In 2022, the world experienced the Russo-Ukrainian war, the energy crisis, and high inflation. Fluctuations in the macro environment have significantly impacted the global consumer electronics market. With all kinds of uncertainties in the post-epidemic era, we have entered the turbulent year of 2023. At the macroeconomic level, it may be difficult to expect high growth, and the global TV market will also maintain weak demand.

In 2023, the global TV market will have weak demand, and the number of shipments will decrease by 0.8% YoY

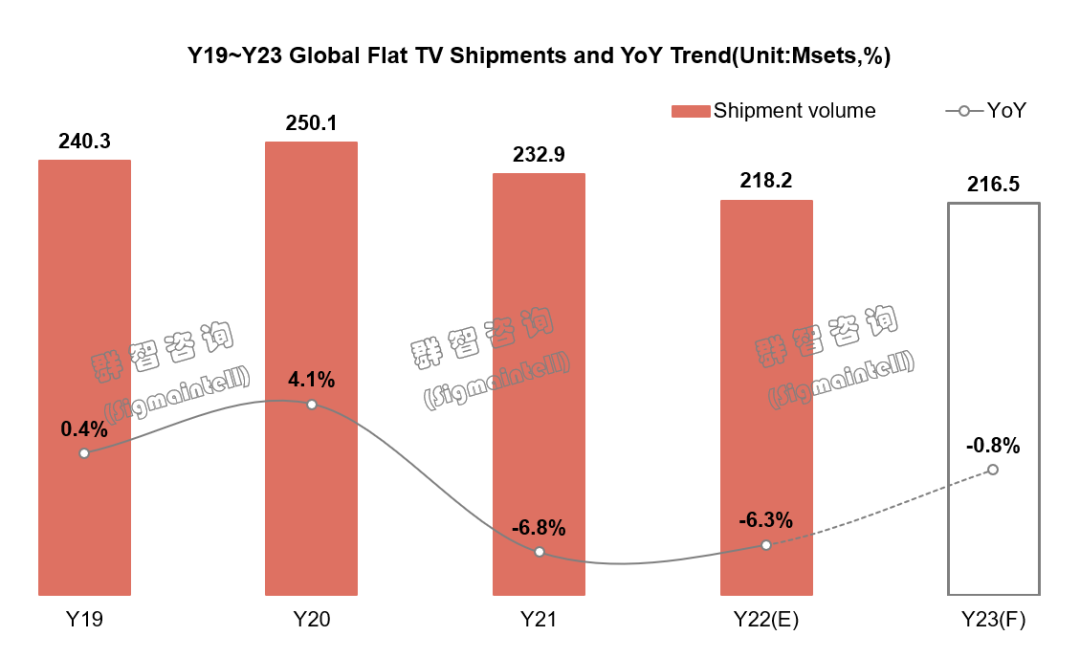

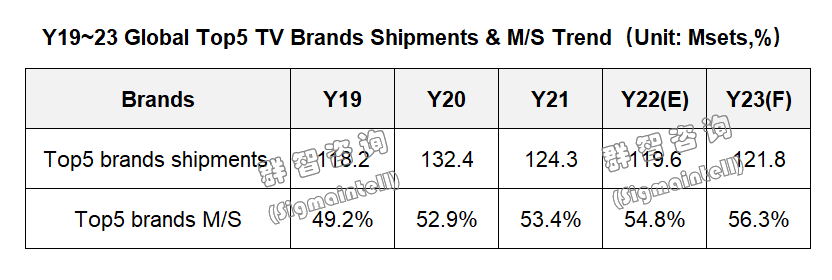

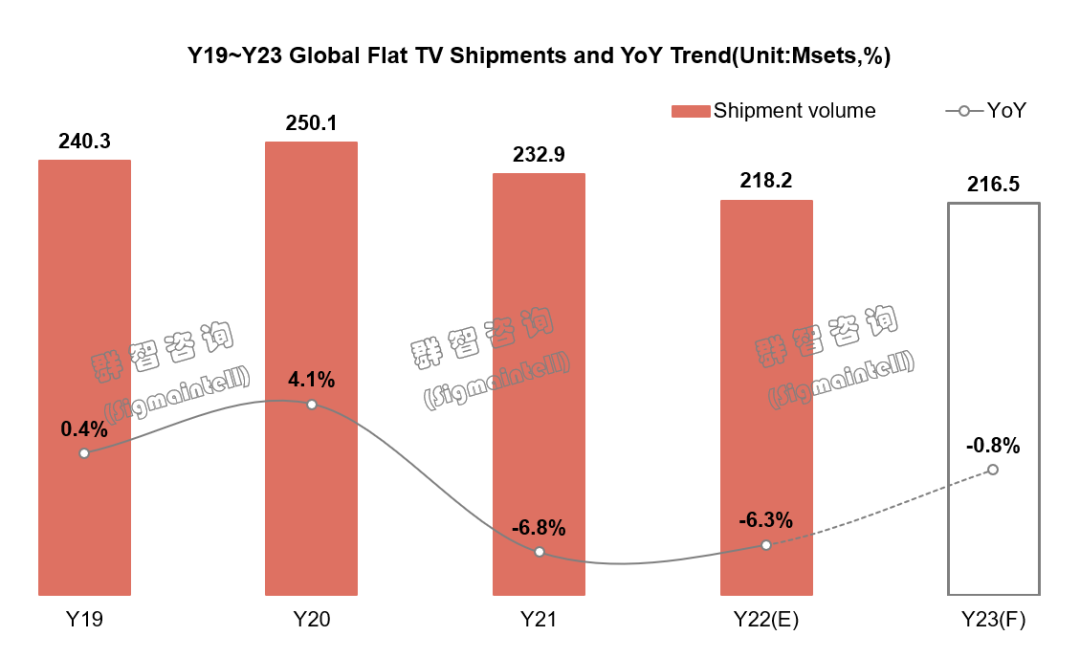

According to Sigmaintell’s statistics, the global Flat TV shipments in 2022 were 218 Msets, a YoY decrease of 6.3%. It is estimated that the shipments in 2023 will be 217 Msets, a YoY decrease of 0.8%. Y23 Market demand will remain weak on a low basis.

The brand competition pattern has formed four competitive classes, and the competition in the second class has intensified.

The brand competition pattern has formed four competitive classes, and the competition in the second class has intensified.

Judging from the shipment performance of brands in 2022, international brands have suffered heavy losses due to the sharp drop in overseas market demand, while the performance of Chinese brands has been stable. Among them, Hisense has grown against the trend and has an outstanding performance.

According to Sigmaintell’s statistics, the global TV brand competition is undergoing a class differentiation, forming four competitive classes, as can be seen from the ranking of the global Top 15 brands’ own-brand shipments.

The first class is dominated by Samsung Electronics and maintains a clear competitive advantage. With the support of its years of brand accumulation and perfect global layout, it will maintain its leading position for a long time.

The second class is represented by LGE, and the Chinese brands Hisense and TCL, which have maintained a growth momentum in recent years, also joined the second class and competed fiercely with LGE for the second and third places.

The third class is a group of brands led by Xiaomi, including Skyworth and Sony, which occupy the 4th to 10th place in the global TV brand rankings.

The fourth class is other brands. The global annual shipment of a single brand is less than 5 Msets, and the global competitiveness of those brands has weakened.

Five Opportunities in the Global TV Market and Supply Chain in 2023

Five Opportunities in the Global TV Market and Supply Chain in 2023

Although demand in the global TV market will remain weak in 2023, and most brands may face the dual challenges of declining scale and profits, there are still many opportunities and potential tracks in the market. Overall, Sigmaintell forecasts that five major opportunities exist in the global TV market in 2023:

