Geopolitical conflicts, inflation, and the epidemic have caused global demand to shrink more than expected.

2022 is about to pass halfway through; the world has not recovered from the epidemic, the geopolitical conflict between Russia and Ukraine continues, global hyperinflation and many other factors have affected the economic recovery as expected, and the TV market demand has fallen into a deep recession. In North America, the epidemic dividend has subsided, combined with demand overdraft and persistently high inflation, and demand is not expected to recover; in Europe, due to the continued impact of geopolitical conflicts, the cost of living has risen due to high energy prices, TV demand has been suppressed, and shipment demand has fallen sharply YoY; other Emerging economies are also affected by the U.S. dollar interest rate hike and inflation. It is difficult to expect the economy to recover in the short term, and TV demand may remain sluggish for a long time. The Chinese market is affected by the epidemic and the economy is facing severe challenges. Constrained consumption power has led to continued sluggish demand.

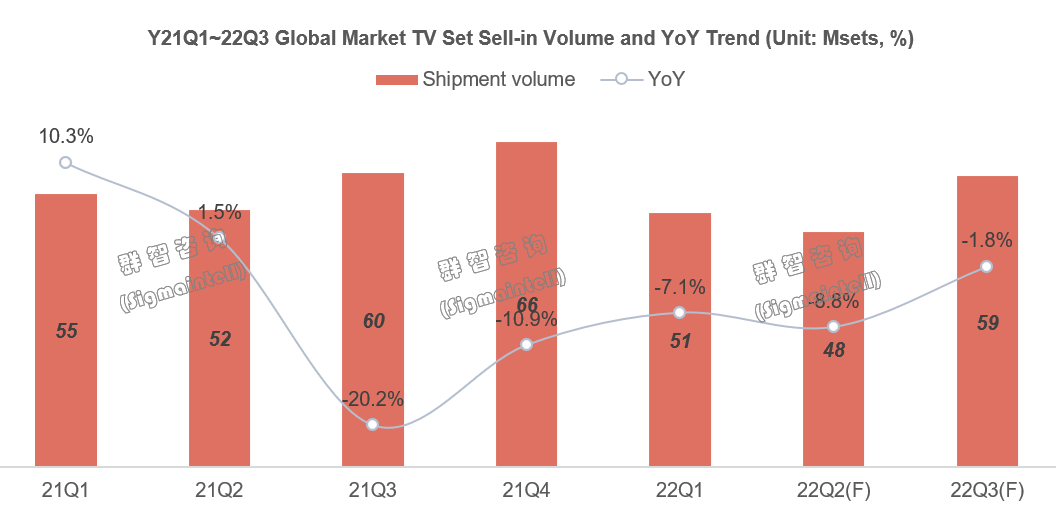

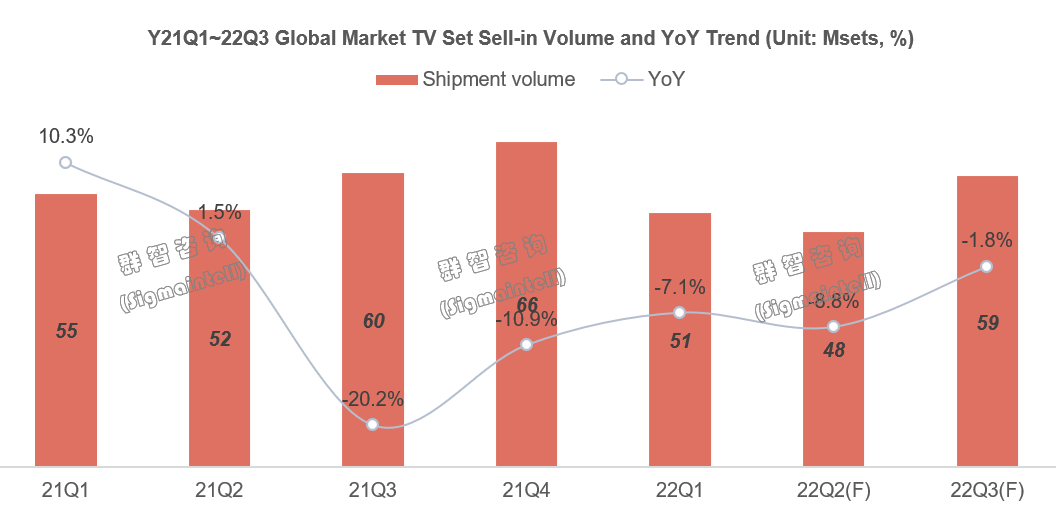

According to research data from Sigmaintell, the number of global TV shipments in 22Q1 fell by 7.1% YoY. In 22Q2, demand contracted more than expected, and the decline in shipments is expected to expand to 8.8% YoY. In the second half of the year, the demand situation is still not optimistic. It is expected that the global TV market shipments will drop to 222 million units in 2022, a YoY decline of 4.9% and a record low in the past ten years.

