Looking back at 2022, which is known as the cold winter of the industry. "Declining demand" and "destocking" are the two key words in the notebook market. Under the unbalanced supply and demand relationship, panel prices continue to decline, and the global notebook panel market is experiencing the darkest moment in the post-epidemic era. Looking forward to 2023, will the notebook market usher in the dawn? When will panel prices rebound? How is the panel supply pattern changing? Which segment have potential development opportunities? These series of issues are worthy of in-depth thinking and exploration by the industry.

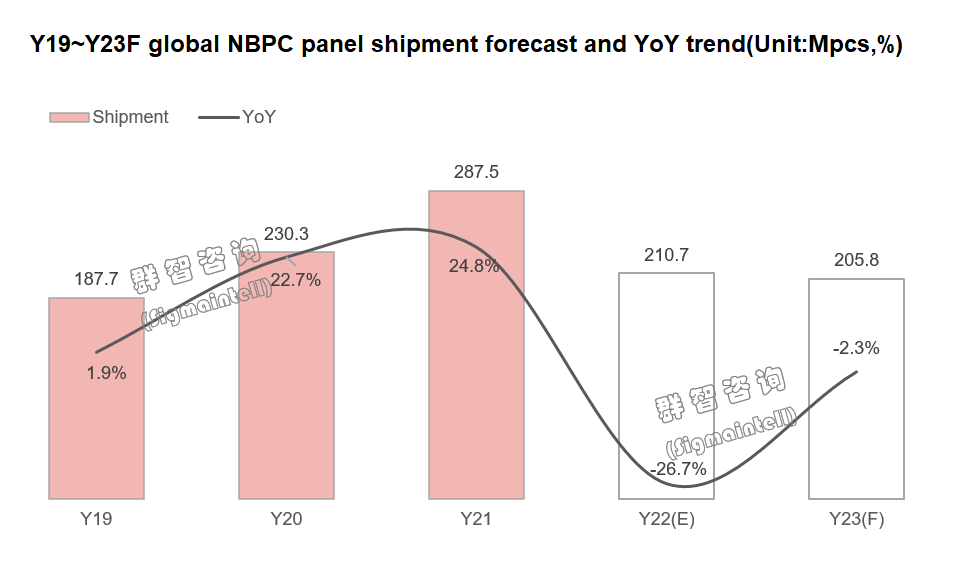

Shipment: a sharp decline of 26.7% in 2022 and will continue to shrink in 2023

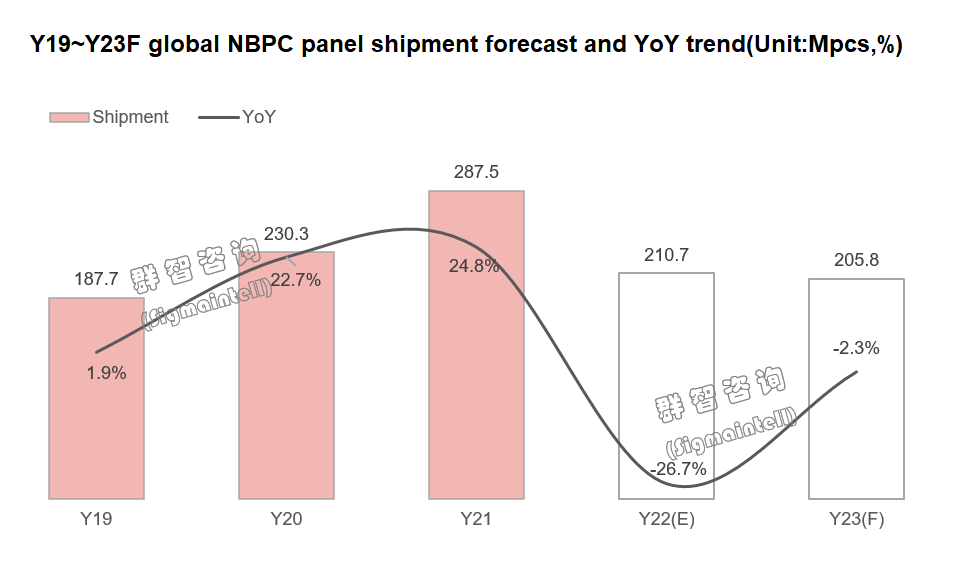

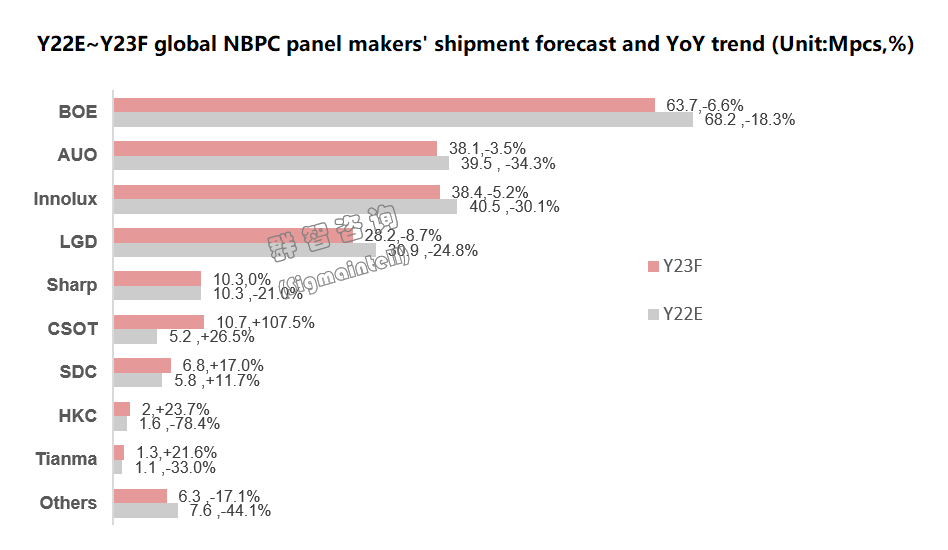

2022 – a sharp decline. On the one hand, the overall demand declined: education demand fell by 53.4% YoY, consumer demand fell by 12.8% YoY, and commercial demand fell by 9.4% YoY. On the other hand, the makers had heavy inventory pressure: Almost all brands have experienced high-level inventory pressure. Even if they adopt active destocking management strategies, most brands are still under pressure of inventory. According to Sigmaintell’s survey data, the global notebook panel shipments in 2022 were 210.7Mpcs, a sharp drop of 26.7% YoY. From the point of the quarterly shipment volume, the current shipment volume has dropped to the pre-epidemic level.

2023 – continuous shrinking. Although the epidemic policy is fully loosened, it will have a certain boost to consumer electronics. However, the economic recession has had a significant impact on government finances, and consumer spending, so commercial and consumer demand is still weak. At the same time, it will take time to destock for brands, and its 2023 BP (Business Plan) is also showing a conservative trend, which also reflects the brand's lack of confidence in the market. Sigmaintell predicts that global notebook panel shipments will continue to shrink to 205.8Mpcs in 2023, a slight YoY decline of 2.3%.

Supply&demand and prices: prices are still difficult to rebound in 23H1, and capacity control is still the primary measure

Supply&demand and prices: prices are still difficult to rebound in 23H1, and capacity control is still the primary measure

