发布时间: 2021/12/03 关注度: 733

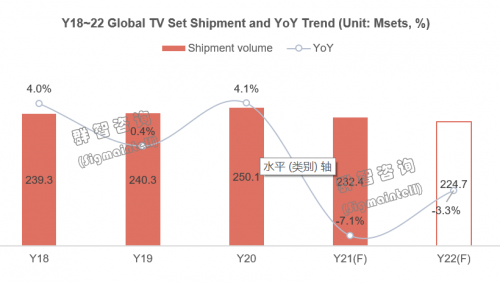

In the post-pandemic era, affected by the declining driving force of the “Stay-at-home economy”, the global TV market demand shifted from high growth to decline. According to statistics from Sigmaintell, the global TV market shipments in 2021 are expected to reach 232 million units, a YoY decrease of 7.1%. In 2022, this number is expected to be 225 million, with another YoY decrease of 3.3%. The shipment scale has shown a continued downward trend. As the market is in a down cycle, how to use technology upgrades based on scenarios to satisfy consumers’ shifting toward rationalized consumption concepts and break through the growth bottleneck is worth pondering for upstream and downstream manufacturers in the industry chain. Technological changes are at the crossroads of development. OLED, MiniLED, high-frequency and supersize products will all face fierce competition on their own tracks and product ranges.

OLED: Samsung enters the game, the brand structure is facing adjustment, accelerated growth is expected.

Relying on high contrast ratio, excellent color reproduction, and extreme lightness and other performance advantages, OLED TVs have all been deployed on high-end product lines. The OLED TV market is still dominated by global brands. LG occupies more than 60% of the global market share by virtue of its advantages in brand and panel; Sony occupies about 20% of the market share by virtue of its high-end positioning and brand influence. In 2022, Samsung Electronics will also join the game in the OLED TV camp. On the one hand, it is expected to promote the further expansion of the global OLED TV market; On the other hand, it will impose a profound impact on the global OLED TV brand structure and form a tripartite confrontation.

In view of panel supply, with SDC’s QD-OLED panel enters mass production, the global OLED TV panel supply has shifted from a single supplier to a diversified supply, providing brands with more technology and resource options and capacity guarantees.

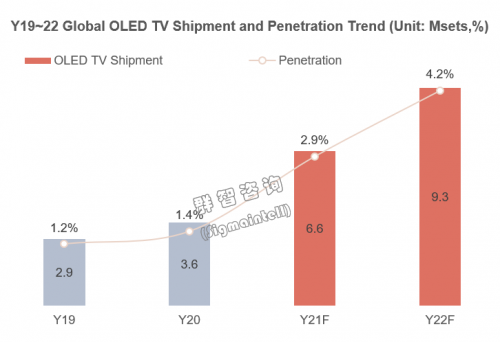

According to Sigmaintell, global shipments of OLED TVs are expected to reach 6.6 million units in 2021, a year-on-year increase of 85%, and the market share will reach 3%. In 2022, the global OLED TV shipments are expected to reach 9.35 million units, an increase of 41% year-on-year, and a market share will be more than 4%. The global OLED TV shipment is expected to have an accelerating growth.

MiniLED TV: Products are expected to sink to the mid-end, starting the scale up.

2021 is a special year for MiniLED. From the perspective of brand layout, almost all brands launched their MiniLED BLU TV. However, as the technology is still in the early stages of development, the current technical route, product solutions, cost control and product positioning are all under exploration. From the view of performance, MiniLED BLU TVs have better contrast ratio than normal LED BLU TVs, a lighter and thinner body, and higher brightness and color reproduction. They are even comparable to OLED products. Therefore, brands have positioned MiniLED BLU TV products at mid-to-high end currently, almost on the same level as OLED products. Global brands are particularly active, where Samsung is leading the market. It launched Neo 4K and 8K series products this year, with annual shipment expectation exceeding one million units. Although LGE has been adhering to OLED as the main high-end technology for many years, it officially launched QNED MiniLED series products in the second half of this year. Sony also has a plan for MiniLED BLU TV next year. Chinese brands, led by TCL, are also actively deploying MiniLED BLU TVs. In 2022, they will adhere to the route of MiniLED with large-size products.