Brand concentration has increased, and leading brands have tightened their procurement to resist the cold winter of the market.

Brand concentration has increased, and leading brands have tightened their procurement to resist the cold winter of the market.

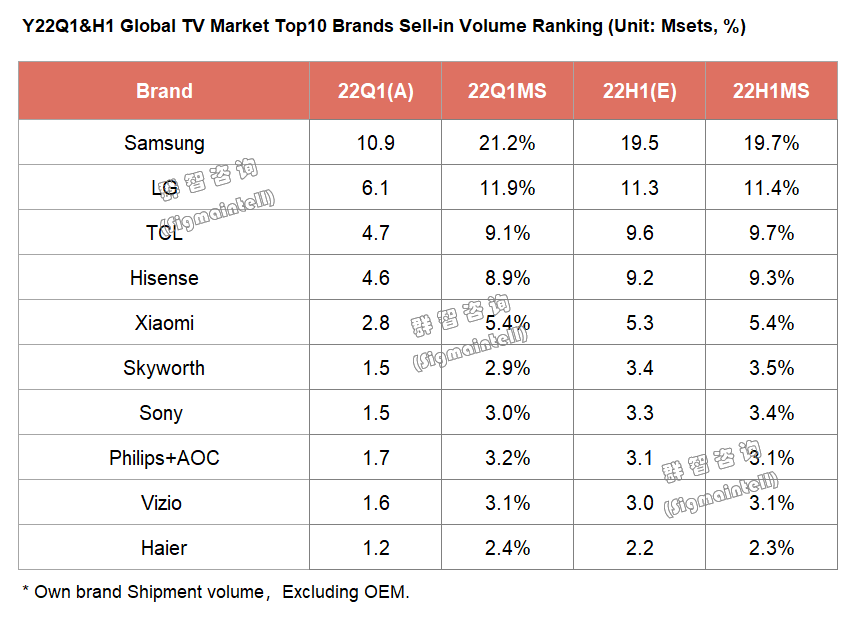

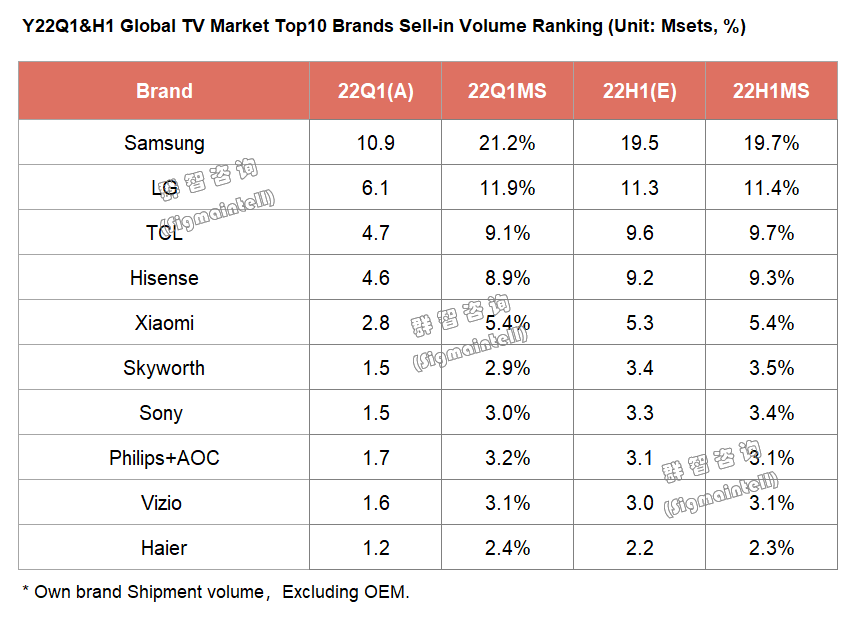

Since the outbreak of the epidemic in 2020, the dividend of the epidemic has pushed up the demand for TVs. Affected by demand overdraft and the recovery of economic fundamentals not as expected, global TV demand has contracted, and market volatility has intensified. In the downward market cycle, leading brands maintain strong competitiveness in the global TV market by their outstanding advantages such as globalization, rich product lines, and integration of core supply chain resources.