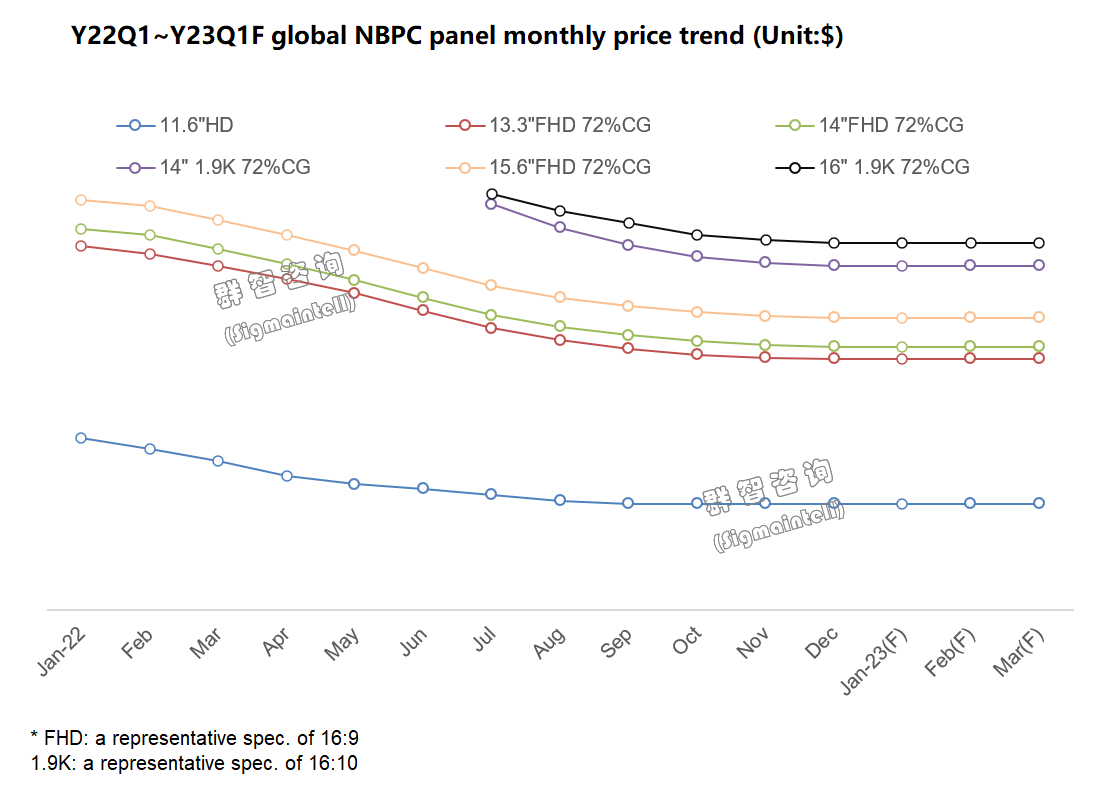

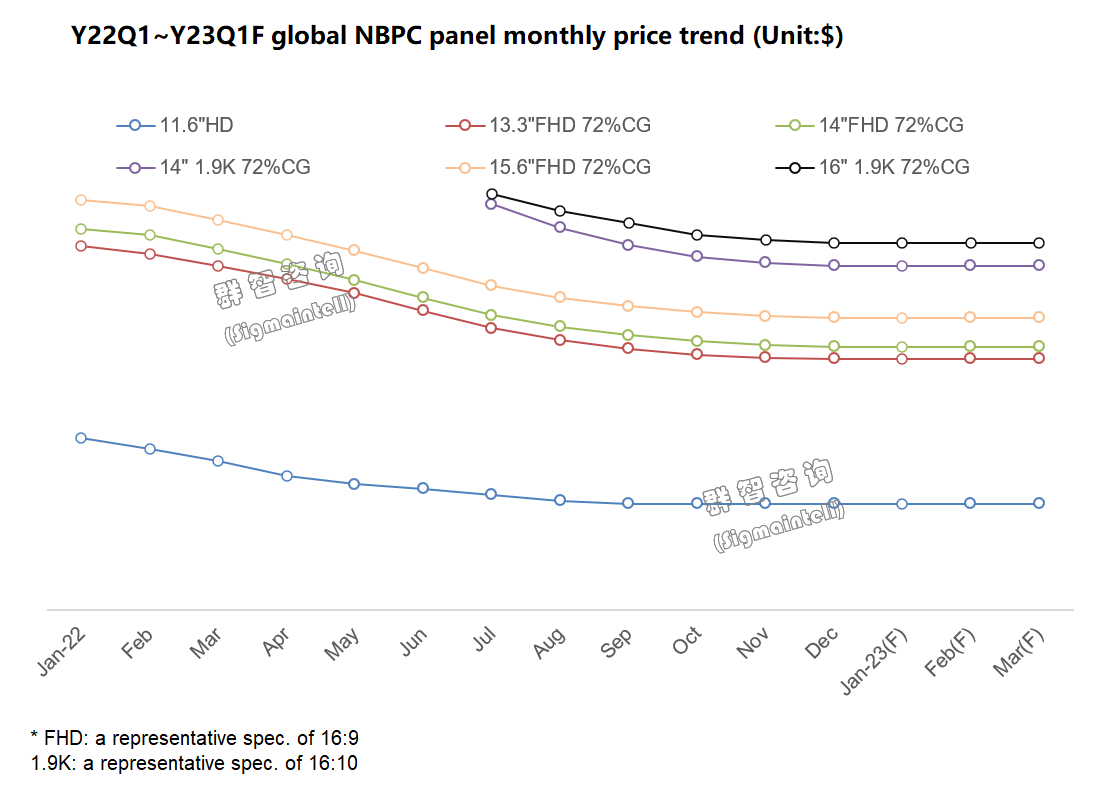

Since 22Q2, although major panel makers have gradually lowered their notebook utilization rates, the decline of brand demand has far exceeded expectations. The supply-demand ratio of notebook panels has continued to rise, and the decline in panel prices has expanded. Entering 22H2, as panel makers continue to increase capacity control, the supply and demand of notebook panels have improved significantly. Although panel prices have maintained a downward trend, the decline has gradually narrowed.

Entering 2023, the current prices of 16:9 mainstream specification products have stabilized, and the prices of 16:10 mid- and high-end specification panels are expected to reach the price bottom in 23Q1. Overall it will take time for most top brands to destock, and the demand in 23Q1 is still weak. According to Sigmaintell's supply and demand model, it is difficult for demand to show a comprehensive recovery in 23H1. In order to continuously improve supply and demand ratio, capacity control is still the primary measure. With the arrival of the 23Q3 and the continuous improvement of brand inventory in the peak purchasing season, panel prices are expected to usher in a slight recovery.

Competitive landscape: the competition of major makers is intensified, and the waist & tail brands seek growth

Competitive landscape: the competition of major makers is intensified, and the waist & tail brands seek growth

