Core opinion:

Limited by sluggish demand, foundry is expected to continue to decline in 2023

The utilization rate of the foundry is expected to reach the bottom in 23Q2, and a mild recovery is expected in 23H2

In 2023, foundry prices are expected to drop by 10%~15% YoY

Upstream semiconductor equipment and raw material industries will be impacted in 2023

The overall industry is oversupply, but the possibility of structural shortages still exists

Limited by sluggish demand, foundry is expected to continue to decline in 2023

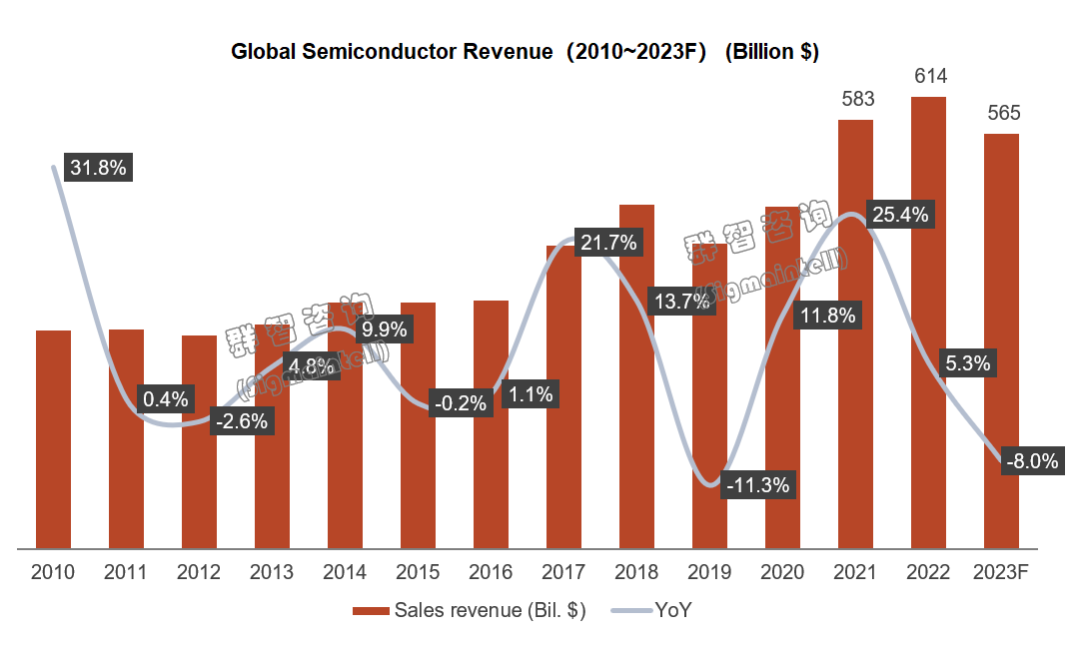

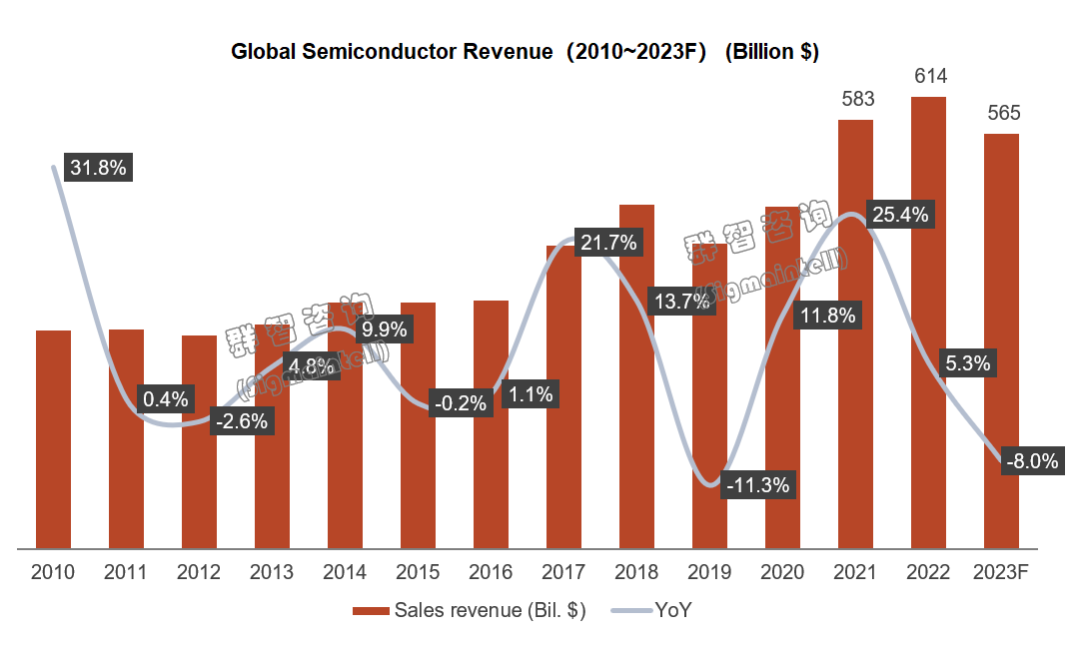

Starting from 22H2, affected by the global economic environment, market growth will slow down, end demand will decline, and the global semiconductor market will show a comprehensive downward trend. Although the IMF predicts that the global inflation rate will drop from 8.8% in 2022 to 6.5% in 2023, and further drop to 4.1% in 2024, the recovery of the global economy will still take a long period, and the global economic growth will continue to slow down to below the pre-pandemic level. According to Sigmaintell’s data, global semiconductor sales in 2023 are expected to decline by about 8% YoY.