(1) Samsung has been greatly affected by the fall in demand in Europe and the United States, especially after the outbreak of the Russian-Ukrainian geopolitical conflict, the global TV shipment plan has been lowered several times, and the actual achievement is much lower than expected. Overall, shipments in the first quarter were stable, but shipments in the second quarter were far less than expected. It is expected that the global TV shipments in the first half of the year will be less than 20 million units, a YoY decline. It is expected to ship slightly more than 40 million units this year, and it is still difficult to achieve growth under the blessing of OLED. Samsung will join the OLED TV camp in 2022, but the delay of WOLED products may affect its conservative strategy on OLED TV technology. In an environment where the cost advantage of LCD TVs is prominent, it will focus on LCD product promotions, and the high-end market will actively expand the market share of Mini LED backlight TVs. At the same time, the panel procurement strategy began to shrink at the end of the first quarter. Under the influence of lower- than-expected terminal demand, inventory control will be the primary goal.

(2) The high-end demand for LGE and Sony in the European market was not as expected, and global hyperinflation had an impact on OLED TV sales. At the same time, under the multiple pressures of Samsung and other Chinese brands' strong promotion, the shipments of these two brands in the first half of the year were lower than expected. The OLED TV market also fell into the predicament of slowing shipment growth and declining profitability, and its contribution to brand shipments declined throughout the year. Since LGE maintained a relatively high level of procurement in the first quarter, it began to shrink its procurement strategy in the second quarter to control the continuous growth of inventory. Sony's procurement strategy continues to be conservative and implements the strategy of on-demand procurement. On the whole, from the second quarter to the third quarter, global brands will be affected by the sluggish overseas end demand, and the panel purchasing demand will remain conservative.

(3) Although the overseas market demand for Hisense has declined, the Vidda brand has grown rapidly in the Chinese online market. In the first half of the year, despite the decline in the Chinese market, shipments increased by more than 20% YoY. It is expected that the annual shipments will increase YoY, and the market share will continue to rise.

(4) TCL was affected by the downturn in overseas markets. Although the sub-brand Thunderbird performed well in the Chinese market, the overall performance was still lower than expected. It is estimated that the global shipment in the first half of the year will be less than 10 million units, a YoY decline of more than 10%. The procurement strategy has continued to shrink since the second half of 2021. The current inventory is at a healthy level. The global market is about to enter the peak sales season in the second half of the year. Without the impact of inventory burden, TCL has a prominent cost competitive advantage in the end market in the second half of the year. It is expected to have a better performance.

(5) MI has changed its market strategy in China. Instead of promoting growth with low prices, MI hopes to achieve a balance between profit and market share growth. However, due to the impact of Hisense and TCL sub-brands, it is difficult to increase the domestic market share. While MI still actively expands the overseas business and seek new growth. In the first half of the year, its global shipments are expected to exceed 5 million units, which is the same as the same period last year.

The TV market needs to get rid of "pseudo-upgrade" to promote growth.

The TV market needs to get rid of "pseudo-upgrade" to promote growth.