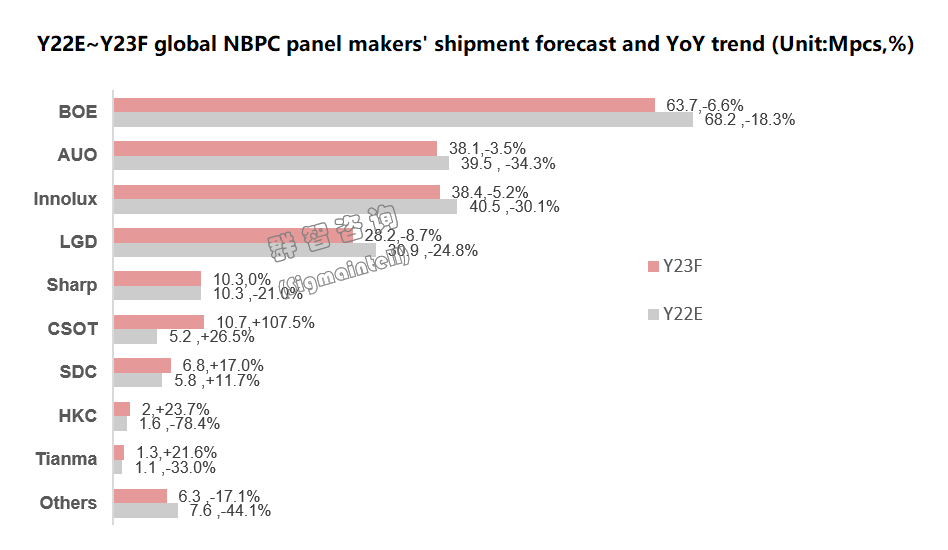

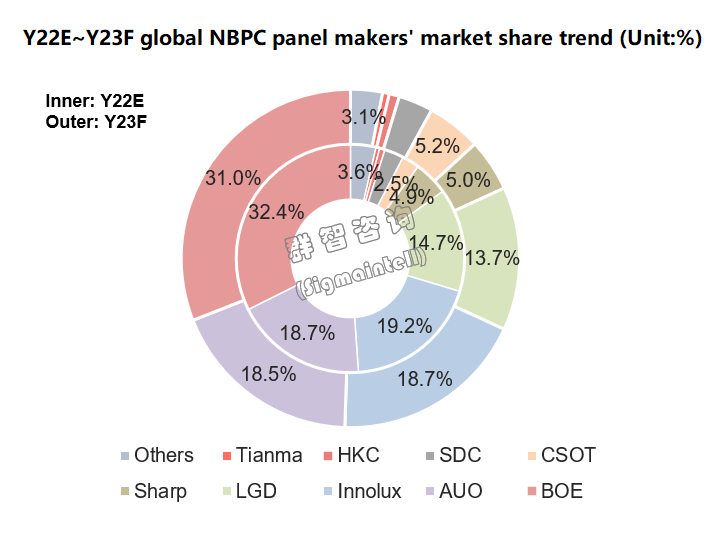

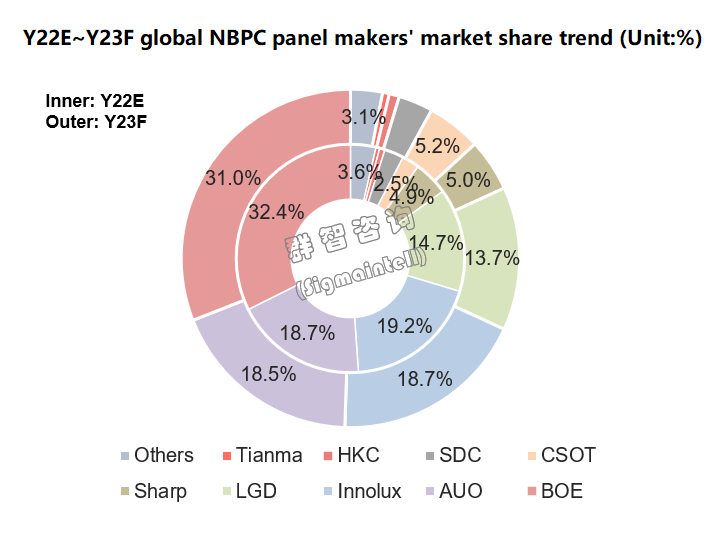

In the process of large fluctuations in the supply chain and market demand, the global notebook panel supply pattern has changed significantly. According to Sigmaintell’s survey data, the supply of waist and tail panels will usher in growth, and the competition among the main panel makers at the head will intensify. Among them, CSOT, Samsung, HKC, and Tianma are expected to usher in growth in 2023, and the competition between traditional giants continues to intensify.

BOE, in the background of customer order adjustments, relying on strong brand effects and good customer relationships, performed steadily in 2022. Although the shipment fell to 68.2Mpcs, down 18.3% YoY, its market share grew against the trend and increased to 32.4%, ranking first. Looking forward to 2023, on the one hand, it will face continuous competition from domestic waist & tail panel makers. On the other hand, it will also face the adjustment of brand supply chain strategies. Overall, in 2023, BOE will face a lot of challenges.

CSOT, despite the obvious decline in the overall market in 2022, CSOT has performed brilliantly. CSOT is the only LCD panel maker that has shown growth against the trend except for OLED makers. In 2022, its shipment reached 5.2Mpcs, a YoY increase of 26.5%. Analyzing its customer structure, it is highly concentrated, and the needs of core customers will directly affect the overall performance of the company. Looking forward to 2023, on the one hand, core customer orders will continue to grow. On the other hand, with the release of T9 capacity and the introduction of most major brands, the shipment and market share are expected to double.