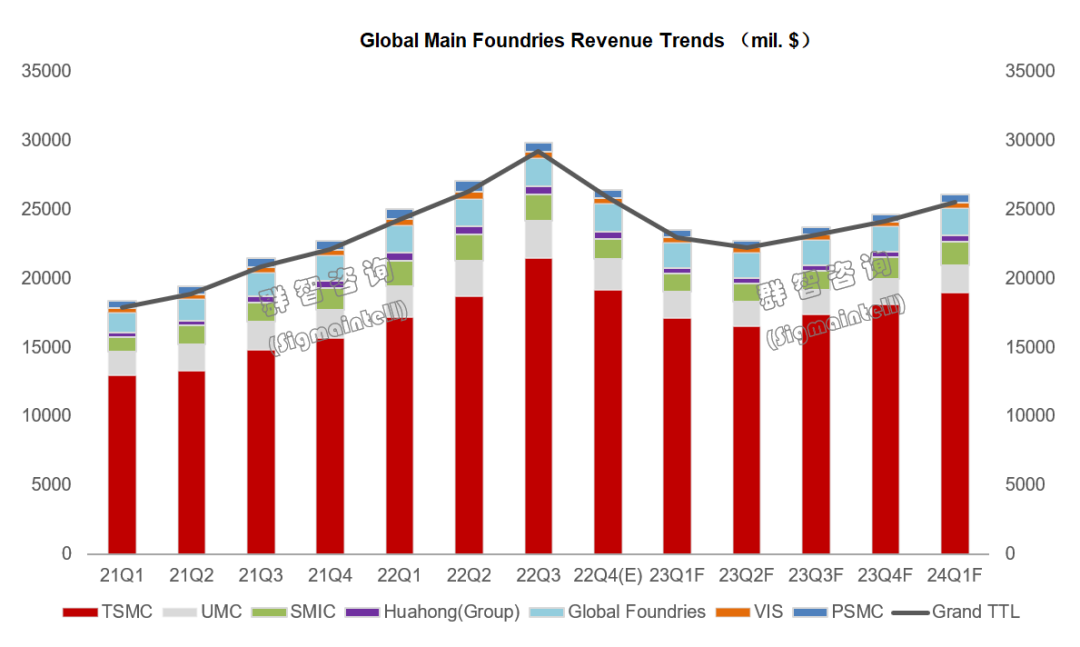

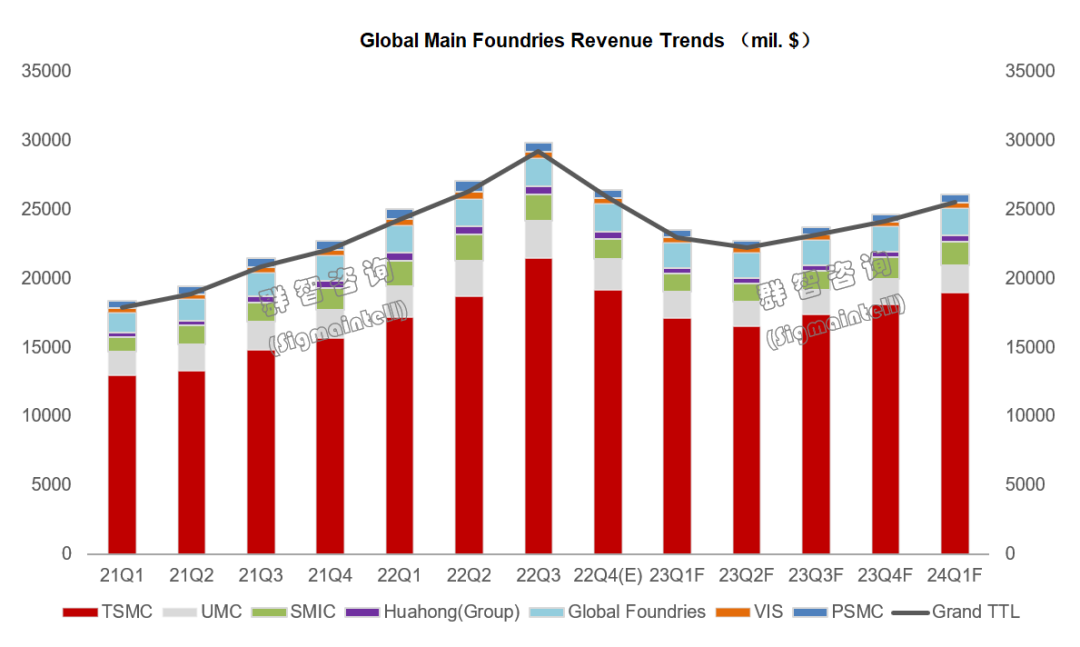

Affected by the tightening of the demand side, the foundry industry will also continue to decline in 2023. Under the impact of this round, some foundries such as PSMC, Vis, and Nexchip set off bearing the pressure of declining performance, and began to adjust capacity planning and capital expenditure in 22Q3; although the performance of makers such as TSMC, GlobalFoundries is still showing a growth trend in 22H2, they also began to give conservative expectations for the future. According to Sigmaintell’s forecast, the overall revenue of major global foundries in 22Q4 will experience a QoQ decline for the first time since 2019, with a drop of about 11.5%, and this downward trend will continue until at least 23Q2.

The utilization rate of the foundry is expected to reach the bottom in 23Q2, and a mild recovery is expected in 23H2

The utilization rate of the foundry is expected to reach the bottom in 23Q2, and a mild recovery is expected in 23H2

In 22H2, due to the reversal of end demand in the consumer electronics market such as TVs, PC, and smart phones, IC design makers have cut orders to curb the continued rise in inventories. As orders decrease QoQ, the utilization rate of foundries has dropped significantly, and the most affected is the mature process above 55nm; even TSMC's advanced processes such as 5nm and 7nm processes have affected, and the utilization rate has declined significantly.

Due to the wide distribution of product lines and high-quality customer structure, makers such as TSMC and UMC have less fluctuation in utilization rate than the industry average; other makers have a more significant decline in utilization rate due to their single product structure, such as Vis and PSMC, the former is an 8-inch maker, and the latter’s 8-inch production capacity accounts for nearly 40%. Its utilization rate is greatly affected by the decline in the consumer electronics market; and mainland Chinese makers such as SMIC and Nexchip are not only affected by market conditions, was also restricted by the chips act, the impact on utilization rate was more obvious.

According to Sigmaintell’s data, the utilization rate of major foundries in the world will decline QoQ from 22Q2 to 22Q4, and it is expected that the industry utilization rate will reach the bottom in 23Q2 (about 75%) ), as downstream demand picks up, the foundry utilization rate is expected to slowly recover in 22H2.