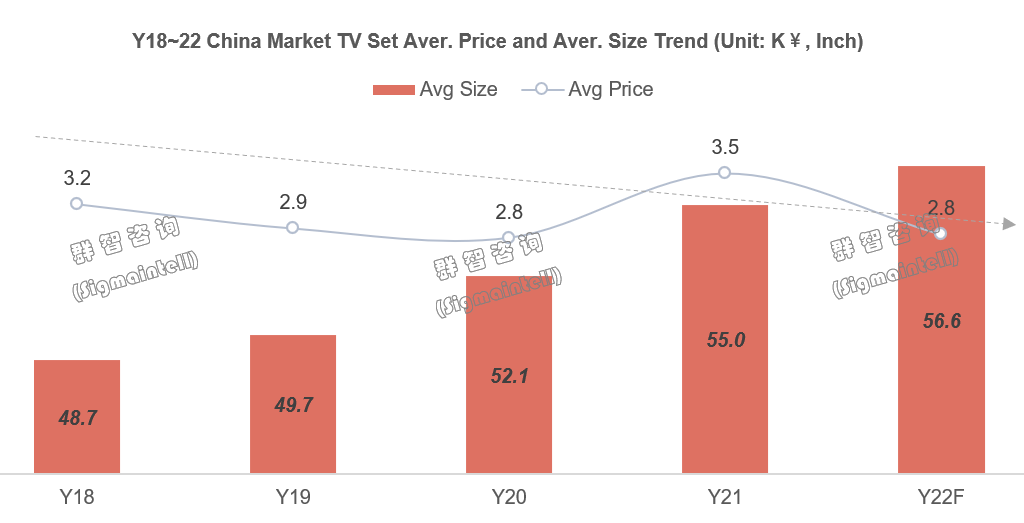

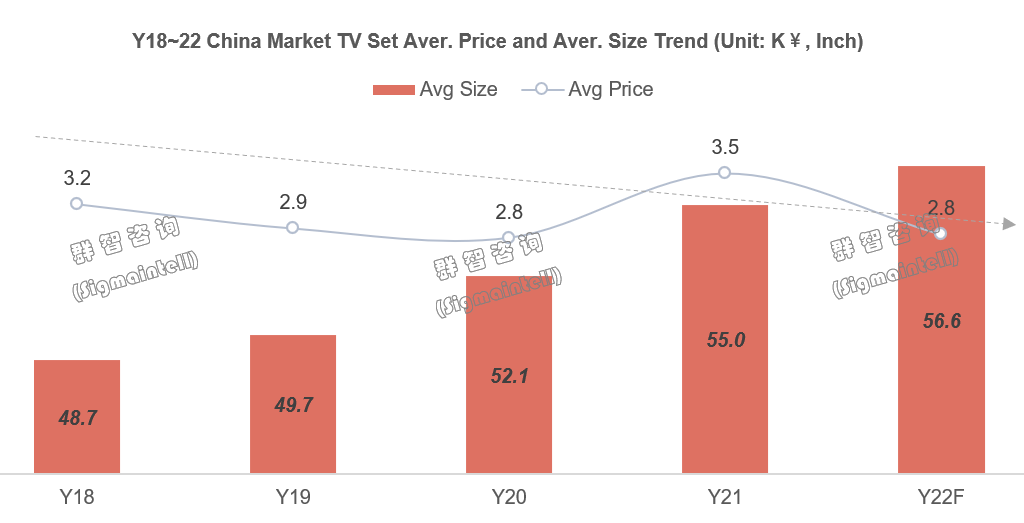

The global TV market is almost saturated, and the economic recovery is not as good as expected, restraining the growth of the TV market. How to break through the industrial bottleneck and achieve a “price” increase while the “quantity” decreases? Sigmaintell believes that there is a "pseudo-upgrade" phenomenon in the current TV market; that is, technological upgrades have not brought about industrial value-added and user stickiness. The best evidence is that the increase in the penetration rate of large size and high resolution has not brought about an increase in the average price of the industry, and the increased investment in new technologies in the industry chain has failed to obtain a corresponding return in the end market, so it is called "Pseudo-Upgrade". Therefore, from the perspective of the healthy development of industrial value, the primary solution for the current period is to get rid of "pseudo-upgrade" and establish a real product upgrade path.

Upgrading the refresh rate - is an important technical choice to improve the user experience.

Upgrading the refresh rate - is an important technical choice to improve the user experience.