HKC & Tianma, the two panel makers, have certain similarities. Affected by the group's strategy, the current notebook market is not the main battlefield. Due to the lack of order support from top-brand customers, the shipment is limited. As the company increases its investment in notebook applications, it is expected to introduce major brand with mainstream specifications in 2023, driving the growth of its shipment.

For Chinese Taiwan makers, the decline in 2022 was significantly higher than the average level of the market. On the one hand, it is affected by the demand decline for major brands. On the other hand, due to the further pressure on the cost of its own small generation and product competitiveness positioning, the YoY decline in 2022 reached more than 30%, and its performance is significantly worse than that of BOE, LGD, etc. . Looking forward to 2023, the steady growth of overseas brand orders will become the largest supply guarantee for Chinese Taiwan makers, and it is expected to usher in a bright performance. According to Sigmaintell's forecast, AUO's estimated shipments in 2023 will reach 38.1Mpcs, down 3.5% YoY, and its market share will remain stable. Innolux's estimated shipments will reach 38.4Mpcs, down 5.2% YoY, and its market share will decline by only 0.5%.

For Korean makers, in 2022, supported by Apple orders, LGD shipments reached 30.9Mpcs, a YoY decrease of 24.8%, slightly better than the average level of the market. Looking forward to 2023, in addition to Apple's stable orders, other customers are expected to shrink in overall purchase volume. The shipment is expected to continue to decline to 28.2Mpcs, and its market share will further shrink to 13.7%. On the other hand, SDC, because OLED products are actively sinking into the high-performance ultrabook market, the market has shown contrarian growth, with shipments reaching 5.8Mpcs in 2022, a YoY increase of 11.7%. In 2023, it is expected to usher in continuous growth, and the market share will further increase to 3.3%.