1. Regional incremental opportunities in the N/A and S&East Asia market

1. Regional incremental opportunities in the N/A and S&East Asia market

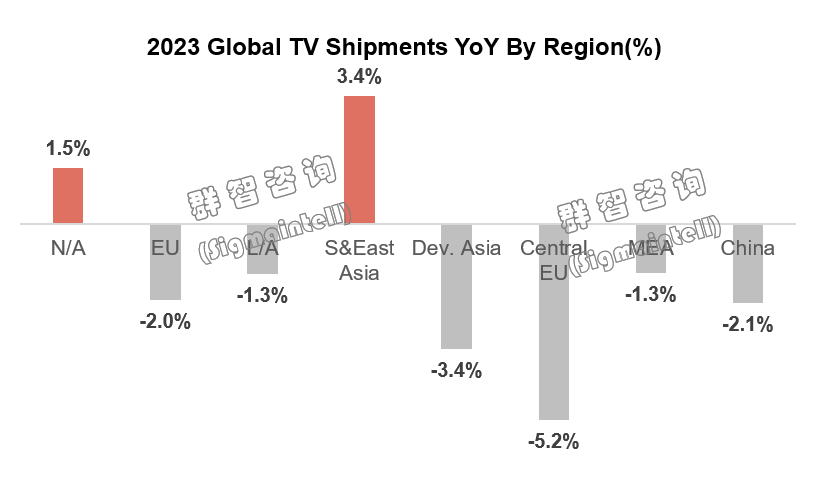

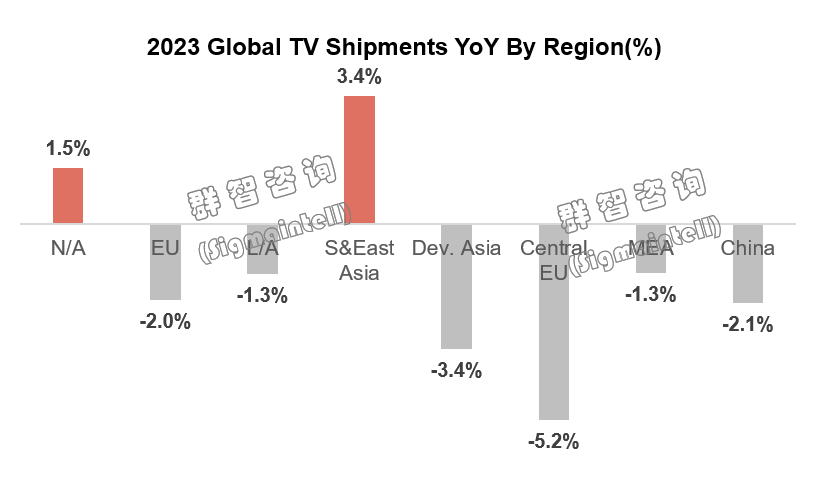

As inflationary pressures continue, economic recovery in various regions of the world will face different resistances in 2023, so TV demand will show regional differentiation. Sigmaintell forecasts that TV demand in N/A and S&East Asia is expected to grow YoY in 2023, driven by economic growth support and cost reduction. While other regions are still dragged down by the macro economy, and demand growth may be difficult to resume.

In 2023, the N/A TV market is expected to undergo both scale and structure upgrades. Compared with other regions, the economic performance of N/A is more stable, and the purchasing power of consumption remains strong, which has certain support for demand. At the same time, driven by a sharp drop in logistics costs and key material costs, the TV shipments in the N/A market will increase by 1.5% YoY in 2023, and the upgrade of the size structure can be expected to drive large-size demand.

In 2023, the S&East Asia market is expected to grow by 3.4% YoY and continue high growth. The S&East Asia market has a large population base and a low penetration rate of Flat TVs. In the context of continuously undertaking the transfer of manufacturing industries from mainland China, its economic vitality and consumer purchasing power are also increasing, and it is expected to become the engine for the stability and recovery of the global TV market.

2. Driven by cost and product segmentation, the market demand for 65"+ super-large size will turn from decadent to prosperous in 2023

2. Driven by cost and product segmentation, the market demand for 65"+ super-large size will turn from decadent to prosperous in 2023