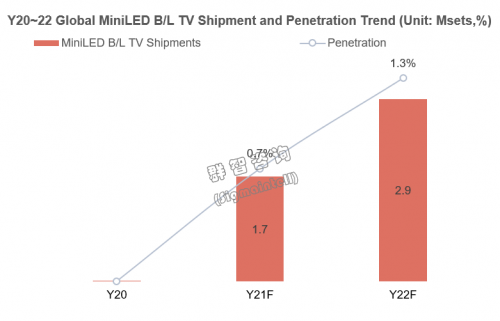

The active brand strategy will become the driving force for the sustainable development of MiniLED technology. However, the current poitioning of MiniLED BLU TV is too high, inhibiting the development of scale. With the maturing of technical routes and product solutions, the cost control will be improved. It is expected that MiniLED BLU TV will sink to the mid-end market driven by cost reductions, finish the full upgrade of normal LED BLU TVs, and bring scale growth. At present, Sigmaintell is cautiously optimistic about the development of the MiniLED BLU TV market. According to Sigmaintell data, the global shipment of MiniLED BLU TVs is expected to be less than 2 million units in 2021, with a market share of less than 1%. In 2022, the global shipment will reach 3 million units, with a market share of 1.3%, the overall trend of steady growth will be maintained.

About MiniLED BLU TVs, Sigmaintell believes that the product plan needs to be improved continuously, pushing the maturing of COB plan and glass substrate technology, thereby balancing the product cost and performance upgrade. Only the technology sinks to mid-end market can the accelerated scale growth be achieved.

Supersize: The panel supply improved, 80” + will face accelerated growth.

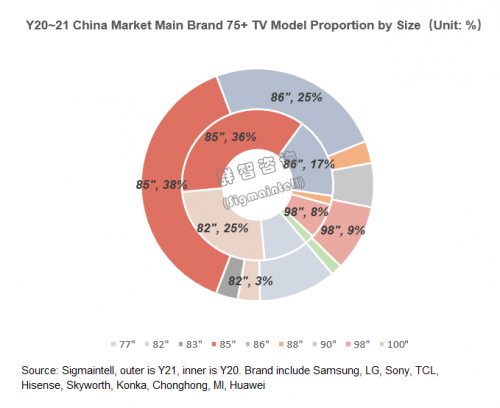

Under the environment where the capacity of the global LCD TV market is relatively saturated, although the overall market demand is stable, there are still significant opportunities for large-size products. According to Sigmaintell, compared to 2020, the proportion of 65” + large-size products will increase significantly in the global TV market in 2021, where 65” accounting for nearly 2.7% and 75” accounting for an increase of 1.8%. Especially for the main 80” + sizes, 85” and 86”, will have a substantial increase. This is particularly prominent in the Chinese market. The attention of Chinese consumers on TV products are focusing on the size updates. According to statistics from Sigmaintell, global shipments of 80” + products in 2021 will reach 2.9 million units, a YoY increase of 150%, and their share in the global TV market will increase to 1.2%. The growth in 2022 is expected to accelerate, the shipment scale will reach 4 million units, a YoY increase of 40%, and the market share will reach 1.8%.

From the view of panel supply, the current 80” + products are still dominated by Korean and Taiwanese manufacturers. China’s leading panel makers are relatively conservative, while HKC is very active. As its Changsha capacity ramps up and its capacity advantages from set cutting, it is expected to become the world’s biggest 80” + panel supplier in the future and contribute a strong supplement to the supply of super-large panel resources. Set makers are actively deploying super-large sizes, driving the growth of mid-to-high-end market share. While realizing differentiated competition, it is also expected to bring better profit margins.

High frequency rate: Accelerated brand layout, satisfying young consumers’ core demand.

In the post-pandemic era, entertainment methods represented by gaming and games have gradually become the spiritual nourishment for younger consumers. At present, game players mainly focus on the mobile gaming market and the PC gaming market. The popularity of console games is low, and the demand for gaming TV is still at an initial stage. With the development of gaming TV functions and the continuous enrichment of TV gaming content, as well as the adaptability to other terminals is enhanced, it is expected that the high-frequency TV market will have more development space.