Supply chain pattern: Double risks of environment and cost superimpose, and the development trend of "alliance-style" is strengthened

Supply chain pattern: Double risks of environment and cost superimpose, and the development trend of "alliance-style" is strengthened

During the period of market volatility, supply chain management is the core issue that tests top makers, and the importance of this issue will continue in 2023. Sigmaintell comprehensively studies and judges the situation of the global notebook PC panel supply chain from 2022 to 2023. The environment and cost constitute a double risk, which is like the sword of Damocles hanging on the development road of PC makers. From the perspective of the environment, the game of big powers continues to spread to the economic field, and the geopolitical issue of the supply chain has resurfaced. From the perspective of cost, the pressure of sluggish end demand, fluctuating exchange rates, and inventory pressure are transmitted through the supply chain. The urgent need to reduce costs, increase efficiency, and improve development resilience is also a common problem faced by all PC makers.

According to Sigmaintell's research and judgment, in addition to the double risks of environment and cost, the notebook PC panel supply chain in 2023 will gradually strengthen the "alliance-style" development characteristics. This trend is mainly reflected in the fact that upstream and downstream makers in the supply chain are gradually establishing an alliance and cooperative development relationship to enhance the production-supply efficiency between partners, avoid environmental risks, reduce cost risks, and improve market competitiveness.

As shown in the figure below, the changes in the panel supply chain of the global Top 5 PC makers all show the characteristics of gradually strengthening the cooperative relationship with their top panel suppliers. Especially for the top 3 PC set makers, choose 1~2 strategic panel suppliers and continue to strengthen their head share. This change will be more obvious in 2023. From the perspective of supplier share trends, the share of leading cooperation in this "alliance-style" development will also increase from 33% in 2021 to 38% in 2023 in the supply chain structure of the Top 5 makers.

This "alliance-style" development trend is a cluster development strategy adopted by PC makers under the dual pressure of environment and cost. In the current market stage, this strategy does have the advantages of reducing costs, increasing efficiency, and avoiding geo-environmental risks. However, the adverse impact of this strategy on the market in the medium and long term cannot be ignored. When the "alliance-style" develops to a certain stage, there may be multiple internal self-sufficient supply chain groups or alliances, the supply chain and the market will become closed, and the openness, liquidity, and diversification will decline. Eventually, it will weaken the vitality of the PC industry as a whole. Therefore, Sigmaintell suggests that major PC makers need to restrain their stress response to risks in their supply chain strategies and rationally examine the long-term impact of the "alliance" development strategy.

Market opportunity: Driven by a new wave of evolution, screen performance continues to increase

Market opportunity: Driven by a new wave of evolution, screen performance continues to increase

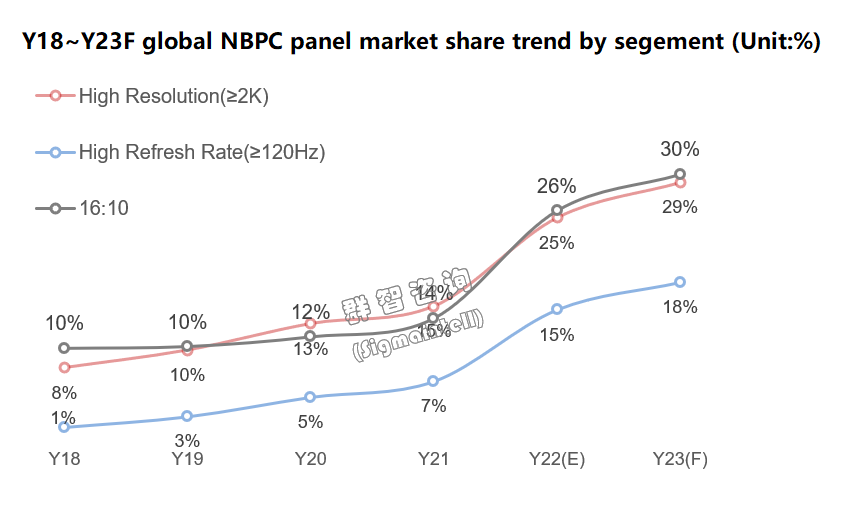

In the past two years, marked by the performance evolution of CPU and GPU, PC products have started a new round of evolution. The performance evolution of the set has given the momentum to upgrade the screen technology. With the continuous decline of mid- and high-end panel technology, a series of high-performance ultrabook and gaming notebooks have emerged in the market. Through the product's superior performance and good cost performance, it has also won the favor of consumers in the end market and promoted the continuous upgrade of notebook panel specifications. The upgraded notebook panel has highly similar labels - "high resolution”, "high frequency”, "16:10" and "high-end backplane technology”.