In 2023, foundry prices are expected to drop by 10%~15% YoY

In 2023, foundry prices are expected to drop by 10%~15% YoY

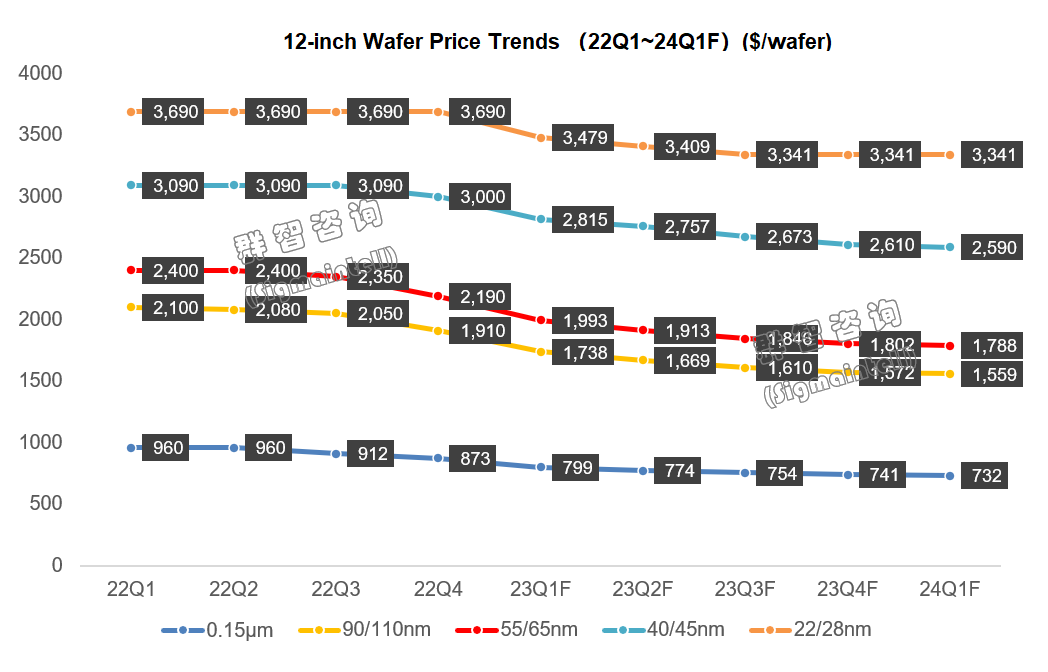

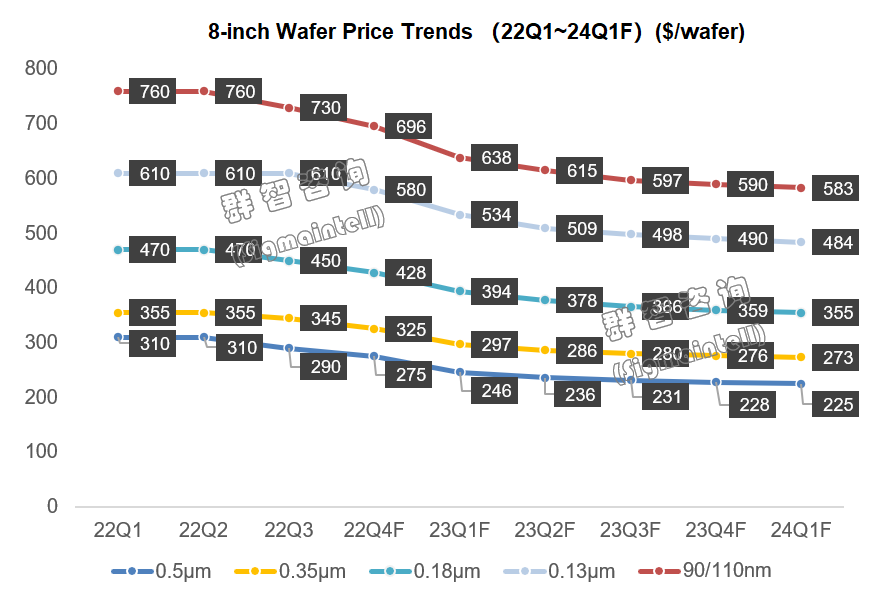

Under the current market conditions, although a considerable number of makers still "declare no price reduction" or "do not declare price reduction", the overall price strategy of the foundry industry has begun to adjust, and the prices of wafers in various processes have loosened, and some makers' quotations are already close to before 2021 level.

Sigmaintell believes that even if the current market conditions are not good, the drop in wafer foundry prices will be limited. There are two main reasons. First, the foundry has high operating costs and high operating pressure. So, the profit zone is smaller than the IC design industry, and the willingness to bear the pressure in the down market cycle is limited. Second, under the long-term contract price framework, it will be difficult to pull back when the market reverses. It is favorable for foundries’ short-term price adjustment range, but it is not good for the medium and long-term performance.