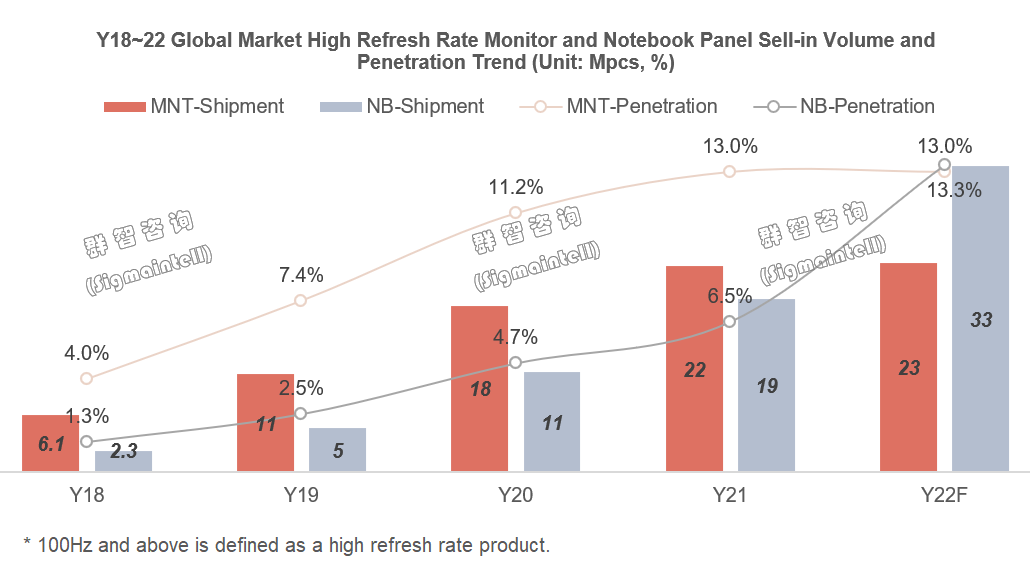

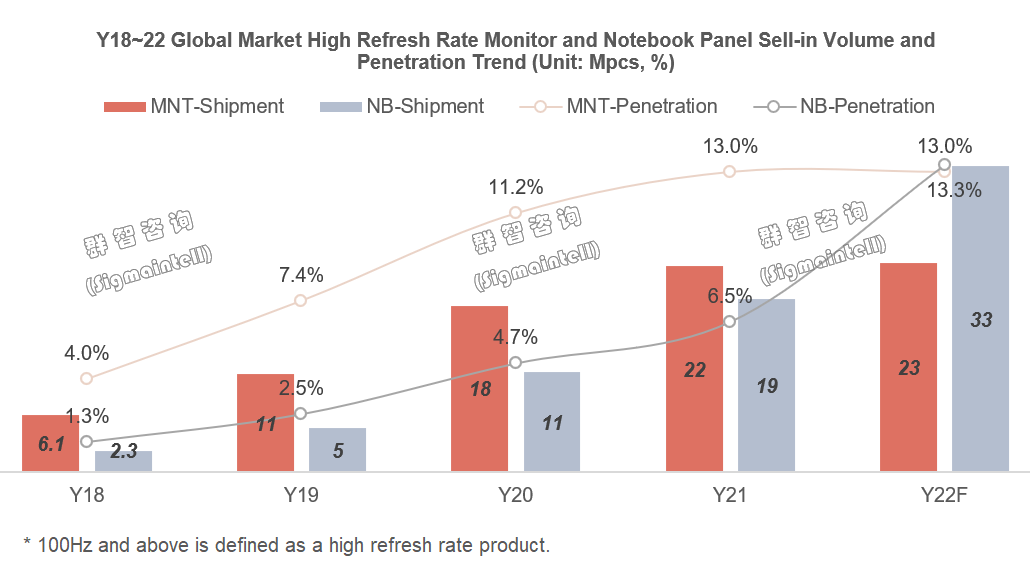

Driven by the scenarios of interconnection and multi-screen collaboration of various categories, the current trend of integration of smart devices in various applications and product trends in applications such as smartphones, laptops, and monitors have an increasingly significant impact on TV, such as the hot-selling gaming TV shows the desire of gaming users for high-performance large screens, and the launch of smart displays shows the personalized needs of movie-watching users. Observing the product trends of smartphones, notebooks, and monitors, we can see that high refresh rates have gradually become the trend of product upgrades and have driven steady growth in product mix and average price.

Therefore, we think about whether it is possible to promote TV products to usher in a real product upgrade through the upgrade of the refresh rate. The refresh rate upgrade can share the learning experience of other categories in terms of IC resources, panel technical capabilities, etc., the learning curve is shorter, and the probability of success in the market is also higher.

From the perspective of TV products, after years of industry development, the current high-brush ecosystem, including panels, decoding chips, HDMI2.1 high-flow interfaces, and signal sources, is almost mature.

From the perspective of consumer demand, to meet the growing demand for audio-visual entertainment of young consumers, high-refresh TVs can present users with coherent and tear-free pictures when dealing with dynamic scenes such as game competitions and action movies, making users more Immerse themselves in the picture itself, bringing a comprehensive improvement in the visual sense.

From the perspective of brand strategy, including global brands such as Samsung, LG, and Sony, as well as major Chinese brands such as TCL, Hisense, Skyworth, MI, etc., through the launch of market-focused products such as game TVs, the gradual popularization of high-browsing TVs has been achieved, on the one hand, to avoid price competition. , improve product profitability, and on the other hand, promote product structural upgrading.

From the perspective of panel supply, the active layout of high-brush panels of 120Hz and above, including BOE, CSOT, AUO, LGD, and other mainland and South Korean and Taiwanese head panel makers, provides supply support for the growth of high-brush TV scale. According to research data from Sigmaintell, the global shipments of 120Hz high-brush panels will exceed 25 million in 2022, a YoY increase of over 30%.

With the expansion of the market scale, the cost gap can be further reduced, and the profit margin of the industrial chain can be improved through product upgrades. But it is worth mentioning that any technological upgrade requires more investment, and the superposition of costs needs to be reflected through the pricing of end products. Therefore, upgrading product specifications must truly improve the user experience to support real product upgrades.