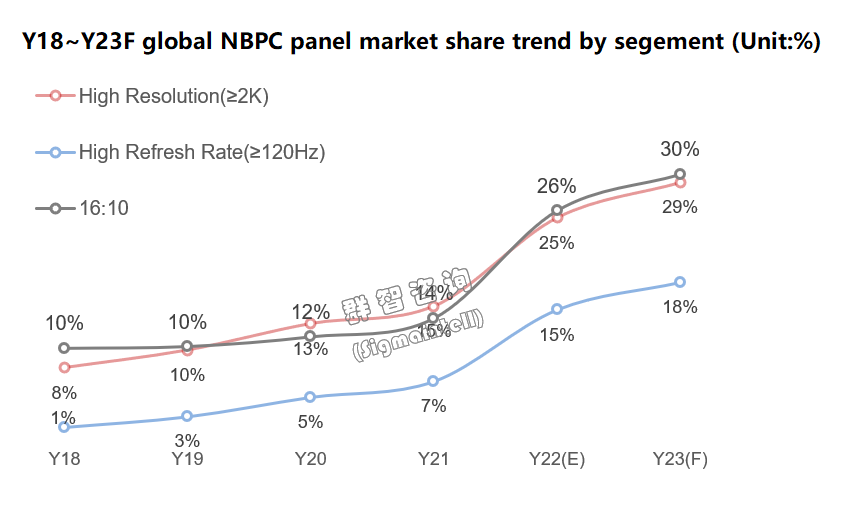

According to Sigmaintell’s research data, in the high-resolution market, 2K+ have ushered in rapid development, and the market share will increase by nearly 10 % in 2022. In the high-frequency market, 120Hz refresh rate has become the standard configuration for high-performance ultrabook. In the gaming notebook market, 144Hz is gradually upgraded to 165Hz, and 200Hz+ ultra-high refresh rate products are also continuously enriched. The two have jointly promoted the rapid increase in the market share of high-frequency products. In addition, under the brand demonstration effect, 16:10 format products have simultaneously ushered in rapid growth, and the current market share has exceeded 30%.

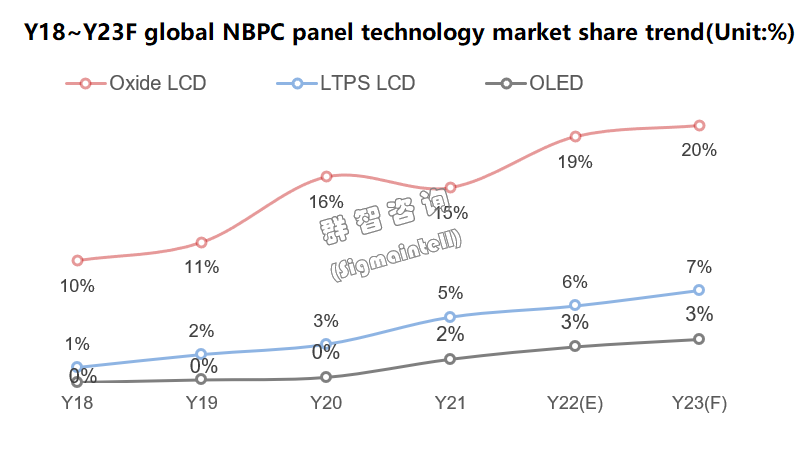

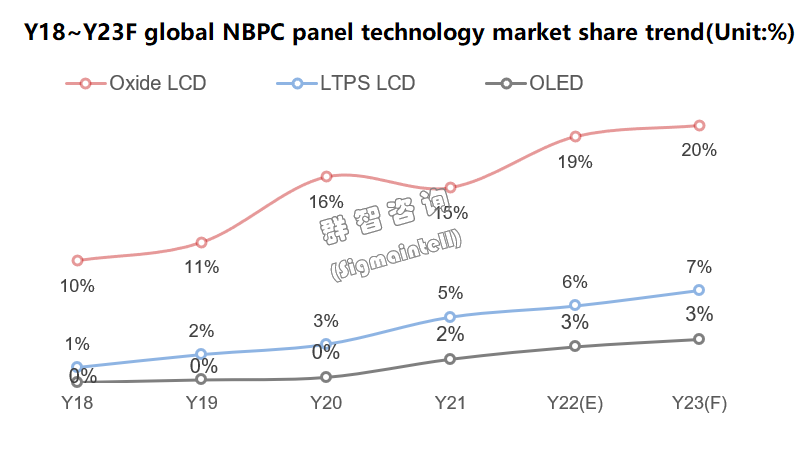

Behind the upgrade of panel specifications, it is inseparable from the penetration of mid- and high-end backplane technology into the mainstream market. According to Sigmaintell’s survey data, mid- and high-end backplane technologies such as Oxide, LTPS, and OLED will all usher in growth in 2022, especially the rapid growth of Oxide technology. Currently, the cost is the biggest constraint on the development of mid- and high-end panel technology. However, as panel makers increase R&D investment and mass production of high-generation lines, etc., the cost of these panel technology is expected to be further improved. It is foreseeable that in the next 3-5 years, these panel technologies will continue to accelerate their penetration into the mainstream market.

Based on the above analysis, the notebook panel market is expected to be cold in 2023: the demand recovery in 23H1 still lacks momentum, and 23H2 is expected to usher in an overall recovery. Although the annual shipment volume will still decline slightly, the upgrade of panel specifications continues, and the subdivision track represented by "high resolution”, "high frequency”, "16:10" and "high-end backplane technology" still has a lot to do. From the perspective of the supply chain, the superposition of multiple risks drives the core PC makers to adopt an active "alliance-style" development strategy in order to achieve the goal of reducing costs and increasing efficiency, and reducing geographical risks. To make the PC panel supply chain in a period of continuous adjustment.