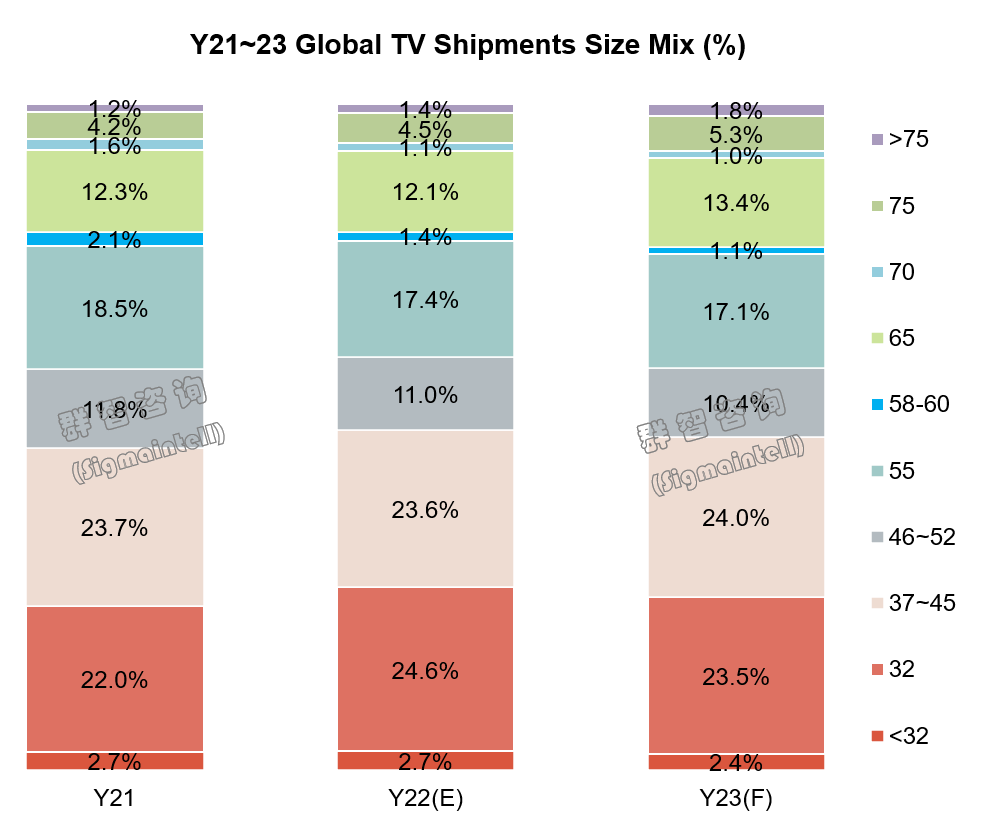

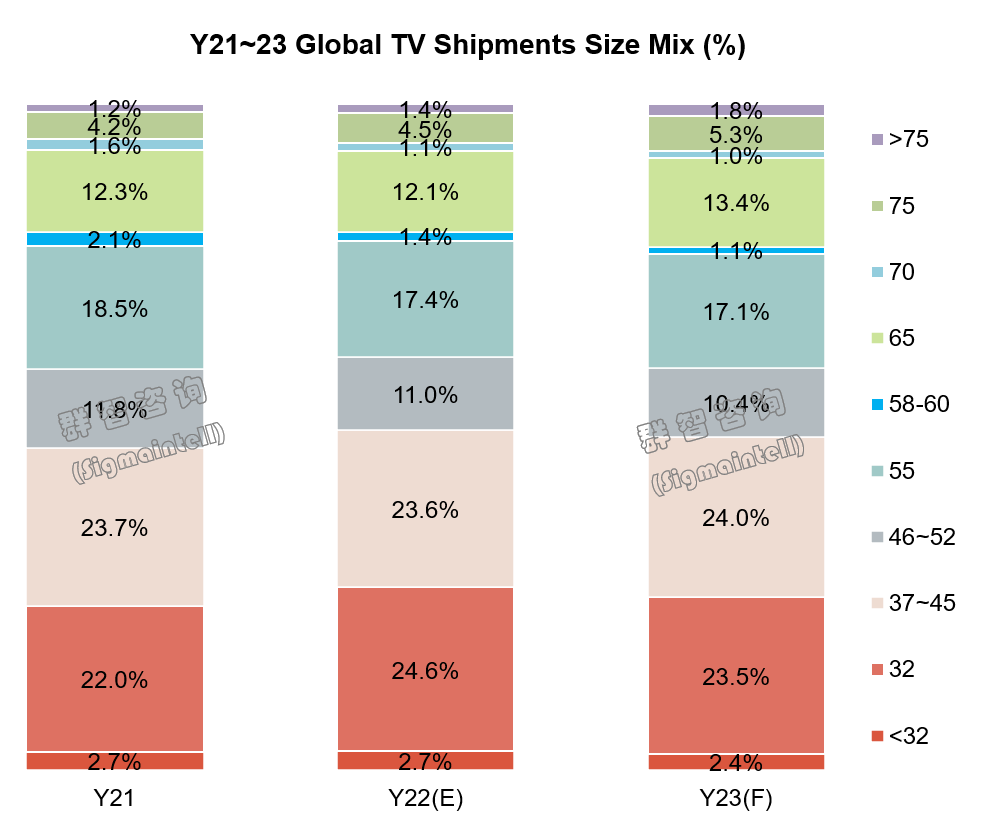

In 2022, the average size of the global TV market dropped YoY for the first time in nearly ten years. However, in 2023, driven by a sharp drop in costs, the global TV size structure will accelerate its upgrade, with the average size increasing by 0.7 inches. Sigmaintell believes that the upgrade of size structure is mainly shown in the following two aspects:

① The decline in panel prices will increase the space for end promotions. Emerging markets are expected to promote 43" to replace 32". The share of the 43" size segment in the global TV market will exceed 32" in 2023.

②The 65"+ super-large size will usher in greater market growth space. According to Sigmaintell’s statistics, in 2023, 65" shipments will increase by 9.4% YoY, 75" will increase by 16.4% YoY, and 75"+ super-large sizes will increase by 24.6% YoY. Under the expectation of a weakening overall market, the super-large size’s shipment scale will continue to grow, so its market share will also increase.

In the large-size market, with the release of G10.5 capacity, the panel supply capacity has increased, and the cost has been reduced. So, 65"/75" size has become the preferred size of living room TV. In recent years, with the increasing supply of 80"+ panel makers in mainland China, brand makers have aggressively deployed around 85"/86"/98". Leading brands hope to seize the opportunity in the super-large size market and gradually form the 85" brand camp led by Samsung/Sony/Hisense/TCL and the 86" brand camp led by LGE/Xiaomi. Sigmaintell believes that in the short term, whether it is panel supply or brand camp layout, 85" has a relative scale competitive advantage in the TV market. Some brands will actively push the strategy of "large size + Mini LED BLU" to enhance the share and competitiveness of LCD TV products in the high-end market. Overall, the effect of cost reduction will appear in the end market, and the continuous product segmentation improvement from panels to brands will provide users with more accurate products. Sigmaintell believes that in 2023, super-large-size products will play a big role in the TV market.