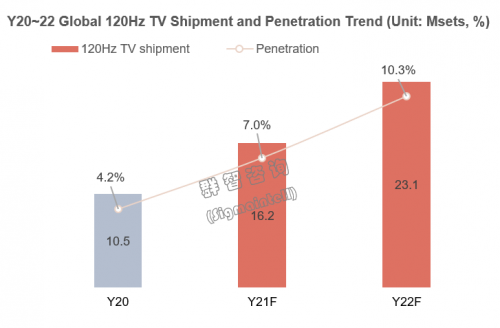

According to Sigmaintell, the global shipment of 120Hz TV is expected to reach 16 million units in 2021, a YoY increase of 54%, and the market share will reach 7%. In 2022, the shipment will exceed 23 million units, a YoY increase of 43%, with a market share of over 10%.

In terms of global brands, Sony is the most active in the layout and promotion of high-frequency TVs due to its advantages of next-generation PS5 game console. The strategies of Samsung Electronics and the LGE strategy are also relatively aggressive. They actively promote the frequency rate from 60Hz to 120Hz and better, keep promote product technology innovation. Chinese brands are still following in the field of high- frequency TV.

In the post-pandemic era, under the giant wave of global digitalization and IoT, changes in user scenarios and application demands have brought opportunities for product innovation and brought new incremental space to the market. OLED, MiniLED, super-size TV, high frequency TV and other market segments are all having good growth potential. Sigmaintell believes that strengthening innovation, digging the needs of segmented scenarios, and meeting the personalized demand of different consumers for TV are the necessary path for brands to enhance products’ differentiated competition and create more product value.

中文:

进入后疫情时代,受“宅经济”推动力不断减弱的影响,全球电视市场需求由高增长转向回落。根据群智咨询(Sigmaintell)统计数据显示,2021年全球TV市场出货数量预计达2.32亿台,同比下降7.1%,预计2022年全球TV出货数量为2.25亿台,同比下降3.3%,出货规模呈现持续回落态势。在市场处于下行周期中,如何通过基于场景需求的技术提升,满足消费者趋于理性的消费观念转变,突破增长瓶颈,值得产业链上下游厂商深思。技术变革正处在发展的十字路口,OLED、MiniLED、高刷新以及超大尺寸产品,都将在各自的赛道和产品区间展开激烈的竞争和角逐。

OLED赛道:三星入局,品牌格局调整,有望迎加速增长

OLED电视以其高对比度,优秀色彩还原以及极致轻薄等性能优势,各品牌均布局高端产品线。OLED电视市场依然由国际品牌主导,LG凭借品牌及面板资源优势,占据全球60%以上市场份额;Sony凭借高端产品定位和品牌影响力,也占据20%左右市场份额。2022年,三星电子也将加入到OLED电视阵营的角逐当中,一方面有望推动全球OLED 电视市场规模进一步扩大,同时,预计将对全球OLED电视品牌格局带来深远影响,形成三足鼎立之势。

从面板供应来看, 随着SDC的QD-OLED面板进入量产,全球OLED电视面板供应已由单一供应商向多元化供应转变,为品牌提供了更多的技术和资源选择以及产能保障。

根据群智咨询(Sigmaintell)统计数据显示,预计2021年OLED电视全球出货量将达到660万台,同比增长85%,市场占有率将接近3%,预计2022年全球OLED电视出货规模将达到935万台,同比增长41%,市场占有率超过4%,全球OLED电视赛道有望迎加速增长。

MiniLED背光电视赛道:期待产品下沉中端,开启规模增长之路

2021年对于MiniLED是个特别的年份,从品牌布局来看,百家争鸣,几乎所有品牌都相继推出了MiniLED背光电视,但由于技术还处于发展初期,目前从技术路线,产品方案,成本管控以及产品定位等方面,均处于摸索阶段。从性能角度,MiniLED背光电视产品对比普通LED背光电视具备更优异的对比度,更轻薄的机身以及更高的亮度和色彩还原度,甚至可以与OLED产品相媲美,因此,目前各品牌将MiniLED背光电视产品定位于中高端,几乎与OLED产品不相上下。国际品牌尤为积极,Samsung引领市场,今年推出了Neo 4K和8K系列产品,预计全年出货量超百万台,LGE多年秉承OLED为高端技术路线主轴,也在下半年正式推出了QNED MiniLED系列产品,明年Sony也有MiniLED背光电视的产品规划。中国品牌以TCL为首积极布局MiniLED背光电视,2022年将坚持MiniLED搭配大尺寸的产品路线。