Sigmaintell suggests that panel makers need to rationally understand the development characteristics of PC market demand, improve their understanding and insight into PC consumers, continue to overcome mid- and high-end technical barriers, keep up with the pace of market upgrades, and enhance product competitiveness. For PC set makers, improving competitiveness through "alliance-style" development is indeed a reasonable strategy in the current period of declining demand, but it is also necessary to rationally examine the potential negative market impact of this strategy in the medium and long term and make timely and flexible adjustments.

中文:

春寒料峭,市场博弈加剧,联盟式发展格局凸显——2022年笔电面板市场总结与2023年展望

回顾行业寒冬的2022年,“需求下滑”、“库存去化”是整个笔电市场的两大关键词。在失衡的供需关系下,面板价格持续走低,全球笔电面板市场正经历着后疫情时代的至暗时刻。展望2023,笔电市场是否会迎来黎明?面板价格何时回暖?面板供应格局如何演变?哪些赛道存在潜在发展机遇?这一系列问题均值得行业深度思考与探寻。

出货规模:2022年大幅下滑26.7%,2023年仍持续收缩

2022,

大幅下滑。一方面,需求全盘性下滑:教育需求同比下滑53.4%,消费需求同比下滑12.8%,商用需求同比下滑9.4%。另一方面,库存高压:几乎所有品牌均经历过高水位库存压力,即便持续采取积极的去库存化管理策略,当前多数品牌库存仍持续受压。根据群智咨询(Sigmaintell)调研数据显示,2022年全球笔电面板(Notebook Panel)出货量为210.7Mpcs,同比大幅下滑26.7%;细分季度出货体量来看,当前已跌落至疫情前水位。

2023,

持续收缩。虽疫情全面放开,对消费电子有一定的提振作用。但宏观经济的滑落,对政府财政、消费者支出均产生了显著的影响,商用、消费类需求仍旧疲软。同时,品牌库存去化仍需时日,其2023年BP(销售目标)也呈现保守势态,从一定程度也反映出品牌对于市场信心不足。群智咨询(Sigmaintell)预测,2023年全球笔电面板出货规模仍将持续收缩至205.8Mpcs,同比小幅下滑2.3%。

供需及价格:上半年价格仍难以回暖,控产仍是首要举措

自2022年二季度开始,虽各大面板厂逐步下修笔电产能稼动率,但品牌需求下滑幅度远超预期,笔电面板供需比呈现持续走高,面板价格跌幅扩大。进入下半年,随着面板厂持续加大控产力度,笔电面板供需出现明显改善,面板价格虽维持下跌趋势,但跌幅逐渐收窄。

进入2023年,当前16:9主流规格产品价格已经稳定,16:10中高阶规格面板价格也有望在一季度达到价格底部。整体来看,多数头部品牌库存去化仍需时日,一季度需求依旧疲软。根据群智咨询(Sigmaintell)供需模型测算,整个上半年,需求难以呈现全面性回暖,为持续改善供需关系,控产仍是首要举措。随着三季度采购旺季到来,叠加品牌库存持续改善,面板价格有望迎来小幅回暖。

竞争格局:主力厂商博弈加剧,腰部&尾部力量谋求增长

在供应链和市场需求大幅波动的过程中,全球笔电面板供应格局变化显著。群智咨询(Sigmaintell)调研数据显示,腰部&尾部面板供应将迎来增长,头部主力面板厂之间的博弈加剧。其中,TCL华星、三星、惠科、天马2023年将有望迎来增长,传统豪强之间的博弈持续加剧。

京东方(BOE),在客户订单调整浪潮中,依托强大的品牌效应和良好的客户关系,2022年表现稳健,虽出货规模下滑至68.2Mpcs,同比下滑18.3%,但市占率逆势增长至32.4%,稳居第一。展望2023年,一方面面临国内中尾部面板厂的持续冲击,另一方面还面临品牌供应链策略调整,2023年将面临不小挑战。

TCL华星(CSOT),尽管2022年大盘滑落明显,但CSOT表现亮眼,是除OLED厂商外唯一呈现逆势增长的LCD面板厂。2022年其出货规模达5.2Mpcs,同比增长26.5%。分析其客户结构,具有高度集中性,核心客户的需求将直接影响该公司整体表现。展望2023年,一方面核心客户订单持续增长,另一方面随着T9产能释放,多数主力品牌的导入,出货规模和市占将有望迎来翻倍式增长。

惠科(HKC)&天马(Tianma),两家面板厂具有一定的相似性。受集团战略布局影响,当前笔电市场均为非主力战场,因缺少头部品牌客户订单支持,出货规模相对有限。随着公司加大在笔电应用上的投入,2023年有望在主流规格上导入品牌客户,拉动其出货规模增长。

台厂方面,2022年下滑幅度明显高于大盘平均水平。一方面有受到主力品牌需求下滑影响,另一方面由于自身小世代线成本进一步受压,再叠加自身产品竞争力定位,2022年同比下滑均达到30%以上,其表现明显差于BOE、LGD等。展望2023年,海外品牌订单稳定增长将成为台厂最大供应保障,有望迎来亮眼表现。根据群智咨询(Sigmaintell)预测,2023年友达(AUO)预估出货38.1Mpcs,同比下滑3.5%,市占保持稳定;群创(Innolux)预估出货38.4Mpcs,同比下滑5.2%,市占仅下滑0.5%。