3. Re-exploration of subdivided tracks, high refresh rate, and Mini LED BLU TVs usher high growth

3. Re-exploration of subdivided tracks, high refresh rate, and Mini LED BLU TVs usher high growth

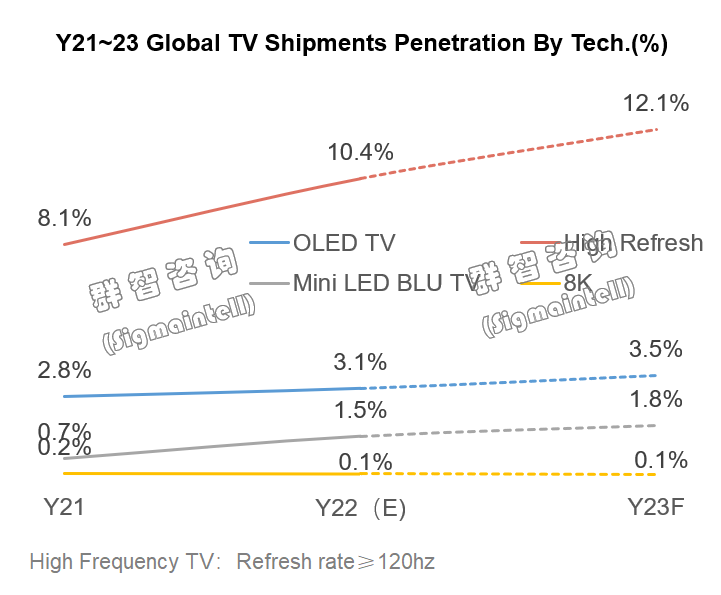

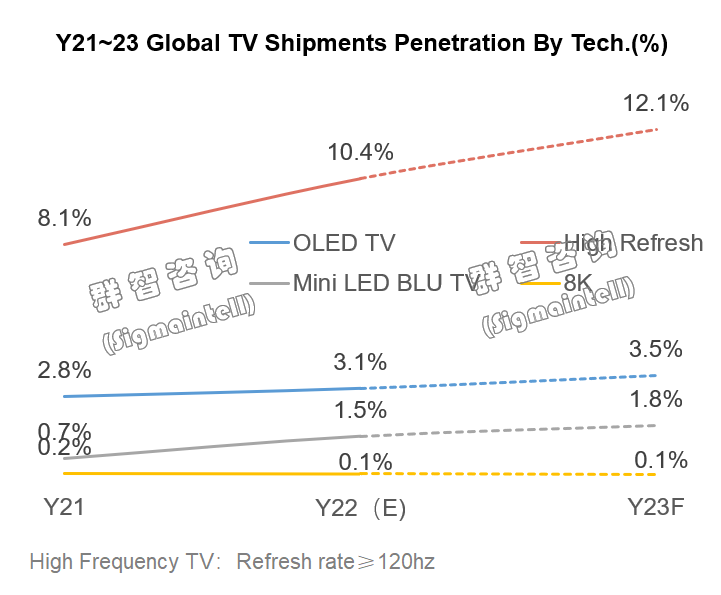

Regarding the subdivision track, Sigmaintell believes that after 4K TV and Smart TV are popularized in major markets, the global TV market has not yet formed a new stable growth subdivision track. Although OLED TVs have grown in scale, they continue to be affected by the price spread brought about by LCD price fluctuations. In recent years, they have been harassed by Mini LED BLU TVs, and the growth pace has slowed down. Due to its high-end product positioning, 8K TV does not have a competitive cost advantage, and under the trend of energy saving and the policy of carbon peaking and carbon neutrality, the problem of high energy consumption needs to be solved urgently by tech. The scale growth in the past two years has been lower than expected, and the penetration rate has remained low. Under the active deployment of brand strategies, high refresh rate and Mini LED BLU TVs are expected to usher in sustained high growth in the next two years.

First, for high frequency TV, from the perspective of the consumer base, it can cover younger people, especially cross-device consumers attracted from IT devices. From the perspective of product experience, it can bring consumers a better viewing experience, especially in the experience of watching sports events, movies, and gaming, which can bring more stable and clearer display images. From the perspective of cost and price spread, as the cost of materials decreases, the overall cost difference between 60hz and 120hz TVs is expected to shrink in the future. Therefore, Sigmaintell believes that there is potential for the popularization of high frequency TVs. According to Sigmaintell’s statistics, in the global TV market, the penetration rate of high frequency TVs has exceeded 10% in 2022 and is expected to reach 12.1% in 2023.