品牌策略积极将成为MiniLED技术持续发展的源动力。但目前MiniLED背光电视产品定位过高,抑制了规模的发展。伴随技术路线和产品方案更加成熟,成本管控更加完善,期待MiniLED背光在成本下降的驱动下可以下沉到中端市场,完成对普通LED背光电视的全面升级,带来规模增长。目前群智咨询(Sigmaintell)对MiniLED市场的发展持谨慎乐观态度,根据群智咨询(Sigmaintell)数据显示,预计全球2021年MiniLED背光电视的出货规模不到200万台,市占率不足1%,2022年,全球出货规模将接近300万台,市占率达到1.3%,整体维持稳中增长的态势。

关于MiniLED背光电视,群智咨询认为需要不断完善产品方案,推动COB方案以及玻璃基板技术更加成熟,要做到均衡产品成本和性能升级,只有产品技术下沉至中端市场,才能有望实现规模加速增长。

超大尺寸:面板供应增强,80"+规模将迎加速增长

在全球液晶电视市场容量相对饱和的环境下,虽然市场整体需求稳定,大尺寸产品依然存在显著的增量机会。根据群智咨询(Sigmaintell)统计数据显示,相较2020年,2021年全球电视市场中,65"及以上大尺寸占比将明显增长,其中65"占比增长接近2.7个百分点,75"占比增长了1.8个百分点,尤其是80"+的主力尺寸85"和86"迎来的大幅增长。中国市场这一规律尤为突出,中国消费者对电视产品的关注度聚焦在尺寸更新。根据群智咨询(Sigmaintell)统计数据显示,2021年全球80"+产品出货规模接近290万台,同比增长150%,在全球电视市场中的占比增加到1.2%,预计2022年将应加速增长,出货规模达400万台,同比增长40%,市占率达到1.8%。

从面板供应来看,目前80"+产品依然以韩台厂商为主,中国头部面板厂商相对保守,而HKC则非常积极。随着其长沙产能开出,并利用其套切的产能优势,未来有望成为全球80"+最大面板供应商,对超大尺寸面板资源供应形成强有力的补充。而电视厂商积极布局超大尺寸,带动中高端市场份额增长,实现差异化竞争的同时,有望带来更好的获利空间。

高刷新率赛道:品牌加速布局,满足年轻消费者核心诉求

后疫情时代,以电竞和游戏为代表的娱乐方式逐步成为年轻一代消费群体的精神食粮和寄托。目前游戏玩家主要聚焦手游市场和端游市场,主机游戏普及度偏低,游戏电视需求尚处于起步阶段,伴随游戏电视功能开发以及电视游戏内容的不断丰富,同时,适配其他终端性能增强,预计高刷新电视市场需求存更多发展空间。

根据群智咨询(Sigmaintell)统计数据显示,2021年全球市场120Hz电视出货规模预计将达到1600万台,同比增长54%,市场占有率达到7%,2022年出货规模将突破2300万台,同比增长43%,市场占有率超过10%。

国际品牌方面, 索尼(Sony)因兼具PS5次世代游戏主机资源优势,对高刷新电视布局和推广最为积极,三星电子以及LGE策略也相对激进,并积极推动刷新率从60Hz向120Hz以及更好刷新率产品进阶,不断推动产品技术创新,中国品牌在高刷新电视方面仍然处于跟随状态。

后疫情时代,在全球数字化以及IoT的大浪潮下,用户使用场景和应用需求的变化为产品创新带来了机会,为市场带来了新的增量空间,特别是OLED、MiniLED、超大尺寸、高刷新率电视等细分市场的需求均有不错的增长潜能。群智咨询(Sigmaintell)认为,强化创新,挖掘细分场景需求,满足不同消费者对电视的个性化需求,是品牌提升产品差异化竞争,创造更多产品价值的必经之路。

提交右侧信息,了解更多会员服务方案;

或直接联系我们:

+86 151-0168-2530