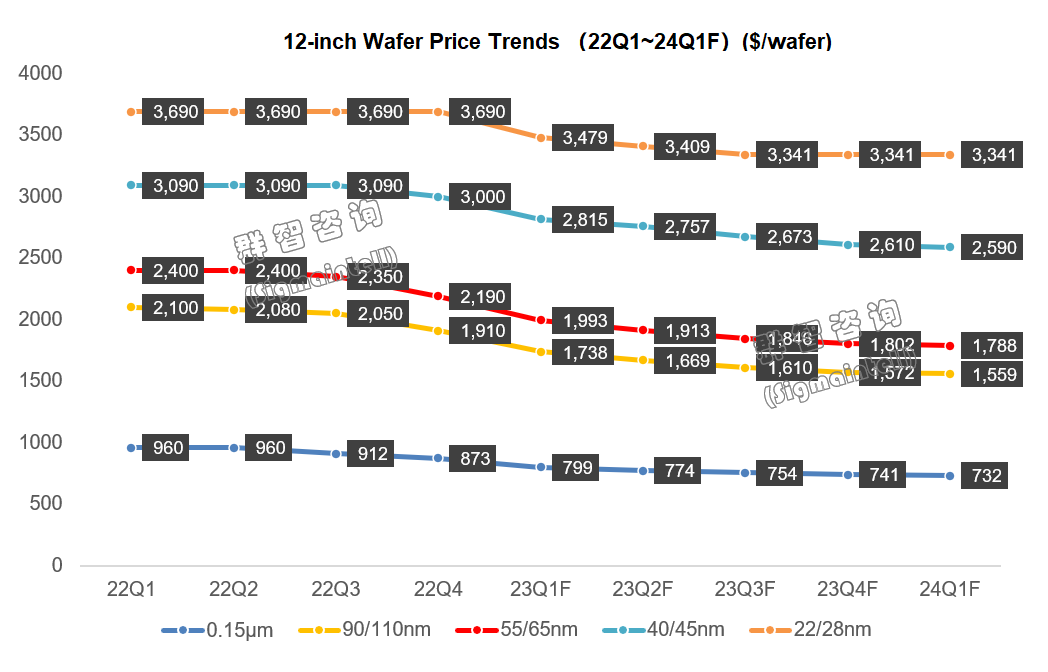

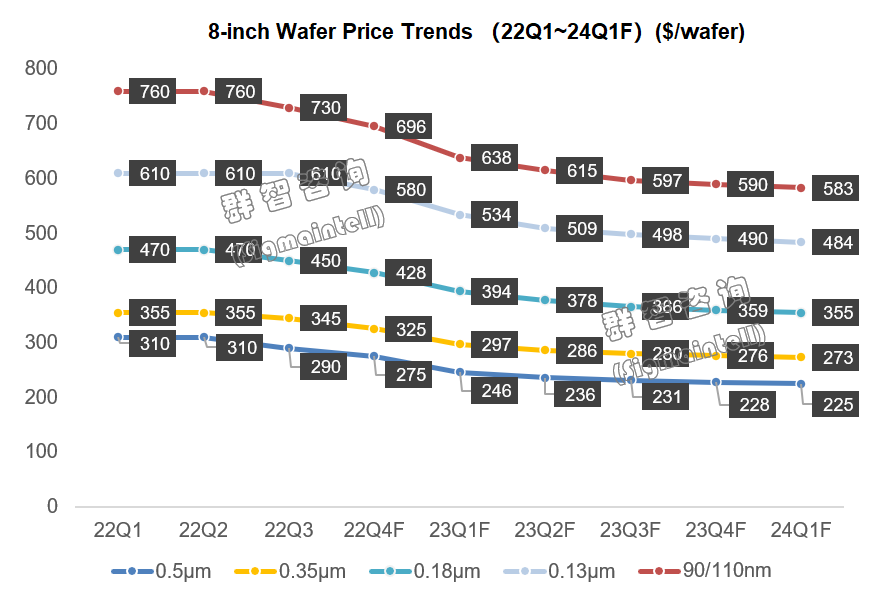

According to Sigmaintell’s data, it is expected that in 2023, the prices of 8-inch wafers and 12-inch wafers with a process above 55nm will drop by about 15% to 17% YoY. The price of 12-inch wafers and wafers with a process below 40mm is expected to drop by about 5% to 12% YoY, and the overall industry price of wafer foundry will drop by about 10% to 15% YoY.

Upstream semiconductor equipment and raw material industries will be impacted in 2023

Upstream semiconductor equipment and raw material industries will be impacted in 2023

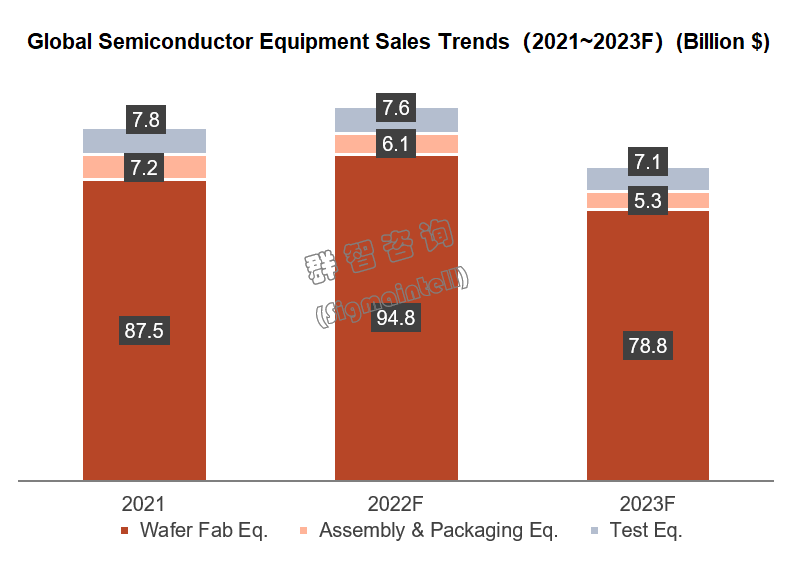

Just as the wafer foundry industry lags behind the panel market by two to three quarters and is affected by the decline in end demand, its upstream industry will also face order adjustments in the next six months. Some wafer foundries and IDMs have successively announced the reduction of capital expenditures to deal with the weak market in 2023 by reducing equipment investment and production. Industries such as semiconductor equipment and semiconductor materials will experience the risk of declining demand and fluctuating performance in 2023 and are expected to resume growth after 2024.