Mini LED BLU TVs are expected to usher in accelerated growth in 2023, mainly due to the following three reasons: First, due to the deterioration of the operating conditions of OLED TVs, brands will pay more attention to balance in the competition of high-end products. In addition, the enthusiasm for the layout of LCD products will increase. Secondly, the brand seeks to lower the product positioning of Mini LED BLU TV to the mid-end, and it is expected that more products with 100-level divisions will be launched to further promote the growth of scale and market sinking. Finally, with the reduction of material costs and the improvement of yield rate, the overall cost of the Mini LED BLU solution will maintain a large decrease. According to Sigmaintell’s statistics, the global shipment of Mini LED BLU TVs was 3.2 Msets in 2022, and it is expected to reach 4 Msets in 2023, and the penetration rate will increase from 1.5% to 1.8%. In the long term, the growth of the penetration rate depends on the brand strategy, the speed of the product market sinking, promotion, and consumer education.

4. Under the Matthew Effect, the share of Top5 will increase again, and leading brands will maintain their competitive advantage

4. Under the Matthew Effect, the share of Top5 will increase again, and leading brands will maintain their competitive advantage

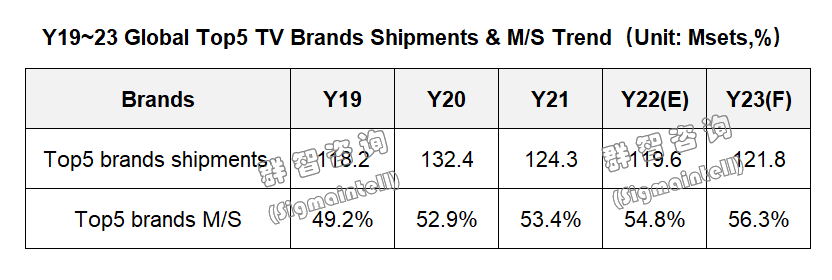

Compared with other consumer electronics markets, although the concentration in the global TV market is low, it has still shown a trend of increasing concentration in recent years, which is reflected in the continuous increase in the market share of leading brands than decreasing brand power of other brands. According to Sigmaintell’s statistics, the market share of the top 5 global TV brands has dropped from less than 50% before the epidemic to 54.8% in 2022 but is expected to increase further to 56.3% in 2023.

Sigmaintell believes that there are two main reasons for the increase in brand concentration.

First, the global trade environment fluctuates. In the case of high global trade barriers and turbulent trade relations, brands with mature global layouts and operating experience have more resources to make reactions. But for small and medium-sized brands, they have greater resistance to active expansion.

Second, the supply share of the upstream panel continues to gather with mainland makers, which drives the localization of the supply chain. Driven by panel resources, compared with other consumer electronics categories, the overall TV supply chain is more Chinese. From this point of view, Chinese TV brands with global layout capabilities, rich experience in supply chain management, and keen business sense have won growth opportunities. Therefore, Sigmaintell believes that TV brands with advantages in global layout, supply chain management, and stable operation will maintain a leading competitive position in the global market competition in the future.

5. Restructuring supply chain relationships, brands will pay more attention to supply chain robustness

The upstream panel market has suffered huge losses after undergoing in-depth adjustments. The panel supply pattern is undergoing drastic changes. Korean makers are accelerating their shift to the OLED track. The future supply structure of the panel market is still facing the possibility of mergers and acquisitions, and the supply chain relationship between brands and panel makers is highly dependent and complementary. For TV brands, supply chain management will be one of the most important factors affecting brand competitiveness. The panel supply chain must not only be "stable" to ensure long-term stability of panel supply and guarantee the growth of the brand scale, but also be "flexible" enough to ensure efficient supply chain management and higher bargaining initiative, so as to maintain a competitive advantage for the brand in terms of product cost and efficiency.

The current situation is also an important window for the reconstruction of the relationship between brands and the panel supply chain. TV brands should not only flexibly adjust short-term procurement strategies according to internal sales plans and the rhythm of market supply and demand fluctuations to maximize short-term benefits, but also prepare to adjust the supply chain system according to long-term goals and changes in the upstream panel supply chain pattern. Sigmaintell believes that the overall direction of TV brand supply chain management is to improve supply chain robustness to establish a supply chain relationship with both stability and flexibility. The more changeable the environment, the more important robustness is.