Overall, based on the active investment of panel, IC, and set brands, Sigmaintell maintains an optimistic forecast for the end scale of high refresh rate TVs. It is estimated that in 2022, the global shipment of high-brush TVs will reach 23 million units, and the penetration rate will increase to more than 10%.

Strong human-computer interaction - refine usage scenarios and optimize usage experience.

Strong human-computer interaction - refine usage scenarios and optimize usage experience.

As a home display center, the TV should actively expand its segmented usage scenarios, such as gaming TV, social TV, educational TV, etc. Enhance human-computer interaction, such as adding a touchpad to the remote control; camera AI recognition gesture control, high-recognition voice control and touch, convenient screen projection, and other settings. In the process of expanding new scenes and improving details, it is particularly important to improve the user experience while highlighting the large screen and high image quality of the TV.

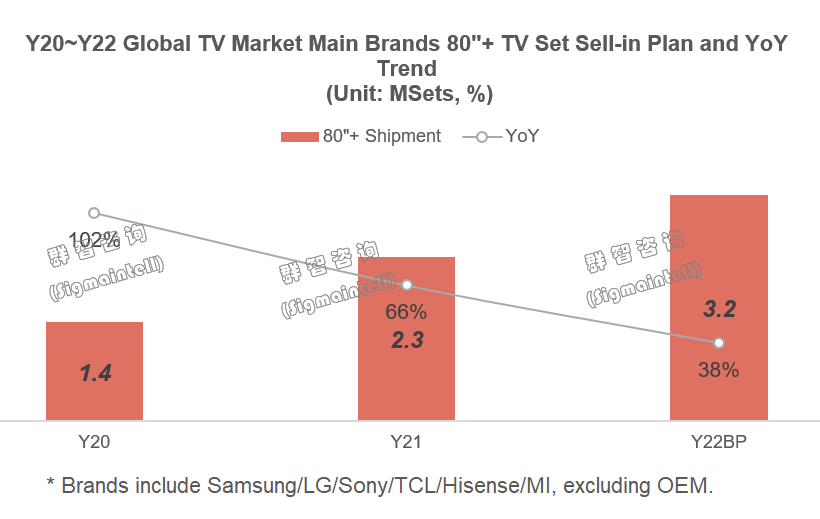

Extra large size - mention home decoration specifications outside, enjoy immersive view inside.

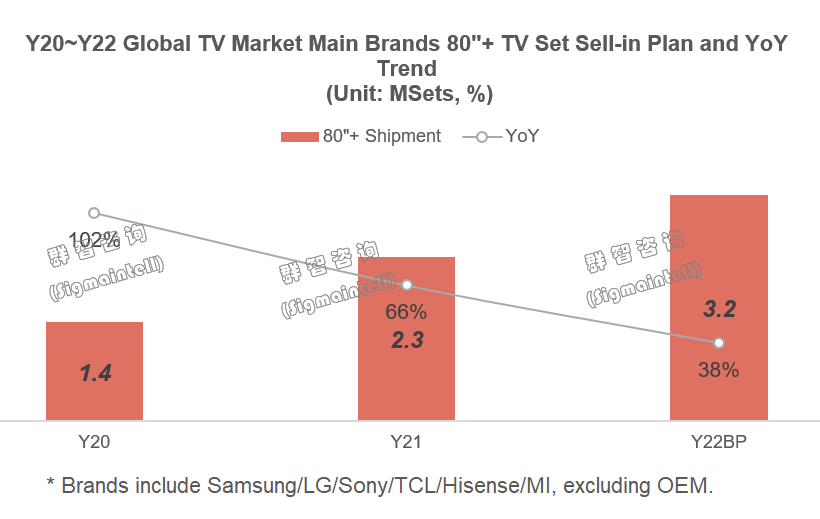

Installing 80"+ super-sized TVs into the living room has become the choice of more and more consumers. While improving the home decoration specifications, it also enhances the immersive experience of watching movies and games. With the development of the G8.6-line sleeve cutting capacity out, the supply of 80"+ TV panels has been greatly improved. At the same time, the brand strategy is also active due to the better profitability of oversized products. According to research data from Sigmaintell, in 2022, the global TOP 6 TV brand makers plan to have more than 80" TVs totaling more than 3 million units, an increase of nearly 40% YoY. Among them, Chinese brands including MI, TCL, and Hisense are in the Chinese market. Oversized products are actively deployed, and their market share continues to rise.