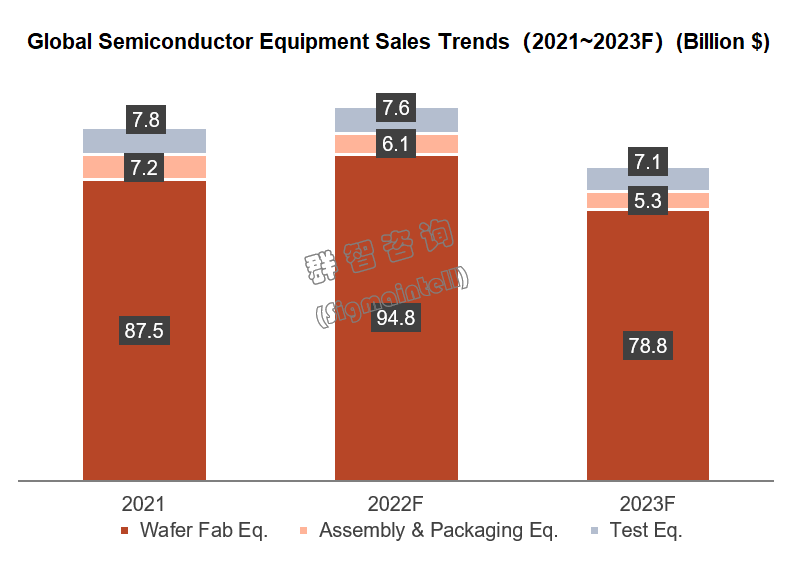

In the past two years, the semiconductor equipment market can be summarized as "in short supply.” As the industry enters a down cycle, the pace of expansion of the semiconductor manufacturing industry slows down, and sales of semiconductor equipment will decline accordingly. According to the data of the US Semiconductor Industry Association (SEMI), the sales of global Wafer Foundry Equipment will drop by about 17% YoY in 2023, of which the wafer foundry-related equipment will drop by about 8%, and the greater decline will come from the memory industry.