中文:

2023年全球TV市场展望:大盘维持弱需求,存五大发展机会

2022年经历了俄乌战争、能源危机以及高通胀,宏观环境的动荡给全球消费电子市场带来了显著冲击。伴随着后疫情时代的种种不确定性,我们步入了依然动荡的2023年,宏观经济层面恐将难以期待高增长,而全球电视市场大盘亦将维持弱需求。

2023年全球电视大盘弱需求,出货数量同比下降0.8%

群智咨询(Sigmaintell)统计数据显示,2022年全球平板电视出货规模为2.18亿台,同比下降6.3%,预计2023年出货为2.17亿台,同比下降0.8%,大盘需求在低位基础上维持弱势。

品牌竞争格局形成四个竞争梯队,第二梯队竞争加剧

从2022年品牌出货表现来看,国际品牌受海外市场需求大幅回落的影响出货遭受重创,而中国品牌表现则相对稳定,其中海信更是逆势增长,表现抢眼。

群智咨询(Sigmaintell)统计数据显示,从全球Top15品牌的自有品牌的出货数量排名可以看到,全球电视品牌竞争正在发生分层变化,形成四个竞争梯队。

第一梯队以三星电子独占鳌头,且保持明显的竞争优势,在其多年品牌积累,完善的全球化布局等支撑下将在较长时间保持领先优势。

第二梯队以LGE为代表,以及近几年保持增长势头的中国品牌海信和TCL也加入第二梯队,并与LGE就第二名和第三名展开激烈争夺。

第三梯队则是以小米领衔的一众品牌,包括创维、索尼等分别占据全球电视品牌排行榜的第4~第10位。

第四梯队则是其他品牌,其单一品牌全球年度出货规模不到500万台,自有品牌在全球的竞争力走弱。

2023年全球电视市场和供应链存五大机会

尽管2023年全球电视市场大盘需求维持弱势,大部分品牌恐将面临规模和利润下滑的双重挑战,但市场依然存在诸多机会点和潜力赛道。整体来看,群智咨询(Sigmaintell)认为,2023年全球电视市场存在以下五大机会点:

1. 北美/东南亚市场存区域性增量机会

伴随着控通胀压力持续,2023年全球各个区域的经济恢复面临不同的阻力,电视需求将呈现区域分化的特点。群智咨询(Sigmaintell)预计,北美和东南亚市场在经济增长支撑和成本下降的驱动下,2023年电视需求有望迎同比增长,而其他区域则依然受宏观经济的拖累,需求恐难恢复增长。

2023年北美电视市场有望迎规模及结构双升级。相较其他区域,北美的经济表现更加稳健,消费购买力维持强劲,对需求有一定的支撑。同时,在物流成本及核心材料成本大幅下降的推动下,2023年北美市场电视出货规模将同比增长1.5%,尺寸结构升级推动大尺寸需求可期。

2023年预计东南亚市场同比增长3.4%,并有望持续高增长。东南亚市场人口基数大,平板电视普及率低。在不断承接来自中国大陆制造业转移的背景下,其经济活力和消费者购买力亦不断增强,其有望成为全球电视市场大盘稳定及恢复的引擎。

2. 成本和产品细分化驱动,2023年65“+超大尺寸市场需求将由颓转盛

2022年全球电视市场平均尺寸现近10年来的首次同比下降。预计2023年在成本大幅下降的推动下有望带动尺寸结构加速升级,平均尺寸增长0.7英寸。群智咨询(Sigmaintell)认为,尺寸结构升级主要表现在以下2个方面。

①面板价格下降推动终端促销空间加大,新兴市场有望推动43“进一步替代32“,预计2023年全球电视市场43”尺寸段的份额将超过32“。

②65“+超大尺寸迎来更大的增量空间。群智咨询(Sigmaintell)统计数据显示,预计2023年65“出货同比增长9.4%,75“同比增长16.4%,75”+超大尺寸同比增长24.6%,在大盘走弱的预期下,其出货规模保持增长,市场份额亦将明显提升。

在大尺寸市场中,随着G10.5代线产能的释放带动面板供应能力提升及成本下降,65“/75“已然成为客厅电视的首选尺寸。而近年来随着中国大陆面板厂对于80“+供应的增加,品牌厂商围绕着85”/86“/98”布局激进,头部品牌希望在超大尺寸市场中抢占先机,并逐步形成了以三星/索尼/海信/TCL 为首的85“品牌阵营以及以LGE/小米为首的86”品牌阵营。群智咨询(Sigmaintell)认为,短期来看不管是面板供应还是品牌阵营布局,在电视市场中85“具备相对规模竞争优势。另一方面,在OLED电视短期增长艰难的预期下,预计大部分头部品牌将会更加积极推进“大尺寸+MiniLED背光”的策略以提升LCD 电视产品在高端中的份额和竞争力。总体来看,成本下降的效果将在终端市场显现,而从面板到品牌不断的产品细分化将给用户提供更精准的产品,群智咨询(Sigmaintell)认为,2023年超大尺寸产品在电视市场中将大有作为。

