财报数据显示,2022年四季度高通净利润率为24%,而联发科的净利润率仅为17%,对比2021年第四季度均减少了7-8个百分点。

进入到2023年,头部芯片处理器厂均下调了今年出货量目标,将经营重点放在保产品利润上。在芯片供应过剩且受到地缘政策干扰的状况下,国内三家手机处理器厂商(紫光展锐、瓴盛、海思)面对的挑战也更加严峻。“短期看现金流、长期看产品”,寻找适合的产品市场策略将成为国内芯片厂的布局之道。

英文:

Y22 global smartphone SoC shipments were about 1.24 Bil, and the 5G penetration rate was about 52%

Core Topics:

英文:

Y22 global smartphone SoC shipments were about 1.24 Bil, and the 5G penetration rate was about 52%

Core Topics:

In 2022, the global smartphone SoC shipments were about 1.24 Bil, and the 5G penetration rate was about 52%

Leading makers have obvious competitive advantages. Qualcomm made a profit of 13 Bil USD, with a net profit margin of 29%, an increase of 2.4% YoY

Global leading makers continue to be under pressure, and mainland chip makers’ challenges intensify

In 2022, the global smartphone SoC shipments were about 1.24 Bil, and the 5G penetration rate was about 52%

According to Sigmaintell’s survey data, the global smartphone SoC shipments in 2022 were about 1.24 Bil, of which the 4G SoC shipments were about 600 Mil, and the 5G SoC shipments were about 6.4 Mil. The penetration rate of global 5G SoC shipments was about 51.7%. Affected by multiple factors such as SoC inventory and sluggish end demand, it is expected that global smartphone SoC shipments will decline to 1.11 Bil in 2023, and the penetration rate of 5G SoCs is expected to rise to about 62%.

Leading makers have obvious competitive advantages. Qualcomm made a profit of 13 Bil USD, with a net profit margin of 29%, an increase of 2.4% YoY

Apple:

From the perspective of SoC makers, Apple mainly uses self-developed A-series chips. According to Sigmaintell’s survey data, Apple’s shipments of A-series SoCs were about 230 Mil in 2022. The market share was about 19%. Apple continues to strengthen its foundry relationship with TSMC's advanced manufacturing process. The Apple A17 SoC in 2023 will also be the first to use TSMC's 3nm advanced manufacturing process to provide protection for the competitiveness of the new iPhone 15.

Qualcomm:

Despite the impact of chip inventory, Qualcomm still adheres to the "profit orientation.” According to the company's fiscal report, Qualcomm's fiscal year Y22 revenue was 44.2 Bil USD, and its net profit reached 13 Bil USD, an increase of 4 Bil USD compared with 2021. At the same time, it continues to occupy a solid position in high-end flagship chips with high added value. In 2022, its net profit margin was about 29.4%, a YoY increase of about 2.4%. According to Sigmaintell’s survey data, in 2022, Qualcomm shipped about 330 Mil smartphone SoCs, of which 5G chips shipped about 190 Mil, and the contribution rate of 5G chips was about 58%, which is higher than the industry average.

MTK:

In addition to the advantages of mid-to-low-end chips, MTK also continued to make efforts on high-end chips in 2022. It has successively released mid-to-high-end smartphone SoCs such as D9000 and D8000. And it will compete head-on with Qualcomm on high-end chips. According to Sigmaintell’s survey data, MTK shipped about 470 Mil smartphone SoCs in 2022, of which 5G chips shipped about 180 Mil, and the contribution rate of 5G chips was about 38%, which is lower than the industry average. Undoubtedly, from the absolute value of SoC shipments, MTK’s SoC shipments were about 140 Mil more than Qualcomm’s, which has a certain scale advantage, but it is still inferior to Qualcomm in terms of profitability. According to the Y22 fiscal report, MTK’s annual revenue was about 18.5 Bil USD, with a profit of 4 Bil USD. Compared with 2021, its revenue has increased by nearly 2 Bil USD. In terms of profitability, its net profit margin was about 21.5% in 2022. With inventory pressure and chip prices falling, its profit margin dropped by 1% YoY. From the perspective of net profit margin, the gap with Qualcomm’s net profit margin in 2022 is about 7.9%, compared with 4.3% in 2021, and the gap is gradually widening.

Samsung:

In 2022, Samsung's smartphone SoC shipments were about 77 Mil, its main supply was Samsung smartphones, and the contribution rate of 5G chips was about 75%. Its mainland customers are mainly vivo. Affected by the partnership in 2021, its chips shipped to the mainland in 2022 were affected. Looking forward to 2023, Samsung’s Exynos 2300 chip has shifted from mass production to R&D due to factors such as Samsung’s foundry technology and its high-end flagship series SoCs are all purchased from Qualcomm, which will inevitably affect its business performance in 2023.

Unisoc:

Unisoc is the only mainland smartphone SoC maker with 4G and 5G products. Its smartphone SoC shipments in 2022 were about 220 Mil, and its 5G chip shipments contributed less than 2% and were mainly based on 4G chips. In the "chip shortage tide" in 2021, Unisoc received a large number of orders. 4G products have been used by customers such as Samsung, Transsion, and OPPO, and its 5G products, T760, T770, and T820, have also been launched. Feedback from end brands is conservative. In the process of changing from "out of stock" in 2021 to "oversupply" in 2022, Unisoc was slightly affected. The competitive pressure from Qualcomm and MTK is also increasing. How to deal with "oversupply" in such an environment is particularly important to seek effective marketing strategies.

Global leading makers continue to be under pressure, and mainland chip makers’ challenges intensify

Looking back at 2022, the consumer electronics market has been in a slump due to the impact of the R-U war, the mainland epidemic lockdown, and the energy crisis. Especially in 22H2, end makers focused on destocking and delayed the delivery time of smartphone SoCs. This phenomenon was transmitted to smartphone SoC makers, resulting in a decline in their Q4 financial data. According to fiscal report data, Qualcomm's net profit margin in 22Q4 was 24%, while MTK's net profit margin was only 17%, which is a decrease of 7-8% compared with 21Q4.

Entering 2023, head chip SoC makers have lowered their shipment targets for this year, focusing on ensuring product profits. Under the situation of oversupply of chips and interference from geopolitical policies, the challenges faced by the three mainland smartphone SoC makers (Unisoc, JLQ, HiSilicon) are also more severe. "Look at cash flow in the short term, and look at products in the long term", and finding a suitable product market strategy will become the layout of mainland chip makers.