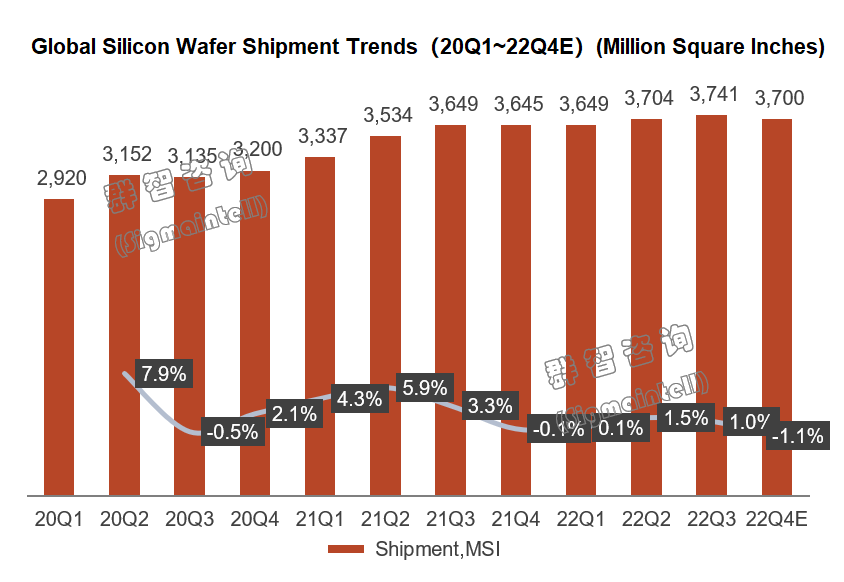

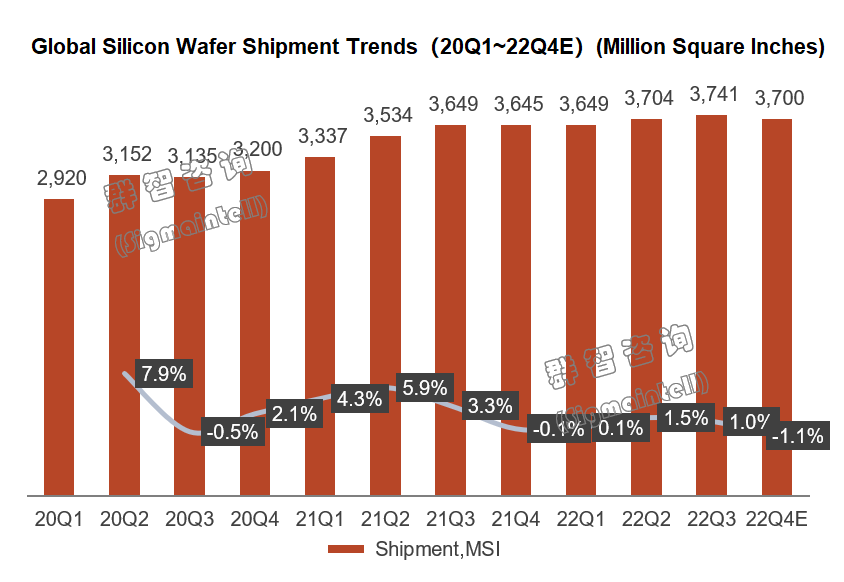

On the other hand, the monocrystalline silicon wafer market, which is the most important raw material for wafer production, will maintain a stable revenue and profit level in 2022, but inventory has begun to increase. According to data from the US Semiconductor Industry Association (SEMI), since 21Q1, although global silicon wafer shipments have maintained overall growth, the growth rate has begun to slow down significantly. From 22Q4, silicon wafer shipments may decline slightly, and the annual shipments in 2023 may decline by about 2% YoY.

The overall industry is oversupplied, but the possibility of structural shortages still exists.

The overall industry is oversupplied, but the possibility of structural shortages still exists.

The current cold wave of the semiconductor industry is mainly affected by three factors: first, the macro environment of slowing global economic recovery; second, the impact of emergencies such as epidemics and geopolitical conflicts on regional demand; third, it is due to the cyclical fluctuations in the semiconductor industry and the mismatch between supply and demand.

Judging from the supply and demand relationship in the next three to five years, the growth in demand has not exceeded the growth in supply. According to Sigmaintell’s data, from 2022 to 2027, the CAGR of global semiconductor sales will be about 2.2%, while the CAGR of global wafer foundry production capacity will be about 7.6%. The overall industry is oversupplied.

However, it is worth noting that the process nodes and downstream applications of semiconductor foundries are complex and extensive, and the expansion rhythms of different process nodes are also inconsistent. As the industry's inventory is gradually digested, end demand may rise again from 23H2. At the same time, limited by the fact that equipment delivery, production line process adjustment, chip manufacturing, and other process are in the ramp-up mass production cycle, structural supply issues still deserve attention.

Sigmaintell suggests that wafer foundries should still flexibly adjust the pace of capacity expansion based on the market, continue to increase investment in advanced technology research and development, properly deploy diversified and anti-cyclical IP products, and focus on long-term profitability.

中文:

晶圆厂稼动率预计在2023年二季度步入谷底,下半年有望温和修复

核心观点:

受限于需求低迷,预计2023年晶圆代工销售额将衰退

晶圆厂稼动率预计在2023年二季度步入谷底,下半年有望温和修复

2023年晶圆代工价格预计将有10%~15%同比下降

上游半导体设备及原材料行业在2023年有可能受到连带冲击

伴随未来需求回升,晶圆供应仍将存在结构性风险

受限于需求低迷,预计晶圆代工在2023年将持续衰退

2022年下半年开始,受到全球经济环境影响,市场增速放缓、终端需求减退、全球半导体市场呈现全面下行趋势。尽管国际货币基金组织(IMF)预计2023年全球通胀率将从2022年的8.8%下降至6.5%,2024年将下降至4.1%,但全球经济复苏仍然需要较长周期,全球经济增速都将处在低于疫情之前的水平。根据群智咨询(Sigmaintell)数据,2023年全球半导体销售额预计将出现同比8%左右降幅。

受需求端的紧缩影响,晶圆代工业也将在2023年持续下行。在本轮冲击之下,部分晶圆厂如力积电、世界先进、晶合集成等率先承受业绩下滑压力,在2022年第三季度即开始调整产能规划和资本开支;虽然台积电、格罗方德等厂商业绩仍在2022年下半年呈现增长趋势,不过后续也开始对未来给出保守预期。根据群智咨询(Sigmaintell)预测,2022年第四季度全球主要晶圆厂整体营收将出现自2019年以来首度环比下滑,下降幅度约11.5%,并且该下降趋势将至少持续到2023年第二季度。