3. 细分赛道再探索,高刷新率及MiniLED 背光电视迎高增长

关于细分赛道,群智咨询(Sigmaintell)认为,4K TV、Smart TV在主要区域市场普及后,全球电视市场尚未形成稳定增长的细分赛道。OLED 电视尽管规模增长,但持续受到LCD价格波动带来的价差影响,近年来更受到Mini LED背光电视的侵扰,增长步伐放缓。8K 电视受自身产品定位过高,不具备成本竞争优势,且在节能双碳趋势下,高能耗问题亟待技术改善,近两年规模增长低于预期,渗透率维持低位。而高刷及MiniLED 背光电视在品牌策略积极布局下,未来两年有望迎来持续高增长。

首先,高刷电视High frequency TV,从用户群来看,高刷电视可覆盖的人群更为年轻化,特别是从IT设备中吸引来的跨品类用户。从产品体验来看,给消费者带来更好的观看体验,尤其是在观看体育赛事、电影大片和玩游戏的体验中,可以带来更稳定和更清晰的显示画面。从成本和价差来看,随着材料成本下降,60hz和120hz电视的整体成本未来有望进一步缩小,因此,群智咨询(Sigmaintell)认为,高刷电视存在普及化的潜力。群智咨询(Sigmaitnell)统计数据显示,全球TV市场中,高刷电视2022年的渗透率已超10%,预计2023年将达到12.1%。

MiniLED背光电视2023年有望迎来加速增长,动因主要有以下三点:首先,因OLED电视的运营状况恶化,品牌在高端产品的竞争将更注重平衡性,对LCD产品的布局积极性增强。其次,品牌寻求将MiniLED背光的产品定位下沉到中端,预计将会有更多百级分区的产品面世,进一步推动规模的增长。最后,MiniLED 背光方案随着材料成本下降及良率的提升,整体成本将维持较大幅度下降。根据群智咨询(Sigmaintell)统计数据,2022年全球MiniLED 背光电视出货数量为320万台,预计2023年将达400万台,渗透率将从1.5%提升到1.8%。长远来看,渗透率的增长取决于品牌策略、产品下沉速度及对用户的推广和教育。

4. 马太效应下Top5份额再提升,头部品牌保持竞争优势

相较于其他消费电子市场,尽管全球TV市场品牌集中度偏低,但近年来也呈现集中度提升的趋势,表现在头部品牌的市场份额呈现持续提升,而其他品牌的品牌力则逐步走弱。群智咨询(Sigmaintell)统计数据显示,全球Top5电视品牌的市场份额由疫情前的低于50%,2022年达到54.8%,预计2023年将进一步提升到56.3%。

群智咨询(Sigmaintell)认为,品牌集中度提升有两个主要原因。

其一,全球贸易环境波动,在全球贸易壁垒高企和贸易关系动荡的情况下,对于有着成熟全球化布局和运作经验的品牌,其做出应对调整的资源更多;而对于中小品牌来说,其积极扩张的阻力反而更大。

其二,上游面板供应份额持续向大陆厂商聚集带动供应链的中国化。在面板资源牵引下,相较于其他消费电子品类,TV供应链整体更中国化。由此而言,兼具全球布局能力、供应链管理丰富经验和敏锐嗅觉的中国TV品牌赢得了增长机会。因此,群智咨询(Sigmaintell)认为,在全球化布局、供应链管理以及稳健经营方面保有优势的TV品牌,未来在全球市场竞争中将保持领先的竞争态势。

5. 供应链关系重构 品牌将更注重供应链韧性

上游面板市场在经历了深度调整后陷入巨额亏损,面板供应格局正发生着剧烈变化,韩厂加速转向OLED赛道,台湾厂商策略保守,中国大陆厂商份额和话语权进一步增强。未来面板市场的供应格局依然面临着并购重组可能,品牌与面板厂商之间的供应链关系高度依存,相辅相成。对于电视品牌而言,供应链管理将是影响品牌竞争力的重要因素之一。面板供应链既要“稳固”以确保面板供应的长期稳定,为品牌规模增长提供保障;又要“灵活”以保证高效的供应链管理以及更高的议价主动权,为品牌在产品成本和效率等方面保持竞争优势。

当前的局面也是品牌与面板供应链关系重构的重要窗口,电视品牌既要根据内部的销售计划以及市场供需波动的节奏灵活调整短期的采购策略以保障短期利益最大化;又要根据长期目标和上游面板供应链格局的变化调整供应链体系。群智咨询(Sigmaintell)认为,TV品牌供应链管理的总体方向是提高供应链韧性,以建立兼具稳定性和灵活性的供应链关系,环境越多变,韧性越重要。