2022 will be a difficult year. Hyperinflation caused by geopolitical conflicts and a possible food crisis will have a profound impact on the global TV market in the future. In the downward cycle of the global TV market, the upstream and downstream supply chains should actively seek real value growth space for TV products, focus on market segments, actively explore potential application scenarios, improve product value, and get rid of "pseudo-upgrades" to promote growth through upgrades to resist the impact of shrinking demand on business operations.

中文:

电视市场下行,价值增长空间何在?

地缘冲突、通胀、疫情多因素导致全球需求超预期收缩

2022年即将过半,全球尚未真正从疫情走出,俄乌地缘冲突持续,全球超级通胀等诸多因素影响下,经济恢复不如预期,电视市场需求陷入深度衰退。北美地区疫情红利消退叠加需求透支以及持续高通胀影响,需求并未期待恢复;欧洲地区受地缘冲突持续影响,能源价格高涨带来生活成本攀升,电视需求被抑制,出货需求同比大幅下滑;其他新兴经济体亦受美元加息以及通胀影响,经济短期恐难以期待恢复,电视需求恐将在较长一段时间内维持低迷;中国市场受疫情影响经济面临严峻挑战,消费力受抑制致使需求持续低迷。

根据群智咨询(Sigmaintell)研究数据显示,2022年一季度全球电视出货数量同比下降了7.1%,二季度需求超预期收缩,预计出货数量同比降幅扩大到8.8%。而下半年需求形势依然不容乐观,预计2022年全球电视市场出货量回落至2.22亿台,同比下滑4.9%,创近十年历史新低。

品牌集中度提升,头部品牌收紧采购抵御市场寒冬

自2020年疫情爆发至今,疫情红利推升电视需求暴涨,受需求透支以及经济基本面恢复不如预期的影响,全球电视需求收缩,市场震荡加剧。在市场下行周期中,头部品牌凭借全球化布局,丰富的产品线,以及核心供应链资源整合等突出优势,在全球电视市场中维持强劲竞争力。

(1) 三星电子(Samsung)受欧美需求回落影响大,尤其是俄乌地缘冲突爆发后,全球电视出货计划多次下调,实际达成情况远低于预期。整体来看,一季度出货稳定,但二季度出货远不及预期,预计上半年全球电视出货规模不到2000万台,同比回落。预计今年全年出货略高于4000万台,在OLED加持下依然难以达成增长。三星2022年加入OLED电视阵营,但WOLED产品延迟,恐影响其对OLED电视技术策略转保守,在LCD 电视成本优势凸显的环境下将聚焦LCD产品促销,高端市场积极扩大MiniLED背光电视的市场份额。同时一季度末开始面板采购策略收缩,在终端需求不如预期的影响下将以控库存为首要目标。

(2) LG电子(LGE)和索尼(Sony)欧洲市场高端需求不如预期,全球超级通胀对OLED电视销售产生冲击,同时,在三星以及其他中国品牌强势促销的多重压力下,这2个品牌上半年出货不及预期。OLED电视市场亦陷入出货增速放缓及盈利能力下降的困境,全年对品牌出货的贡献下降。LG电子由于一季度维持较高水平采购,二季度开始收缩采购策略,控制库存持续增长。索尼采购策略则持续保守,基本执行按需采购的策略。整体来看,二季度至三季度国际品牌受海外终端需求低迷影响,面板备货需求维持保守。

(3) 海信(Hisense)虽海外市场需求下滑,但Vidda品牌在中国线上市场增势迅猛,上半年在中国市场大盘下滑的情况下出货逆势同比增长超20%,预计全年出货有望同比增长,市占率持续攀升。

(4) TCL受海外市场低迷影响明显,中国市场虽然子品牌雷鸟表现抢眼,但整体表现依然不及预期,预计上半年全球出货不足1000万台,同比下滑超10%。采购策略自2021年下半年开始持续收缩,目前库存处于健康水位,下半年全球市场即将进入销售旺季,TCL在没有库存包袱影响下,其下半年在终端市场成本竞争优势凸显,有望期待有较好的表现。

(5) 小米(MI)在中国市场策略来有所转变,不再以低价促增长,而是希望在获利和市场份额增长之间获取平衡。但受到来自海信和TCL子品牌的冲击,内销市场份额难以增长。依然积极拓展海外业务,寻求新增量。上半年预计全球出货量超500万台,与去年同期持平。