晶圆厂稼动率预计在2023年二季度步入谷底,下半年有望温和修复

2022年下半年,由于消费电子市场如电视、个人电脑、手机等终端需求反转,IC设计厂商纷纷砍单以遏制库存继续上升。随着订单逐季减少,晶圆厂稼动率显著降低,受影响最大的是55nm以上的成熟制程;即使台积电的先进制程如5nm、7nm制程也未能幸免,稼动率出现明显下滑。

台积电、联电等厂商由于产品线分布广泛,客户结构优质,稼动率波动程度较行业平均水平更小;其他业者由于产品结构单一,稼动率下降幅度更为显著,例如,世界先进、力积电,前者为8英寸厂商,后者8英寸产能占比近40%,其稼动率受消费电子大盘下滑影响剧烈;再如中芯国际、晶合集成等中国大陆厂商,不仅受市场行情影响,还受到同期发生的芯片法案引发的一系列贸易政策制约,稼动率受影响幅度更为明显。

根据群智咨询(Sigmaintell)数据,全球主要晶圆厂稼动率在2022年第二季度至第四季度出现逐季下滑,预计在2023年第二季度行业稼动率将到达谷底(约75%),随着下游需求回暖,下半年晶圆厂稼动率有望缓慢修复。

2023年晶圆代工价格预计将有10%~15%同比下降

在目前的行情下,尽管相当一部分厂商仍“声明不降价”或“不声明降价”,但晶圆代工业整体价格策略已开始调整,各制程晶圆价格均出现松动,部分厂商报价已经接近2021年之前水平。

群智咨询(Sigmaintell)认为,即使目前市况不佳,晶圆代工价格降幅也会有限,主要原因有二,一是晶圆厂运营成本较高,运营压力较大,利润空间相比IC设计业更薄,在下行市场周期中承担压力的意愿有限,二是长约价格框架下,市况反转的时候将难以回调,对晶圆厂短期调整幅度有一定的保护作用,但对中长期业绩不利。

根据群智咨询(Sigmaintell)数据,预计2023年8英寸晶圆及12英寸55nm以上制程晶圆代工行业价格将有望同比下降约15%~17%,12英寸40nm及以下制程晶圆代工行业价格同比有望下降约5%~12%,晶圆代工整体行业价格同比下降约10%~15%之间。

上游半导体设备及原材料行业在2023年将受到连带冲击

正如晶圆代工业滞后于面板市场两到三个季度受到终端需求下行影响,其上游行业在接下来的半年内也将面临订单调整。已有一部分晶圆代工厂及IDM先后宣布削减资本开支,通过减少设备投资、降低产量来应对2023年的疲软行情,诸如半导体设备、半导体材料等行业在2023年将出现需求减退、业绩波动的风险,2024年之后有望重新恢复增长。

在过去的两年中,半导体设备行情可用“供不应求”概括,随着行业进入下行周期,半导体制造业扩产节奏放缓,半导体设备销售额将相应下跌。根据美国半导体行业协会(SEMI)数据,2023年全球晶圆制造设备(Wafer Foundry Equipment)的销售额同比下降约17%,其中晶圆代工相关设备降幅约8%,更大的降幅来自存储行业。

另一方面,作为晶圆生产最重要原料的单晶硅片市场,2022年保持着稳定的营收和利润水平,但库存已开始增加。根据美国半导体行业协会(SEMI)数据,自2021年第一季度起,全球硅片出货量虽保持整体增长,但增长幅度明显开始放缓。自2022年第四季度起,硅片出货量将可能微幅下跌,2023年全年出货量将可能同比下滑约2%。

行业整体处于供大于求态势,结构性缺货可能性仍然存在

当前半导体行业的寒潮主要受三个因素影响:一是全球经济复苏放缓的宏观环境;二是疫情、地缘冲突等突发事件对区域性需求的影响;三是半导体行业周期性波动,供需错配的使然。

从未来三到五年的供需关系来看,需求的增长并没有超过供应增长。根据群智咨询(Sigmaintell)数据,2022年~2027年,全球半导体销售额年复合增长率约2.2%,而全球晶圆代工产能年复合增长率约7.6%,未来一段时间,晶圆代工行业整体处于供大于求的态势。

不过值得关注的是,半导体代工的制程节点和下游应用比较复杂且广泛,不同制程节点的扩产节奏也都不一致。随着行业库存逐步消化,2023年下半年起,终端需求将有可能重新拉升。同时,受限于设备交付、产线制程调整、芯片制造等环节的爬坡量产周期,结构性供应问题仍然值得关注。

群智咨询(Sigmaintell)建议,晶圆代工业者仍然应以市场为导向灵活调整产能扩充步伐,持续加大先进技术研发投入,适当布局多元化抗周期的IP产品,以长期获利为发展重心而努力。