韩厂方面,2022年,在Apple订单支持下,LG显示(LGD)出货规模达30.9Mpcs,同比下滑24.8%,稍优于大盘平均水平。展望2023年,除Apple订单稳定外,其他客户因整体采购规模收缩,LGD出货规模预计将持续下滑至28.2Mpcs,市占将进一步收缩至13.7%。反观三星显示(SDC),因OLED产品积极下沉主力轻薄本市场,市场规模呈现逆势增长,2022年出货达5.8Mpcs,同比增长11.7%。2023年将有望迎来持续增长,市占进一步提升至3.3%。

供应链格局:环境与成本双重风险叠加,“联盟式“发展趋势强化

在市场波动期,供应链管理是考验各大厂商的核心问题,这一议题的重要性在2023年仍将延续。综合研判2022~2023年全球笔记本PC面板供应链形势,环境与成本构成双重风险,仍然如悬挂于PC厂商发展之路的达默斯之剑。从环境层面来看,大国博弈往经济领域不断蔓延,供应链的地缘安全问题再次浮现;从成本层面来看,低迷的终端需求、波动的汇率与库存的压力从供应链节节传导,降本增效,提升发展韧性,也是各PC厂商面临的共性问题。

根据群智咨询(Sigmaintell)对供应链的研判,除环境与成本双重风险叠加外,2023年笔记本PC面板供应链也将逐渐强化“联盟式”发展特征。这一趋势主要体现在,供应链上下游厂商正在逐渐建立联盟合作式的发展关系,以增强合作方之间的生产-供应效能,规避环境风险,降低成本风险,以期提升市场竞争力。

如下图数据所示,在全球Top 5 PC整机厂商的面板供应链变化中,都呈现与其头部面板供应商合作关系逐渐强化的特点。尤其是Top 3的PC整机厂商,选择1~2家战略性面板供应商并不断强化其头部份额,这种变化在2023年将体现得更加明显。而从供应商份额趋势来看,这种“联盟式”发展的头部合作份额在Top 5的厂商供应链结构中也将从2021的33%提升到2023年38%。

此种“联盟式”发展趋势是PC整机厂商在环境与成本双重压力下所采取的一种集群化发展策略。该策略在当下的市场阶段的确具有降本增效,规避地缘环境风险的有利性。但不可忽视这一策略在中长期对市场的不利影响。当“联盟式”发展到一定阶段,或将出现多个内部自给自足的供应链集团或集群,供应链和市场逐渐走向封闭性,开放性、流动性和和多元化下降,最终在整体上削弱PC产业的发展活力。因此,群智咨询(Sigmaintell)建议PC主力厂商需在供应链策略上克制对风险的应激反应,理性审视“联盟式“发展策略的长久影响。

市场机遇:新一轮进化浪潮驱动,屏幕性能持续加码

近两年来,以CPU与GPU的性能进化为标志,PC产品开启了新一轮的进化浪潮。整机性能进化赋予屏幕技术升级动能,随着中高阶面板技术的不断下沉,市场涌现出一系列高性能轻薄本、游戏本产品。通过产品自身优越的性能和良好的性价比,在终端市场上也赢得了消费者青睐,推动了笔电面板规格的持续升级。升级后的笔电面板,具备高度相似的代名词-“高分”、“高刷”、“16:10”和“高阶背板技术”。

根据群智咨询(Sigmaintell)调研数据显示,在高分市场中,以2K+为代表的高分辨率产品迎来了飞速发展,2022年市占提升近10个百分点。在高刷市场中,120Hz刷新率当前已成为高性能轻薄本的标配;在游戏本市场,144Hz逐渐向165Hz升级迭代,且200Hz+超高刷新率产品亦持续丰富。两者共同推动了高刷产品市占的迅速提升。除此之外,在品牌示范效应下,16:10形态产品同步迎来了飞速增长,当前市场份额已突破三成。

面板规格升级的背后,离不开中高阶背板技术向主流市场的渗透。根据群智咨询(Sigmaintell)调研数据显示,2022年Oxide、LTPS、OLED等中高阶背板技术均迎来了增长,尤其是Oxide技术增长迅速。当前,成本是中高阶面板技术发展的最大制约因素。但随着面板厂加大研发投入,高世代线产线的量产等,中高阶面板技术成本有望得到进一步改善。可以预见,未来3-5年,三大高阶面板技术将持续加速对主流市场的渗透。

综合上述分析,2023年笔电面板市场春寒料峭:上半年需求复苏仍缺乏动力,下半年有望迎来全盘性回暖。虽全年出货规模仍将小幅下滑,但面板规格升级持续,以“高分”、“高刷”、“16:10”和“高阶背板技术”为代表的细分赛道仍大有作为。从供应链来看,多重风险叠加,驱使核心PC厂商采取积极的“联盟式”发展策略,以期实现降本增效目标,并降低地缘风险,从而促使PC面板供应链处于持续调整期。

群智咨询(Sigmaintell)建议,面板厂商需理性认识PC市场需求的发展特点,提升对PC用户的认识与洞察,并持续攻克中高阶技术壁垒,紧跟市场升级步伐,提升产品竞争力;对于PC整机厂商来说,通过“联盟式”发展提升竞争韧性的确是当前需求下行期的合理之策,但也需理性审视该策略中长期潜在的市场负面影响,适时作出灵活调整。