电视市场需要摆脱“伪升级”以升级促增长

全球TV市场几近饱和,经济恢复不如预期抑制电视市场规模增长,如何突破产业瓶颈,在“量”减的情况下,实现“价”增?群智咨询(Sigmaintell)认为,当前电视市场存在着“伪升级”现象,即技术升级并未带来产业增值和用户粘性提升。最好的证据便是大尺寸和高解析度渗透率的提升并未带来行业均价的提升,产业链为新技术增加的投资未能在终端市场获得与之相应的回报,因此称之为“伪升级”。因此,从产业价值良性发展的角度来看,当期首要解决的是摆脱“伪升级”,建立真正的产品升级路径。

升级刷新率-提高用户体验的重要技术选择

在各品类互联互通、多屏协同的场景带动下,当前各应用智能终端呈现融合的趋势,智能手机、笔记本电脑和显示器终端等应用的产品趋势对TV终端的影响越来越显著,如:游戏电视热卖展现了电竞用户对高性能大屏的需求渴望,智慧显示器的推出则展现了观影用户对个性化的需求。观察智能手机、笔记本和显示器终端的产品趋势,可以看到高刷新率已逐渐成为产品升级的趋势,并带动产品结构和均价稳中增长。因此,我们不妨思考是否可以通过刷新率的升级来推动TV产品迎来真正的产品升级。

刷新率升级在IC资源、面板技术能力等方面可以共享其他品类的学习经验,学习曲线更短,在市场面的成功概率也更高。

从电视产品角度,经多年行业发展,目前包括面板,解码芯片,HDMI2.1大流量接口以及信号源等高刷生态系统几近成熟,120Hz“全通道“支撑高刷电视扩张市场规模已是水到渠成。

从消费需求角度,为迎合年轻消费群日益增长的影音娱乐需求,高刷新电视在应对比如游戏竞技、动作电影的动态场面时,能够为用户呈现出连贯、无撕裂感的画面,让用户更加沉浸于画面本身,带来视觉感官上的全面提升。

从品牌策略角度,包括三星、LG、索尼等国际品牌以及TCL、海信、创维、小米等主要中国品牌,通过推出游戏电视等聚焦细分市场产品,实现高刷电视逐步普及,一方面规避价格竞争,提升产品盈利性,另一方面促进产品结构性升级。

从面板供应角度,包括京东方(BOE)、TCL华星(CSOT)、友达(AUO)以及LG显示(LGD)等大陆及韩台头部面板厂对120Hz及以上高刷面板的积极布局,为高刷电视规模增长提供了供应支撑。群智咨询(Sigmaintell)研究数据显示,2022年全球120Hz高刷面板出货规模将超过2500万片,同比增长超30%。

随着市场规模的扩大,可进一步缩小成本差,产业链的利润率得以通过产品升级提升起来。但值得一提的是,任何技术升级都需要投入更多成本,而成本的叠加需要通过终端产品定价体现出来。因此,提升产品规格要真正给用户带来体验感的提升,才能支撑真正的产品升级。

总体来看,在面板、IC和终端品牌积极投入的基础上,群智咨询(Sigmaintell)对高刷新率电视的终端规模保持乐观预测,预计2022年全球高刷电视出货规模达2300万台,渗透率提升到10%以上。

强人机交互-细化使用场景,优化使用体验

电视作为家庭显示中心,应积极拓展细分使用场景,如游戏电视、社交电视、教育电视等。增强人机交互,如遥控器加装触控板,摄像头AI识别手势操控,高识别度声控以及触控,便捷投屏等设置,在新场景拓展和细节改善过程中提升消费者使用舒适度,突出电视大屏高画质的同时,提升使用体验尤为重要。

超大尺寸-外提家装规格,内享沉浸视野

80"+超大尺寸电视逐步进入客厅,成为越来越多消费者的选择。提升了家装规格的同时提升观影,游戏的沉浸式体验感。随着G8.6代线套切产能的开出,大大提升了80"+电视面板的供应。同时,由于超大尺寸产品具备更好的盈利能力,品牌策略积极。群智咨询(Sigmaintell)研究数据显示,2022年全球TOP 6 电视品牌厂商80"以上电视规划总计超300万台,同比增幅近40%,其中小米、TCL、海信在内的中国品牌在中国市场对超大尺寸产品布局积极,市场占比持续攀升。

2022年将是艰难的一年,地缘冲突引发的超级通胀以及可能到来的粮食危机等因素均对未来全球电视市场产生持续深刻的影响。在全球电视市场下行的周期中,上下游供应链应积极寻求电视产品真正的价值增长空间,聚焦细分市场,积极开拓潜力应用场景,提升产品价值,摆脱“伪升级”以升级促增长,从而抵抗需求收缩对企业运营带来的冲击。